How much can I Borrow for a mortgage based on my income?

This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. The short answer: These days, most lenders limit borrowers to a maximum debt-to-income ratio of 45% to 50%. So those applicants who fall above that threshold might have a harder time qualifying for a mortgage loan.

How much of your income you should spend on housing?

You should only spend up to 28% of your monthly gross income on housing costs, according to the 28/36 rule recommended by many financial experts. Housing costs include your mortgage payment, taxes, and insurance. However, how much house you can realistically afford will depend on multiple personal and financial factors.

How do you calculate housing to income ratio?

What is Housing Ratio?

- Housing Ratio is a Measure of Risk. Lenders use housing ratio as a measure of risk. ...

- Formula for Housing Ratio. Housing ratio is calculated by dividing the monthly mortgage obligation by gross monthly income. ...

- Examples for Housing Ratio Calculations. ...

- Calulators and Tools

How do you calculate mortgage income?

Using the Mortgage Income Calculator

- Loan information. Begin by entering the desired loan amount, expected mortgage rate and length of the loan in the spaces provided.

- Monthly liabilities. ...

- Housing expenses. ...

- Required annual income for a variety of interest rates. ...

- Viewing your report

What is the 28% 36% rule?

A Critical Number For Homebuyers One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldn't be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income (DTI) ratio.

Is 28 36 Rule gross or net?

According to this rule, a household should spend a maximum of 28% of its gross monthly income on total housing expenses and no more than 36% on total debt service, including housing and other debt such as car loans and credit cards.

What percentage of income should go to mortgage Ramsey?

25%Figure out 25% of your take-home pay. To calculate how much house you can afford, use the 25% rule: Never spend more than 25% of your monthly take-home pay (after tax) on monthly mortgage payments.

What percentage of net income should mortgage be UK?

35 per centA good rule of thumb is that no more than 35 per cent of post-tax income should go on mortgage payments. Will the mortgage be more or less than your current rent?

Is the 30% rule outdated?

The 30% Rule Is Outdated Rather than looking at what consumers should be spending on housing, however, the government selected these percentages because that's what consumers were spending.

Is the 30% rule gross or net?

A popular standard for budgeting rent is to follow is the 30% rule, where you spend a maximum of 30% of your monthly income before taxes (your gross income) on your rent. This has been a rule of thumb since 1981, when the government found that people who spent over 30% of their income on housing were "cost-burdened."

What mortgage can I afford with 100K salary?

A 100K salary means you can afford a $350,000 to $500,000 house, assuming you stick with the 28% rule that most experts recommend. This would mean you would spend around $2,300 per month on your house and have a down payment of 5% to 20%.

What is the 50 30 30 budget rule?

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

How much house can I afford on 120k salary?

If you make $50,000 a year, your total yearly housing costs should ideally be no more than $14,000, or $1,167 a month. If you make $120,000 a year, you can go up to $33,600 a year, or $2,800 a month—as long as your other debts don't push you beyond the 36 percent mark.

What salary do you need for a 400k house UK?

400k mortgages To get a mortgage of £400,000 the minimum you'll need to be earning is between £88,000 and £100,000 at 4-4.5 times your income.

Can my mortgage be 50% of my income?

The 28% rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g. principal, interest, taxes and insurance). To determine how much you can afford using this rule, multiply your monthly gross income by 28%.

Do mortgage lenders look at gross or net income UK?

net profitsUltimately, your mortgage will be assessed on your declared net profits.

Does the 50 30 20 rule use gross or net income?

The 50/30/20 rule is ideally based on after-tax income (also known as net income or take-home pay) rather than gross (or pretax) income. Your take-home pay can be calculated by subtracting any taxes and pretax payroll deductions from your gross income.

Does the 28 rule include taxes?

Front-end ratio: No more than 28% of your income The front-end ratio is how much of your income is taken up by your housing expenses. According to the 28/36 rule, your mortgage payment -- including taxes, homeowners insurance, and private mortgage insurance -- shouldn't go over 28%.

Is the 50 30 20 rule before or after taxes?

Key Takeaways. The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

Should I save based on gross or net income?

Not sure where to put this money? Experts recommend saving 10% of your net income for retirement. Use the remaining 10% for extra payments on debts and saving goals, such as your emergency fund.

What Percentage Of Income Should Go Toward A Monthly Mortgage Payment?

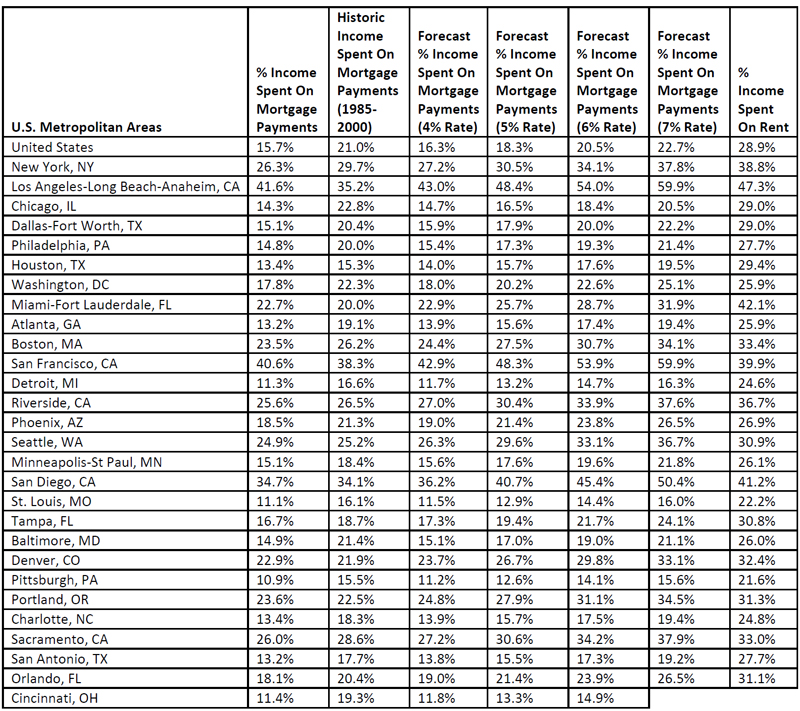

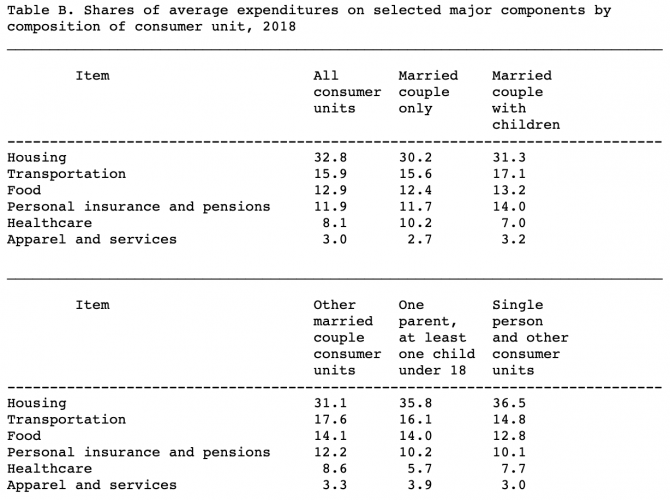

Every homeowner’s situation is different, so there’s no hard and fast rule about how much money you should be spending on your mortgage each month. Still, experts do have some words of wisdom to help make sure you don’t end up stretching your housing budget too thin.

What is the income to mortgage ratio for Quicken?

At Quicken Loans®, the income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, it’s important to remember that you don’t need to spend up to your monthly limit. Think of 28% as the maximum amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes and insurance in your total before you sign on a loan.

What Is My Debt-To-Income Ratio (DTI)?

Lenders don’t just look at your gross income when they decide how much you can afford to take out in a loan. Your debt-to-income ratio also plays a major role in the process.

How to keep DTI ratio at 43%?

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. You’ll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

How to find DTI ratio?

After you add up all of your debts, divide your monthly debt obligation by your gross monthly income . Then, multiply the result by 100 to get your DTI ratio. If your DTI ratio is more than 43%, you might have trouble finding a mortgage loan. To learn more about calculating your DTI ratio, read our complete guide.

What is gross income?

Gross income is your total household income before you deduct taxes, debt payments and other expenses. Lenders typically look at your gross income when they decide how much you can afford to take out in a mortgage loan. The 28% rule is fairly easy to figure out.

How to calculate DTI?

When it comes to calculating your DTI ratio, you’ll have to add up your fixed monthly expenses. Only minimum payments and fixed recurring expenses count toward your DTI ratio. For example, if you have $15,000 worth of student loans but you only need to pay $200 a month, you’d include $200 in your debt calculation. Don’t include variable expenses (like utilities and transportation costs) in your calculation.

What percentage of income should go to a mortgage?

Every borrower’s situation is different, but there are at least two schools of thought on how much of your gross income should be allocated to your mortgage: 28 percent and 36 percent.

What is the 28 percent cap?

This 28 percent cap centers on what’s known as the front-end ratio, or the borrower’s total housing costs compared to their income.

What do mortgage reporters and editors focus on?

Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner.

What is the DTI for conventional loans?

Note that there are maximum DTI ratios set by Fannie Mae, Freddie Mac and the FHA that lenders use in underwriting, as well. These are 45 percent (sometimes up to 50 percent) for conventional loans and 43 percent for FHA loans.

What is home maintenance?

Home maintenance, including a fund for future replacement of things that wear out over time such as appliances, the roof and HVAC system

Does owning a home add up to mortgage?

As any homeowner can attest, the expenses of owning and maintaining a home can add up well beyond the monthly cost of a mortgage.

Does Bankrate include credit?

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. When you buy a home, it’s important to know how much of your income you can reasonably dedicate to your monthly mortgage payment.

What Percentage of Income Should Go to A Mortgage?

How Do Lenders Determine What I Can Afford?

- These are the major factors mortgage lenders weigh to determine how much mortgage a borrower can reasonably afford: 1. Gross income – Your gross incomeis your total earnings before taxes and other deductions are factored in. Other sources of income, such as spousal support, a pension or rental income, are also included in gross income. 2. DTI ratio– Your DTI rat…

Other Considerations on What You Can Afford

- Costs of homeownership

As any homeowner can attest, the expenses of owning and maintaining a homecan add up well beyond the monthly cost of a mortgage. “HOA fees, utility payments and other expenses must be factored into the affordability calculation,” Winograd says. These other costs can include: 1. Ho… - Mortgage type

The kind of mortgage you choose can also have a significant impact on what you can afford. To find a loan that’s right for you, it’s important to explore all your options, including conventional, FHA and VA loans. It’s also smart to find a mortgage lender that understands your financial situ…

Bottom Line

- You can work with your lender to do the affordability calculations based on your income and the cost of the home you have in mind, and from there, evaluate whether you can reasonably afford it. Remember that when it comes to estimating what you can afford, there are guidelines you can follow, but ultimately it’ll be based on your individual circumstances. “There is no hard and fast r…