What are some concepts behind variance analysis?

Concept of Variance Analysis. Variance analysis is the quantitative investigation of the difference between actual and planned behavior. The terms variance refers to the deviation of the actual costs from the standard costs due to various causes. This is typically involves the isolation of different causes for the variation in income and ...

What activities are performed in variance analysis?

Variance analysis is much more than simply identifying outliers. It involves analytical research, proactive planning, strategic decision making, and the foresight to understand how your company’s financials behave, in addition to what is most important to senior management.

What does analysis of variance tell us?

Updated December 31, 2018 Analysis of Variance, or ANOVA for short, is a statistical test that looks for significant differences between means on a particular measure. For example, say you are interested in studying the education level of athletes in a community, so you survey people on various teams.

What is the purpose of calculating variance in statistics?

What is variance analysis?

- The variance is not simply the average difference from the expected value.

- In budgeting (or management accounting in general), a variance is the difference between a budgeted, planned, or standard cost and the actual amount incurred/sold.

- Variance analysis can be carried out for both costs and revenues.

What is a variance analysis when and how can it be used?

Variance analysis is a method of assessing the difference between estimated budgets and actual numbers. It's a quantitative method that helps to maintain better control over a business.

Why is variance analysis useful?

In project management, variance analysis helps maintain control over a project's expenses by monitoring planned versus actual costs. Effective variance analysis can help a company spot trends, issues, opportunities and threats to short-term or long-term success.

What are variances used for?

The variance is a measure of variability. It is calculated by taking the average of squared deviations from the mean. Variance tells you the degree of spread in your data set. The more spread the data, the larger the variance is in relation to the mean.

How is variance analysis performed?

Variance Analyses can be performed by comparing planned activity cost against actual activity cost to identify variances between the cost baseline and actual project performance.

What are the types of variance analysis?

Variance analysis can be applied to both revenues and expenses. When actual results are better than planned, variance is referred to as 'favourable'....There are four main forms of variance:Sales variance.Direct material variance.Direct labour variance.Overhead variance.

How do you write a good variance analysis report?

8 Steps to Creating an Efficient Variance ReportStep 1: Remove background colors of your variance report. ... Step 2: Remove the borders. ... Step 3: Align values properly. ... Step 4: Prepare the formatting. ... Step 5: Insert absolute variance charts. ... Step 6: Insert relative variance charts. ... Step 7: Write the key message.More items...•

Why we use variance instead of standard deviation?

Variance helps to find the distribution of data in a population from a mean, and standard deviation also helps to know the distribution of data in population, but standard deviation gives more clarity about the deviation of data from a mean.

What is variance vs standard deviation?

Variance is the average squared deviations from the mean, while standard deviation is the square root of this number. Both measures reflect variability in a distribution, but their units differ: Standard deviation is expressed in the same units as the original values (e.g., minutes or meters).

What is a good variance?

As a rule of thumb, a CV >= 1 indicates a relatively high variation, while a CV < 1 can be considered low. This means that distributions with a coefficient of variation higher than 1 are considered to be high variance whereas those with a CV lower than 1 are considered to be low-variance.

How do managers use variance analysis?

Managers use variance analysis to measure and analyze what has already occurred in the company's activity, since variance analysis requires managers to use actual company performance.

How can variance analysis improve financial performance?

Managers use variance analysis to make decisions about the labor and materials costs incurred to create a product or deliver a service. The technique also helps managers with sales and production forecasting. To perform variance analysis accurately, you need to identify and record all business costs.

What is the importance of variance and standard deviation?

Variance helps to find the distribution of data in a population from a mean, and standard deviation also helps to know the distribution of data in population, but standard deviation gives more clarity about the deviation of data from a mean.

How does variance analysis help in continuous improvement?

Variance analysis, by providing information about actual performance relative to standards, can form the basis of continuous operational improvement. The underlying causes of unfavorable variances are identified and corrective action taken where possible.

Why is variance important in budgeting?

Budget variance analysis helps to reveal where your business exceeded expectations and where it came up short. Predictive budgeting can also help. The process of analyzing the variances reveals processes, initiatives, and other activities that created positive or negative results.

How do managers use variance analysis?

Managers use variance analysis to measure and analyze what has already occurred in the company's activity, since variance analysis requires managers to use actual company performance.

What is variance analysis?

Variance analysis refers to the comparison of predicted and actual outcomes. For example, a company may predict a set amount of sales for the next year and compare their predicted amount to the actual amount of sales revenue they received. Variance measurements might occur monthly, quarterly or yearly, depending on individual business preferences.

Key terms for variance analysis

Here are some helpful key terms to help you gain a better understanding of variance analysis:

Types of variance analysis

The type of variance analysis you perform depends on the information you are examining. Here are steps and formulas for calculating three different variance analyses:

Examples of variance analysis

Feminine Fashionista, a clothing company, is interested in calculating its overall material variance. It has an actual quantity of 30,000 pieces of fabric at a standard price of $0.65 per fabric and a standard quantity of 25,000 pieces of fabric at an actual price of $0.50 per fabric.

What is the Variance Analysis?

Variance analysis refers to identifying and examining the difference between the standard numbers expected by the business to achieve and the actual numbers achieved by them , which helps the company analyze favourable or unfavourable outcomes.

Why is it important to know the cause of variance analysis?

It is very important to know the cause of variance analysis so that one can approach for corrective measure

How does variance analysis help minimize risk?

Thus Variance analysis helps to minimize the Risk by comparing the actual performance to Standards.

What is the reason for sales variation?

Further Sales Variance is due to either change in sales price or Change in Sales Volume

What are the four types of variance analysis?

Here we look at the calculation and examples of the top 4 types of variance analysis, including material variance, sales variance, labor variance, and variable overheads. You may also take a look at the following articles:-

Is production cost dependent on purchasing cost?

Both purchasing and production costs are dependent on each other, so we have to look into not only the purchasing cost but also the Production Cost to know the total variance as well.

What Does the Analysis of Variance Reveal?

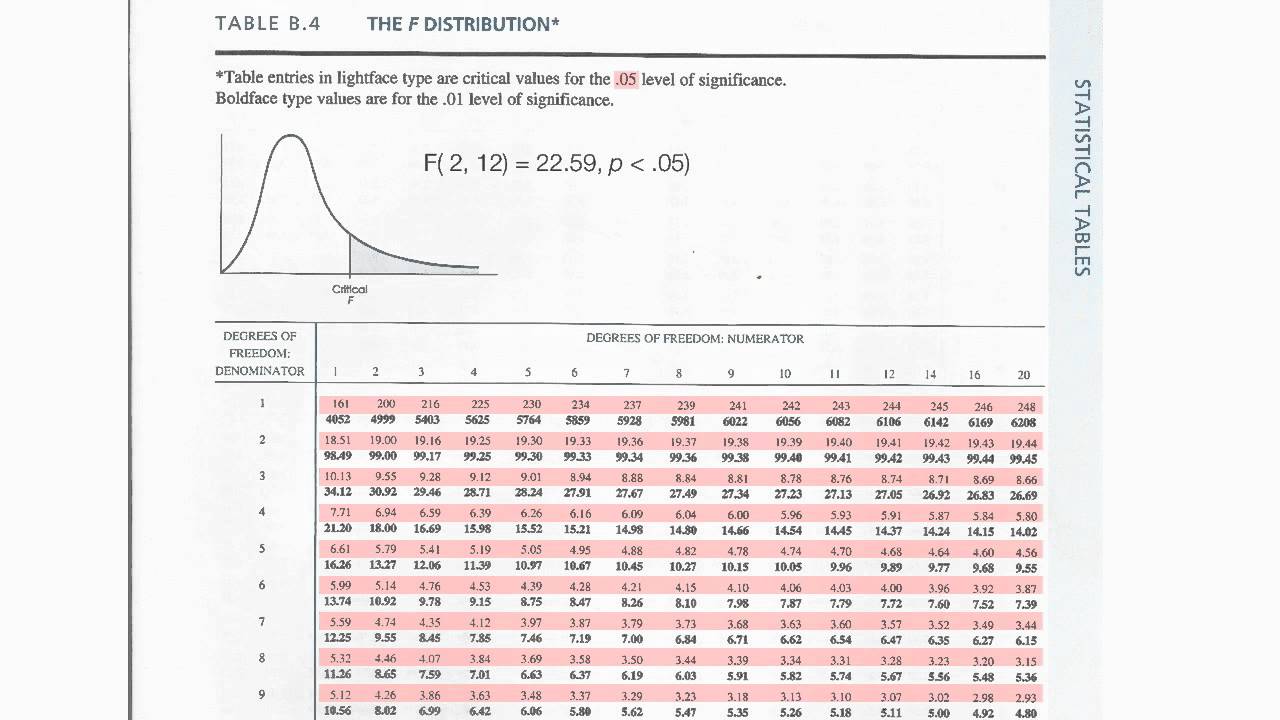

The ANOVA test is the initial step in analyzing factors that affect a given data set. Once the test is finished, an analyst performs additional testing on the methodical factors that measurably contribute to the data set's inconsistency. The analyst utilizes the ANOVA test results in an f-test to generate additional data that aligns with the proposed regression models.

What is ANOVA in statistics?

What is Analysis of Variance (ANOVA)? Analysis of variance (ANOVA) is an analysis tool used in statistics that splits an observed aggregate variability found inside a data set into two parts: systematic factors and random factors.

What is the difference between a one way and a two way ANOVA?

A two-way ANOVA is an extension of the one-way ANOVA. With a one-way, you have one independent variable affecting a dependent variable.

What are the two types of ANOVA?

There are two main types of ANOVA: one-way (or unidirectional) and two-way. There also variations of ANOVA. For example, MANOVA (multivariate ANOVA) differs from ANOVA as the former tests for multiple dependent variables simultaneously while the latter assesses only one dependent variable at a time.

What is the F statistic in ANOVA?

The result of the ANOVA formula, the F statistic (also called the F-ratio), allows for the analysis of multiple groups of data to determine the variability between samples and within samples.

How does ANOVA work?

ANOVA groups differences by comparing the means of each group and includes spreading out the variance into diverse sources. It is employed with subjects, test groups, between groups and within groups .

What is one way ANOVA?

A one-way ANOVA is used for three or more groups of data, to gain information about the relationship between the dependent and independent variables.

Why do organizations do variance analysis?

The services offered by an organization also determines which variance will be analyzed. For instance, a consulting firm might focus on labor efficiency variance will a store or retail business might focus on purchase price and selling price variation. Variance analysis help organizations discover underlying issues in their practices and where the issues can be rectified. Despite the usefulness of variance analysis, certain problems associated with the analysis discourage organizations from using it. Some of the problems are;

What is variation analysis?

It is a study of the variation (difference) between an actual (forecasted) action and a planned action. Variance analysis carries out a quantitative investigation to find out the difference between the actual cost and the standard cost of production. This investigation or analysis aids in adequate management of a business or project. Oftentimes, there is a variation between planned cost and the actual cost of a project, these variations are compiled using variance analysis.

Why use horizontal analysis?

Many organizations have developed preference for the use of horizontal analysis in place of variance analysis. Horizontal analysis examines financial results of multiple periods or preceding months. This makes it easier for management to discover the variance on a trend line.

How is variance used?

Variance is used in investing to determine the individual performance of the separate parts of an investment portfolio. This helps asset managers and investors improve their investment performance.

Why is variance important for risk analysis?

The variance helps risk analysts determine a measure of uncertainty, which without variance and the standard deviation is difficult to quantify. While uncertainty isn't expressly measurable, variance and standard deviation allow analysts to determine the estimated impact a particular stock could have on a portfolio.

What is variance?

Variance is a calculation that considers random variables in terms of their relationship to the mean of its data set. Variance can be used to determine how far each variable is from the mean and, in turn, how far each variable is from one another. It is also used in statistical inferences, hypothesis testing, Monte Carlo methods (random sampling) and goodness-of-fit analyses.

What are the disadvantages of using variance?

One disadvantage of using variance is that larger outlying values in the set can cause some skewing of data, so it isn't necessarily a calculation that offers perfect accuracy. That's because, once squared, outliers on either side of the population can have a significant weight associated with them depending on the values in the rest of the sample.

How to calculate variance?

To calculate variance, you need to square each deviation of a given variable (X) and the mean.

Why do investors use mean in risk assessment?

In a risk assessment, investors use the mean to determine variability that could equate to risk within a portfolio. This is often used when considering a new purchase to decide whether the investment is worth the risk. The variance helps risk analysts determine a measure of uncertainty, which without variance and the standard deviation is difficult to quantify.

Why do researchers prefer standard deviation?

This is exacerbated by the fact that some researchers prefer to work with smaller numbers, so they might prefer to work in standard deviations, which takes the square root of the variance and is less likely to skew heavily toward high numbers . Variance can also be difficult to interpret, which is another reason why its square root might be preferable.

What is the purpose of variance testing?

Statistical tests like variance tests or the analysis of variance (ANOVA) use sample variance to assess group differences. They use the variances of the samples to assess whether the populations they come from differ from each other.

What does variance tell you?

Variance tells you the degree of spread in your data set. The more spread the data, the larger the variance is in relation to the mean.

What is the difference between standard deviation and variance?

Variance is the average squared deviations from the mean, while standard deviation is the square root of this number. Both measures reflect variability in a distribution, but their units differ:

What is variance in statistics?

Published on September 24, 2020 by Pritha Bhandari. Revised on October 12, 2020. The variance is a measure of variability. It is calculated by taking the average of squared deviations from the mean. Variance tells you the degree of spread in your data set.

What is the term for a test that requires equal or similar variances?

These tests require equal or similar variances, also called homogeneity of variance or homoscedasticity, when comparing different samples. Uneven variances between samples result in biased and skewed test results. If you have uneven variances across samples, non-parametric tests are more appropriate.

What is standard deviation derived from?

The standard deviation is derived from variance and tells you, on average, how far each value lies from the mean. It’s the square root of variance.

Why is standard deviation used as a measure of variability?

Since the units of variance are much larger than those of a typical value of a data set, it’s harder to interpret the variance number intuitively. That’s why standard deviation is often preferred as a main measure of variability.

What Is Analysis of Variance (ANOVA)?

- Analysis of variance (ANOVA) is an analysis tool used in statistics that splits an observed aggregate variability found inside a data set into two parts: systematic factors and random factors. The systematic factors have a statistical influence on the given data set, while the random factors do not. Analysts use the ANOVA test to determine the infl...

The Formula For Anova Is

- F=MSTMSEwhere:F=ANOVA coefficientMST=Mean sum of squares due to treatmentMSE=Mean…

What Does The Analysis of Variance Reveal?

- The ANOVA test is the initial step in analyzing factors that affect a given data set. Once the test is finished, an analyst performs additional testing on the methodical factors that measurably contribute to the data set's inconsistency. The analyst utilizes the ANOVA test results in an f-test to generate additional data that aligns with the proposed regressionmodels. The ANOVA test all…

Example of How to Use Anova

- A researcher might, for example, test students from multiple colleges to see if students from one of the colleges consistently outperform students from the other colleges. In a business application, an R&D researcher might test two different processes of creating a product to see if one process is better than the other in terms of cost efficiency. The type of ANOVA test used de…

One-Way Anova Versus Two-Way Anova

- There are two main types of ANOVA: one-way (or unidirectional) and two-way. There also variations of ANOVA. For example, MANOVA (multivariate ANOVA) differs from ANOVA as the former tests for multiple dependent variables simultaneously while the latter assesses only one dependent variable at a time. One-way or two-way refers to the number of independent variable…