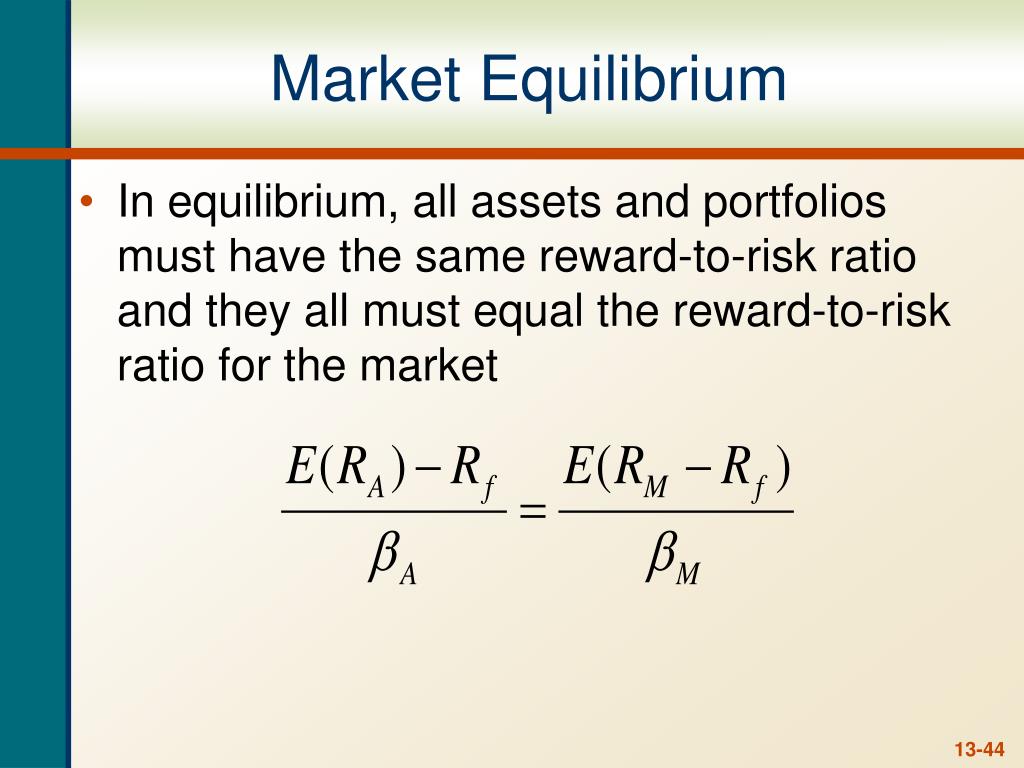

How do you calculate the slope of the capital market line?

The slope of the Capital Market Line(CML) is the Sharpe Ratio. You can calculate it by, Sharpe Ratio = {(Average Investment Rate of Return – Risk-Free Rate)/Standard Deviation of Investment Return} read more of the market portfolio.

Is beta the slope of the capital market line?

A beta coefficient can measure the volatility of an individual stock compared to the systematic risk of the entire market. In statistical terms, beta represents the slope of the line through a regression of data points.

Does the CML have a positive slope?

The CML always has a positive slope. c. The CML is the line from the risk-free rate through the market portfolio.

What is the slope of the CML What does it measure?

The capital market line (CML) represents portfolios that optimally combine risk and return. CML is a special case of the capital allocation line (CAL) where the risk portfolio is the market portfolio. Thus, the slope of the CML is the Sharpe ratio of the market portfolio.

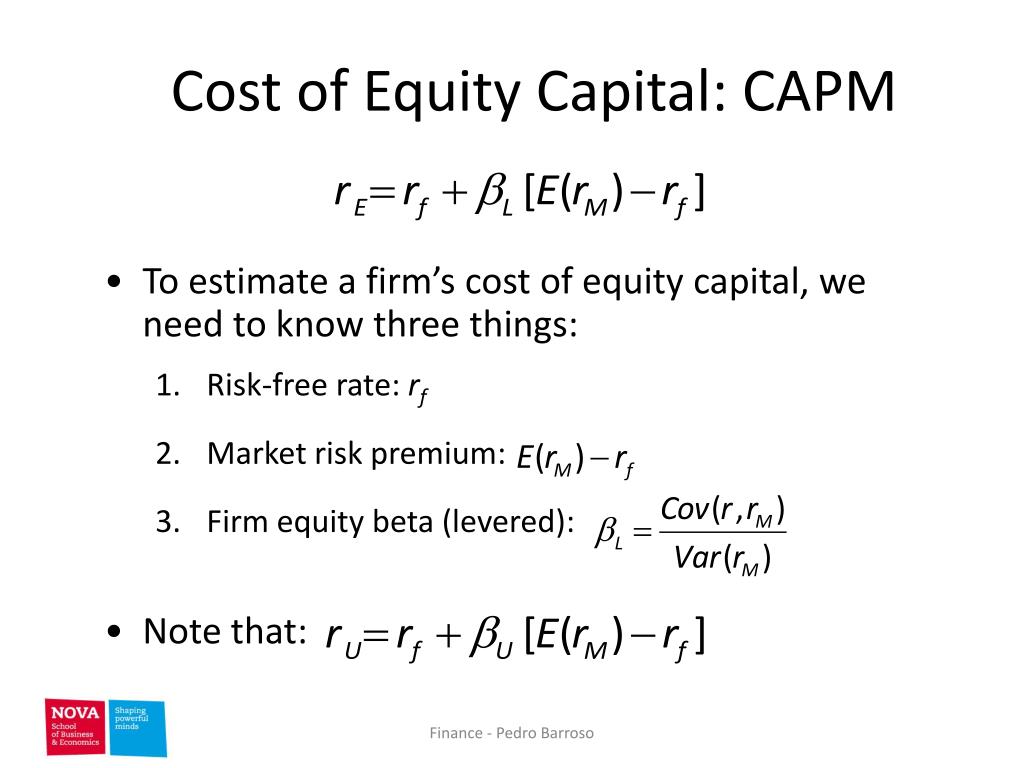

What is beta in CAPM?

Beta is the standard CAPM measure of systematic risk. It gauges the tendency of the return of a security to move in parallel with the return of the stock market as a whole. One way to think of beta is as a gauge of a security's volatility relative to the market's volatility.

Do the SML and CML have the same slope?

The SML is unique in a space. It also represents the portfolios on the CMLand portfolios from the efficient frontier derived by the minimum-variance one. In the space, the SML and CML differ because of the SML slope that represents the correlation coefficient.

Can SML be negative slope?

The slope of the negative SML is significant and negative with an insignificant intercept coefficient. The correspond- ing positive SML evinces a marginally significant positive slope and an insignificant intercept term.

How do you draw a CML line?

The formula for plotting the SML is: Required return = risk-free rate of return + beta (market return - risk-free rate of return)

How do you calculate beta in CAPM?

Beta could be calculated by first dividing the security's standard deviation of returns by the benchmark's standard deviation of returns. The resulting value is multiplied by the correlation of the security's returns and the benchmark's returns.

Is beta a measure of market risk?

Beta is a statistical measure of the volatility of a stock versus the overall market. It's generally used as both a measure of systematic risk and a performance measure. The market is described as having a beta of 1. The beta for a stock describes how much the stock's price moves compared to the market.

What is the beta of market portfolio?

In finance, the beta (β or market beta or beta coefficient) is a measure of how an individual asset moves (on average) when the overall stock market increases or decreases. Thus, beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity.

What is beta data?

Beta Data any data (whether pre-clinical, clinical data, or otherwise) necessary or useful for the use and development of any Beta Material or Beta Product that is owned by, licensed to, or otherwise controlled by the Company prior to the date of this Agreement.

What is difference between CML and SML?

The primary distinction between CML and SML is that CML defines your average rate of success or loss in market share, whereas SML determines the ma...

Why CML is a straight line?

The Sharpe-Lintner version of the Capital Asset Pricing Model has a straight Capital Market Line since everyone can borrow or lend any amount at th...

What is the slope of the SML?

The security market line's slope shows the market risk premium, or the excess return over the market return. The market risk premium compensates fo...

How to calculate the slope of the capital market line?

You can calculate it by, Sharpe Ratio = { (Average Investment Rate of Return – Risk-Free Rate)/Standard Deviation of Investment Return} read more of the market portfolio .

What is capital market line?

The Capital Market Line is a graphical representation of all the portfolios that optimally combine risk and return. CML is a theoretical concept that gives optimal combinations of a risk-free asset and the market portfolio. The CML is superior to Efficient Frontier in the sense that it combines the risky assets with the risk-free asset.

What is the CML in investing?

The Capital Market Line (CML) draws its basis from the capital market theory as well as the capital asset pricing model. It is a theoretical representation of different combinations of a risk-free asset and a market portfolio for a given Sharpe Ratio. As we move up along the capital market line , the risk in the portfolio increases, and so does the expected return. If we move down along the CML, the risk decreases as does the expected return. It is superior to the efficient frontier because the ef only consists of risky assets/market portfolio. The CML combines this market portfolio with this market portfolio. We can use the CML formula to find the expected return for any portfolio given its standard deviation.

How to calculate expected return?

Subsequently, the return expectation Return Expectation The Expected Return formula is determined by applying all the Investments portfolio weights with their respective returns and doing the total of results. Expected return = (p1 * r1) + (p2 * r2) + ………… + (pn * rn), where, pi = Probability of each return and ri = Rate of return with probability . read more will also increase or decrease, respectively.

What is the efficient frontier?

The efficient frontier Efficient Frontier The efficient frontier, also known as the portfolio frontier, is a collection of ideal or optimal portfolios that are expected to provide the highest return for the minimum level of risk. This frontier is formed by plotting the expected return on the y-axis and the standard deviation on the x-axis. read more represents combinations of risky assets.

What are some examples of assumptions in the capital market?

However, these assumptions are often violated in the real world. For example, the markets are not frictionless. There are certain costs associated with the transactions. Also, investors are usually not rational.

Do all investors choose the same market portfolio?

All investors will choose the same market portfolio, given a specific mix of assets and the associated risk with them.

What is the slope of a capital market line?

The slope of a capital market line of a portfolio is its Sharpe Ratio. We know that the greater the returns of a portfolio, the greater the risk. The optimal and the best portfolio is often described as the one that earns the maximum return taking the least amount of risk.

What is the Sharpe ratio?

The Sharpe ratio is a calculation of risk-adjusted returns of how good is the investment return vis-a-vis the amount of risk taken. An increased Sharpe ratio for an investment means a better risk-adjusted return.

How to Calculate?

The Sharpe Ratio is easy to calculate, as it takes only three variables −

When a number of assets have low correlations and are mixed to form a portfolio, what happens?

When a number of assets have low correlations and are mixed to form a portfolio, the portfolio SD goes lower than the sum of the two SDs. As a result, the Sharpe Ratio goes higher since the denominator of the ratio is lower.

Is Sharpe ratio better than market?

In this example, we see that the Sharpe ratio is less even though portfolio A earned more than the market. The market portfolio with a better Sharpe Ratio was more optimal even though the return was less than portfolio A. Therefore, portfolio A assumed excess risk without any additional compensation. Alternately, the overall market, with a higher Sharpe Ratio, had a better risk-adjusted return.

Is Sharpe Ratio a measure of risk?

The Sharpe Ratio relies on the SD as a measure of risk , however, the standard deviation assumes a normal distribution where the mode, mean, and median are all equal. Recent history has shown that market returns are not usually normally distributed in the short term. In fact, market returns are actually skewed.

What is Capital Market Line?

Capital Market Line graphically represents all portfolios with an optimal combination of risk and return. They are the best performing portfolios. Risk is represented by using a standard deviation on the x-axis, while the y-axis represents the expected return of a portfolio. It consists of a mix of risk-free assets and risky assets. They offer an optimal risk-return trade-off i.e. maximum return on a given amount of risk or minimum risk on a given return.

What are the components of the Capital Market Line?

As described above, CML assumes that the entire risk portfolio is the market portfolio. Therefore, the slope of the CML is the Sharpe Ratio of the portfolio. The measure of the return of a financial portfolio that is adjusted to the risk is Sharpe Ratio. Therefore, a higher Sharpe Ratio means a better portfolio and vice versa. If the Sharpe Ratio is above the capital market line, an investor should buy or invest more in that asset. He should sell or lower his investment in the asset if the Sharpe Ratio is below the capital market line.

What is the optimal combination of a set of portfolios that offer the lowest risk for a given return or the?

An optimal combination of a set of portfolios that offer the lowest risk for a given return or the highest return for a given amount of risk is the efficient frontier. A line that is drawn tangentially to the Efficient Frontier from the rate of return that is risk-free is the capital market line. The most efficient portfolio will be that formed at the point of the tangent of the CML and the Efficient Frontier.

What is the measure of the return of a financial portfolio that is adjusted to the risk?

The measure of the return of a financial portfolio that is adjusted to the risk is Sharpe Ratio. Therefore, a higher Sharpe Ratio means a better portfolio and vice versa. If the Sharpe Ratio is above the capital market line, an investor should buy or invest more in that asset. He should sell or lower his investment in the asset if ...

What is the difference between CML and Efficient Frontier?

The CML and the Efficient Frontier are similar, but the main difference between the two is that the former consists not only of risky investments but also of risk-free investments.

What is the difference between CML and real world investors?

In the real world, there is a lack of a strong form of efficiency in the market, so investors do not have equal and uninhibited access to information. Moreover, CML assumes that all investors will behave rationally, which is not always necessary.

Is the capital market line assumption flawed?

There are a number of capital-market line assumptions that are flawed and do not hold up in the real world.

What is capital market line?

Capital market line is the graph of the required return and risk (as measured by standard deviation) of a portfolio of a risk-free asset and a basket of risky assets that offers the best risk-return trade-off. It is a special case of capital allocation line that is tangent to the efficient frontier and the slope of the capital allocation line represents the Sharpe ratio.

What is captial allocation?

The captial allocation line is a graph that represents the risk and return profile of a portfolio that is a combination of the risk-free rate and ANY portfolion on the efficient frontier. Both the lines in the above graphs (representing the combination of risk-free asset and Portfolio C and risk-free asset and Portfolio D) are capital allocation lines.

What is the slope of a cal?

The slope of the CAL measures the trade-off between risk and return. A higher slope means that investors receive a higher expected return in exchange for taking on more risk. The value of this calculation is known as the Sharpe ratio .

What Is the Capital Allocation Line (CAL)?

The capital allocation line (CAL), also known as the capital market link (CML), is a line created on a graph of all possible combinations of risk-free and risky assets. The graph displays the return investors might possibly earn by assuming a certain level of risk with their investment. The slope of the CAL is known as the reward-to-variability ratio.

What is capital allocation?

Asset allocation is the allotment of funds across different types of assets with varying expected risk and return levels, whereas capital allocation is the allotment of funds between risk-free assets, such as certain Treasury securities, and risky assets, such as equities .

How to adjust risk level of portfolio?

An easy way to adjust the risk level of a portfolio is to adjust the amount invested in the risk-free asset. The entire set of investment opportunities includes every single combination of risk-free and risky assets. These combinations are plotted on a graph where the y-axis is the expected return and the x-axis is the risk of the asset as measured by the standard deviation.

How to calculate risk of portfolio?

Risk of portfolio = weight of risky asset x standard deviation of risky asset

What is the slope of a portfolio called?

The portfolios on the CML optimize the risk and return relationship. it maximizes the performance. The slope CML is called the Sharpe Ratio of the portfolio. It is usually popularly discussed among investors that one should buy assets if the Sharpe ratio is above the CML and sell if the ratio falls below the CML.

What is SML in financials?

The security market line (SML) is a graph that is drawn with the values obtained from the capital asset pricing model (CAPM). It is a theoretical presentation of expected returns of assets that are based on systematic risk.

What is the difference between CML and SML?

The security line is derived from the capital market line. CML is used to see a specific portfolio’s rate of return while the SML shows a market risk and a given time’s return. SML also shows the anticipated returns of individual assets.

Is CAPM a one factor model?

The most notable factor is CAPM is a one-factor model that is based only on the level of systematic risk the securities are exposed to.

Is there a risk free asset in CML?

Absence of risk-free asset − The CML concept is built on the principle of the existence of risk-free assets. In reality, there is hardly any asset that is a risk-free asset.

Is CAPM applicable in SML?

The more the risk the more are the expected returns that are applicable in CAPM are also applicable in the case of SML.