Unearned Income – This is cash you receive in the absence of active work or in providing a commercial service. For example, if you’re that firefighter who earns $50,000 in salary, you also likely get a pension or retirement fund as a benefit. Any money earned from those vehicles, not included in a paycheck, is a prime example of unearned income.

What is unearned revenue on the income statement?

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Once the product or service is delivered, unearned revenue becomes revenue on the income statement.

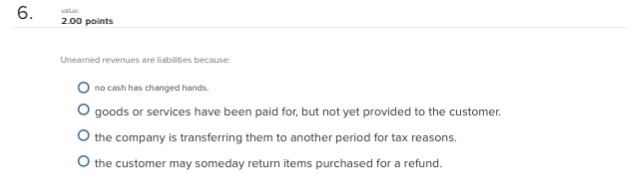

Why is unearned service revenue considered a liability?

Unearned service revenue is considered a liability because the company has an obligation to perform services for the amount it collected in advance. Advances from customers can be initially recorded as Unearned Service Revenue (a liability) or Service Revenue (income).

What are the different types of unearned income?

Interest and dividend income are the most common types of unearned income. Money received this way is unearned income, and the tax paid on it is considered an unearned income tax. Interest income, such as interest earned on checking and savings deposit accounts, loans, and certificates of deposit (CDs), is normally taxed as ordinary income.

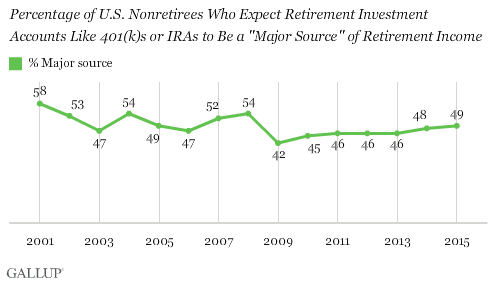

Is retirement income considered earned or unearned income?

Retirement income, such as cash earned from company pensions, annuities, and 401k plan or IRA account withdrawals Even income that at first glance appears to have come from active work, like working in a prison, is considered to be unearned income in the eyes of the federal government.

What is a good example of unearned income?

Two examples of unearned income you might be familiar with are money you get as a gift for your birthday and a financial prize you win. Other examples of unearned income include unemployment benefits and interest on a savings account.

Is unearned service income an asset?

Because the business has been paid but no product or service has been rendered, unearned revenue is considered a liability. The liability converts to an asset over time as the business delivers the product or service.

Is unearned service revenue a revenue?

Sometimes you are paid for goods or services before you provide those services to your customer. That's the essence of unearned revenue. Earned revenue means you have provided the goods or services and therefore have met your obligations in the purchase contract. Unearned revenue is simply the opposite.

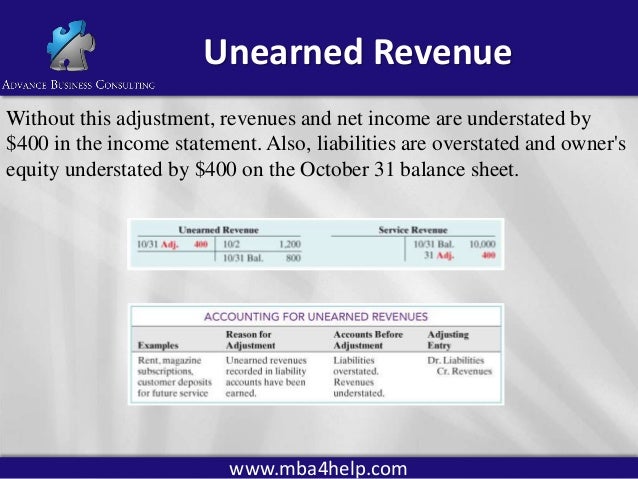

How do you record unearned income?

Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned revenue account. The credit and debit are the same amount, as is standard in double-entry bookkeeping. Also, each transaction is always recorded in two accounts.

How do you record unearned service revenue?

Unearned revenue should be entered into your journal as a credit to the unearned revenue account, and a debit to the cash account. This journal entry illustrates that the business has received cash for a service, but it has been earned on credit, a prepayment for future goods or services rendered.

Is unearned income a current liabilities?

The unearned revenue account is usually classified as a current liability on the balance sheet.

What is the difference between accrued income and unearned income?

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid.

What type of account is unearned service revenue?

If a prepaid good or service becomes undeliverable (or even if the client cancels their order) the business must pay the client back as it is liable for the delivery or completion of that good or service. That's why unearned revenue is considered a current liability account under the balance sheet.

Where does unearned income belong?

Unearned revenue is included on the balance sheet. Because it is money you possess but have not yet earned, it's considered a liability and is included in the current liability section of the balance sheet.

Is service revenue a liability or asset?

No, service revenue is not an asset. Assets are defined as resources with economic value that a business owns. Whereas service revenue is a business' earnings from providing goods and services to its customers. So, service revenue is considered a revenue (or income) account and not an asset.

Is unearned service revenue a debit or credit?

Under the liability method, you initially enter unearned revenue in your books as a cash account debit and an unearned revenue account credit. The debit and credit are of the same amount, the standard in double-entry bookkeeping. Additionally, you record each transaction in two accounts.

Is unearned rent an asset?

Unearned revenues are money received before work has been performed and is recorded as a liability. Prepaid expenses are expenses the company pays for in advance and are assets including things like rent, insurance, supplies, inventory, and other assets.

Why are earned and unearned income taxed differently?

Tax-wise, earned income and unearned income are taxed differently because of their unique income classifications and taxpayers should be aware of tax-related distinctions between the two.

What is Uncle Sam's unearned income?

Unearned income is Uncle Sam’s way of saying there’s another way to make money other than actively working for it.

What is income that has no direct link to a paycheck?

In plain talk, that means income that has no direct link to a paycheck, earned from active employment. As the IRS notes, it’s primarily cash that’s earned from investments, but it could also be garnered from non-investment activity, such as a family inheritance or alimony after a divorce.

What is income in finance?

Primarily, income is defined as monetary assets earned, primarily through the act of working for a company or organization, or by working for yourself. Or it can be earned indirectly, through financial vehicles like investments, trusts, and wagering, among other examples (listed above.)

What is non cash income?

Non-cash income earned on the job, such as a vehicle provided to a traveling salesperson by his or her company.

How much do you pay for 1099?

If you’re a 1099-based self-employed worker, you pay the entire 12.4% yourself. The deduction is based on what the federal government calls a “contribution and benefit base”, which amounts to $137,700 in 2020. That’s the amount of income a worker receives up to a fixed dollar limit (i.e., the $137,700.)

What is retirement income?

Retirement income, such as cash earned from company pensions, annuities, and 401k plan or IRA account withdrawals

What is the difference between earned and unearned income?

No one can completely avoid paying taxes, but not everybody pays taxes in the same way. People who work for someone else often receive compensation by paycheck. Individuals who earn paychecks produce active or earned income. People who get their money to do the work for them generate passive or unearned income.

Earned income vs. unearned income: why the distinction matters and how each is taxed

Remember how Warren Buffet famously said he pays less as a percentage in tax than his secretary? The reason this can happen is that the secretary is collecting earned income through a paycheck while Warren is making money through capital gains and dividends. Warren’s income is taxed at different rates.

Which is better, earned or unearned income?

The short answer is that it depends on your situation. Let’s look at two scenarios: a high-income worker with mostly earned income, and a retiree with primarily unearned income.

Increasing income: earned and unearned

When you work to increase your income, you may increase your earned income, your unearned income, or both.

Key takeaways

Earned income is also called active income because you worked for it during the current tax year.

What is unearned income?

Unearned income, also referred to as passive or deferred income, is income from investments and other sources unrelated to employment. While earned income comes from working a regular job where you provide a product or service, unearned income doesn't require direct participation. Lower tax rates usually apply to unearned income.

How much is unearned income taxed?

Most unearned income is taxed according to your tax bracket. However, capital gains and certain dividends are taxed at a lower rate. For example, those with very low incomes will pay 0% on dividends and long-term capital gains, while most will pay 15%.

How to start exploring unearned income?

Hire a financial analyst: A great way to start exploring unearned income investment opportunities is by hiring and meeting with a financial analyst. Their experience and financial expertise can help you make informed decisions that are relevant to the current market.

Do you report unearned income to the IRS?

By law, you must report all unearned income to the Internal Revenue Service (IRS). The IRS wants to know how much money you earn and from which sources. Be sure to account for all of your income and properly report it on your taxes.

Is unearned income a supplement to earned income?

Unearned income is beneficia l in that it can act as a supplement to earned income, provide financial security or help you prepare for retirement. Unearned income is typically the only source of income for retirees, so it can be beneficial to start exploring alternative streams of income early so you have time to prepare.

Is unearned income passive?

Unlike unearned income, this type of income is not passive, since you actively have to work to earn it. Understanding the differences between unearned and earned income can help you strategize about your financial future and give you the chance to explore alternative ways of making money. It can also help you determine the amount ...

How Is Unearned Income Reported?

Unearned income is reported in the liabilities section of your balance sheet. This is because it indicates value that your company owes in the form of goods and services unfulfilled.

What Are the Benefits of Unearned Income?

Unearned income brings in working capital quickly, which can help you scale your business and remove a lot of the uncertainty from accounts receivable or selling on credit.

What is Unearned Income?

Unearned income is income from sources, not from employment or a job. The IRS views unearned income as income from sources other than personal effort. For example, income from a salary, wages, tips, self-employment, and a few other sources are earned income. However, a person must put in the effort to make this income.

Examples of Unearned Income

A person is paid $50,000 per year in salary, as shown in a W-2 form. The same person receives a bonus of $5,000, interest income from certificates of deposits or CDs of $2,000, and qualified dividends of $2,000. In this example, the $50,000 salary and the $5,000 bonus are earned income.

Types of Unearned Income

The list below contains the most common types of unearned income. Of course, there are other types, but the ones on this list are common.

Summary on What is Unearned Income

Unearned income is an involved topic. Despite receiving income from a passive activity, the money, stock, property, or asset can still be subject to federal taxes. In some cases, the taxes must be paid in the current year. In other cases, taxes are paid at a particular threshold value or upon sale of the asset.

What is unearned service revenue?

Definition. Unearned Service Revenue is a liability account that is used to record advanced collections from clients of a service type business. In other words, it pertains to revenue already collected but the service has not yet been rendered. Also known as: Advances from Customers or Customer's Advances.

Is unearned service revenue a liability?

It is usually included as part of current liabilities in the balance sheet. Unearned service revenue is considered a liability because the company has an obligation to perform services for the amount it collected in advance.

Is unearned income counted as unearned income?

Unearned income that is “recouped” for an overpayment is often not countable. See Question 77. Pension or retirement savings account withdrawals that are more frequent than one time withdrawals are likely countable as unearned income. Interest income is also countable.

Is a pension withdrawal counted as unearned income?

Pension or retirement savings account withdrawals that are more frequent than one time withdrawals are likely countable as unearned income. Interest income is also countable. Hotline Q&A (Feb 2014)

What Is Unearned Revenue?

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a "prepayment" for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered. This liability is noted under current liabilities, as it is expected to be settled within a year.

How much is Morningstar's unearned revenue?

At the end of the second quarter of 2020, Morningstar had $287 million in unearned revenue, up from $250 million from the prior-year end.

Why is unearned revenue recorded on a company's balance sheet?

It is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Once the product or service is delivered, unearned revenue becomes revenue on the income statement. Receiving funds early is beneficial to a company as it increases its cash flow that can be used for a variety of business functions.

Is unearned revenue a liability?

Unearned revenue is recorded on a company’s balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer. As the prepaid service or product is gradually delivered over time, it is recognized as revenue on the income statement .

What are some examples of unearned revenue?

Some examples of unearned revenue include advance rent payments, annual subscriptions for a software license, and prepaid insurance. The recognition of deferred revenue is quite common for insurance companies and software as a service (SaaS) companies.

What is revenue stream?

Revenue Streams Revenue Streams are the various sources from which a business earns money from the sale of goods or provision of services. The types of

Is revenue recognized as a liability?

Therefore, the revenue must initially be recognized as a liability. Note that when the delivery of goods or services is complete, the revenue recognized previously as a liability is recorded as revenue (i.e., the unearned revenue is then earned).

Is unearned revenue a liability?

Accounting reporting principles state that unearned revenue is a liability for a company that has received payment (thus creating a liability) but which has not yet completed work or delivered goods. The rationale behind this is that despite the company receiving payment from a customer, it still owes the delivery of a product or service.

Understanding Unearned Income

- As noted above, unearned income is any money that is earned passively. It differs from earned i…

Unearned income cannot be contributed to individual retirement accounts (IRAs). 1 According to the Internal Revenue Service (IRS), earned income includes wages, salaries, tips, and self-employment income. 2

Types of Unearned Income

Benefits of Unearned Income

Examples of Unearned Income

What Are Some Types of Unearned Income?

Do I Have to Pay Tax on Unearned Income?

How Much Tax Will I Pay on Unearned Income?

What's the Difference Between Unearned Income and Earned Income?

What Is the Tax Treatment of Unearned Income for a Child?

The Bottom Line