What percentage of donations to Susan G Komen go to cancer research?

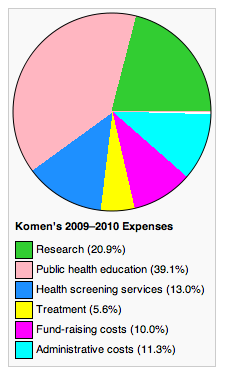

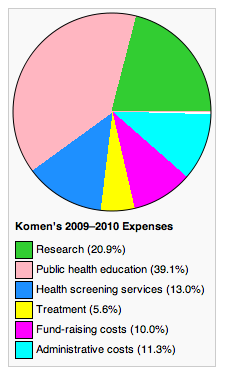

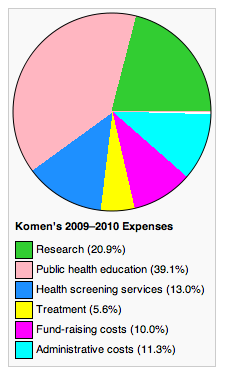

Komen only devotes 20.9 percent of the donations it receives to researching breast cancer. The rest of their funding goes towards administrative costs and raising “awareness,” i.e. devoting money to advertising the Susan G. Komen brand and merchandise.

Are donations to Komen for the cure tax-deductible?

Susan G. Komen for the Cure is a 501 (c) (3) organization, with an IRS ruling year of 1992, and deductibiltiy of donations depends on various factors. Is this your nonprofit? Access your Star Rating Portal to submit data and edit your profile. The IRS is significantly delayed in processing nonprofits' annual tax filings (Forms 990).

Which charities should you donate to?

Other charities that should be donated to, based on the ranking of Charity Navigator, are the National Breast Cancer Foundation, the Dr. All of these organizations were given at least a score of 90.9 (out of 100) by Charity Navigator, while Susan G. Komen only received an 81.11. You might be interested: FAQ: How To Get Donations For Charity?

Does Komen for the cure score affect the organization's star rating?

The score earned by Susan G. Komen for the Cure is a passing score. This score has no effect on the organization's Star Rating. Encompass Rating V4 provides an evaluation of the organization's Leadership & Adaptability through the nonprofit organization submitting a survey response directly to Charity Navigator.

What does Susan G Komen donate to?

How does a charity come up with the suggested donation amount?

What happened to the Komen board after the executive director stepped down?

What charities took less from donations than others?

How much to ask for a donation?

Do donors have to be accountable?

Does Goodwill give money?

See 4 more

About this website

How does Susan G. Komen rate as a charity?

Good. This charity's score is 82.42, earning it a 3-Star rating. Donors can "Give with Confidence" to this charity.

How much does the CEO of Susan Komen make?

At Susan G. Komen for the Cure, the most compensated executive makes $720,000, annually, and the lowest compensated makes $52,000.

How much money does Susan G. Komen give to cancer research?

Komen reports spending a total of $685 million for research in the past 30 years, a considerable sum in private cancer philanthropy, and its money goes to a wide variety of initiatives.

How much money does the Komen Foundation give to research?

With this investment, Komen is now supporting more than 152 active research projects representing more than $115 million in funding.

How much does a CEO of Red Cross make?

For the past 11 years, Gail McGovern has served as president and CEO of the American Red Cross, and in 2018, she was paid $694,000, which reflects her leadership of the country's largest humanitarian organization.

How much money does Susan G. Komen give to Planned Parenthood?

Planned Parenthood, which received about $680,000 from Komen last year, according to the Associated Press, has reportedly already raised $250,000 on news of Komen's decision. And it will likely end up recouping its losses quickly.

What's the best cancer charity to donate to?

Cancer CharitiesCharityRatingMemorial Sloan Kettering Cancer CenterB+Multiple Myeloma Research FoundationANational Breast Cancer Coalition FundAOvarian Cancer Research AllianceA-8 more rows

What is the best breast cancer charity to donate to?

What is the best breast cancer charity to donate to?American Cancer Society.Breastcancer.org.Breast Cancer Research Foundation.Living Beyond Breast Cancer.National Breast Cancer Foundation.Susan G. Komen Foundation.Young Survival Coalition.

Is March of Dimes a good charity?

This charity's score is 71.40, earning it a 2-Star rating. Charity Navigator believes donors can "Give with Confidence" to charities with 3- and 4-Star ratings. This score is calculated from two sub-scores: Finance: 59.67 View details.

Is the Pink Fund legitimate?

Pink Fund Inc. is a 501(c)(3) organization, with an IRS ruling year of 2009, and donations are tax-deductible.

Is Susan G. Komen a nonprofit?

Susan G. Komen® is a 501(c)(3) tax-exempt organization.

What happened to Susan B Komen?

The foundation's namesake, Susan Goodman Komen, died of breast cancer in 1980 at the age of 36. Susan Komen's younger sister, Nancy Brinker, believed that Susan's outcome might have been better if patients knew more about cancer and its treatment, and founded the Susan G. Komen Breast Cancer Foundation in 1982.

Who is the CEO of Susan G. Komen?

President and CEO. Paula Schneider is president and CEO of Susan G. Komen®, responsible for the strategic direction and day-to-day operation of Komen's research, community health, public policy advocacy and global programs.

How much does Paula Schneider make?

$74,786,769Key Employees and OfficersCompensationPaula Schneider (President and CEO)$631,413Dana Brown (CHIEF OPERATING OFFICER)$330,938Christina Alford (SVP, Development)$326,215Victoria Wolodzko (VP RESEARCH AND COM. HEALTH PR)$260,25222 more rows

Is Susan G. Komen non profit?

Susan G. Komen® is a 501(c)(3) tax-exempt organization.

Who was Nancy Brinker married to?

Norman E. BrinkerNancy Brinker / Spouse (m. 1981–2000)Norman Eugene Brinker was an American restaurateur who was responsible for the creation of new business concepts within the restaurant field. He served as president of Jack in the Box, founded Steak and Ale, and helped establish Bennigan's and founded Brinker International. Wikipedia

Question: Susan G Komen How Much Goes To Charity?

How much does the CEO of the breast cancer Foundation make? Then, in August, Brinker announced that she would be stepping down. But 10 months later, Brinker still holds her position and tax documents reveal that she received a 64-percent raise and now makes $684,000 a year, according to the charity’s latest available tax filing.

Charity Navigator - Rating for Susan G. Komen for the Cure

Important note on the timeliness of ratings . The IRS is significantly delayed in processing nonprofits' annual tax filings (Forms 990). As a result, the Financial and Accountability & Transparency score for Susan G. Komen for the Cure is outdated and the overall rating may not be representative of its current operations.

How to calculate charity efficiency?

To calculate a charity's fundraising efficiency, we divide its average fundraising expenses by the average total contributions it receives. We calculate the charity's average expenses and average contributions over its three most recent fiscal years.

What does Charity Navigator look for on Form 990?

Charity Navigator looks to confirm on the Form 990 that the organization has these governance practices in place .

Why is Charity Navigator important?

Charity Navigator believes nonprofit organizations that engage in inclusive practices, such as collecting feedback from the people and communities they serve, may be more effective. We award every nonprofit that completes the Candid survey full credit for this Beacon, in recognition of their willingness to publicly share this information with the nonprofit and philanthropic communities. Although the data is not evaluated for quality at this time, future iterations of this Beacon will include third party or other data that will serve to validate the information provided by the nonprofit.

How to find program expense ratio?

The Program Expense Ratio is determined by Program Expenses divided by Total Expense (average of most recent three 990s).

What is the impact score of a nonprofit?

This score estimates the actual impact a nonprofit has on the lives of those it serves, and determines whether it is making good use of donor resources to achieve that impact.

What is a charity navigator?

Charity Navigator evaluates a nonprofit organization’s financial health including measures of stability, efficiency and sustainability. We also track accountability and transparency policies to ensure the good governance and integrity of the organization.

What are fundraising expenses?

Fundraising expenses can include campaign printing, publicity, mailing, and staffing and costs incurred in soliciting donations, memberships, and grants. Dividing a charity's average fundraising expenses by its average total functional expenses yields this percentage. We calculate the charity's average expenses over its three most recent fiscal years.

Why should charities spend more on overhead?

Overhead costs include important investments charities make to improve their work: investments in training, planning, evaluation, and internal systems—as well as their efforts to raise money so they can operate their programs. These expenses allow a charity to sustain itself (the way a family has to pay the electric bill) or to improve itself (the way a family might invest in college tuition).

Who started the Overhead Myth campaign?

Read more about the Overhead Myth campaign sparked by GuideStar, BBB Wise Giving Alliance, and Charity Navigator, and see the back of the letter for research from other experts, including our own Snapshot research—as well as Indiana University, the Urban Institute, the Bridgespan Group, and others—that proves the point.

When we focus solely or predominantly on overhead, we can create what the Stanford Social Innovation Review has called “The answer?

When we focus solely or predominantly on overhead, we can create what the Stanford Social Innovation Review has called “ The Nonprofit Starvation Cycle. ” We starve charities of the freedom they need to best serve the people and communities they are trying to serve.

Is overhead a poor measure of a nonprofit?

It's understandable that you want to invest in a cause, not line a nonprofit executive's pocket. But the fact is that overhead—the percent of charity expenses that go to administrative costs versus program costs—is a poor measure of a charity’s performance.

Can nonprofits skew their ratio?

In fact, with clever accounting, a nonprofit can skew their ratio. It's far more useful to focus on true indicators of a nonprofit's performance: transparency, governance, leadership, and results. That is not to say that overhead has no role in ensuring charity accountability.

Who is the CEO of Komen?

In 2012, Komen founder and CEO Nancy Brinker became the focus of controversy when she announced Komen would be pulling the grants the organization had been providing to Planned Parenthood for breast cancer screenings, then quickly reversed that decision.

How much does Nancy Brinker make?

Charity Navigator’s last compensation figure for Nancy Brinker was $560,896 per year, which at the time put her below Komen president Elizabeth Thompson’s reported annual compensation of $606,461. In June 2013, Komen finally announced that Brinker would be stepping down as president and CEO of that organization and named Judith A. Salerno, M.D. as her successor. In June 2015, Brinker reportedly resigned from her paid position to assume an unpaid role role as a top volunteer with Komen. Dr. Salerno’s most recently reported compensation (in August 2017) was $479,858, while Nancy Brinker was still listed as a “founder” receiving a salary of $397,093.

What did Brinker promise her sister?

Brinker fulfilled a promise to her sister that she would do everything she could to help eradicate the disease — a disease that Brinker also was diagnosed with and successfully fought.

Did Komen pull breast cancer screenings?

In early 2012, Komen announced it was pulling its grants for breast-cancer screenings from Planned Parenthood , drawing an immediate backlash from Komen supporters and abortion rights advocates. Within days, Nancy Brinker, the group’s founder and CEO, reversed the decision to defund the organization. Then, in August, Brinker announced that she would be stepping down.

What does Susan G Komen donate to?

If a brief description works, it probably goes like this: Every dollar donated to Susan G Komen goes to breast cancer services and research —right after Planned Parenthood gets their skim off the top.

How does a charity come up with the suggested donation amount?

So basically, how a charity comes up with the suggested donation amount is a mixture of knowing how much the charity needs to raise in the first place, the ability to budget, understanding the behaviours of your donors, a bit of psychology around giving, and careful communication.

What happened to the Komen board after the executive director stepped down?

After the Komen executive director stepped down, the board and Komen bowed to Planned Parenthood and promised not to be so brash ever again.

What charities took less from donations than others?

My recollection from reading this list was that Salvation Army and Red Cross were the charities who took less from donations than others. But it is worth checking.

How much to ask for a donation?

Tailor your ask to the individual giving history of each donor. For example, if a bunch of people on your database usually give you between $20 and $25 each time they make a donation, you would not ask them to make a donation of $19 - you’d ask them for a donation of $29 (make a small incremental increase). If someone gives you $15 as a donation, the next ask could be $19.

Do donors have to be accountable?

It is always up to donors to engage with their donee organizations and their boards to encourage them to do things better or differently; we expect charities and nonprofits to be accountable and we as donors and as grant makers have a role to play in this accountability through both our voices and our charitable dollars.

Does Goodwill give money?

Goodwill doesn’t hand out money to clients. It’s mission is to help people access paid work - people who have been out of the work force for many years (stay-at-home moms, people who were incarcerated, people with disabilities, etc.) and people who have never been in the work force but need to be. 100% of Goodwill’s money raised through its thrift shops goes to delivering its services - in the form of rent and leases for those shops, paying staff that conduct trainings for Goodwill’s clients, including for those working in the shop, equipment, etc.