How do I calculate the taxable amount of an annuity?

Step 1: Determine Cost Basis. Determine your cost basis. ... Step 2: Divide Cost Basis By Accumulation Value. Divide your cost basis by the accumulation value. ... Step 3: Multiply Monthly Payout By Exclusion Ratio. Multiply the size of your monthly payout by the exclusion ratio. ... Step 4: Subtract Tax-Free Portion.

How much of an annuity is taxable?

Half of the contract is basis; half is gain. When an annuity payment is made, 50% of each payment would be income taxable. If the payout is over an annuitant's lifetime, and annuitant outlives life expectancy, all further payments are subject to ordinary income as received.

What formula is used to determine what portion of an annuity payout is taxable?

The taxable portion of your variable annuity is calculated in the same manner as a fixed income annuity, by multiplying the number of total monthly payments by the dollar amount of each monthly payment, then dividing that figure by your initial lump-sum premium.

How do you avoid tax on an annuity distribution?

As long as you do not withdraw your investment gains and keep them in the annuity, they are not taxed. A variable annuity is linked to market performance. If you do not withdraw your earnings from the investments in the annuity, they are tax-deferred until you withdraw them.

When should you cash out an annuity?

The most clear-cut way to withdraw money from an annuity without penalty is to wait until the surrender period expires. If your contract includes a free withdrawal provision, take only what's allowed each year, usually 10 percent.

Step 1: Determine Cost Basis

Determine your cost basis. Find the sum of all deposits you made into the annuity. For example, if you deposited $500 a year for five years, your cost basis in the annuity is $2,500.

Step 2: Divide Cost Basis By Accumulation Value

Divide your cost basis by the accumulation value. The result is your exclusion ratio. For example, if you deposited $2,500 into an annuity and its accumulation value is $5,000, then your exclusion ratio is 50 percent.

Step 3: Multiply Monthly Payout By Exclusion Ratio

Multiply the size of your monthly payout by the exclusion ratio. The product is the portion of your payout that is excluded from taxation. For example, if your exclusion ratio is 50 percent and your monthly payments are $500, then $250 is excluded from taxation as a return of investment.

Step 4: Subtract Tax-Free Portion

Subtract the excluded portion from the total monthly payout to determine the taxable portion. For example, if the excluded portion of your $500 payment is $250, then your taxable portion is $150.

How to figure out your tax liability on an annuity?

To figure out your tax liability with a lifetime annuity, first estimate how long you’ll live. Multiply the number of years you expect to live after you start getting payments by the size of the annual payments. That gives you your expected return on a lifetime annuity.

What is a qualified annuity?

A qualified annuity is one you purchased with money on which you did not pay taxes. For instance, if the premiums to pay for an annuity came from a tax-deferred retirement account such as a traditional 401(k) or traditional IRA, it would be a qualified annuity.

What is a period annuity?

A period annuity is one that will provide you with regular payments for a set number of years.

Do annuities grow tax deferred?

On the other hand, annuities you purchased using non-Roth assets will grow tax-deferred, with federal income taxes down the road. After this distinction, things can get rather complex. There are varying types of annuities (indexed, variable etc.) and different situations that affect tax liability.

Do annuities pay taxes?

An annuitycan provide you with income that is guaranteed for as long as you live. These retirement savings vehicles do provide some tax benefits by letting earnings grow tax-deferred. However, at least part of your annuity payments may be subject to federal income taxes.

Is an annuity qualified or non qualified?

In the eyes of the government, this will decide whether your annuity is “qualified” or “non-qualified” for tax purposes.

Can you predict when you take money out of an annuity?

In other words, you can’t say for sure what will actually happen when it comes time to take money out of your annuity.

What is the general rule for pensions?

The General Rule requires that you use the life expectancy or "actuarial" tables provided by the IRS to figure the taxable and tax-free portions of your payments. They're included in IRS Publication 939, General Rule for Pensions and Annuities, and the publication also walks you through the calculations for your taxable pension ...

Does the balance provide tax?

NOTE: The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results.

Is pension income taxable in 2021?

Tax time can be particularly confusing when you have pension or annuity income. The Internal Revenue Service indicates that some or all of the amounts you receive from these sources can be taxable. How pensions and annuities are taxed depends on various factors.

Is a contribution to a plan taxable?

Any contributions you made with after-tax income and for which you never took a tax deduction aren't taxable to you at the time of distribution.

Is an annuity taxable?

The Taxable Portion of Your Pensions and Annuities. The IRS indicates that your payments are partially taxable if your contributions to your pension or annuity were made with after-tax dollars. You won't pay tax on the portion of the payments that represent a return of the after-tax amount you paid. 1 . These contributions represent your cost in ...

It depends on your contributions

Justin Pritchard, CFP, is a fee-only advisor and an expert on personal finance. He covers banking, loans, investing, mortgages, and more for The Balance. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades.

What Is an Annuity?

An annuity is an insurance contract designed to help investors with long-term goals. These insurance products offer a variety of guarantees, such as lifetime income, and any earnings inside of an annuity contract are tax-deferred.

Are Annuities Taxable?

The tax treatment of contributions, withdrawals, and income depends on several factors. We’ll dig into the details below, but first, it’s important to distinguish between qualified annuities, non-qualified annuities, and Roth accounts.

How Annuities Are Taxed

Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity. But taxation on contributions and withdrawals depends, in part, on whether or not the contract is a qualified or non-qualified annuity.

Tax Rules for Inherited Annuities

When you inherit an annuity, the tax rules are similar to everything described above:

Frequently Asked Questions (FAQs)

The death of a contract owner does not eliminate taxation on an annuity. However, you may be able to avoid early withdrawal penalties if you take distributions from an inherited annuity before age 59 ½.

How much tax is paid on an annuity?

If the owner of the account or contract is younger than 59½ years old and withdraws funds from an annuity, the taxable portion of the payout could be hit by a 10 percent tax penalty.

What is a qualified annuity?

Qualified annuities are those purchased through a qualified plan like a 401 (k) or SIMPLE IRA, and are normally paid for with pre-tax dollars. In this case, the tax rules governing qualified plans and IRAs essentially trump the annuity tax rules, which generally means that the full annuity payout is taxed as ordinary income.

What is annuity withdrawal?

Withdrawals are pursuant to possible contract limitations/adjustments and IRS tax rules. Annuities are contracts sold by life insurance companies and are considered long-term investments that may be suitable for retirement.

Does an annuity grow tax deferred?

While the money in an annuity will grow tax-deferred, once you start withdrawing your money, that growth will be taxed as ordinary income.

Do you owe taxes on an annuity?

For non-qualified annuities: You won’t owe tax on the amount you paid into the annuity. But you will owe ordinary income tax on the growth. And when you make a withdrawal, the IRS requires that you take the growth first — meaning you will owe income tax on withdrawals until you have taken all the growth.

Is principal taxed as ordinary income?

The principal portion of your payment is tax-free and divided equally among your expected payments, while the earnings portion is taxed as ordinary income. But say you live to age 95. During those “extra” five years, your full payouts will be taxed as ordinary income, given that the principal has been exhausted.

Is an annuity income taxed?

Non-qualified annuities are funded with money that has already been taxed. And because the money you put in was already taxed, only the growth portion of your annuity is subject to taxation. The principal (or basis) — the money you put in — will be returned to you tax-free, while the earnings growth will be taxed as ordinary income.

What is an annuity?

Annuities allow individuals to set money aside for the future and enjoy tax-deferred growth. When an annuity owner settles for a lifetime stream of payments, the Internal Revenue Service expects to get its share of the taxable portion as the money comes out.

Is an annuity taxable gain?

Annuities, unless set up as a qualified pre-tax plan like an IRA, are funded by regular income. Since annuity owners already paid taxes on the money they used to fund the annuities, only the growth is considered taxable gain.

When do you use the simplified method for annuities?

411. If the starting date of your pension or annuity payments is after November 18, 1996 , you generally must use the Simplified Method to determine how much of your annuity payment is taxable and how much is tax-free.

How much do you have to withhold from a rollover?

If you receive an eligible rollover distribution, the payer must withhold 20% of it, even if you intend to roll it over later. You can avoid this withholding by choosing the direct rollover option. A distribution sent to you in the form of a check payable to the receiving plan or IRA isn't subject to withholding.

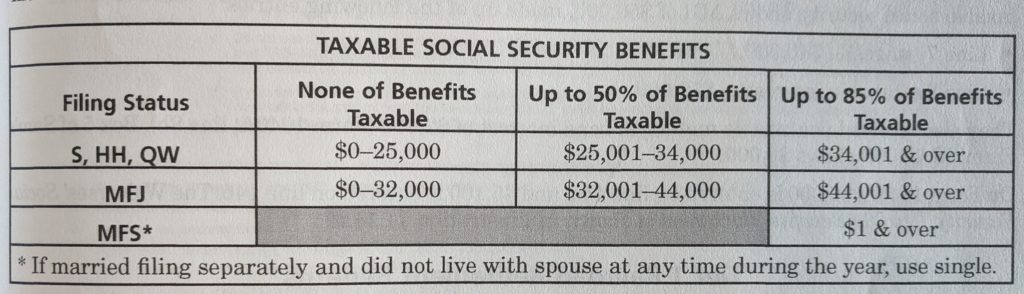

Is 410 pension taxable?

Topic No . 410 Pensions and Annuities. If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan, all or some portion of the amounts you receive may be taxable. This topic doesn't cover the taxation of social security and equivalent railroad retirement benefits.

Is a pension payment taxable?

Partially Taxable Payments. If you contributed after-tax dollars to your pension or annuity, your pension payments are partially taxable. You won't pay tax on the part of the payment that represents a return of the after-tax amount you paid. This amount is your investment in the contract and includes the amounts your employer contributed ...

Is an annuity taxable if you have no investment?

The pension or annuity payments that you receive are fully taxable if you have no investment in the contract (sometimes referred to as "cost" or "basis") due to any of the following situations: