.JPG)

What is the IFRS Foundation and what does it do?

The IFRS Foundation (formerly known as the International Accounting Standards Committee Foundation (IASC)) is the supervisory body for the IASB and is responsible for governance issues and ensuring each member body is properly funded. The principal objectives of the IFRS Foundation are to:

What is the difference between IFRS and IAS?

The IFRS system is sometimes confused with International Accounting Standards (IAS), which are the older standards that IFRS replaced in 2001. International Financial Reporting Standards (IFRS) were created to bring consistency and integrity to accounting standards and practices, regardless of the company or the country.

What are the standard requirements of IFRS?

Standard IFRS Requirements. IFRS covers a wide range of accounting activities. There are certain aspects of business practice for which IFRS set mandatory rules. Statement of Financial Position: This is also known as a balance sheet. IFRS influences the ways in which the components of a balance sheet are reported.

How many countries are covered by IFRS?

IFRS currently has complete profiles for 166 jurisdictions. including those in the European Union. 1 The United States uses a different system, the Generally Accepted Accounting Principles (GAAP). The IFRS are issued by the International Accounting Standards Board (IASB). 2

What are the 4 principles of IFRS?

IFRS requires that financial statements be prepared using four basic principles: clarity, relevance, reliability, and comparability.

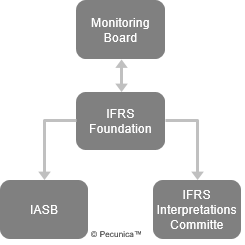

What is the structure of the IASB?

The IASB structure has the following main features: The IASC Foundation is an independent organization having two main bodies, the Trustees and the IASB, as well as a Standards Advisory Council and the International Financial Reporting Interpretations Committee.

What are the main features of IFRS?

Objectives of IFRS#1- Create a Common Law. ... #2 – Aid analysis. ... #3 – Assist in preparation of reliable financial records. ... #4 – Ensure comparability, transparency, and flexibility in reporting. ... #1 – Financial Tool. ... #2 – Principles and Guide. ... #3 – Promotes Decision Making. ... #4 – Improves Economy.More items...

What are the IFRS process?

The due process comprises the requirements followed by the International Accounting Standards Board when setting IFRS Standards and developing the IFRS Taxonomy, and by the IFRS Interpretations Committee when working with the Board to support consistent application of those Standards.

Who is in charge of IFRS?

The International Accounting Standards Board (IASB)The International Accounting Standards Board (IASB) is an independent, private-sector body that develops and approves International Financial Reporting Standards (IFRSs).

Who set IFRS?

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

What is the main objectives of IFRS?

The objectives of the IFRS Foundation are: to develop, in the public interest, a single set of high quality, understandable, enforceable and globally accepted financial reporting standards based upon clearly articulated principles.

What is the purpose of IFRS in accounting?

The purpose of IFRS is that entities have common accounting rules that allow financial statements to be consistent, reliable, and comparable between every business in any country.

What is the importance of IFRS?

The International Financial Reporting Standards (IFRS) are a set of accounting rules for public companies with the goal of making company financial statements consistent, transparent, and easily comparable around the world. This helps for auditing, tax purposes, and investing.

How many IFRS are there?

IFRS is an accounting framework that is adopted in over 120 countries and operates on an international platform.

What is the IASB when was the IASB formed and why is its structure important?

The International Accounting Standards Board, which was formed in 2001. Its structure is important because of its historical cooperation in the formation. The structure is also largely modeled on the FASB in addition to its governance, and independence. Briefly explain the process followed by the IASB for issuing IFRS.

What is the main purpose of the IASB?

IASB's objectives Under the IFRS Foundation Constitution, the objectives of the IASB are: to develop, in the public interest, a single set of high quality, understandable, enforceable and globally accepted financial reporting standards based upon clearly articulated principles.

What is the main function of IASB?

IASB members are responsible for the development and publication of IFRS Accounting Standards, including the IFRS for SMEs Accounting Standard. The IASB is also responsible for approving Interpretations of IFRS Accounting Standards as developed by the IFRS Interpretations Committee (formerly IFRIC).

What is the composition of IASB foundation?

The IASB comprises 16 board members, including the Chairman and Vice- Chairman. Mr. Takatsugu Ohchi is appointed from Japan. The Trustees undertake governance and oversight of the IFRS Foundation, for example, funding, approving the annual budget, amending operating procedures and so on.

What is the IFRS foundation?

Overview of the structure of the IFRS Foundation and IASB. The International Accounting Standards Board (IASB) is organised under an independent foundation named the IFRS Foundation. The Foundation is a not-for-profit corporation which was created under the laws of the State of Delaware, United States of America, on 8 March 2001.

When did IFRIC replace IASC?

IFRIC replaced the Standards Interpretations Committee (SIC) of the IASC with effect from 1 April 2001. The SIC was part of the original IASC structure formed in 1973. Until 31 March 2010, the IFRS Advisory Council was named the Standards Advisory Council (SAC). Formerly the Analyst Representative Group (ARG).

What is IFRS statement?

IFRS influences the ways in which the components of a balance sheet are reported. Statement of Comprehensive Income: This can take the form of one statement, or it can be separated into a profit and loss statement and a statement of other income, including property and equipment.

What is the IFRS Foundation?

The IFRS Foundation sets the standards to “bring transparency, accountability, and efficiency to financial markets around the world… fostering trust, growth, and long-term financial stability in the global economy.”.

What Are International Financial Reporting Standards (IFRS)?

International Financial Reporting Standards (IFRS) are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and easily comparable around the world.

Who Uses IFRS?

IFRS are required to be used by public companies based in more than 160 countries, including all of the nations in the European Union as well as Canada, India, Russia, South Korea, South Africa, and Chile. 8

How Does IFRS Differ from GAAP?

The two systems have the same goal: clarity and honesty in financial reporting by publicly-traded companies.

Why are IFRS standards important?

International Financial Reporting Standards (IFRS) were created to bring consistency and integrity to accounting standards and practices, regardless of the company or the country.

How many countries use IFRS?

IFRS are used in at least 120 countries, as of 2020, including those in the European Union (EU) and many in Asia and South America, but the U.S. uses Generally Accepted Accounting Principles (GAAP).

About the course

Do you understand the fundamental principles underlying IFRS? Without a clear understanding of the essential background to the IFRS regime as a whole, it is impossible to fit the individual IFRSs into the bigger picture.

Author

Specialising in public sector financial management and budgeting, Wayne has worked as a consultant and lecturer throughout the world.

What is IFRS standard?

What are IFRS Standards? IFRS standards are International Financial Reporting Standards ( IFRS) that consist of a set of accounting rules that determine how transactions and other accounting events are required to be reported in financial statements. They are designed to maintain credibility and transparency in the financial world, ...

Where are IFRS standards used?

IFRS are the standard in over 100 countries, including the EU and many parts of Asia and South America. The United States, however, has not yet adopted them and the SEC is still deciding whether or not they should move toward them as the official standard of accounting.

Why are IFRS standards important?

They are designed to maintain credibility and transparency in the financial world, which enables investors and business operators to make informed financial decisions. IFRS standards are issued and maintained by the International Accounting Standards Board and were created to establish a common language so that financial statements can easily be ...

What is the difference between IFRS and GAAP?

The largest difference between the US GAAP (Generally Accepted Accounting Principles) and IFRS is that IFRS is principle-based while GAAP is rule-based. Rule-based frameworks are more rigid and allow less room for interpretation, while a principle-based framework allows for more flexibility.

Understanding IFRS

The purpose of financial statements Financial Statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly).

Objectives of IFRS

International Financial Reporting Standards represents an international financial reporting system and serves multiple purposes. Some of its significant goals in the financial world are as follows:

Uses of IFRS

This standard is a multi-layer set of rules and guidelines prepared like a blueprint to follow in accounting. Its main uses are as follows:

Importance of IFRS

It is treated as an international accounting standard and holds great importance for many countries and the world economy. Here is its significance:

Recommended Articles

This has been a guide to what is IFRS and its meaning. We explain the objectives of International Financial Reporting Standards along with their uses & importance. You may refer to the following articles to learn more about finance –

Who appoints the IASB?

The IASC Foundation Trustees appoint the IASB members, exercise oversight and raise the funds needed, but the IASB has sole responsibility for setting accounting standards.

What is the IASC Foundation?

The IASC Foundation is the parent entity of the International Accounting Standards Board, an independent accounting standard-setter based in London, UK. On April 1, 2001, the International Accounting Standards Board (IASB) assumed accounting standard-setting responsibilities from its predecessor body, the International Accounting Standards ...

What is an IFRS?

IFRS are issued by the International Accounting Standards Board (IASB), and they specify exactly how accountants must maintain and report their accounts. 2 IFRS was established in order to have a common accounting language, so business and accounts can be understood from company to company and country to country. 3 .

What is the purpose of IFRS?

The point of IFRS is to maintain stability and transparency throughout the financial world. IFRS enables the ability to see exactly what has been happening with a company and allows businesses and individual investors to make educated financial decisions. 3

What is the difference between IFRS and GAAP?

Perhaps the most notable specific difference between GAAP and IFRS involves their treatment of inventory. IFRS rules ban the use of last-in, first-out (LIFO) inventory accounting methods. GAAP rules allow for LIFO. Both systems allow for the first-in, first-out method (FIFO) and the weighted average-cost method.

What are the standards of financial reporting?

1 Generally accepted accounting principles refer to a common set of accepted accounting principles, standards, and procedures that companies and their accountants must follow when they comp ile their financial statements.

What is IFRS accounting?

International Financial Reporting Standards (IFRS) are a set of international accounting standards, which state how particular types of transactions and other events should be reported in financial statements.

How many countries have adopted IFRS?

More than 144 countries around the world have adopted IFRS, which aims to establish a common global language for company accounting affairs. 4 While the Securities and Exchange Commission (SEC) has openly expressed a desire to switch from GAAP to IFRS, development has been slow. 5

What is GAAP in financial statements?

GAAP addresses such things as revenue recognition, balance sheet, item classification, and outstanding share measurements. If a financial statement is not prepared using GAAP, investors should be cautious. Also, some companies may use both GAAP- and non-GAAP-compliant measures when reporting financial results.

What Are International Financial Reporting Standards (IFRS)?

Understanding International Financial Reporting Standards

- IFRS specify in detail how companies must maintain their records and report their expenses and income. They were established to create a common accounting language that could be understood globally by investors, auditors, government regulators, and other interested parties. The standards are designed to bring consistency to accounting language, practices, and statem…

IFRS vs. GAAP

- Public companies in the U.S. are required to use a rival system, the generally accepted accounting principles (GAAP). The GAAP standards were developed by the Financial Standards Accounting Board (FSAB) and the Governmental Accounting Standards Board (GASB). The Securities and Exchange Commission (SEC) has said it won't switch to International Financial Reporting Standa…

Standard IFRS Requirements

- IFRS covers a wide range of accounting activities. There are certain aspects of business practice for which IFRS set mandatory rules. 1. Statement of Financial Position: This is the balance sheet. IFRS influences the ways in which the components of a balance sheet are reported. 2. Statement of Comprehensive Income: This can take the form of one statement or be separated into a profi…

History of IFRS

- IFRS originated in the European Union with the intention of making business affairs and accounts accessible across the continent. It was quickly adopted as a common accounting language. Although the U.S. and some other countries don't use IFRS, currently 167 jurisdictions do, making IFRS the most-used set of standards globally.1

The Bottom Line

- The International Financial Reporting Standards (IFRS) are a set of accounting rules for public companies with the goal of making company financial statements consistent, transparent, and easily comparable around the world. This helps for auditing, tax purposes, and investing.