What is better a personal loan or home equity loan?

A personal loan is usually better for small loan amounts. Home equity loans take a long time and incur a lot of fees just to get the small amount you need. On the other hand, personal loans fund fast and have very few fees, making more sense when you only need a small amount.

Can you buy a house with a home equity loan?

Yes, you can use a home equity loan to buy another house. Using a home equity loan (also called a second mortgage) to purchase another home can eliminate or reduce a homeowner’s out-of-pocket expenses. However, taking equity out of your home to buy another house comes with risks. Learn more about using a home equity loan for a second home.

Is a home equity loan better than refinancing?

Typically, home equity loans and lines come with higher interest rates than cash-out refinances. They also tend to have much lower closing costs. So if a new mortgage rate is similar to your current rate, and you don’t want to borrow a lot of extra cash, a home equity loan is probably your best bet.

Is a home equity loan the same as a mortgage?

“The process is generally the same between a mortgage and a home equity in that the lender has to evaluate income, employment and appraise the property,” Gupta says. During at least one stage, though, the home equity loan process is faster, Gupta points out.

What is the normal term for a home equity loan?

Repayment terms usually start at five years, but can be stretched to between 10 and 30 years, depending on your home equity lender. Just as some homeowners may choose a longer-term mortgage and pay it off early, you may opt for a longer home equity loan term length and make extra payments to pay it down faster.

What is the monthly payment on a $100 000 home equity loan?

Loan payment example: on a $100,000 loan for 180 months at 5.79% interest rate, monthly payments would be $832.55.

What is home equity term?

Home equity is the value of a homeowner's interest in their home. In other words, it is the actual property's current market value (less any liens that are attached to that property).

What are two types of home equity loans?

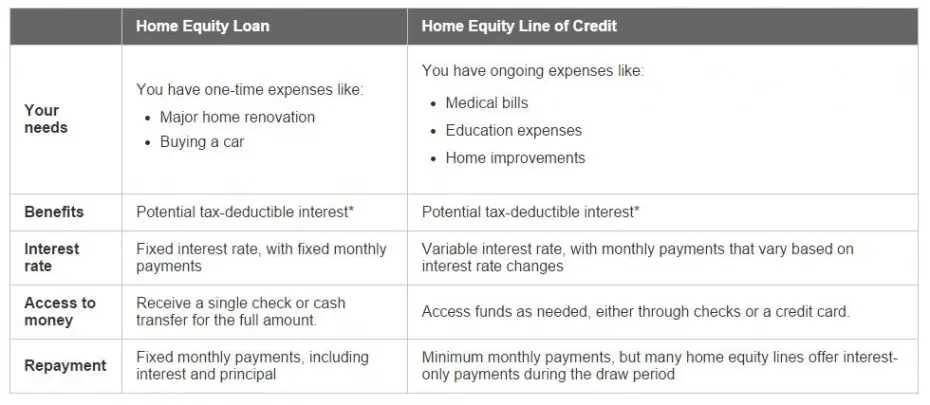

There are two main types of home equity loans: fixed-rate loans and home equity lines of credit (HELOCs). The interest paid on home equity loans is tax-deductible, but only if the loan is used to buy, build, or substantially improve the home that secured the loan.

Can you pull equity out of your home without refinancing?

Home equity loans and HELOCs are two of the most common ways homeowners tap into their equity without refinancing. Both allow you to borrow against your home equity, just in slightly different ways. With a home equity loan, you get a lump-sum payment and then repay the loan monthly over time.

How soon can you pull equity out of your home?

Technically, you can get a home equity loan as soon as you purchase a home. However, home equity builds slowly, which means it can take a while before you have enough equity to qualify for a loan. It can take five to seven years to begin paying down the principal on your mortgage and start building equity.

Can I pay off a home equity loan early?

The Bottom Line Paying off your home equity loan early is a great way to save a significant amount of interest over the life of your loan. Early payoff penalties are rare, but they do exist. Double-check your loan contract and ask directly if there is a penalty.

How do you pay back an equity loan?

Home equity loans When you get a home equity loan, your lender will pay out a single lump sum. Once you've received your loan, you start repaying it right away at a fixed interest rate. That means you'll pay a set amount every month for the term of the loan, whether it's five years or 15 years.

What is the best way to get equity out of your home?

You can take equity out of your home in a few ways. They include home equity loans, home equity lines of credit (HELOCs) and cash-out refinances, each of which has benefits and drawbacks. Home equity loan: This is a second mortgage for a fixed amount, at a fixed interest rate, to be repaid over a set period.

How much can you borrow on a home equity loan?

around 80% to 85%How much can you borrow with a home equity loan? A home equity loan generally allows you to borrow around 80% to 85% of your home's value, minus what you owe on your mortgage.

What's the difference between a home equity loan and a HELOC?

With a home equity loan, you receive the money you are borrowing in a lump sum payment and you usually have a fixed interest rate. With a home equity line of credit (HELOC), you have the ability to borrow or draw money multiple times from an available maximum amount.

How long does a home equity loan take?

two weeks to two monthsThe entire home equity loan process takes anywhere from two weeks to two months. A few factors influence the timeline—some in and some out of your control: How well you're prepared. Your lender will want to see copies of your current mortgage statement, property tax bill, and proof of income.

What is the monthly payment on a $250 000 home equity loan?

Monthly payments for a $250,000 mortgage On a $250,000 fixed-rate mortgage with an annual percentage rate (APR) of 4%, you'd pay $1,193.54 per month for a 30-year term or $1,849.22 for a 15-year one.

Do you have to pay interest on a home equity loan?

Home equity loans When you get a home equity loan, your lender will pay out a single lump sum. Once you've received your loan, you start repaying it right away at a fixed interest rate. That means you'll pay a set amount every month for the term of the loan, whether it's five years or 15 years.

How much can you borrow on a home equity loan?

around 80% to 85%How much can you borrow with a home equity loan? A home equity loan generally allows you to borrow around 80% to 85% of your home's value, minus what you owe on your mortgage.

How are home equity payments calculated?

Lenders calculate home equity loan payments by creating an amortization schedule based on the loan amount, interest rate, and loan term. 3 Usually, amortized loans feature equal payments throughout the life of the loan. Most home equity loans require monthly payments.

What Is A Home Equity Loan?

A home equity loan — also known as a second mortgage, term loan or equity loan — is when a mortgage lender lets a homeowner borrow money against th...

How Do Home Equity Loans Work?

The amount of money you can borrow with a home equity loan or second mortgage is partially based on how much equity you have in your home. Equity i...

What Can A Home Equity Loan Be Used for?

As a homeowner, you can use home equity loans or second mortgages for almost anything you want. Since the money comes as a lump sum (unlike a home...

What Fees Do I Need to Pay?

Home equity loans or second mortgages have fees similar to what you paid for your original mortgage, which may include: 1. Appraisal fees 2. Origin...

Who Should Consider A Home Equity Loan?

If you need a lump sum of money for something important (such as a home repair, not a vacation or something fleeting) and are sure you can easily r...

What is a Home Equity Loan?

A home equity loan — also known as a second mortgage, term loan or equity loan — is when a mortgage lender lets a homeowner borrow money against the equity in his or her home. If you haven’t already paid off your first mortgage, a home equity loan or second mortgage is paid every month on top of the mortgage you already pay, hence the name “second mortgage.”

Who Should Consider a Home Equity Loan?

If you need a lump sum of money for something important (such as a home repair, not a vacation or something fleeting) and are sure you can easily repay a home equity loan or second mortgage, it’s worth considering. The rates on a home equity loan tend to be significantly lower than rates on credit cards, so a second mortgage can be a more economical option than paying for what you need with plastic. And sometimes the interest paid on home equity loans or second mortgages is tax deductible, so this may be an added financial bonus (talk to your tax advisers, as this varies person to person).

How much equity do you have if you put down $30,000?

You put down $30,000 when you bought it and have paid down $30,000 in mortgage principal. You would have $60,000 in equity ($300,000 value of home – $240,000 still owed = $60,000 in equity) in the home. The lender would use this equity number — in addition to your credit score and income — to determine how much of a loan you will get.

How does a lender use equity?

The lender would use this equity number — in addition to your credit score and income — to determine how much of a loan you will get. Your lender will need to pull your credit report and verify your income to determine the interest rate you’ll pay for your second mortgage.

What is a second mortgage?

A home equity loan or second mortgage can be a source of money to fund your major financial goals, such as paying for college education or medical bills, and can prevent building up credit card debt with high interest rates.

How long does it take to pay off a second mortgage?

Often, you have to pay off a home equity loan or second mortgage within about 15 years, though the terms vary. The interest rate on the loan is typically fixed. Similar to your first mortgage, second mortgages will require closing costs, which can cost about 3 -6 % of the amount of the loan.

What happens if you default on a second mortgage?

Just beware: with a second mortgage, you are putting up your home as collateral for the loan, so if you default on this second mortgage, the bank can take your home. And this type of loan will reduce the equity you have in your home. So when you sell your home, you’ll have to pay off both your first and second mortgages with your sale proceeds.

What is home equity loan?

A home equity loan is a type of second mortgage that allows you to borrow against your home equity, or the difference between your home’s value and your outstanding loan balance. Similar to a mortgageused to buy a home, the loan is repaid in fixed monthly installments and the home is used as collateral.

What is a home equity line of credit?

A home equity line of credit(HELOC), on the other hand, is another type of second mortgage that uses your home as collateral. You receive the funds on a revolving credit line instead of a lump sum, and make payments based on what you borrow, plus the interest charged on that balance.

What is the LTV ratio for a home equity loan?

Home equity loans are repaid after first mortgages in the event of a foreclosure. You typically need a maximum 85% loan-to-value (LTV) ratio to meet home equity loan requirements. Your LTV ratio is the percentage of your home value that is financed by a mortgage.

What is the maximum LTV for a home loan?

You typically need a maximum 85% loan-to-value (LTV) ratio to meet home equity loan requirements. Your LTV ratio is the percentage of your home value that is financed by a mortgage. Additionally, you may be limited to borrowing 85% of your home’s value, minus your outstanding loan balance, though some lenders offer high-LTV home equity loans.

How long does a home equity loan last?

A home equity loan is a lump sum of cash paid to you and secured by your home. Depending on your lender, home equity loan terms can range from five to 30 years.

Can you take out a home equity loan?

A home equity loan or HELOC may not be the right option for every homeowner looking to tap the equity in their home. Another option is a cash-out refinance, which allows you to take out a new mortgage for more than you owe on your original home loan. The new loan pays off your existing mortgage, and you receive the difference between the two loan amounts in a lump sum.

Is home equity loan variable?

Home equity line of credit interest rates are usually variable and can be lower than rates on home equity loans. That’s because home equity loans have fixed interest rates for the entire repayment term and won’t change with market movements.

What is a home equity loan?

A home equity loan is a loan in which borrowers use their house as collateral. You can get a home equity loan before or after you pay of your first mortgage, which is why it’s sometimes called a “second mortgage.” Home equity loans are conforming loans, so the minimum and maximum loan amounts are determined by the amount of equity you have in your property as well as federal regulations.

What is the difference between a HELOC and a home equity loan?

Alternatively, a HELOC is more like a credit card.

How does a cash out refinance work?

Cash-out refinance: Cash-out refinancing is a way to pay off your first mortgage based on your home’s current value, whereas a home equity loan is another loan on top of your current mortgage. A cash-out refinance is similar to a home equity loan in that you’re liquidating your equity for more immediate funds. A lender will evaluate your loan-to-value limits to determine how much cash you can take out from the equity of your property. Interest rates are usually lower with cash-out refinancing than with a home equity loan, but not by much.

What is an unsecured loan?

Unsecured personal loan: With an unsecured personal loan, lenders determine the amount you can borrow based on your credit history and current income. Interest rates are sometimes double or triple that of home equity loans. Since the loan is unsecured, if you default on your loan you won’t lose your house.

What are the benefits of home equity loans?

On the plus side of a home equity loan, you’ll get fixed rates with predictable payments and lower interest rates than you would with a personal loan or credit card. If your mortgage rate is currently low, a home equity loan won’t change that. Disadvantages of home equity loans.

How long does it take to pay off a home equity loan?

5-15 YEARS. to pay off a home. equity loan. When you take out a home equity loan, you’re borrowing a large sum against your house under the condition that you’ll make payments every month until it is paid off. As part of the 2018 Tax Reform, interest on most home equity loans is no longer tax deductible.

When does home equity increase?

Also sometimes called “real property value,” home equity increases as you make payments on your mortgage and when your property value appreciates. You use your home equity as collateral when you take out a home equity loan or a home equity line of credit. A home equity loan is especially advantageous if your property values have gone up ...

What Is Home Equity?

Home equity is the value of a homeowner’s interest in their home. In other words, it is the real property’s current market value (less any liens that are attached to that property). The amount of equity in a house—or its value—fluctuates over time as more payments are made on the mortgage and market forces impact the current value of the property.

How does equity work?

How Home Equity Works. If a portion—or all—of a home, is purchased via a mortgage loan, the lending institution has an interest in the home until the loan obligation has been met. Home equity is the portion of a home's current value that the owner actually possesses at any given time.

How much equity does a house owner have?

If a homeowner purchases a home for $100,000 with a 20% down payment (covering the remaining $80,000 with a mortgage), the owner has equity of $20,000 in the house. If the market value of the house remains constant over the next two years, and $5,000 of mortgage payments are applied to the principal, the owner would possess $25,000 in home equity at the end of the two year period.

What is a HELOC loan?

A home equity line of credit (HELOC) is a revolving line of credit usually with an adjustable interest rate, which allows you to borrow up to a certain amount over a period of time. HELOCs work in a manner similar to credit cards, where you can continuously borrow up to an approved limit while paying off the balance.

How much equity would a home owner have if the market value of the home increased?

If the market value of the home had increased by $100,000 over those two years, and that same $5,000 from mortgage payments were applied to the principal, the owner would then have a home equity of $125,000.

Why do you get more equity on a mortgage?

After that, more equity is achieved through your mortgage payments, since a contracted portion of that payment will be assigned to bring down the outstanding principal you still owe on the loan. You can also benefit from property value appreciation because it will cause your equity value to increase.

Can equity be converted to cash?

Unlike other investments, home equity cannot be quickly converted into cash. The equity calculation is based on a current market value appraisal of your property. But that appraisal is no guarantee that the property would sell at that price.

What is a home equity loan?

The Bottom Line. A home equity loan, also known as a second mortgage, lets homeowners borrow money by leveraging the equity value in their homes.

What is a fixed rate home equity loan?

Fixed-rate home equity loans can help cover the cost of a single, large purchase, such as a new roof on your home or an unexpected medical bill. A HELOC provides a convenient way to cover short-term recurring costs, such as the quarterly tuition for a four-year degree at a college.

What are the pitfalls of home equity?

The main pitfall associated with home equity loans is that they sometimes seem to be an easy solution for a borrower who may have fallen into a perpetual cycle of spending and borrowing, spending and borrowing—all the while sinking deeper into debt.

What is a HELOC loan?

Home Equity Lines of Credit (HELOCs) A home equity line of credit ( HELOC) is an adjustable or variable-rate loan that works much like a credit card and, in fact, sometimes comes with one to use for purchases on the line of credit. Borrowers are pre-approved for a certain spending limit and can withdraw money when they need it via a credit card ...

Why do people get home equity loans?

Indeed, a popular reason consumers have for borrowing against the value of their homes via a fixed-rate home equity loan is to pay off credit card balances.

How long does a fixed rate loan last?

Fixed-rate loans provide a single, lump-sum payment to the borrower, which is repaid over a set period of time, usually five to 15 years, at an agreed-upon interest rate. The payment and interest rate remain the same over the lifetime of the loan.

How to avoid reloading a home equity loan?

To avoid the pitfalls of reloading, conduct a careful review of your financial situation before you borrow against your home. Make sure you understand the home equity loan terms and have the means to make the payments and comfortably repay the debt on or before its due date without compromising other bills.

What is a traditional home equity loan?

Traditional Home Equity Loan: This type of loan allows you to borrow a fixed amount of money in one lump sum usually as a second mortgage on your home in addition to your primary mortgage. With a traditional home equity loan, you can expect to have a fixed interest rate, loan term and monthly payment amount.

How long does a home equity loan last?

A home equity loan term can range anywhere from 5-30 years. HELOCs generally allow up to 10 years to withdraw funds, and up to 20 years to repay. A cash-out refinance term can be up to 30 years. Repayment options are the various structures a lender provides for you to repay the borrowed funds.

What is a cash out refinance?

Cash-Out Refinance Loan: This type of home loan allows you to borrow a fixed amount against the equity in your home by refinancing your current mortgage into a new home loan for more than you currently owe, and you take the difference in cash. With a cash-out refinance loan, the additional borrowed amount is combined with the balance of your existing mortgage.

What is a revolving line of credit?

Home Equity Line of Credit (HELOC): This product is considered revolving credit because it allows you to borrow money as you need it with your home as collateral. Most HELOC plans allow you to draw funds over a set amount of time known as the “draw period”. At the end of this period you may be able to renew the credit line and keep withdrawing money, but not all lenders allow renewals. Some lenders require borrowers to pay back the entire amount at the end of the draw period and others may allow you to make payments over another time period known as the “repayment period.”

How to get started with home equity loan?

To find out how much you can borrow and what rates, terms and payment options apply to your personal situation, apply online now and see if you qualify in minutes, or contact a Personal Banker at 1-855-361-3435.

When do you pay interest on a home equity loan?

Usually, you will repay your loan on a monthly basis, and your loan is paid in full when the term ends. In some cases, as with home equity lines of credit, you might pay the interest only during the term of the loan and pay the full amount of borrowed funds when the loan term ends.

How to calculate equity?

Equity can be calculated by subtracting all debts secured by your home from your home’s appraised value. For instance, if your home is worth $275,000 and your current mortgage is $100,000, then you have $175,000 of equity. Loan to Value Ratio is the amount of your mortgage divided by the appraised value of your home.

What is a home equity loan?

A home equity loan is a type of second mortgage that allows you to borrow against your home’s value, using your home as collateral. A home equity line of credit (HELOC) typically allows you to draw against an approved limit and comes with variable interest rates. Beware of red flags, like lenders who change the terms of the loan at ...

Why do people get home equity loans?

Home equity loans can provide access to large amounts of money and be a little easier to qualify for than other types of loans because you're putting up your home as collateral.

How long do you have to pay off a HELOC loan?

Repayment terms depend on the type of loan you get. You'll typically make fixed monthly payments on a lump-sum home equity loan until the loan is paid off. With a HELOC, you might be able to make small, interest-only payments for several years during your “draw period" before the larger, amortizing payments kick in. Draw periods might last 10 years or so. You’ll start making regular amortizing payments to pay off the debt after the draw period ends.

Why is a HELOC loan more flexible?

A HELOC is a more flexible option, because you always have control over your loan balance—and, by extension, your interest costs. You'll only pay interest on the amount you actually use from your pool of available money.

What are some alternatives to home equity loans?

Alternatives to home equity loans include cash-out refinancing, which replaces the mortgage, and a reverse mortgage, which depletes equity over time.

How much equity do you need to buy a house?

Lenders commonly look for, and base approval decisions on, a few factors. You'll most likely have to have at least 15% to 20% equity in your property. You should have secure employment—at least as much as possible—and a solid income record even if you've changed jobs occasionally. You should have a debt-to-income (DTI) ratio, also referred to as "housing expense ratio," of no more than 36%, although some lenders will consider DTI ratios of up to 50%.

How to get a loan estimate?

Apply with several lenders and compare their costs, including interest rates. You can get loan estimates from several different sources, including a local loan originator, an online or national broker, or your preferred bank or credit union.

What is home equity loan?

A home equity loan is a fixed-term loan granted by a lender to a borrower based on the equity in their home. Home equity loans are often referred to as second mortgages. Borrowers apply for a set amount that they need, and if approved, receive that amount in a lump sum upfront. The home equity loan has a fixed interest rate and schedule of fixed payments for the term of the loan. A home equity loan is also called a home equity installment loan or equity loan.

What is a home equity line of credit?

Home equity loans and home equity lines of credit (HELOCs) are loans that are secured by a borrower's home. A borrower can take out an equity loan or credit line if they have equity in their home. Equity is the difference between what is owed on the mortgage loan and the home's current market value.

What is a good alternative to a HELOC or a home equity loan?

If you don’t mind slightly higher interest rates and want to avoid the risk of foreclosure, then a personal loan is a solid alternative. Each option has pros and cons and should be considered carefully.

What is a HELOC loan?

A home equity line of credit (HELOC) is a revolving credit line. A HELOC allows the borrower to take out money against the credit line up to a preset limit, make payments, and then take money out again.

What are the disadvantages of home equity loans?

A disadvantage of home equity loans is that the home could be sold to satisfy the remaining debt if the loan is not paid off or goes into default or nonpayment. As a result, borrowers must be sure not to get overextended and borrow more than they can afford to pay back. If the loan goes into default, the bank may foreclose on or take back the home to satisfy the debt.

How long can you borrow against a HELOC?

Generally, it gives you ongoing access to cash for a set period—sometimes up to 10 years. You can borrow against your line, repay it all or in part, and then borrow that money again later, as long as you’re still in the HELOC's draw period. However, an equity line of credit is revocable—just like a credit card.

How long does an equity loan last?

A portion of each payment goes to interest and the principal amount of the loan. Typically, the term of an equity loan term can be anywhere from five to 30 years, but the length of the term must be approved by the lender.