What is the Wilshire 5000 index?

The Wilshire 5000 is an index that tracks the performance of the entire U.S. stock market. Unlike other proxies for the market that may contain as few as 30 stocks, the Wilshire 5000 holds thousands at any given time to try to truly replicate the whole market.

Is Wilshire 5000 the same as Dow Jones?

After Dow Jones and Wilshire split up, Dow Jones made their own total stock market index, called the Dow Jones U.S. Total Stock Market Index, similar to the Wilshire 5000. Of the popular indexes, the Wilshire 5000 has been found to be the best index to use as a benchmark for US stock valuations.

What is the best index to use as a benchmark for valuations?

Of the popular indexes, the Wilshire 5000 has been found to be the best index to use as a benchmark for US stock valuations. ^ a b "Wilshire Associates - Wilshire 5000 Fact Sheet" (PDF).

What is the Wilshire liquid alternative index?

The Wilshire Liquid Alternative indexes help investors more accurately benchmark liquid alternatives. aunched in 2014, they provide a more relevant, broad market measure for the performance of diversified liquid alternative investment strategies implemented in mutual fund structures.

What is the FT Wilshire 5000 index?

The FT Wilshire 5000 Index (FTW5000) is a broad-based market capitalization-weighted index that seeks to capture 100% of the United States investible market.

What is the Wilshire 5000 index symbol?

W5000: Wilshire 5000 Index - Stock Price, Quote and News - CNBC.

Is there an ETF that tracks the Wilshire 5000?

The index measures the performance of all U.S. equity securities with readily available price data. The index was named after the nearly 5,000 stocks it contained when it was originally created, but it has grown to include over 5,000 issues.

Why do most professionals consider the Wilshire 5000 a better index of the performance of the broad stock market than the Dow Jones Industrial Average?

The reason why the Wilshire 5000 is considered a better index of performance of the broad stock market than Dow Jones Industrial Average is because of the very small size of the latter. While the Dow Jones Industrial Average has 30 large corporations in its index, it doesn't have odd 500 stocks listed in Wilshire 5000.

What is the Wilshire 5000 index explain what it is used for?

The FT Wilshire 5000 is a stock index that tracks the performance of virtually all publicly traded companies in the United States. Created in 1974, the Index is arguably the most comprehensive barometer of the performance of the U.S. stock market.

What companies are in the Wilshire 5000 index?

The Wilshire 5000 is an index that tracks the performance of the entire U.S. stock market....Wilshire 5000 Companies.CompanyTicker% of Net AssetsApple Inc.AAPL6.29%Microsoft Corp.MSFT5.04%Amazon Inc.AMZN3.31%Alphabet Inc. Class CGOOG1.97%6 more rows•Apr 29, 2022

What is the best total market index fund?

The Vanguard Total Stock Market Index Admiral Shares (VTSAX)The Schwab Total Stock Market Index (SWTSX)The iShares Russell 3000 ETF (IWV)The Wilshire 5000 Index Investment Fund (WFIVX)Total Stock Market Funds FAQs.

How do I invest in the Wilshire 5000?

How to invest in the Wilshire 5000Pick a platform. Compare trading platforms to find the brokerage that best meets your investment needs.Open an account. ... Purchase securities. ... Monitor investments.

What index funds have the highest returns?

Best index funds to invest in for October 2022Fidelity ZERO Large Cap Index.Vanguard S&P 500 ETF.SPDR S&P 500 ETF Trust.iShares Core S&P 500 ETF.Schwab S&P 500 Index Fund.Shelton NASDAQ-100 Index Direct.Invesco QQQ Trust ETF.Vanguard Russell 2000 ETF.More items...•

Are mutual funds or index funds better?

Index funds seek market-average returns, while active mutual funds try to outperform the market. Active mutual funds typically have higher fees than index funds. Index fund performance is relatively predictable over time; active mutual fund performance tends to be much less predictable.

What is the difference between S&P 500 and Dow Jones?

Key Takeaways. The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

What is the difference between Dow Jones and Nasdaq S&P?

The Dow tracks the value of 30 large companies which tend to be blue-chip firms that are household names. The S&P 500 tends to be broader, hoping to have a bigger representation of companies from various sectors and industry groups. And the Nasdaq composite includes only stocks that are traded on the Nasdaq market.

Is there a Russell 2000 ETF?

The iShares Russell 2000 ETF seeks to track the investment results of an index composed of small-capitalization U.S. equities.

Does Vanguard have index funds?

Created in 1992, Vanguard Total Stock Market Index Fund is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks. The fund's key attributes are its low costs, broad diversification, and the potential for tax efficiency.

What is the Wilshire 5000?

The Wilshire 5000 is an index that tracks the performance of the entire U.S. stock market. Unlike other proxies for the market that may contain as few as 30 stocks, the Wilshire 5000 holds thousands at any given time to try to truly replicate the whole market.

How many versions of the Wilshire index are there?

Wilshire maintains three different versions of the index, each of which is weighted slightly differently:

What is Russell 3000?

The Russell 3000 measures the performance of 3,000 of the largest U.S. stocks and gives exposure to the total stock market. It is the most similar to the Wilshire 5000 of the indexes listed.

What is the Nasdaq 100?

The Nasdaq 100 measures just 100 companies traded on the Nasdaq exchange. Unlike the Wilshire 5000, it includes both domestic and international companies, but it doesn’t include financial organizations.

What are the three stock indexes?

When market analysts talk about the stock market, they’re always mentioning the Nasdaq, the Dow and the S&P 500. While these three indexes are the most common stand-ins for the entire stock market, there’s another option that truly fits the bill: the Wilshire 5000.

Which is the most comprehensive market index?

While the Wilshire 5000 is the most comprehensive of the market indices, there are several other indexes to consider when evaluating the market:

What is equal weight index?

Equal weight: With an equal weight index, the index invests an equal amount into each security. Each company has the same level of importance and impact on the index’s performance, no matter their size.

What is the Wilshire 5000?

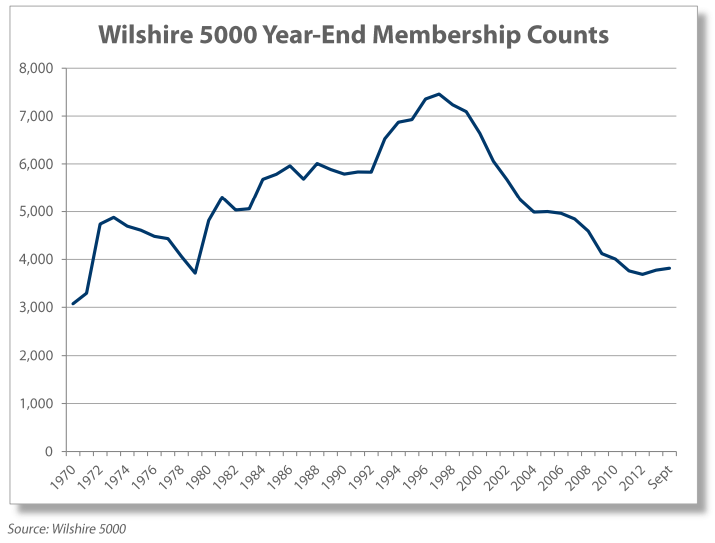

The Wilshire 5000, also called the Wilshire 5000 Total Market Index (TMWX), is an index that tracks all US equities actively traded on the American Stock Exchange. This broad-based market index was named for its nearly 5,000 stocks when first launched in 1974 — but the index hasn’t held more than 5,000 companies since 2005. As of 2019, the index held 3,492 stocks.

What are the risks of investing in Wilshire 5000?

The Wilshire 5000 suffers from the same flaw as the Russell 3000: it overweights large-cap stocks. As a result, the index is largely dominated by the biggest companies it tracks.

How to invest in stocks?

Here’s a snapshot of the process: 1 Pick a platform. Compare trading platforms to find the brokerage that best meets your investment needs. 2 Open an account. Applications for web-based brokerages can be completed online, and you’ll need to fund your account before you start trading. 3 Purchase securities. Use your platform’s research tools to find the stocks or funds you’d like to purchase. 4 Monitor investments. Log in to your brokerage account to track your investment performance.

What is Finder.com?

Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision.

Is Wilshire 5000 the same as Russell 3000?

The Wilshire 5000 suffers from the same flaw as the Russell 3000: it overweights large-cap stocks. As a result, the index is largely dominated by the biggest companies it tracks. To build a balanced portfolio, consider investing in indexes that specifically target small-cap stocks, like the Russell 2000.

What is the Wilshire 5000?

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American- stocks actively traded in the United States. As of December 31, 2019, the index contained 3,473 components. The index is intended to measure the performance of most publicly traded companies ...

How much did the Wilshire 5000 gain in 2009?

The Wilshire 5000 gained approximately $2.5 trillion in market value during the first 11 months of 2009 while the index rose 2,105 points. Therefore, as of November 2009, each index point represented about $1.2 billion in market value.

What is CRSP index?

The CRSP U.S. Total Market Index (ticker CRSPTM1) is a very similar comprehensive index of U.S. stocks supplied by the Center for Research in Security Prices. It was especially designed for use by index funds. After Dow Jones and Wilshire split up, Dow Jones made their own total stock market index, called the Dow Jones U.S. Total Stock Market Index, similar to the Wilshire 5000.

Why is the S&P 500 still below its March 2000 high?

On that day, the S&P 500 was still several percentage points below its March 2000 high, because small cap issues absent from the S&P 500 and included in the Wilshire 5000 outperformed the large cap issues that dominate the S&P 500 during the cyclical bull market.

When did the Wilshire 5000 hit its intraday high?

On January 7, 2021, the Wilshire 5000 had its first intraday high and its first closing over 40,000 points.

Which is the best stock index to use as a benchmark?

Of the popular indexes, the Wilshire 5000 has been found to be the best index to use as a benchmark for US stock valuations.

When was the Wilshire 5000 renamed?

It was renamed the "Dow Jones Wilshire 5000" in April 2004, after Dow Jones & Company assumed responsibility for its calculation and maintenance.

What is the Wilshire Bond Index?

The Wilshire Bond Index measures the performance of fixed income securities held by US institutional investors. Introduced in 2016, it provides a more accurate view of the performance and risks in the US fixed income market based on institutional investments held than bond market indexes that track issue-based holdings.

What is Wilshire liquid alternative index?

The Wilshire Liquid Alternative indexes help investors more accurately benchmark liquid alternatives. aunched in 2014, they provide a more relevant, broad market measure for the performance of diversified liquid alternative investment strategies implemented in mutual fund structures.

What is Wilshire BDC?

The Wilshire BDC Index measures the performance of publicly traded business development company securities that focus on debt financing of small, developing and financially distressed companies.

What is a real estate index?

Our real estate indexes help investors measure and better understand the performance of the real estate market. Introduced in 1991, they comprise publicly traded real estate equity securities and help provide a more accurate reflection of the performance of real estate held by pension funds.

When did Wilshire start?

Wilshire has been applying highly tested theories and approaches to our client solutions since 1981.

What is US style index?

Our US style indexes help investors evaluate the performance of an active manager’s investment style. Launched in 1986, they are designed to help investors quantify a portfolio’s growth, value and size characteristics. Growth and value are defined by six factors: projected price-to-earnings ratio, projected earnings growth, price-to-book ratio, dividend yield, trailing revenue growth and trailing earnings growth.

:max_bytes(150000):strip_icc()/dotdash_final_Wilshire_5000_Total_Market_Index_Dec_2020-01-0268363358be408eb29551ec73fae4a4.jpg)