Which states have the lowest taxes?

For example, property tax in one state may be much lower but personal income tax may be much higher. But we can break down the states with the lowest taxes based on tax type. In 2018, it was found that Louisiana had the lowest property tax rate at 0.18%. Hawaii came in second with a property tax rate of 0.26%.

Which states have the highest tax burdens?

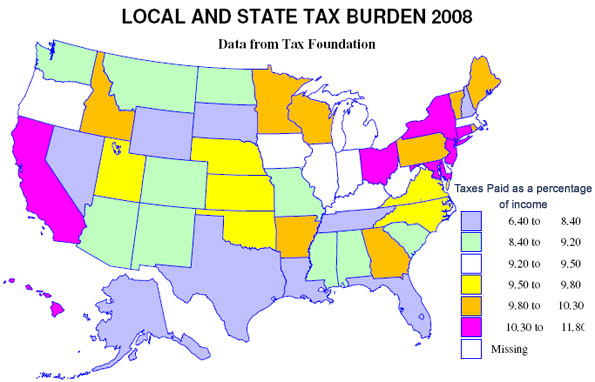

New Yorkers faced the highest burden, with 15.9 percent of net product in the state going to state and local taxes. Connecticut (15.4 percent) and Hawaii (14.9 percent) followed close behind. On the other end of the spectrum, Alaska (4.6 percent), Wyoming (7.5 percent), and Tennessee (7.6 percent) had the lowest burdens.

Which states don’t have state taxes?

As of 2021 Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. 1 Why Do States Charge a State Tax?

How much of the US tax burden comes from non-residents?

In calendar year 2022, state-local tax burdens are estimated at 11.2 percent of national product. Taxpayers remit taxes to both their home state and to other states, and about 20 percent of state tax revenue comes from nonresidents.

What are the most tax-friendly states?

Seven states do not collect tax on personal income, and Tennessee is poised to join the list:Alaska.Wyoming.South Dakota.Florida.Texas.Nevada.Washington.

What is the most tax free state?

Known as 'The Last Frontier', Alaska is the most tax-friendly state in the country. It has no sales tax and no state income tax. Alaska charges a slightly higher than average property tax rate of 1.18%, but the state has several ways to apply for property tax exemptions.

What is the least tax-friendly state?

Illinois1. Illinois. Sorry, Illinois, but you're the least tax-friendly state in the country for middle-class families. For all three taxes we're tracking – income, sales, and property taxes – you tax middle-income residents at an above average rate (at least).

Where is the cheapest place to live for taxes?

1. Cheyenne, Wyoming. While not an obvious candidate, Cheyenne, Wyoming tops the list of U.S. cities with the lowest tax rates. Cheyenne tax rates are low across the board, with an average 9.7% rate for lower-income families.

What states have no property tax?

States With No Property Tax 2022StateProperty Tax RateMedian Annual TaxAlaska$3,231$3,231New Jersey$2,530$7,840New Hampshire$2,296$5,388Texas$1,993$2,77546 more rows

What is the most tax friendly state to retire in?

Delaware1. Delaware. Congratulations, Delaware – you're the most tax-friendly state for retirees! With no sales tax, low property taxes, and no death taxes, it's easy to see why Delaware is a tax haven for retirees.

How do I avoid paying state taxes?

0:107:58How To Avoid STATE Income Taxes (100% Legally) - YouTubeYouTubeStart of suggested clipEnd of suggested clipOr if you live in an rv. And you travel all over the place what you can do is almost like moving toMoreOr if you live in an rv. And you travel all over the place what you can do is almost like moving to that state except you're actually just changing your domicile. Since you're a world traveler.

What's the most affordable state to live in?

Mississippi1. Mississippi. Coming in as the cheapest state to live in in the United States is Mississippi with a cost of living index score of 83.3. It also has the lowest average housing costs in the nation at 33.7% below the national average.

Is there anywhere in the US with no property tax?

States with no property tax Unfortunately, there's no such thing as a state with no property tax. That's because property taxes are used to fund essential government services such as schools, fire and police departments, water districts, and libraries.

What states do not tax Social Security?

If you live in any of these states — or the District of Columbia — you won't have to worry about paying state taxes on your Social Security income....These states include the nine that don't have any income tax at all, which are:Alaska.Florida.Nevada.New Hampshire.South Dakota.Tennessee.Texas.Washington.More items...•

Which states have no state tax for retirees?

Nine of those states that don't tax retirement plan income simply because distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Why Florida has no state tax?

In 1924, they passed an amendment to the Florida constitution that prevents the state from collecting income tax. Article IX, Section 11 states: No tax upon inheritances or upon the income of residents or citizens of this state shall be levied by the State of Florida, or under its authority…

Which state has the highest overall taxes?

Here are the 10 states with the highest income tax rates:California (13.30%)Hawaii (11.00%)New Jersey (10.75%)Oregon (9.90%)Minnesota (9.85%)New York (8.82%)Vermont (8.75%)Iowa (8.53%)More items...

Which state has the lowest tax burden?

Alaska offers the lowest total tax burden of any state, costing taxpayers an average of 5.16% of their income. That breaks down to an average of 3.71% of income going to property taxes (the 12th highest in the U.S.), 0% in income taxes, and 1.45% of income going to excise taxes.

Which states don't charge sales tax?

Currently, five states do not charge sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. These states and those that don’t charge income taxes make up most of the top 10 list for lowest tax burden.

What is the tax rate in Delaware?

The average Delawarean pays 1.85% of their income in property taxes, 2.47% to income taxes, and 1.20% to excise taxes.

How much does Alaska lose in taxes?

That comes to around $8,470 per year in state taxes. In the state with the lowest tax burden, Alaska, the average household can expect to lose an average of only 5.16% of their income to taxes. That means the median taxpayer in Alaska only loses around $3,560 per year to state taxes.

How much is sales tax in Tennessee?

Sales and excise taxes: 4.18%. Tennessee imposes no income tax on regular earnings and a small tax on income from investments. Low property taxes help reduce the tax burden as well. The average resident pays 1.92% of their income to property taxes, 0.08% in income taxes, and a higher 4.18% in sales and excise taxes.

How much is sales tax in Oklahoma?

Sales and excise taxes: 3.50%. Oklahoma imposes all three tax types. Still, the total tax burden remains relatively low due to low property tax rates and low income tax rates. Average Oklahomans can expect to pay 1.65% of their income in property taxes, 1.79% in income tax, and 3.50% in sales and excise taxes.

How much does a household lose in taxes in New York?

Census Bureau. In the state with the highest tax burden, New York, an average household can expect to lose 12.28% of their income to taxes according to the WalletHub study. That comes to around $8,470 per year in state taxes.

What is the state's overall tax burden?

A state's overall tax burden, which measures the percent of income paid in state and local taxes, could be a more accurate measure of its affordability than its income tax rate alone. Other factors—including healthcare, cost ...

What is the tax burden in Nevada?

19 This results in an overall state-imposed tax burden of 8.39% of personal income for Nevadans.

How much is sales tax?

In some jurisdictions, sales taxes can be as high as 8.25%. 31 Property taxes are also higher than in most states, with the net result being an overall tax burden of 8.20% of personal income.

How much do South Dakotans pay in taxes?

South Dakotans pay just 7.86% of their personal income in taxes, according to WalletHub, putting the state 11th in terms of the overall tax burden. 16 The state ranks 14th in affordability and 20th on the U.S. News & World Report "Best States to Live In" list. 8 9 .

Which states have no income tax in 2021?

One way to accomplish that might be to live in a state with no income tax. As of 2021, our research has found that seven states—Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming —levy no state income tax. 1 Two others, New Hampshire and Tennessee, don't tax earned wages.

Does Alaska have state income tax?

Alaska has no state income or sales tax. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is just 5.16% of personal income, the lowest of all 50 states. All residents of Alaska receive an annual payment from the Alaska Permanent Fund Corp.

Does New Hampshire tax earned income?

9. New Hampshire. New Hampshire does not tax earned income but does tax dividends and interest. New Hampshire's Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2025. 4 The state has no state sales tax but does levy excise taxes, including taxes on alcohol, ...

Which state has the lowest income tax?

Oregon. It’s important to note that local municipalities in Montana and Alaska can impose a sales tax. Here are the 10 states with the lowest income taxes: Wyoming ( 0.00%) Washington ( 0.00%) Texas ( 0.00%) Tennessee ( 0.00%) South Dakota ( 0.00%)

Is property tax lower in one state or higher?

For example, property tax in one state may be much lower, but personal income tax may be much higher. But we can break down the states with the lowest taxes based on tax type.

How much do you have to earn to pay the highest tax rate?

In some states, most taxpayers in the lower and middle classes pay the top rate; in others, you have to earn more than $1 million to pay the highest rate. 3.

When do you pay taxes on 1040?

One of the biggest tax bills that most people pay is the federal income tax calculated on Internal Revenue Service (IRS) Form 1040 in April of each calendar year. 1 Three other major taxes come from your state or locality: state income taxes, sales taxes, and property taxes.

Do states have tax burdens?

Many states impose similar tax burdens on their residents; if you’re considering living in these states, then taxes are unlikely to be a deciding factor. But at the high and low ends, there are large differences in tax burdens that could have a real impact on your ability to make ends meet in the short run and to save for the long run. While tax rates may not be your first or even fifth consideration, sometimes they’re the tiebreaker in a close decision.

Do you pay state tax on the money you earn?

Since you pay state income tax on the money you earn, sales tax on the money you spend, and property tax on the value of any real estate you might own, you can’t simply add up the average rates in each state and rank them from lowest to highest.

Do you pay higher taxes in one state or another?

Another factor to consider is that while you might pay higher taxes in one state compared with another, you also might be able to earn more in the higher-taxed state. The question is whether you’ll earn enough extra to make up for, or exceed, the cost of the higher tax burden.

Can you add up the average state tax rate?

And since you pay state income tax on the money you earn, sales tax on the money you spend, and property tax on the value of any real estate you might own, you can’t simply add up the average rates in each state and rank them from lowest to highest.

Ask the Experts

For more insight on the differences in state tax policies, we asked a panel of taxation experts to weigh in with their thoughts on the following key questions:

Methodology

In order to determine the states that tax their residents the most and least aggressively, WalletHub compared the 50 states across the following three tax burdens and added the results to obtain the overall tax burden for each state:

Videos for News Use

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the author’s alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners.