What Are Visa Chargebacks? When a cardholder files a dispute with the issuing bank that provides their Visa-branded credit card, the transaction becomes a Visa chargeback, also known as a Visa dispute. The bank debits the transaction amount from the merchant and gives the cardholder a temporary credit.

Full Answer

What happens if there is a chargeback?

Chargebacks have both short and long-term ramifications for merchants. Each time a consumer files a chargeback, the merchant is hit with a fee ranging from $20 to $100 per transaction. Even if the chargeback is later canceled, the merchant will still have to pay fees and administrative costs.

What to know about visa's New chargeback rules?

Visa's New Chargeback Rules: What You Need To Know

- Get Ready For New Chargeback Rules. If one of your customers has ever disputed a transaction, you understand how frustrating the chargeback resolution process can be.

- The "VCR" Initiative. Visa refers to its new chargeback rules as the Visa Claims Resolution ("VCR") initiative. ...

- You Are In Control. ...

What do chargebacks mean to issuers?

The debit card or credit card chargeback process begins when a cardholder submits a request to dispute a transaction with the merchant to the bank that issued the card. The technical term for your bank is the issuing bank. Once the issuing bank accepts your request, it will raise a dispute with the merchant’s bank.

How much is a chargeback fee?

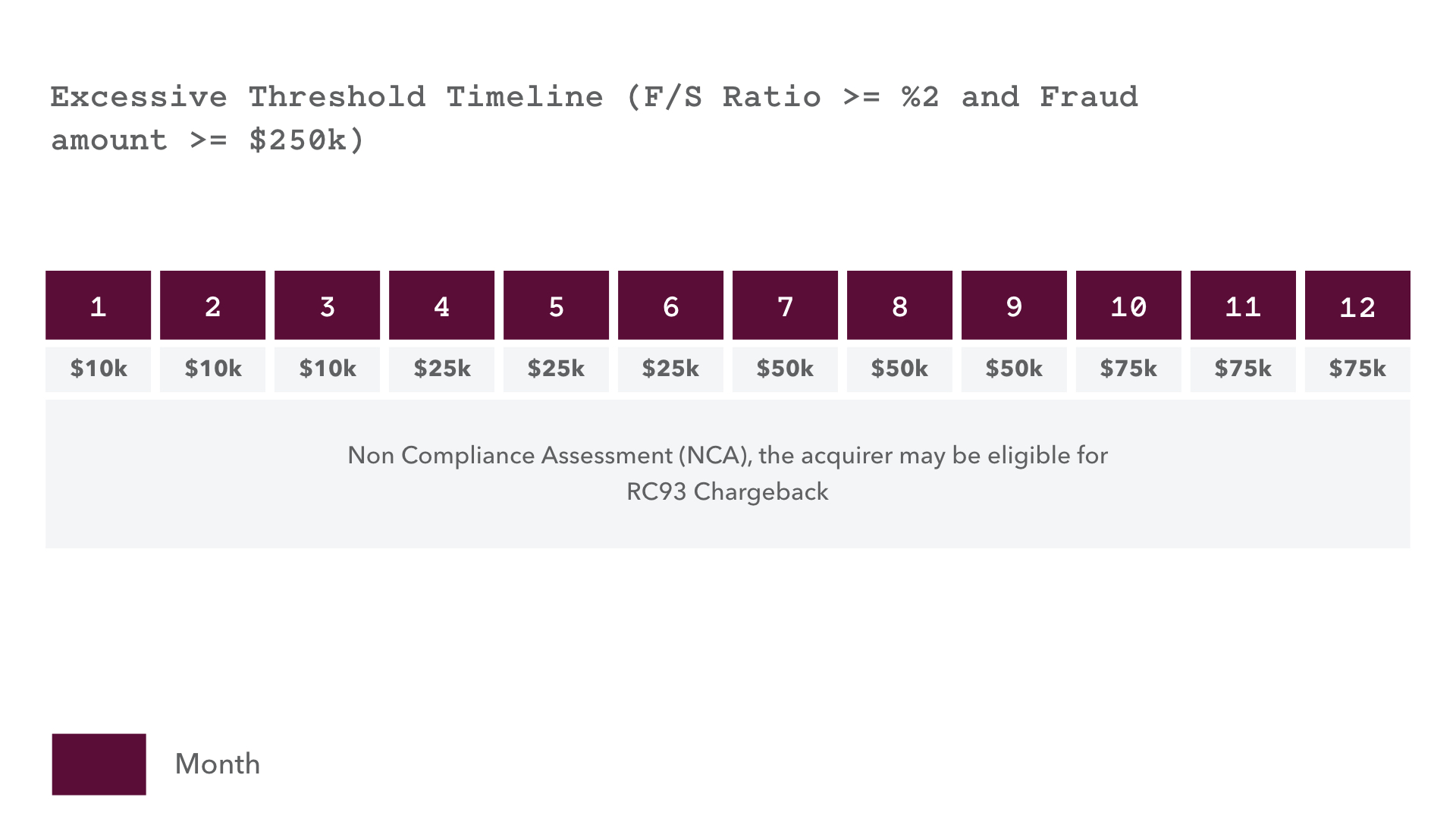

When a chargeback happens, the merchant is hit with a chargeback fee, which typically ranges from $20 to $100. The more chargebacks you get, the higher the fee. If you have too many chargebacks in a short period of time, you could lose your merchant account that enables you to process credit card payments.

How does a Visa chargeback work?

What Are Visa Chargebacks? When a cardholder files a dispute with the issuing bank that provides their Visa-branded credit card, the transaction becomes a Visa chargeback, also known as a Visa dispute. The bank debits the transaction amount from the merchant and gives the cardholder a temporary credit.

What happens when you get a chargeback?

The meaning of the word chargeback is fairly straightforward. The bank will charge back the amount of the disputed transaction to the merchant, returning the money to the cardholder without needing the merchant's approval.

Is a chargeback a refund?

No. Refunds are provided by the merchant in exchange for the return of a purchase. Chargebacks are forced payment reversals in which the consumer typically does not return merchandise to the merchant. The merchant will also be hit with an additional chargeback fee.

What is a chargeback on my credit card?

A credit card chargeback is a bank-initiated payment reversal for a credit card purchase. Rather than request a refund from the merchant who facilitated the purchase, cardholders can dispute a particular transaction by contacting their bank and requesting a chargeback.

Can you get in trouble for chargeback?

Can you Get in Trouble for Disputing a Charge? Yes. Cardholders can face consequences for abusing the chargeback process.

Does a chargeback hurt your credit?

Chargebacks won't affect your credit scores. But an account might say “in dispute” on your credit reports during the investigation period. Dispute notations on credit reports may temporarily make it difficult to qualify for a new loan, especially in the mortgage world.

What happens if you lose a chargeback?

For merchants who have lost their chargeback dispute during any of the three cycles, or decided not to contest the chargeback, they are out the money from the sale, the product sold, plus any fees incurred. Once a merchant loses a chargeback, the dispute is closed and they can't petition any further.

How long does a chargeback take?

around 30-90 daysHow Long Does the Chargeback Process Take? Depending on the reason code, issuing bank, and credit card network, the entire process usually takes around 30-90 days. Cases that go to arbitration will take longer.

How do you handle a chargeback?

To resolve the chargeback, you should get in touch with your customer. It's possible that you can explain the misunderstanding, or come to an agreement with the customer. If you come to an agreement, then you should tell the customer to contact their bank and say that they want to drop the chargeback.

Why did I get a chargeback fee?

A chargeback fee is a fee that acquiring banks charge to merchants to penalize them for processing a transition that is illegitimate. A chargeback on a credit card occurs when a customer (cardholder) disputes a credit card charge and wants to void the sales transaction.

Who pays when you dispute a charge?

You must keep paying your credit card bill like normal during the dispute process. As mentioned previously, card issuers usually remove disputed charges from the bill until the dispute is resolved, but you're still responsible for paying the rest of the bill.

What is the difference between dispute and chargeback?

A dispute is an action taken by a cardholder to challenge a transaction appearing on the cardholder's statement. A "dispute" is an action taken by a cardholder, while a chargeback is a process resulting from a dispute. In contrast, a chargeback is a forced payment reversal.

What happens when a customer loses a chargeback?

If you lose the initial chargeback determination, you'll have the option to appeal it directly to Visa or Mastercard. If your customer loses the chargeback but disagrees with the bank's decision, they can also pursue arbitration. However, there's a big drawback: arbitration costs a few hundred dollars.

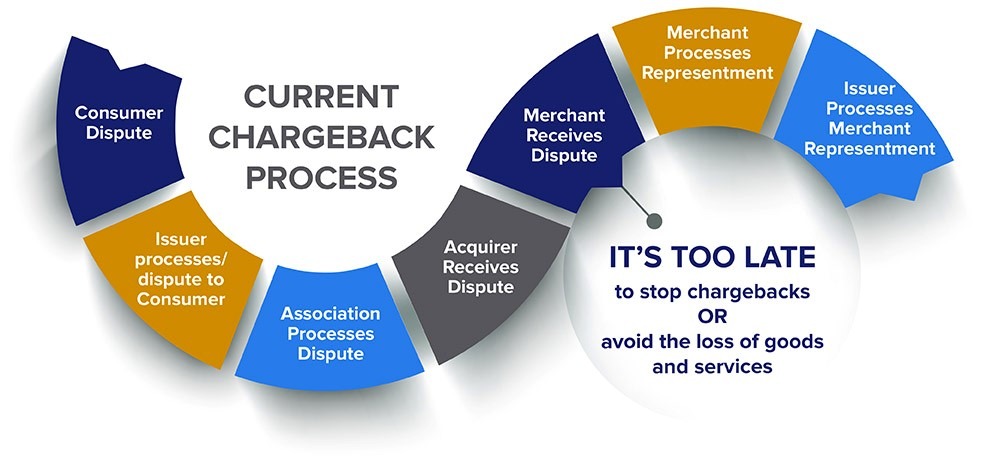

What is the process of a chargeback?

What Is the Chargeback Process? Chargebacks usually begin with the cardholder disputing a charge. If the bank initates a chargeback, the merchant can either fight it or accept it. If they fight it, the bank examines the evidence and makes a decision, which can be appealed if necessary.

What happens when you lose a chargeback?

If you lose the initial chargeback claim, you may appeal directly to your service provider. To do this, you must be able to prove your case with irrefutable evidence. First, ask your merchant service provider to give you the full details of the chargeback.

How often do merchants win chargeback disputes?

However, research shows that on average merchants who dispute chargebacks have a 32 percent win rate. What happens if a merchant does not respond to a chargeback? If a merchant doesn't respond to a chargeback by the stipulated deadline, they accept the chargeback by default.

What is Visa purchase return authorization?

The Visa purchase return authorization mandate is a processing regulation update implemented by Visa in 2019. It stated that, to process return tra...

Does Visa purchase return authorization apply to all credit card brands?

No. The Visa rules only impact Visa card transactions, but the mandate is similar to Mastercard’s earlier action regarding their refund authorizati...

Is the merchant required to have the cardholder re-present the card/device used for the original tra...

No. The merchant may initiate the return by scanning the original purchase receipt to obtain the information of the Visa card used.

Why did Visa make the change?

The basic goal was to create transparency in the return process for merchants, banks, and cardholders. It helps reduce the volume of Visa customer...

What are valid responses to a Visa return authorization request?

Valid responses to a purchase return authorization request are “Approval”, “No reason to decline” and “Decline” with various decline reasons. “No r...

Will Visa purchase return authorization prevent friendly fraud?

Not for the most part, no. It could catch some fraudulent card use before the transaction is processed, but the rules are not really designed to st...

What Are Visa Chargebacks?

When a cardholder files a dispute with the issuing bank that provides their Visa-branded credit card, the transaction becomes a Visa chargeback, also known as a Visa dispute. The bank debits the transaction amount from the merchant and gives the cardholder a temporary credit.

How Do Visa Chargebacks Work?

Much like other chargebacks, Visa chargebacks start with a cardholder disputing a charge with their issuing bank. If the bank approves a chargeback, the merchant can either accept the chargeback or fight it through representment.

What Are Visa's Dispute Categories?

Visa specifies four dispute categories that encompass its various chargeback reason codes: Fraud, Authorization, Processing Errors, and Consumer Disputes.

How Can Merchants Prevent Visa Disputes?

Merchants can prevent Visa disputes by using a clear and recognizable billing descriptor , offering helpful and available customer service, and using effective fraud prevention tools.

What Is the Compelling Evidence Requirement for Visa Disputes?

Generally speaking, compelling evidence in chargeback representment will consist of proof that the cardholder knowingly participated in the transaction and received the intended benefit thereof.

Why do credit card companies charge back?

The existence of chargebacks allows cardholders to feel more confident about making purchases with their credit cards, knowing that they won’t be held responsible for the actions of identity thieves, deceptive merchants, and other fraudsters . However, the chargeback process also has loopholes that can be exploited, allowing cardholders to commit so-called “friendly fraud,” when they obtain a chargeback by making false claims, sometimes unknowingly, but often intentionally.

What happens if a merchant accepts a chargeback?

If the issuer accepts the merchant’s evidence, they will reverse the chargeback. If one or more parties involved in the chargeback do not accept the outcome at this point, they may file for arbitration, at which point Visa will decide the matter.

What is a chargeback on a credit card?

A Visa chargeback dispute is often to the benefit of the consumer since the burden of proof to indicate rightful purchase lies with the business.#N#In case the chargeback dispute is unsuccessful, the acquiring bank delays the payment for any chargeback dispute until it settles the matter.

How long does it take to chargeback a Visa?

However, some kinds of transactions define longer time before a chargeback can be initiated. For Visa its 540 days from transaction processing date.

What happens when a chargeback is initiated?

Firstly, once a chargeback claim is initiated, the issuing bank notifies the acquiring bank of the problematic transaction. The Visa Card holder’s account is credited the amount and the sales account has their funds withheld till the matter is resolved.

Does every bank have a chargeback procedure?

Every bank, however, has its own specific procedure in dealing with a chargeback claim .

Is my chargeback easy?

In conclusion, the chargeback process can be complicated and mistakes can cost you. MyChargeback.com makes the process simple and easy, putting your money back where it belongs – in your wallet.

What Is a Chargeback?

A chargeback is a charge that is returned to a payment card after a customer successfully disputes an item on their account statement or transactions report. A chargeback may occur on debit cards (and the underlying bank account) or on credit cards. Chargebacks can be granted to a cardholder for a variety of reasons.

What is chargeback initiated by a merchant?

For example, a chargeback initiated by a merchant would begin with a request sent to the merchant’s acquiring bank from the merchant.

How does a chargeback work?

If a chargeback is initiated by the issuing bank, then the issuing bank facilitates the chargeback through communication on their processing network. The merchant bank then receives the signal and authorizes the funds' transfer with the confirmation of the merchant.

What is chargeback reversal?

Chargebacks can be granted to a cardholder for a variety of reasons. In the U.S. chargeback reversals for debit cards are governed by Regulation E of the Electronic Fund Transfer Act. Chargeback reversal for credit cards are governed by Regulation Z of the Truth in Lending Act.

How long does it take for a chargeback to be settled?

Focused on charges that have been fully processed and settled, chargebacks can often take several days for full settlement as they must be reversed through an electronic process involving multiple entities.

Why are charges disputed?

Charges can be disputed for many reasons. A cardholder may have been charged by a merchant for items they never received, a merchant could have duplicated a charge by mistake, a technical issue may have caused a mistaken charge, or a cardholder’s card information may have been compromised.

How Do You Request a Chargeback?

If you don’t get any luck with that avenue, you can request a chargeback with the issuer of your credit card. The bottom line is that many card issuers will allow you to dispute card transactions in a variety of ways.

What is chargeback advertising?

Advertisment ⓘ. A Chargeback, in ordinary terms, means a reversal. It's more of a buyer protection measure. The customer gets their money back. Take for instance, if the products they receive are faulty, a chargeback is always the feasible remedy. In usual circumstances, this is the last thing a merchant wants to come across.

How long does it take to get a chargeback from a credit card company?

Once you submit the chargeback request, remember that it can take up to 90 days for you to get any response about the credit card transactions. Some companies are better at dealing with customer contacts than others. If you’re worried about a fraudulent transaction, your first port of call should be your credit card company, the bank you’re using, or the police.

Why are chargebacks and refunds similar?

The reason for their parallelism is because both involve money which comes from the merchant, back to the buyer. Both processes revolve around a buyer's product guarantee. Basically, a bank doesn't meddle in refund issues. Arguably, a chargeback is a far much worse experience if we compare it to a refund. And the merchants can very well attest to this.

Why does a customer want a chargeback?

Sometimes, it happens that a customer wants a chargeback since it quickens the results over a refund.

Why do businesses charge back customers?

Also, customers are prone to credit card theft. If their information gets stolen and is used fraudulently to purchase goods, then this highly attracts a chargeback claim. And this is where a Chargeback comes to enforce customer protection rights. Unfortunately, this isn't quite impressive for any business owner. And the reason is pretty obvious. It's all at my expense as a seller.

What happens if you issue a chargeback request and the merchant disagrees with it?

If you issue a chargeback request and the merchant disagrees with it, or thinks friendly fraud is at play, then they can dispute the chargeback. Remember, companies need to pay a chargeback fee for consumer protection.

What is chargeback in credit card?

A “chargeback” provides an issuer with a way to return a disputed transaction. When a cardholder disputes a transaction, the issuer may request a written explanation of the problem from the cardholder and can also request a copy of the related sales transaction receipt from the acquirer, if needed. Once the issuer receives this documentation, the first step is to determine whether a chargeback situation exists. There are many reasons for chargebacks—those reasons that may be of assistance in an investigation include the following: • Merchant failed to get an authorization • Merchant failed to obtain card imprint (electronic or manual) • Merchant accepted an expired card When a chargeback right applies, the issuer sends the transaction back to the acquirer and charges back the dollar amount of the disputed sale. The acquirer then researches the transaction. If the chargeback is valid, the acquirer deducts the amount of the chargeback from the merchant account and informs the merchant. Under certain circumstances, a merchant may re-present the chargeback to its acquirer. If the merchant cannot remedy the chargeback, it is the merchant’s loss. If there are no funds in the merchant’s account to cover the chargeback amount, the acquirer must cover the loss.

What is chargeback management?

The Chargeback Management Guidelines for Visa Merchants contains detailed information on the most common types of chargebacks merchants receive and what can be done to remedy or prevent them. It is organized to help users find the information they need quickly and easily. The table of contents serves as an index of the topics and material covered.

How to get a copy of a credit card transaction?

When a card issuer sends a copy request to an acquirer, the bank has 30 days from the date it receives the request to send a copy of the transaction receipt back to the card issuer. If the acquirer sends the request to you, it will tell you the number of days you have to respond. You must follow the acquirer’s time frame. Once you receive a copy request, retrieve the appropriate transaction receipt, make a legible copy of it, and fax or mail it to your acquirer within the specified time frame. Your acquirer will then forward the copy to the card issuer, which will, in turn, send it to the requesting cardholder. The question or issue the cardholder had with the transaction is usually resolved at this point. Note: When you send the copy to the acquirer, use a delivery method that provides proof of delivery. If you mail the copy, send it by registered or certified mail. If you send the copy electronically, be sure to keep a written record of the transmittal.

Why monitor chargeback rates?

Monitoring chargeback rates can help merchants pinpoint problem areas in their businesses and improve prevention efforts. Card-absent merchants may experience higher chargebacks than card-present merchants as the card is not electronic read, which increases liability for chargebacks.

How to check your DBA?

You can check this information yourself by purchasing an item on your Visa card at each of your outlets and looking at the merchant name and location on your monthly Visa statement. Is your name recognizable? Can your customers identify the transactions made at your establishment?

What is an additional insight?

Additional insights related to the topic that is being covered. A brief explanation of the Visa service or program pertinent to the topic at hand.

Can you get a chargeback without losing the sale?

Even when you do receive a chargeback, you may be able to resolve it without losing the sale. Simply provide your acquirer with additional information about the transaction or the actions you have taken related to it.

What is a chargeback on a Visa card?

When a Visa cardholder files a dispute, a transaction is turned into what is known as a Visa dispute. Visa disputes (aka chargebacks) are governed by rules set out by Visa. The chargeback process includes several steps.

What is a chargeback?

A chargeback is an act initiated by a cardholder to dispute a debit or credit card charge they believe to be illegitimate. When a chargeback occurs, a forced reimbursement of a transaction is initiated by the card issuer. Chargebacks can happen at any time after a sale occurs; however, they are most common within the first 120 days.

How does a chargeback work?

The chargeback process is set and managed by card networks and must be followed by financial institutions and merchants. The parties involved in the chargeback process include:

How can Pay help reduce chargeback disputes?

Pay.com enables merchants to increase conversions with a secure, fraud-resistant checkout that prevents certain fraud chargebacks and brings your business fully in line with the latest PSD2 legislation. With a 3D-secure component, our system decides how risky each transaction is based on the amount being spent and whether the shopper is known to your store. Regular/familiar customers and those spending an expected amount are “exempted” from extra security measures. Only unfamiliar customers, large sums, and suspicious behavior is subject to more stringent checks. To find out more about how Pay.com helps protect you from fraud-based chargebacks - sign up now!

How to handle chargebacks?

As a merchant, you should always be ready to respond to chargebacks because they are bound to happen regularly. One of the most important things to handle chargebacks efficiently is staying organised and having good record-keeping practices. That way, if a customer disputes a charge on their card, you can be ready to fill out the required forms and respond as quickly as possible as soon as you’re notified of a claim. Without good record-keeping practices or the authenticating information necessary at the time of purchase, handling chargebacks can become extremely cumbersome and time-consuming. It’s also essential to know why the chargeback occurred in the first place. To do this, you’ll need to understand the reason code, which is attached to the transaction by the issuing bank. However, as a merchant, you also need to understand that you can’t afford to simply accept chargebacks. You’ll need to defend any valid transactions and recover lost revenue, requiring you to follow the chargeback representment process. Chargeback representment is a regulated process for responding to unwarranted chargebacks.

What happens if a customer files a chargeback claim for late delivery?

If a customer files a chargeback claim for late delivery, they must first try to get a return. A chargeback is only possible if both the return and refund are denied.

How long do you have to charge back a credit card?

Cardholders have 120 days from the day after the transaction date to file a chargeback for most issues.

What is a chargeback?

A chargeback (otherwise known as a dispute) is a way for your bank that issued your card to reclaim money from the retailer’s bank when you do not get the goods or services you paid for, including if the retailer or supplier has gone out of business.

Is a chargeback legal?

Chargebacks are not a legal right , but if you have paid on a Visa debit or credit card, you should address a chargeback claim to the bank that issued your card, and they can then put in a request to the retailer’s bank.

What Is a Chargeback?

Understanding Chargebacks

- While the various card networks have similar chargeback processes, they differ enough in the details that merchants must have means of confidently navigating the many reason codes, evidence requirements, deadlines, and other variables that will impact their ability to fight chargebacks. While guides like this can serve as a helpful reference for me...

Chargeback Processing

How Do You Do a Chargeback on PayPal?

- A chargeback is a charge that is returned to a payment card after a customer successfully dispu…

In the U.S. chargeback reversals for debit cards are governed by Regulation E of the Electronic Fund Transfer Act. Chargeback reversal for credit cards is governed by Regulation Z of the Truth in Lending Act. - A chargeback is the payment amount that is returned to a debit or credit card, after a customer …

The chargeback process can be initiated by either the merchant or the cardholder’s issuing bank.

How Long Do I Have to Ask for a Chargeback?

- A chargeback can be considered a refund since it returns specified funds taken from an accoun…

Focused on charges that have been fully processed and settled, chargebacks can often take several days for full settlement as they must be reversed through an electronic process involving multiple entities. - When to Ask for a Chargeback

Charges can be disputed for many reasons. A cardholder may have been charged by a merchant for items they never received, a merchant could have duplicated a charge by mistake, a technical issue may have caused a mistaken charge, or a cardholder’s card information may have been co…

How Do You Fight a Chargeback?

- The chargeback process can be initiated by either the merchant or the cardholder’s issuing bank…

For example, a chargeback initiated by a merchant would begin with a request sent to the merchant’s acquiring bank from the merchant. The acquiring bank would then contact the card’s processing network to send payment from the merchant’s account at the merchant bank to the … - Who Pays for a Chargeback

If a chargeback is initiated by the issuing bank, then the issuing bank facilitates the chargeback through communication on their processing network. The merchant bank then receives the signal and authorizes the funds' transfer with the confirmation of the merchant.