What percent is 59 out of 65?

you want to know what percent 59 is out of 65. Here are step-by-step instructions showing you how we calculated 59 out of 65 as a percentage: The first step is to divide 59 by 65 to get the answer in decimal form: 59 / 65 = 0.9077 Then, we multiplied the answer from the first step by one hundred to get the answer as a percentage:

Do senior citizens get a higher standard deduction?

Standard Deduction for Seniors-If you do not itemize your deductions, you can get a higher standard deduction amount if you and/or your spouse are 65 years old or older. You can get an even higher standard deduction amount if either you or your spouse is blind. (See Form 1040 and Form 1040A instructions.)

What is 60 percent off 65 dollars?

There are many ways of calculating your discount and final purchase price. One way is to multiply 65 dollars by 60 percent, and then divide the answer by one hundred, then deduct that result from the original price. See illustration below: Thus, a product that normally costs $65 with a 60 percent discount will cost you $26.00, and you saved $39.00.

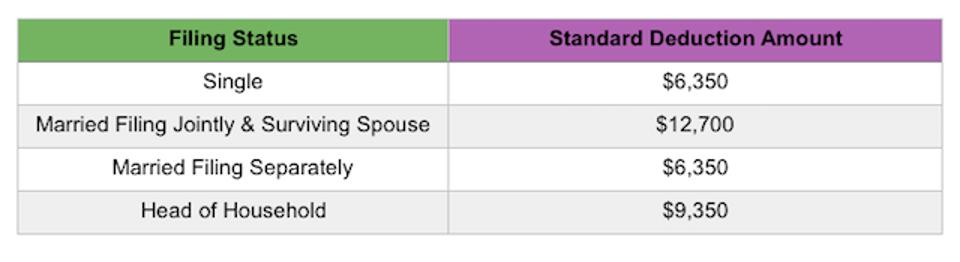

How much is the federal standard deduction?

The standard deduction is a specific dollar amount that reduces your taxable income. For the 2021 tax year, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers and $18,800 for head of household.

What age can you claim standard deduction?

Standard Deduction 2020 Age 65 – The standard deduction is a benefit given to minimize your taxable income when you file your tax commitment. There are two options offered pertaining to the deduction– either to claim the standard quantity or get itemized deductions that you’re entitled to.

Why is income divided?

A portion of your taxed earnings have to be sent to the state or federal government, as well as this part is called income tax. The factor why the earnings is divided like this is that government gives a component of your complete revenue to be deducted or deducted from tax. Currently, this part of your revenue that really did not obtain tired is ...

Can you take standard deduction and itemized deduction?

Standard deduction, you might pick to get your deduction to be itemized. Getting itemized deduction suggests that all tax-deductible costs of your own ( any kind of expenses that majorly affect the amount of your tax) such as clinical spending, property tax, certified charity donations, etc., will be listed and also exhausted independently. It depends on you to determine which choice to take, but it’s not feasible to take both. Typically, individuals will certainly pick any type of options that enhance their deduction worth.

What is standard deduction?

The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness. In general, the standard deduction is adjusted each year for inflation ...

What form to use for increased standard deduction?

Increased Standard Deduction – If you had a net qualified disaster loss and you elect to increase your standard deduction by the amount of your net qualified disaster loss, use Schedule A (Form 1040) to figure your standard deduction. For more information, see the Instructions for Schedule A and the Instructions for Form 4684 .

What age can you claim blindness on taxes?

If you or your spouse were age 65 or older or blind at the end of the year, be sure to claim an additional standard deduction by checking the appropriate boxes for age or blindness on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

When can you deduct blindness on taxes?

Additional Standard Deduction – You're allowed an additional deduction if you're age 65 or older at the end of the tax year. You're considered to be 65 on the day before your 65th birthday. You're allowed an additional deduction for blindness if you're blind on the last day of the tax year.

Can you claim a dependent on the standard deduction?

In general, the standard deduction is adjusted each year for inflation and varies according to your filing status, whether you're 65 or older and/or blind, and whether another taxpayer can claim you as a dependent. The standard deduction isn't available to certain taxpayers.

Who is eligible for the benefits under Article 21?

Students and business apprentices who are residents of India and are eligible for benefits under paragraph 2 of Article 21 (Payments Received by Students and Apprentices) of the United States-India Income Tax Treaty

Can a married person file for standard deduction?

Certain taxpayers aren't entitled to the standard deduction: A married individual filing as married filing separately whose spouse itemizes deductions. An individual who was a nonresident alien or dual status alien during the year (see below for certain exceptions)

How old do you have to be to be permanently disabled?

Age: You and/or your spouse are either 65 years or older; or under age 65 years old and are permanently and totally disabled.

Is Social Security taxable?

Taxable Amount of Social Security Benefits - When preparing your return, be especially careful when you calculate the taxable amount of your Social Security. Use the Social Security benefits worksheet found in the instructions for IRS Form 1040 and Form 1040A, and then double-check it before you fill out your tax return. See Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

Can you get a higher standard deduction if you are 65?

Standard Deduction for Seniors - If you do not itemize your deductions, you can get a higher standard deduction amount if you and/or your spouse are 65 years old or older. You can get an even higher standard deduction amount if either you or your spouse is blind. (See Form 1040 and Form 1040A instructions.)

Do seniors make errors on taxes?

Current research indicates that individuals are likely to make errors when preparing their tax returns. The following tax tips were developed to help you avoid some of the common errors dealing with the standard deduction for seniors, the taxable amount of Social Security benefits, and the Credit for the Elderly and Disabled. In addition, you'll find links below to helpful publications as well as information on how to obtain free tax assistance.

Can you get a 1040EZ for the elderly?

You cannot get the Credit for the Elderly or Disabled if you file using Form 1040EZ. Be sure to apply for the Credit if you qualify; please read below for details.