What mortgage can I get approved for?

Nov 22, 2021 · What is a verification of mortgage and how can I request one? When a borrower refinances their current loan, the lender sends us a “Verification of mortgage” form. This form asks for information and payment history the current loan, which includes: Origination date First interest rate First original amount Next payment date

What is a no-income verification mortgage loan?

Feb 16, 2022 · What Does Verification of Mortgage Mean? Lenders want to know if you’re a good risk for a mortgage and will want you to show them 12 – 24 months of mortgage history. Depending on the type of loan you’re applying for, you’ll want to show minimal or no late payments. For your lender, that’s a good sign that you’ll be able to repay your new mortgage.

When is rental verification required by mortgage lenders?

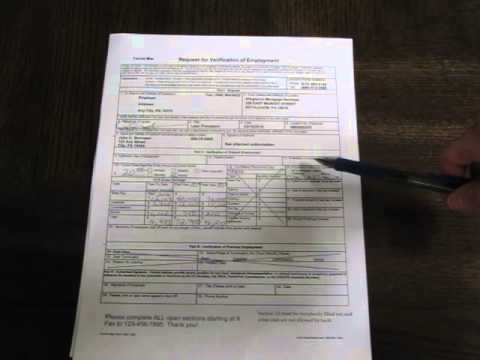

A Verification of Mortgage, also known as a VOM, is used to verify your existing monthly balance payments and to check for any late payments on the account. While reviewing a borrower’s loan application for a new mortgage, lenders should verify the payment history of a previous one.

What is the formula for a 30 year mortgage?

Feb 17, 2022 · What Does Verification of Mortgage Mean? Lenders want to know if you’re a good risk for a mortgage and will want you to show them 12 – 24 months of mortgage history. Depending on the type of loan you’re applying for, you’ll want to show minimal or no late payments. For your lender, that’s a good sign that you’ll be able to repay your new mortgage.

Why do I need a verification of mortgage?

Mortgage lenders will want to verify that you have the means to pay the principal, interest, taxes and insurance on your mortgage. This capability is determined by items you own that have value, like savings accounts, checking accounts, stocks, etc.Jun 22, 2021

How long does a verification of mortgage take?

FAQs. Getting your pre-approval letter could take anywhere from a few days to a few weeks. On average, it usually takes less than 10 days. If you have everything in order, and your credit is good, you can get it in 1 or 2 days.

How can I get mortgage verification?

How to Request Verification of MortgagesCollect your most recent home mortgage statement, your mortgage loan account number and you and your spouse's social security numbers. ... Schedule a meeting with your loan officer at your bank, credit union or finance company.More items...

What is a verification of deposit for mortgage?

Mortgage lenders in particular will generally always require a verification of deposit before approving a mortgage for a home. A verification of deposit is a document prepared by an individual's bank stating that he or she has a certain amount of funds in reserve in the bank, such as in a checking or savings account.Mar 11, 2022

Do mortgage underwriters call employers?

Employment Verification Process An underwriter or a loan processor calls your employer to confirm the information you provide on the Uniform Residential Loan Application. Alternatively, the lender might confirm this information with your employer via fax or mail.

Does underwriting verify employment?

Employment verification is done during the underwriting process, which typically takes anywhere from a few days to a few weeks before your loan is cleared to close. This timeline can depend on multiple factors, including whether you're borrowing for a conventional loan versus an FHA or VA loan.Feb 14, 2022

Why do underwriters need bank statements?

Why do mortgage lenders need bank statements? Mortgage lenders need bank statements to make sure you can afford the down payment and closing costs, as well as your monthly mortgage payment. Lenders use all types of documents to verify the amount you have saved and the source of that money.Feb 18, 2022

Do underwriters verify bank statements?

Analyzing Bank Statements The underwriter will review your bank statements, looking for unusual deposits, and to see how long the money has been in there. The industry term for this underwriting guideline is the “Source and Seasoning” of your funds being used to close.

Do mortgage lenders contact your employer?

When someone is applying for a mortgage the lender will ask them for their employer's contact details. The lender will then phone or email the employer and ask to verify the applicant's claimed salary and other financial details including bonuses.

Do mortgage lenders ask for proof of deposit?

When buying a home, the mortgage lender may ask the borrower for proof of deposit. The lender needs to verify that the funds required for the home purchase are accumulated in a bank account and accessible to the lender.

Do I have to prove where my deposit came from?

The proof you will be required to supply of the source of your mortgage deposit will depend entirely on where the funds came from. For example, where personal savings are being used, most lenders will ask you to provide 6+ months of bank account statements which demonstrate the funds gradually building up over time.

Do mortgage lenders need proof of deposit?

Your mortgage lender – before you can be approved for a mortgage you will need to show that you can pay a deposit and so show that you have that money from a legitimate source.

Why is a VOM required?

Per Verification Of Mortgage Guidelines, reason a verification of mortgage, VOM, is required is because the lender that is processing and underwriting a mortgage loan applicant’s application can verify the following:

What is a VOM mortgage?

A Verification of Mortgage, also referred to as VOM, is a mortgage documentation of borrower’s overall mortgage payment history. Verification of Mortgage on a prior mortgage payment history is important for lenders who are reviewing a borrowers new mortgage loan application request.

How long can you be late on a refinance?

However, the majority of lenders will not allow any 30 days late payments in the past 12 months.

Do you need a verification of mortgage to refinance a home?

If you purchased your home via seller financing and/or had other non-traditional financing to purchase your home and are now refinancing your mortgage loan, a verification of mortgage will still be required.