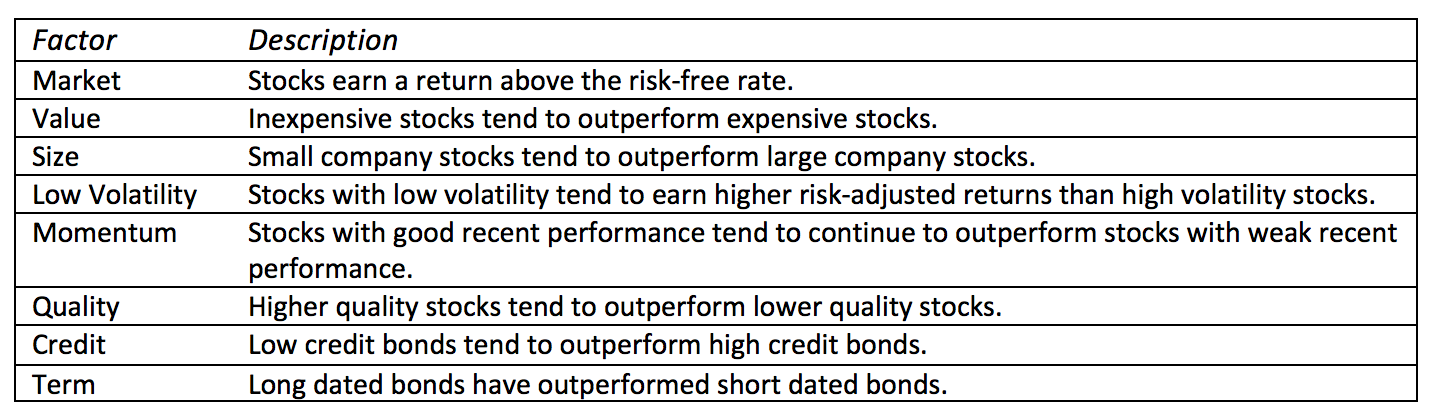

Here is a list of the average fee of a factoring company:

- % each month or 1% per 10 days

- 5% each month or 0.5% per 10 days

- % per 45 days or 0.5% per 15 days

How much does a factoring company charge?

A factoring company may charge 2% for the first 30 days and 0.5% for every 10 days that the invoice remains unpaid. Fees are often referred to as invoice discounting rates.

How are factoring rates calculated?

Factoring rates are calculated based on a number of factors: Average factoring costs fall between 1% and 5% depending on the factors above. Volume plays a huge part in calculating factoring rates. Larger monthly amounts factored equal lower fees. Many factoring companies offer volume discounts.

When is factoring the best option for your business?

This funding option is best for businesses that need immediate cash to pay bills or make a large purchase, such as inventory. Factoring is best used as a short-term funding option because fees can be expensive if customers take more than 30 days to pay their invoices. How Much Does a Factoring Company Charge?

What percentage of an invoice is factored up front?

When your company factors invoices, you’ll typically receive a large percentage of the invoice up front and the remainder is held in a reserve until your customers pay the invoice. Factoring advance rates vary by industry. Industries that are riskier and harder to fund such as medical and construction can expect advance rates between 60% and 80%.

What are typical factoring rates?

How much do factoring companies charge? Factoring companies make money by charging a factoring fee, which is usually a flat percentage of each invoice you factor. Generally, fees range from 1.15% to 3.5% per month.

How much percent does a factoring company take?

between 1% and 5%The average cost of factoring invoices is typically between 1% and 5%, depending on these variables. Remember, the factoring rate is just part of what you may end up paying. The more invoices you factor, the more you're billing. The better your customer's credit is, the lower rates you'll pay.

How much do factoring companies charge per load?

Factoring companies charge a percentage of the load invoice as a fee for the service, typically around 3.5%.

How is factoring fee calculated?

To calculate the factoring fee with a daily rate structure, simply multiply the daily rate by the number of days the invoice was outstanding. In the example below, an invoice aged 42 days would be charged a 2.5% discount in the tiered rate structure and a 2.1% discount in the daily rate structure.

How much does OTR charge for factoring?

OTR Factoring Information: Factoring Rates: 2% flat rate (if loaded through Nolan Transportation Group) Funding Advance: Up to 90% of completed contracts. Credit Facility: $10,000 to $10 million.

Where do factoring companies get their money?

How does a factoring company make money? When a business factors their invoices, the factor (or factoring company) advances up to 90% of the invoice value to the business. When the factor collects the full payment from the end customer, they return the remaining 10% to the business, minus a factoring fee.

How long does it take to factor a load?

The industry-standard average is 40 days, and some companies can take up to 90 days to pay invoices. That's a long time to wait for the money you need for living and business operating expenses. With freight factoring, you can get paid right away, after you receive the invoice.

Do I need a factoring company for trucking?

You can run your trucking business perfectly fine without the services of a factoring company. You will have to plan ahead for the lengthy wait times on getting paid by your customers, but you won't be out the fees and percentage cut taken by a factoring company.

Is Apex a good factoring company?

Apex is one of the better and most well-known freight factoring companies. There are plenty of reasons to consider Apex for your freight factoring needs, including its rapid payment and relatively low flat rate of 2%.

Are factoring fees tax deductible?

The simple answer is yes Factoring fees are tax deductible. Provided funds are being used purely for business purposes, then factoring fees & interest are classed as a business expense.

What are the four types of factoring?

The four main types of factoring are the Greatest common factor (GCF), the Grouping method, the difference in two squares, and the sum or difference in cubes.

What are the benefits of factoring?

Benefits of factoring for your businessGain predictable higher liquidity and a greater portion of equity.Adjust your financing needs to your sales.Use the cash discounts and rebates offered by your suppliers.Grant longer payment terms to your customers.Enjoy security against bad debt losses.More items...

How long does it take to factor a load?

The industry-standard average is 40 days, and some companies can take up to 90 days to pay invoices. That's a long time to wait for the money you need for living and business operating expenses. With freight factoring, you can get paid right away, after you receive the invoice.

What do Trucking factoring companies do?

Trucking factoring companies—also known as freight factoring companies—give you an advance on your outstanding invoices, and they collect the payment from your customer when the invoice is due. Additionally, trucking factoring companies can often take the risk of nonpayment off your shoulders—for a price.

What is an invoice factoring company?

Invoice factoring is type of invoice finance where you "sell" some or all of your company's outstanding invoices to a third party as a way of improving your cash flow and revenue stability. A factoring company will pay you most of the invoiced amount immediately, then collect payment directly from your customers.

What is trucking factoring?

Freight factoring, also called transportation factoring, trucking factoring, or freight bill factoring, is a process in which the person or business that delivers a load sells their invoice to a factoring company.

What Does the Cost of Factoring Offer My Company?

However, when you start factoring invoices, you’ll see that factoring companies offer more than just immediate funding.

How do factoring companies calculate rates?

Factoring companies typically calculate rates using a variable fee structure. With variable fees, they discount a small percentage (1 to 3 percent) of the invoice for as long as the invoice goes unpaid. So, the longer your customer takes to pay, the more you’ll pay in fees.

Why is invoice factoring important?

Instead of a strict credit line, invoice factoring gives you access to the cash you need whenever you need it! Your funding potential is only limited by your sales and will grow as your company grows. Also, you can reduce your invoice factoring costs by choosing which invoices to factor and when.

How to factor invoices?

Just like any other type of business lending service, there are fees associated with invoice financing. Factoring rates are calculated based on a number of factors: 1 The volume of the monthly receivables you wish to factor 2 The average size of each invoice you wish to factor 3 Your industry 4 The creditworthiness of your customers 5 The length of time it takes your customers to pay

What is advance rate factoring?

Advance Rates. When your company factors invoices, you’ll typically receive a large percentage of the invoice up front and the remainder is held in a reserve until your customers pay the invoice. Factoring advance rates vary by industry.

How much does a factoring company charge for a 10 day period?

So, the longer your customer takes to pay, the more you’ll pay in fees. A factoring company may charge 2% for the first 30 days and 0.5% for every 10 days that the invoice remains unpaid. Fees are often referred to as invoice discounting rates.

What is flat fee factoring?

Some factoring companies offer a flat fee structure where a one-time fee is charged up front. With a flat fee structure, the fee remains the same no matter how long the invoice remains open. This type of rate structure is common in the trucking industry. Depending on your industry, one or both of these options may be available and can help you control your costs.

What is the right factoring rate for you?

Our factoring rates start as low as 0.55% and are usually no higher than 2%.

How to calculate factoring rate?

Most people want to calculate the cost of factoring by multiplying the 1.5% rate by 12 months, which would be an 18% APR. But, that is how the banks operate. The invoice factoring rate is calculated by multiplying the factoring rate , which can range from 0.55% to 2%. In this example, the rate is 1.5% of $100,000 x 12 months = $18,000.

How much does it cost to factor $10,000?

Factoring a $10,000 invoice at a weekly 1% rate would cost you $400 a day 30 and $800 by day 60. Universal Funding provides a monthly factoring rate. If you were to agree to a 1.5% rate, the same $10,000 would cost you $150 at 30 days and only $300 at 60 days saving 50% of what a weekly rate would cost you.

How much is a 2% discount on a 7,000 invoice?

A 2% discount on a $7,000 invoice is $140. At 10 carts per month, you would owe the vendor $70,000, so that adds up to $1,400 per month and $16,800 per year. Compare that to the annual cost of factoring, which is $18,000.

What industries are factoring companies considered?

Some industries are considered to have a lower risk. Consequently, they often get better terms. These industries include transportation, staffing, and consulting.

Why do factoring companies use variable rates?

It allows them to link the cost of financing to the actual length of time the invoice is outstanding. With a variable pricing model, the longer the invoice goes unpaid, the higher the cost. Variable rates are quoted in a variety of formats.

How is volume determined?

Factoring volume is by far the most important variable used in determining your rate.

Why is creditworthiness important?

Instead, creditworthiness is used to decide whether or not an invoice from a customer will be funded. Your client’s creditworthiness also affects the size of your financing line and your advance percentage.

What determines the rate of a business?

The two most important criteria that determine your rate are the factor’s risk of buying your invoices and your financing volume. Low-risk clients that finance high sales volumes usually get the lowest rates. On the other hand, higher-risk clients or clients with a low sales volume usually get higher rates.

How much is factoring per 30 days?

In summary, factoring rates range from 1.15% to 4.5% per 30 days. Advances range from 70% to 85%. There are some exceptions, such as transportation and staffing. In these cases, advances can reach or exceed 90%. Rates and advances vary based on volume, industry, and the other variables we discussed.

What is the number to call for invoice factoring?

We are a leading provider of invoice factoring. If you would like a quote, fill out this form or call us toll-free at (877) 300 3258.

How much do freight factoring companies charge?

Truck factoring rates vary depending on which freight factoring company you use and any freight factoring fees for additional services. Typically, charges can range from 1% to 4% per invoice.

How are freight factoring fees calculated?

Freight factoring fees are calculated in two ways: variable fees or flat fees.

Common freight factoring fees

Not all freight factoring companies operate the same way. The truck factoring rates they offer and fees they charge can cost you money if you’re not careful. Make sure you read the fine print when comparing trucking factoring rates.

Get the best truck factoring rates with Truckstop.com Factoring

With Truckstop.com, factoring is easy. Haul a load, scan and submit your paperwork through our app, and get paid right away.

Why is a factoring company a smaller percentage?

This is because a factoring company will want your business since the tiny percentage will still lead to huge profits.

What are the benefits of working with a factoring company?

Advantages of Working with a Factoring Company. The number one benefit is that your cash flow improves immediately, and your money is not delayed. Therefore, you can expand quickly and grow the business. Moreover, factoring users can also get other benefits like: Help with business credit decisions.

How Does Factoring Work?

Factoring transactions are straightforward to implement into a business. They receive the payment you’d get from a client, and you get money instantly from the factoring company.

Why do businesses need factoring?

Working with a factoring company can help a business expand thanks to the faster cash flow . The fees are much smaller than banks, which makes it an excellent alternative. Factoring companies work with various industries, and getting qualifications to receive payments is an easy process.

How long does it take to get paid by factoring?

Rather than waiting 30-90 days to get paid, the factoring company will send money right away. Factoring companies focus on specific industries where money is needed fast. Furthermore, banks can offer this service, but most factoring brands are independent providers.

What are the benefits of factoring?

The number one benefit is that your cash flow improves immediately, and your money is not delayed. Therefore, you can expand quickly and grow the business. Moreover, factoring users can also get other benefits like: 1 Help with business credit decisions 2 Support handling payments 3 Flexibility with money 4 Easy qualification requirements

How long does it take for a factoring company to pay invoices?

After 90-days , the factoring company can present the unpaid invoices to you for reimbursement. However, in a non-recourse plan, you don’t need to worry about if the client doesn’t pay. If the client can’t pay due to bankruptcy, you won’t need to repay the invoice to the factoring company.

How much does a factoring company charge?

If your customer pays within the first month, the factoring company will charge you 2% of the value; if it takes them three months to pay, the factoring company will charge 6% of the value.

What is factoring company?

Factoring companies set prices based on the value of the accounts receivable. Sometimes factoring companies charge flat rates regardless of how long it takes them to recoup payment on the invoice. Others charge variable rates: The longer your customers take to pay the invoice, the more you’ll owe.

How is this different from accounts receivable financing?

Accounts receivable factoring is not the same as accounts receivable financing , despite their similar names.

How do I find an accounts receivable factoring company?

Some small business lenders offer this service, including online lenders like FundThrough. There are also lots of established factoring companies that specialize in certain industries or geographies.

What is factoring receivables?

After receiving it, the factoring company pays the business the remainder of the invoice amount, minus fees. This financing method — also known as invoice factoring or factoring receivables — allows companies to quickly access cash they have earned.

What does nonrecourse factoring mean?

“Nonrecourse factoring” means that the factoring company accepts those potential losses.

How long does it take for a business to pay an invoice?

When a business has an unpaid customer invoice but can't wait 30 to 90 days for a payment, accounts receivable factoring may offer a solution. Here’s how it works: The business owner sells an invoice to a factoring company, which pays the business owner a large percentage of the invoice as an advance. The factoring company follows up ...

What Is Factoring?

Invoice factoring is a mechanism for businesses to inject cash into their accounts by selling their invoices to a third party at a discount. Companies get immediate cash for their unpaid invoices that are due within 90 days, instead of waiting for their customers to pay their financial obligations.

What is factoring in accounting?

Factoring occurs when a company sells one or more accounts receivable invoices owed on credit terms to a financier, known as a factor, for less than what they are owed. That discount, plus some additional fees, is how the factor makes its profit.

What Is the Difference Between Invoice Financing and Factoring?

Invoice financing and invoice factoring both provide funding to a business in need of cash to accomplish its goals, such as making payroll, paying its vendors, or buying more inventory.

Why is Bluevine the best invoice factoring company?

We chose BlueVine as our best overall invoice factoring company because of its superior reputation, 10-minute application process, and 24-hour funding decision, all without a long-term contract.

How long does it take to get a factoring loan with Bluevine?

The application process can be completed in as little as 10 minutes, with a funding decision within 24 hours, and no long-term contract. The company’s discount rates start as low as 0.25% of the advance per week, which is one of the lowest rates in the industry.

Why is factoring the best funding option?

Factoring is best used as a short-term funding option because fees can be expensive if customers take more than 30 days to pay their invoices. 🧾.

How long does it take to get an advance on invoice factoring?

For the invoice factoring service, the company will advance up to 97% of the total amount within 24 hours of taking your application.