Vertical analysis is an accounting tool that enables proportional analysis of documents, such as financial statements. While performing a vertical analysis, every line item on a financial statement is entered as a percentage of another item. For example, on an income statement, every line item is stated in terms of the percentage of gross sales.

What does vertical analysis tell you?

- After adjusting entries are posted but before financial statements are prepared.

- The vertical analysis of financial statements focuses on the relationship of different components to the total amount.

- Horizontal analysis can be performed on a quarterly or on an annual basis.

- The financial statements are key to both financial modeling and accounting.

What is the formula for vertical analysis?

Vertical Analysis – Formula and Advantages. To calculate the percentage for the vertical analysis of financial statements – with reference to the income statement and the balance sheet, the formulas are: Vertical Analysis (Income Statement) = Item in Income Statement/Total Sales * 100.

How to calculate vertical analysis percentages?

Vertical Analysis Formula. The following equation is used to analyze a financial statement using vertical analysis. VA = (SL/B) * 100. Where VA is the vertical analysis (%) SL is the statement line item ($) B is the total base figure/amount ($)

What is horizontal analysis of income statement?

The term “Horizontal Analysis” refers to the financial statement analysis in historical data from the income statement, balance sheet, and cash flow statement is compared with each other. In other words, it indicates the change either in absolute terms or as a percentage change year over year (Y-o-Y) in each of the line items.

What is horizontal and vertical analysis of financial statements?

Horizontal analysis usually examines many reporting periods, while vertical analysis typically focuses on one reporting period. Horizontal analysis can help you compare a company's current financial status to its past status, while vertical analysis can help you compare one company's financial status to another's.

What is vertical analysis example?

Vertical analysis is also useful for trend analysis, to see relative changes in accounts over time, such as on a comparative basis over a five-year period. For example, if the cost of goods sold has a history of being 40% of sales in each of the past four years, then a new percentage of 48% would be a cause for alarm.

What is vertical analysis used for?

Vertical analysis is an accounting tool that enables proportional analysis of documents, such as financial statements. While performing a vertical analysis, every line item on a financial statement is entered as a percentage of another item.

What is vertical analysis also known as?

Vertical analysis is also known as common size financial statement analysis. 3. For example, the vertical analysis of an income statement results in every income statement amount being restated as a percent of net sales.

What is vertical analysis formula?

How do you calculate vertical analysis of a balance sheet? The vertical analysis equation is a very straightforward percentage formula – you simply divide each line item by your base figure and multiple the result by 100.

How do you write a vertical analysis?

In the vertical analysis of financial statements, the percentage is calculated by using the below formula:Vertical Analysis formula = Individual Item / Base Amount *100.Vertical Analysis Formula(Income Statement) = Income Statement Item / Total Sales * 100.More items...

What are the tools of vertical analysis?

Which of the following are the tools of Vertical Analysis? Ratio Analysis Comparative Statements Common Size Statements - AccountancyRatio Analysis.Comparative Statements.Common Size Statements.

What is the difference between horizontal and vertical analysis?

Given these descriptions, the main difference between vertical analysis and horizontal analysis is that vertical analysis is focused on the relationships between the numbers in a single reporting period, while horizontal analysis spans multiple reporting periods.

How do you do vertical analysis on Excel?

0:155:53Vertical Analysis of an Income Statement in Excel by Chris MenardYouTubeStart of suggested clipEnd of suggested clipSo here's your formula equals B 6 divided by B 6. And most people I know will tell you you need toMoreSo here's your formula equals B 6 divided by B 6. And most people I know will tell you you need to make this absolute reference by pressing the f4.

How do you read a vertical analysis on a balance sheet?

A vertical analysis is used to show the relative sizes of the different accounts on a financial statement. For example, when a vertical analysis is done on an income statement, it will show the top line sales number as 100%, and every other account will show as a percentage of the total sales number.

Why is horizontal and vertical analysis important?

The primary aim of horizontal analysis is to keep a track on the behaviour of the individual items of the financial statement over the years. Conversely, the vertical analysis aims at showing an insight into the relative importance or proportion of various items on a particular year's financial statement.

How do you create a vertical analysis in Excel?

0:155:53Vertical Analysis of an Income Statement in Excel by Chris MenardYouTubeStart of suggested clipEnd of suggested clipAnd most people I know will tell you you need to make this absolute reference by pressing the f4.MoreAnd most people I know will tell you you need to make this absolute reference by pressing the f4.

Which of the following tools is an example of horizontal analysis?

A) Comparative financial statement is an example of horizontal analysis. B) Trend Analysis is an example of vertical analysis. C) Cash flow analysis is an example of horizontal analysis.

How do you calculate horizontal and vertical analysis?

Vertical analysis formula = (Statement line item / Total base figure) X 100. Horizontal analysis formula = {(Comparison year amount - Base year amount) / Base year amount} X 100.

What is the importance of horizontal and vertical analysis?

The primary aim of horizontal analysis is to keep a track on the behaviour of the individual items of the financial statement over the years. Conversely, the vertical analysis aims at showing an insight into the relative importance or proportion of various items on a particular year's financial statement.

When is Vertical Analysis Used?

Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g., quarterly. It is done so that accountants can ascertain the relative proportions of the balances of each account.

What is income statement?

Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or. , every line item is stated in terms of the percentage of gross sales. Similarly, in a balance sheet, every entry is made not in terms of absolute currency but as a percentage ...

Is every entry in a balance sheet a percentage of total assets?

Similarly, in a balance sheet, every entry is made not in terms of absolute currency but as a percentage of the total assets. Performing a vertical analysis of a company’s cash flow statement represents every cash outflow or inflow relative to its total cash inflows.

What is vertical analysis?

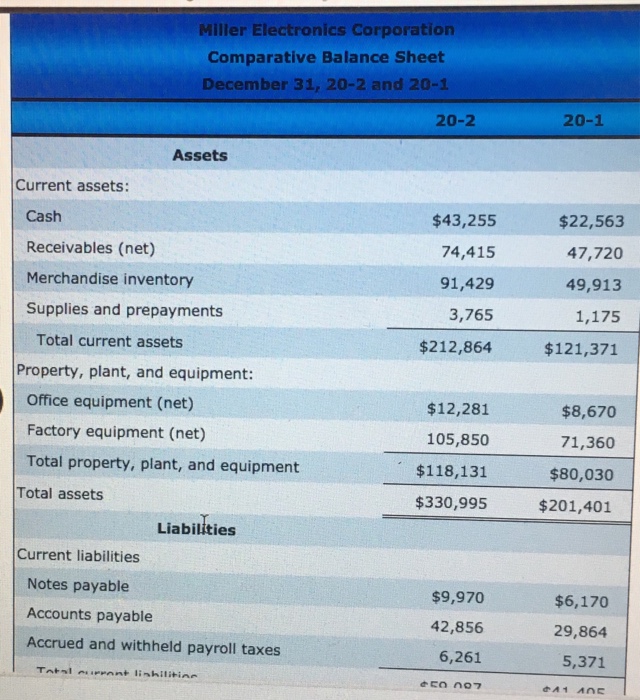

Vertical analysis (also known as common-size analysis) is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement. To conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and stockholders’ equity are generally used as base ...

What is sales figure in income statement?

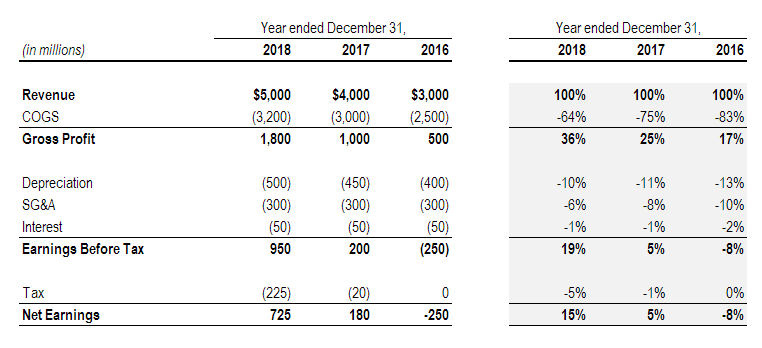

To conduct a vertical analysis of income statement, sales figure is generally used as the base and all other components of income statement like cost of sales, gross profit, operating expenses, income tax, and net income etc. are shown as a percentage of sales.

Why is common size analysis important?

One of the advantages of common-size analysis is that it can be used for inter-company comparison of enterprises with different sizes because all items are expressed as a percentage of some common number. For example, suppose company A and company B belong to same industry. A is a small company and B is a large company.

What is vertical analysis?

Vertical analysis is a kind of financial statement analysis wherein each item in the financial statement is shown in the percentage of the base figure. It is one of the popular methods of financial statements used as it is simple and also called a common size analysis. Here all the items in the income statement are stated as a percentage ...

What is financial statement?

The Financial Statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more

How can different organization statements be compared?

Different organization statements can be compared as the comparison is made in percentage. Vertical analysis is also instrumental in comparing the financial statements with the previous year’s statement and analyze the profit or loss of the period.

Is vertical analysis of financial statements a quality analysis?

The liquidity of the organization cannot be measured precisely by using the analysis. Quality analysis is not done by using vertical analysis of financial statements as there is no consistency in the ratio of the elements.

Is vertical analysis followed by accounting conventions?

The accounting conventions are not followed vigilantly in the vertical analysis.

How does vertical analysis work?

You can use vertical analysis on an income statement, balance sheet or cash flow statement to understand the proportions of each line item to the whole, understand key trends that occur over time, compare multiple companies of varying sizes or compare a company's financial statements to averages within their industry.

What is the difference between horizontal and vertical analysis?

The primary difference between vertical analysis and horizontal analysis is that horizontal analysis uses percentages to represent each line item's percent change quarter over quarter (QoQ) or year over year (YoY). While the formula for a vertical analysis looks at the percentage of an item to the whole, the formula for a horizontal analysis looks at the item's percent change from one period to another. Here is a comparison of each of the formulas for vertical analysis and horizontal analysis:

Why do we use percentages in financial analysis?

Because the vertical analysis method uses percentages to represent each line item, you can proportionately compare a company's relative account balances to those of another company or the company's industry average regardless of whether the total sales for the other company or industry average are higher or lower than the company you are analyzing.

How to compare horizontal and vertical analysis?

The primary difference between vertical analysis and horizontal analysis is that horizontal analysis uses percentages to represent each line item's percent change quarter over quarter (QoQ) or year over year (YoY). While the formula for a vertical analysis looks at the percentage of an item to the whole, the formula for a horizontal analysis looks at the item's percent change from one period to another. Here is a comparison of each of the formulas for vertical analysis and horizontal analysis: 1 Vertical analysis formula = (Statement line item / Total base figure) X 100 2 Horizontal analysis formula = { (Comparison year amount - Base year amount) / Base year amount} X 100

Can you use vertical analysis to compare a line item?

However, it is important to remember that you can still use vertical analysis to compare a line item's percentages from one quarter or year to another. The main difference is that the percentages in a vertical analysis do not represent the percentage of change.

How to do a vertical analysis?

You can use these steps to perform vertical analysis: 1 Choose a financial statement. To begin your vertical analysis, locate the financial statement that you would like to analyze. Typically, vertical analysis is used on the current year's statement, but you could also analyze previous years. 2 Analyze amounts located in the same column of the statement. Next, choose the appropriate column of the statement and look at the numbers that are located vertically within the column. 3 Calculate each amount as a percentage of a base figure. Finally, take the amounts from the column and calculate each amount as a percentage of the base figure, which has a value of 100%. Review the ratios to determine the company's financial state, and make recommendations as necessary.

What is the difference between horizontal and vertical analysis?

Horizontal analysis usually examines many reporting periods, while vertical analysis typically focuses on one reporting period. Horizontal analysis can help you compare a company's current financial status to its past status, while vertical analysis can help you compare one company's financial status to another's.

What is financial statement analysis?

Financial statement analysis is an important business practice that companies use to track financial data and make predictions and comparisons. Companies perform financial statement analysis to help monitor and make sense of data in financial statements, such as income statements, cash flow statements, balance sheets and more. Analyzing these statements can provide insights into potential problems and opportunities, and it can also help a company develop financial strategies and prepare for the next quarter or year. Therefore, financial analysis can contribute heavily to a company's overall success.

What is horizontal analysis?

In horizontal analysis, also known as trend analysis or time series analysis, financial analysts look at financial trends over periods of time—especially quarters or years. Typically, financial analysts perform horizontal analysis before vertical analysis, and it is usually the most useful for companies that have been operating for a long period of time.

What are the two types of financial statements?

There are multiple forms of financial statement analysis—including variance analysis, liquidity analysis and profitability analysis—but two commonly used types are horizontal and vertical analysis.

Why do companies use financial analysis?

Investors, who often conduct comprehensive research into a company's financial statements, can use financial analysis to make sense of a company's financial data and compare one organization to another. This can help them predict which company is more likely to experience financial growth and be an attractive investment.

What can both forms of analysis help you pick out?

Both forms of analysis can help you pick out trends and patterns in financial data and develop strategies .

What Is Financial Statement Analysis?

Financial statement analysis is the process of analyzing a company's financial statements for decision-making purposes. External stakeholders use it to understand the overall health of an organization as well as to evaluate financial performance and business value. Internal constituents use it as a monitoring tool for managing the finances.

What Are the Different Types of Financial Statement Analysis?

Most often, analysts will use three main techniques for analyzing a company's financial statements. First, horizontal analysis involves comparing historical data. Usually, the purpose of horizontal analysis is to detect growth trends across different time periods. Second, vertical analysis compares items on a financial statement in relation to each other. For instance, an expense item could be expressed as a percentage of company sales. Finally, ratio analysis, a central part of fundamental equity analysis, compares line-item data. P/E ratios, earnings per share, or dividend yield are examples of ratio analysis.

How does an income statement work?

The income statement breaks down the revenue a company earns against the expenses involved in its business to provide a bottom line, meaning the net profit or loss. The income statement is broken into three parts which help to analyze business efficiency at three different points. It begins with revenue and the direct costs associated with revenue to identify gross profit. It then moves to operating profit, which subtracts indirect expenses such as marketing costs, general costs, and depreciation. Finally, after deducting interest and taxes, the net income is reached.

What is the purpose of income statement analysis?

Basic analysis of the income statement usually involves the calculation of gross profit margin, operating profit margin, and net profit margin which each divide profit by revenue. Profit margin helps to show where company costs are low or high at different points of the operations.

Why do companies use balance sheet, income statement, and cash flow statement?

Companies use the balance sheet, income statement, and cash flow statement to manage the operations of their business and also to provide transparency to their stakeholders. All three statements are interconnected and create different views of a company’s activities and performance.

How to determine how efficiently a company generates profits and shareholder value?

An analyst may first look at a number of ratios on a company’s income statement to determine how efficiently it generates profits and shareholder value. For instance, gross profit margin will show the difference between revenues and the cost of goods sold. If the company has a higher gross profit margin than its competitors, this may indicate a positive sign for the company. At the same time, the analyst may observe that the gross profit margin has been increasing over nine fiscal periods, applying a horizontal analysis to the company operating trends.

What are the three financial statements that every company creates and monitors?

As mentioned, there are three main financial statements that every company creates and monitors: the balance sheet, income statement, and cash flow statement. Companies use these financial statements to manage the operations of their business and also to provide reporting transparency to their stakeholders.

How Vertical Analysis Works

- Vertical analysis makes it much easier to compare the financial statements of one company with another, and across industries. This is because one can see the relative proportions of account balances. It also makes it easier to compare previous periods for time series analysis, in which q…

Vertical vs. Horizontal Analysis

- Another form of financial statement analysis used in ratio analysis is horizontal analysis or trend analysis. This is where ratios or line items in a company's financial statements are compared over a certain period of time by choosing one year's worth of entries as a baseline, while every other year represents percentage differences in terms of changes to that baseline. For example, the a…

Example of Vertical Analysis

- For example, suppose XYZ Corporation has gross sales of $5 million and cost of goods sold of $1 million and general and administrative expenses of $2 million and a 25% tax rate, its income statement will look like this if vertical analysis is used:

When Is Vertical Analysis used?

Advantages of Vertical Analysis

- Vertical analysis simplifies the correlation between single items on a balance sheetand the bottom line, as they are expressed in a percentage. A company’s management can use the percentages to set...

- It is a relatively more potent tool than horizontal analysis, which shows the corresponding changes in the finances of a particular unit/ account/department over a certain period of time.

- Vertical analysis simplifies the correlation between single items on a balance sheetand the bottom line, as they are expressed in a percentage. A company’s management can use the percentages to set...

- It is a relatively more potent tool than horizontal analysis, which shows the corresponding changes in the finances of a particular unit/ account/department over a certain period of time.

- It is also useful in comparing a company’s financial statement to the average trends in the industry. It would be ineffective to use actual dollar amounts while analyzing entire industries. Common-...

- It is also highly effective while comparing two or more companies operating in the same industry but with different sizes. It is often tricky to compare the balance sheet of a $1 billion …

Practical Examples

- 1. Comparative Balance Sheet with Vertical Analysis

*2019: ($50,000 / $64,000) × 100 = 78.13% **2018: ($43,000 / $56,100) × 100 = 76.65% - 2. Comparative Income Statement with Vertical Analysis

*2018: ($104,000 / $198,000) × 100 = 52.53% **2017: ($98,000 / $176,000) × 100 = 55.68%

Related Readings

- Thank you for reading CFI’s guide to Vertical Analysis. To keep learning and advancing your career, the following resources will be helpful: 1. Analysis of Financial Statements 2. Projecting Balance Sheet Line Items 3. Top-Down Budgeting 4. Vertical Equity