In financial planning, variance is the comparison of two or more sets of data. It measures how far off KPIs are from what was expected. Variance analysis

Analysis of variance

Analysis of variance (ANOVA) is a collection of statistical models used to analyze the differences among group means and their associated procedures (such as "variation" among and between groups), developed by statistician and evolutionary biologist Ronald Fisher.

What activities are performed in variance analysis?

Variance analysis is much more than simply identifying outliers. It involves analytical research, proactive planning, strategic decision making, and the foresight to understand how your company’s financials behave, in addition to what is most important to senior management.

What does it mean to explain variance?

Variance: the fact or quality of being different, divergent, or inconsistent. In probability theory and statistics, variance is the expectation of the squared deviation of a random variable from its mean, and it informally measures how far a set of (random) numbers are spread out from their mean.

What are examples of variance?

Example: if our 5 dogs are just a sample of a bigger population of dogs, we divide by 4 instead of 5 like this: Sample Variance = 108,520 / 4 = 27,130. Sample Standard Deviation = √27,130 = 165 (to the nearest mm) Think of it as a "correction" when your data is only a sample.

What is the purpose of calculating variance in statistics?

What is variance analysis?

- The variance is not simply the average difference from the expected value.

- In budgeting (or management accounting in general), a variance is the difference between a budgeted, planned, or standard cost and the actual amount incurred/sold.

- Variance analysis can be carried out for both costs and revenues.

What is meant by variance analysis?

Definition: Variance analysis is the study of deviations of actual behaviour versus forecasted or planned behaviour in budgeting or management accounting. This is essentially concerned with how the difference of actual and planned behaviours indicates how business performance is being impacted.

What do you mean by variance?

The variance is a measure of variability. It is calculated by taking the average of squared deviations from the mean. Variance tells you the degree of spread in your data set. The more spread the data, the larger the variance is in relation to the mean.

What does variance mean accounting?

A variance in accounting is the difference between a forecasted amount and the actual amount. Variances are common in budgeting, but you can have a variance in anything that you forecast. Basically, whenever you predict something, you're bound to have either a favorable or unfavorable variance.

What are the three types of variance?

There are four main forms of variance:Sales variance.Direct material variance.Direct labour variance.Overhead variance.

Why variance is used?

Statisticians use variance to see how individual numbers relate to each other within a data set, rather than using broader mathematical techniques such as arranging numbers into quartiles. The advantage of variance is that it treats all deviations from the mean as the same regardless of their direction.

What is another name of variance?

Some common synonyms of variance are conflict, contention, discord, dissension, and strife. While all these words mean "a state or condition marked by a lack of agreement or harmony," variance implies a clash between persons or things owing to a difference in nature, opinion, or interest.

When should variance analysis be used?

Variance analysis is used to assess the price and quantity of materials, labour and overhead costs. These numbers are reported to management. While it's not necessary to focus on every variance, it becomes a signalling mechanism when a variance is salient.

How do you perform a variance analysis?

There are four steps involved in this process:Calculate the difference between what we spent and what we budgeted to spend.Investigate why there is a difference.Put the information together and talk to management.Put together a plan to get costs more in line with the budget.

How do you prepare a variance analysis report?

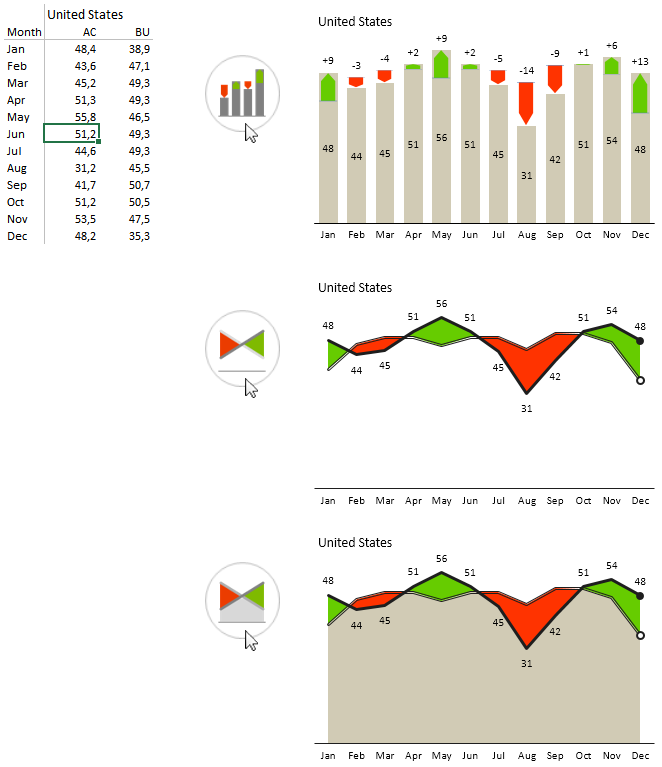

8 Steps to Creating an Efficient Variance ReportStep 1: Remove background colors of your variance report. ... Step 2: Remove the borders. ... Step 3: Align values properly. ... Step 4: Prepare the formatting. ... Step 5: Insert absolute variance charts. ... Step 6: Insert relative variance charts. ... Step 7: Write the key message.More items...•

What are the two types of variance?

When effect of variance is concerned, there are two types of variances:When actual results are better than expected results given variance is described as favorable variance. ... When actual results are worse than expected results given variance is described as adverse variance, or unfavourable variance.

What are examples of variances?

For example, if you budget for sales to be $10,000 and actual sales are $8,000, variance analysis yields a difference of $2,000.

What are the types of variance in statistics?

There can be two types of variances in statistics, namely, sample variance and population variance. The symbol of variance is given by σ2. Variance is widely used in hypothesis testing, checking the goodness of fit, and Monte Carlo sampling.

What do you mean by variance in cost management?

In budgeting (or management accounting in general), a variance is the difference between a budgeted, planned, or standard cost and the actual amount incurred/sold. Variances can be computed for both costs and revenues.

How do you find the variance?

The variance for a population is calculated by: Finding the mean(the average). Subtracting the mean from each number in the data set and then squaring the result. The results are squared to make the negatives positive.

What is variance in statistics with example?

Variance is a statistical measurement that is used to determine the spread of numbers in a data set with respect to the average value or the mean. The standard deviation squared will give us the variance. Using variance we can evaluate how stretched or squeezed a distribution is.

What is the variation in statistics?

What are measures of variation in statistics? Measures of variation in statistics are ways to describe the distribution or dispersion of your data. In other words, it shows how far apart data points are from each other. Statisticians use measures of variation to summarize their data.

What is the Variance Analysis?from wallstreetmojo.com

Variance analysis refers to identifying and examining the difference between the standard numbers expected by the business to achieve and the actual numbers achieved by them , which helps the company analyze favourable or unfavourable outcomes.

What is variance in accounting?from corporatefinanceinstitute.com

Variances are computed for both the price and quantity of materials, labor, and variable overhead, and are reported to management. However, not all variances are important. Management should only pay attention to those that are unusual or particularly significant. Often, by analyzing these variances, companies are able to use ...

What is the role of standard in variance analysis?from corporatefinanceinstitute.com

The Role of Standards in Variance Analysis. In cost accounting, a standard is a benchmark or a “norm” used in measuring performance. In many organizations, standards are set for both the cost and quantity of materials, labor, and overhead needed to produce goods or provide services.

How does variance analysis help minimize risk?from wallstreetmojo.com

Thus Variance analysis helps to minimize the Risk by comparing the actual performance to Standards.

What is the reason for sales variation?from wallstreetmojo.com

Further Sales Variance is due to either change in sales price or Change in Sales Volume

Why is it important to know the cause of variance analysis?from wallstreetmojo.com

It is very important to know the cause of variance analysis so that one can approach for corrective measure

What is financial accounting theory?from corporatefinanceinstitute.com

Financial Accounting Theory Financial Accounting TheoryFinancial Accounting Theory explains the why behind accounting - the reasons why transactions are reported in certain ways. This guide will

What is the Variance Analysis?

Variance analysis refers to identifying and examining the difference between the standard numbers expected by the business to achieve and the actual numbers achieved by them , which helps the company analyze favourable or unfavourable outcomes.

Why is it important to know the cause of variance analysis?

It is very important to know the cause of variance analysis so that one can approach for corrective measure

How does variance analysis help minimize risk?

Thus Variance analysis helps to minimize the Risk by comparing the actual performance to Standards.

What is the reason for sales variation?

Further Sales Variance is due to either change in sales price or Change in Sales Volume

What are the four types of variance analysis?

Here we look at the calculation and examples of the top 4 types of variance analysis, including material variance, sales variance, labor variance, and variable overheads. You may also take a look at the following articles:-

Is production cost dependent on purchasing cost?

Both purchasing and production costs are dependent on each other, so we have to look into not only the purchasing cost but also the Production Cost to know the total variance as well.

What is variance in accounting?

In accounting, a variance is the difference between an actual amount and a budgeted, planned or past amount. Variance analysis is one step in the process of identifying and explaining the reasons for different outcomes.

What is price variance?

The price variance identifies whether the actual cost per pound of the input was more or less than the planned or standard cost per pound

What is Variance Analysis?

Variance analysis is the quantitative investigation of the difference between actual and planned behavior. This analysis is used to maintain control over a business through the investigation of areas in which performance was unexpectedly poor. For example, if you budget for sales to be $10,000 and actual sales are $8,000, variance analysis yields a difference of $2,000. Variance analysis is especially effective when you review the amount of a variance on a trend line, so that sudden changes in the variance level from month to month are more readily apparent. Variance analysis also involves the investigation of these differences, so that the outcome is a statement of the difference from expectations, and an interpretation of why the variance occurred. To continue with the example, a complete analysis of the sales variance would be:

Why is variance analysis important?

Variance analysis is especially effective when you review the amount of a variance on a trend line, so that sudden changes in the variance level from month to month are more readily apparent. Variance analysis also involves the investigation of these differences, so that the outcome is a statement of the difference from expectations, ...

What is variance source information?

Variance source information. Many of the reasons for variances are not located in the accounting records, so the accounting staff has to sort through such information as bills of material, labor routings, and overtime records to determine the causes of problems. The extra work is only cost-effective when management can actively correct problems based on this information.

How to calculate variable overhead efficiency variance?

Variable overhead efficiency variance. Subtract the budgeted units of activity on which the variable overhead is charged from the actual units of activity, multiplied by the standard variable overhead cost per unit.

How to calculate material yield variance?

Material yield variance. Subtract the total standard quantity of materials that are supposed to be used from the actual level of use and multiply the remainder by the standard price per unit.

What is purchase price variance?

Purchase price variance. The actual price paid for materials used in the production process, minus the standard cost, multiplied by the number of units used.

What is fixed overhead variance?

Fixed overhead spending variance. The total amount by which fixed overhead costs exceed their total standard cost for the reporting period.

What Does the Analysis of Variance Reveal?

In the initial stage of the ANOVA test, analyze factors that affect a given data set. When the initial stage finishes, then the analyst performs additional testing on the methodical factors. It helps them to contribute to the data set with consistency measurably. Then the analyst performs the f-test that helps to generate the additional data that align with the proper regression model. The analysis of methods also allows you to compare more than two groups simultaneously to test whether the relationship exists between them or not.

How to determine variability of samples?

You can determine the variability of the samples and within samples with the results of ANOVA. If the tested group doesn’t have any difference, then it is called the null hypothesis, and the result of F-ratio statistics will also be close to 1. There is also the fluctuation in its sampling. And this sampling is likely to follow the Fisher F distribution. It is also a group of distribution functions. It has two characteristic numbers, i.e., numerator degrees of freedom and the denominator degrees of freedom.

How to use ANOVA in Excel?

To use ANOVA in Excel, you have to install the Data Analysis Toolpak and the data that you have to analyze.

Why do statisticians use ANOVA?

On the other hand, random factors don’t have this feature. The analyst uses the ANOVA to determine the influence that the independent variable has on the dependent variable. With the use of Analysis of Variance (ANOVA), we test the differences between two or more means. Most of the statisticians have an opinion that it should be known as “Analysis of Means.” We use it to test the general rather than to find the difference among means. With the help of this tool, the researchers are able to conduct many tests simultaneously.

Why do we use ANOVA?

You would use ANOVA to understand how your different groups react, with a null hypothesis for the test that means the various groups are equal .

What is one way ANOVA?

One way ANOVA is the unidirectional ANOVA. In this ANOVA, there are sole response variables as compared with the two-way ANOVA. It evaluates the impact of a sole factor. And this factor is determined that the samples are the same or not. Besides, it is also used to determine that there is any statistically significant difference between the mean of three or more independent groups.

What is ANOVA in statistics?

Analysis of variance (ANOVA) is a collection of statistical models. It is one of the significant aspects of statistics. The statistics students should be aware of the analysis of variance. But most of the statistics students find it challenging to understand analysis of variance. But it is not that difficult.

What Does the Analysis of Variance Reveal?

The ANOVA test is the initial step in analyzing factors that affect a given data set. Once the test is finished, an analyst performs additional testing on the methodical factors that measurably contribute to the data set's inconsistency. The analyst utilizes the ANOVA test results in an f-test to generate additional data that aligns with the proposed regression models.

What is ANOVA in statistics?

What is Analysis of Variance (ANOVA)? Analysis of variance (ANOVA) is an analysis tool used in statistics that splits an observed aggregate variability found inside a data set into two parts: systematic factors and random factors.

What is the difference between a one way and a two way ANOVA?

A two-way ANOVA is an extension of the one-way ANOVA. With a one-way, you have one independent variable affecting a dependent variable.

What are the two types of ANOVA?

There are two main types of ANOVA: one-way (or unidirectional) and two-way. There also variations of ANOVA. For example, MANOVA (multivariate ANOVA) differs from ANOVA as the former tests for multiple dependent variables simultaneously while the latter assesses only one dependent variable at a time.

What is the F statistic in ANOVA?

The result of the ANOVA formula, the F statistic (also called the F-ratio), allows for the analysis of multiple groups of data to determine the variability between samples and within samples.

How does ANOVA work?

ANOVA groups differences by comparing the means of each group and includes spreading out the variance into diverse sources. It is employed with subjects, test groups, between groups and within groups .

What is one way ANOVA?

A one-way ANOVA is used for three or more groups of data, to gain information about the relationship between the dependent and independent variables.

What is budget variance vs. actual variance analysis?

Budget vs. actual variance analysis is a process businesses use to compare their planned or expected financial transactions to their actual results. A budget variance represents any difference between the budgeted amount and the actual outcome. Businesses often use this analysis to assess their expenses or revenues, and they can examine the variance using percentages or dollars. This concept is sometimes called the budget to actual variance analysis, and financial planning and analysis (FP & A) professionals typically perform it as part of their primary responsibilities.

Why do budget variances happen?

A budget variance represents a difference between the amount a business or individual budgeted for and the actual amount they spent or earned. Understanding the causes of your budget variances can help you identify the business' strengths or weaknesses and develop solutions when needed. Depending on the situation, many factors can contribute to this difference, including: