Summary

- A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks.

- A stop-limit order is implemented when the price of stocks reaches a specified point.

- A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price.

What does stop and limit mean?

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better; whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed at a price significantly different than the stop price.

What does stop limit order mean?

A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to accept. The trader starts by setting a stop price (order to buy or sell a stock once the price’s reached a specific point), and a limit price (an order to buy or sell a specific number of stocks when the price reaches a specific point).

How to do a stop limit buy?

Part 2 Part 2 of 3: Choosing a Type of Limit Order Download Article

- Use a sell limit order to sell securities you own. A limit order used to sell stock that you already own is referred to as a sell limit order.

- Place a buy limit order to buy new securities. A buy limit order directs the broker to purchase a security when the price dips to a certain level.

- Use a stop-limit order. ...

- Place a market order. ...

What is stop limit market order?

- Different trade order types basically make up a trader’s toolkit

- A market order is an instant buy or sell of a cryptocurrency for the best available price at that time

- A limit order is an agreement to buy or sell an asset at a specific price

- A stop limit order is an agreement to buy or sell at a specific price once the stop price is reached

What is a stop limit order example?

A short position would necessitate a buy-stop limit order to cap losses. For example, if a trader has a short position in stock ABC at $50 and would like to cap losses at 20% to 25%, they can enter a stop-limit order to buy at a price of $60 and a limit price of $62.50.

What should I set my stop limit at?

Once you have inserted the moving average, all you have to do is set your stop loss just below the level of the moving average. For instance, if you own a stock that is currently trading at $50 and the moving average is at $46, you should set your stop loss just below $46.

Why would I use a stop limit?

A buy stop limit is used to purchase a stock if the price hits a specific point. It helps traders control the purchase price of stock once they've determined an acceptable maximum price per share. A stop price and a limit price are then set once the trader specifies the highest price they are willing to pay per stock.

What is difference between limit and stop limit?

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better; whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market--which means that it could be executed at a ...

What is the 1% rule in trading?

Key Takeaways The 1% rule for day traders limits the risk on any given trade to no more than 1% of a trader's total account value. Traders can risk 1% of their account by trading either large positions with tight stop-losses or small positions with stop-losses placed far away from the entry price.

Where should I set my stop-loss?

One should generally place a stop loss in trading at the low of the most recent candlestick when they are buying the stock. Similarly, one should place a stop loss in trading at the high of the most recent candlestick when they are selling the stock.

Which is better stop-loss or stop limit?

The Bottom Line. Stop-loss and stop-limit orders can provide different types of protection for both long and short investors. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. U.S. Securities and Exchange Commission.

Whats the difference between buy limit and buy stop?

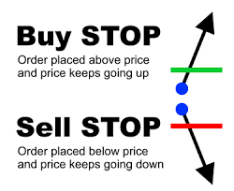

What is the difference between a Buy Stop and a Buy Limit? With a Buy Stop Order you set the Price higher than the current market price. With a Buy Limit Order the limit price is always lower than the current market price, not higher. In a Buy Stop Limit Order the two work together.

What happens if I set a limit order below market price?

Limit order This means that your order may only be filled at your designated price or better. However, you're also directing your order to fill only if this condition occurs. Limit orders allow control over the price of an execution, but they do not guarantee that the order will be executed immediately or even at all.

Can I place a stop-loss and limit order at the same time?

Short Answer. You can place a stop loss as well as a limit order together while trading in derivatives such as Futures and Options.

How do you set a stop-loss and limit?

A stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price. A stop-loss is designed to limit an investor's loss on a security position. For example, setting a stop-loss order for 10% below the price at which you bought the stock will limit your loss to 10%.

How does a stop order work?

A stop order, also referred to as a stop-loss order, is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order.

Whats the difference between stop-loss and stop limit?

The Bottom Line Stop-loss and stop-limit orders can provide different types of protection for both long and short investors. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price.

What is an example of a limit order?

A limit order is the use of a pre-specified price to buy or sell a security. For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower.

What is a stop limit order TD Ameritrade?

A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. It essentially says: “I want to buy (sell) at price X but not any higher (lower) than price Y.”

What is trailing stop limit when buying?

A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain.

What is stop limit order?

Summary. A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks. A stop-limit order is implemented when the price of stocks reaches a specified point. A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price.

What is a stop limit in stock trading?

A stop price and a limit price are then set once the trader specifies the highest price they are willing to pay per stock. The stop price is a price that is above the market price of the stock, whereas the limit price is the highest price that a trader is willing to pay per share.

What is stop price?

A stop price is a price at which the limit order to sell is activated, whereas the limit price is the lowest price that the trader is willing to accept. A sell stop order tells the market maker/broker to sell the stocks if the price decreases to the stop point or below, but only if the trader earns a specific price per share.

How does a stop limit order work?

A stop-limit order provides greater control to investors by determining the maximum or minimum prices for each order. When the price of the stock achieves the set stop price, a limit order is triggered, instructing the market maker to buy or sell the stock at the limit price. It helps limit losses by determining the point at which the investor is unwilling to sustain losses.

Why is a stop limit order not executed?

A stop-limit order does not guarantee that the trade will be executed, because the price may never beat the limit price. If the limit order is attained for a short duration, it may not be executed when there are other orders in the queue that utilize all stocks available at the current price.

What happens if you exceed the $60 limit?

If the limit order is capped at $60, the order is processed after reaching $55, and if it exceeds $60, it is not fulfilled . 2. Sell Stop Limit. A sell stop limit is a conditional order to a broker to sell the stock when its price falls up to a specific price – i.e., stop price.

When do traders use stop limit orders?

Traders use stop-limit orders when they are not actively monitoring the market, and the order helps trigger a buy or sell order when the security reaches a specified point. Once the price is attained, the order is automatically triggered. The following are the two main stop-limit orders that traders place: 1. Buy Stop Limit.

How do stop-limit orders work?

In the case of a stop-loss order with a stop price of $XX per share, this doesn’t mean the investor necessarily will get $XX per share. It simply means that once the price drops to $XX, the broker must begin selling—even if the market price continues to fall below $XX.

Why traders use stop-limit orders

Buy stop-limits are frequently used by short sellers—investors who profit when shares decline— as a way to protect gains or stem losses from this risky and expensive strategy.

The drawbacks of using stop-limits

While potential benefits of using stop-limits are demonstrated from the model scenarios above, less obvious are the drawbacks and the limitations of this strategy. Let’s look at some of them, sticking with Tesla and our investor, Jane.

3 Things to consider before using a stop-limit strategy

How long does the investor want an order to be in effect? A single trading day? Several days? Weeks, months? If it was a one-day order, he needs to decide whether to extend the order time or enter a new order, to maintain his boundaries on buying or selling.

The bottom line

The stop-limit strategy is not particularly useful for active traders, who have their eye on the market constantly and are making quick buying and selling decisions, often for small price movements.

What is a stop limit order?

What is a stop-limit order? A stop-limit order is a market order that has both a stop price and a limit price. When the stop price is reached, it triggers the limit order. The limit price is the specific price of the limit order the stop price triggers. Once your stop price has been reached, the limit order is immediately placed on the order book.

Is stop price the same as limit price?

The stop and limit prices can be the same. However, it’s recommended for sell orders to set your stop price (trigger price) slightly higher than the limit price. The price difference allows for a safety gap in price between the time the order is triggered and when it is fulfilled.

What are the risks of a stop limit order?

A stop-limit order has two primary risks: no fills or partial fills. It is possible for your stop price to be triggered and your limit price to remain unavailable. If you used a stop-limit order as a stop loss to exit a long position once the stock started to drop, it might not close your trade.

What is a limit order?

Limit Orders. A limit order is an order to buy or sell a stock for a specific price. 1 For example, if you wanted to purchase shares of a $100 stock at $100 or less, you can set a limit order that won't be filled unless the price you specified becomes available. However, you cannot set a plain limit order to buy a stock above ...

What does stop on quote mean?

Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. For example, if you set a stop order with a stop price of $100, it will be triggered only if a valid quote at $100 or better is met.

What is a stop order in stock trading?

When you place a limit order or stop order, you tell your broker you don't want the market price (the current price at which a stock is trading); instead, you want your order to be executed once the stock price matches a price that you specify. There are two primary differences between limit and stop orders. The first is that a limit order uses ...

Why do you stop an order?

A stop order avoids the risks of no fills or partial fills, but because it is a market order, you may have your order filled at a price much higher than you were expecting.

What happens when you put a stop order?

If the order is a stop-limit, then a limit order will be placed conditional on the stop price being triggered.

What happens if you sell 500 shares at a stop price?

For example, if you wanted to sell 500 shares at a limit price of $75, but only 300 were filled, then you may suffer further losses on the remaining 200 shares.

What is the risk of a stop limit?

The risk of a stop-limit is that the stop may be triggered but the limit is not, resulting in no execution.

What is stop order?

Stop orders are used by traders to limit downside losses, where a sell-stop order protects long positions by triggering a market sell order if the price falls below a certain level.

What is stop loss?

A stop-loss is common, and in its basic form converts into a market order to sell once the stop price is triggered. However, in a fast moving market, the market order may be less than ideal, leading to larger losses than anticipated. One solution is to modify the stop order into a stop-limit order.

Why do traders put stop orders?

Traders will often enter stop orders to limit their potential losses or to capture profits on price swings. These types of orders are very common in stocks and especially in forex trading where small swings can equal big gains for traders but are also useful to the average investor with stock, option or forex trades.

When to use buy stop limit?

As with buy-stop orders, buy-stop-limit orders are used for short sales, when the investor is willing to risk waiting for the price to come back down if the purchase is not made at the limit price or better.

Why do we use stop limit orders?

Stop-limit orders are sometimes used because, if the price of the stock or other security falls below the limit, the investor does not want to sell and is willing to wait for the price to rise back to the limit price.

Are stop-loss and stop-limit orders foolproof?

Unfortunately, neither stop-loss orders nor stop-limit orders are foolproof or guaranteed to cap your losses at the desired level. Since a stop-loss order becomes a market order once the stop-loss level has been breached, it may get executed at a price significantly away from the stop-loss price. With a stop-limit order, the risk is that the trade may not get executed at the specified limit price. There are pros and cons to both types of orders, so ensure that you do your homework and understand the differences before placing such orders.

What happens if a stock price falls below the limit?

If the stock price falls below $45 before the order is filled, then the order will remain unfilled until the price climbs back to $ 45. Many investors will cancel their limit orders if the stock price falls below the limit price because they placed them solely to limit their loss when the price was dropping.

Why is a stop limit order more effective?

If the stock is volatile with substantial price movement, then a stop-limit order may be more effective because of its price guarantee. If the trade doesn't execute, then the investor may only have to wait a short time for the price to rise again.

Why do you put a stop loss order on a stock?

If the stock is volatile with substantial price movement , then a stop-limit order may be more effective because of its price guarantee. If the trade doesn't execute, then the investor may only have to wait a short time for the price to rise again. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. In this case, the stock price may not return to its current level for months or years (if it ever does). Investors would, therefore, be wise to cut their losses and take the market price on the sale. A stop-limit order may yield a considerably larger loss if it does not execute.

How does a sell stop order work?

Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. The underlying assumption behind this strategy is that, if the price falls this far, it may continue to fall much further. The loss is capped by selling at this price.

How Stop-Limit Orders Work

- When a trader makes a stop-limit order, the order is sent to the public exchange and recorded on the order book. The order remains active until it is triggered, canceled, or expires. When an investor places a stop-limit order, they are required to specify the duration when it is valid, either for the current market or the futures markets. For examp...

Why Traders Use Stop-Limit Orders

- Traders use stop-limit orders when they are not actively monitoring the market, and the order helps trigger a buy or sell order when the security reaches a specified point. Once the price is attained, the order is automatically triggered. The following are the two main stop-limit orders that traders place:

Risks of A Stop-Limit Order

- While a stop-limit order can limit losses and guarantee a trade at a specified price, there are some risks involved with such an order. The risks include:

More Resources

- Thank you for reading CFI’s guide on Stop-Limit Order. To help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful: 1. Buy Side vs Sell Side 2. Market Maker 3. Stop-Loss Order 4. Trade Order

What Is A Stop-Limit Order?

- Stop-limit order is a core risk management tool used by traders to minimise losses and maximise returns. The tool allows traders to set the highest or lowest asset price that they are willing to accept. The stop-limit order combines features of a stop-loss and limit order. It is a form of conditional trading that takes place over a specific timefra...

How Do Stop-Limit Orders Work?

- Before executing a stop-limit order strategy, traders should know what market scenario is needed for it to work. The process requires two price point settings: stop and limit. The stop price point marks the beginning of a specific price target for the trade, while the limit gives us the outside of the price target. A trader must then select a timeframe in which the stop-limit order can be exec…

Stop-Limit Order Example

- Let’s go through an example for more clarity. A trader holds shares of X company at $100 per share. According to their analysis, if the price falls to $98, it could continue to move lower. So, with the intention of limiting downside risk to $2, the trader sets a stop at $98 and places a limit at the minimum price they are willing to sell the shares; let’s consider that to be $95. The stock clo…