What are examples of federal taxes?

- Individual Income Taxes.

- Corporate Income Taxes.

- Payroll Taxes.

- Capital Gains Taxes.

- Sales Taxes.

- Gross Receipts Taxes.

- Value-Added Taxes.

- Excise Taxes.

Which type of tax does the federal government collect?

Why Do State & Federal Governments Collect Taxes?

- Individual Income Tax. The U.S. ...

- Corporate Income Tax. Corporate income tax is imposed on corporations’ taxable income. ...

- Payroll Tax. Payroll taxes refer to taxes paid from the employee’s earnings through payroll deduction, usually by the employer.

- Excise Tax. ...

Why does the federal government collect taxes?

Why Governments Levy Taxes

- National Defense Spending. One of the primary functions of national governments is to provide for the common defense of the nation.

- Funding Government Programs. Governments provide a number of services to their citizens that are paid for with taxes. ...

- Government Debt Payments. ...

- Effects on Individuals. ...

- Effects on Companies. ...

What agency collects the federal taxes?

Internal Revenue Service (IRS) The federal agency that collects income taxes in the United States revenue-The income the nation collects from taxes. 1040EZ. The quick tax form most often used. 1099INT. Report on interest income sent from the bank to both the IRS and the taxpayer for savings account interest. 1099MISC.

Does federal government pay state taxes?

When it comes to federal income taxes, the answer is yes. Uncle Sam taxes unemployment benefits as if they were wages. However, when it comes to state income taxes, it depends on where you live....

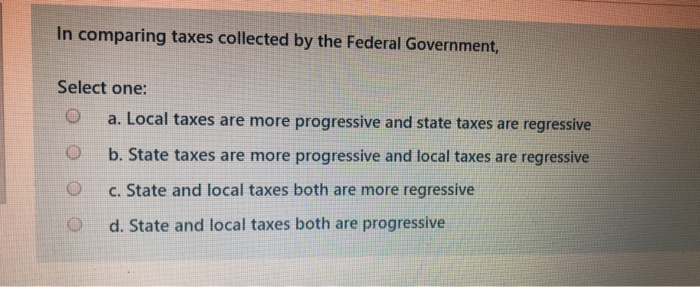

Are taxes only collected by federal government?

Federal income taxes are collected by the federal government, while state income taxes are collected by the individual state(s) in which a taxpayer lives and earns income.

What are 4 things the federal government uses taxes to pay for?

Mandatory. Mandatory spending consists primarily of Social Security, Medicare, and Medicaid. Several welfare programs are smaller items, including food stamps, child tax credits, child nutrition programs, housing assistance, the earned income tax credit, and temporary assistance for needy families.

What does the federal government use taxes for?

The rest includes investing in education, investing in basic infrastructure such as roads, bridges, and airports; maintaining natural resources, farms, and the environment; investing in scientific and medical research; enforcing the nation's laws to promote justice, and other basic duties of the federal government.

Which is not a tax collected by the federal government?

The federal government occupies the majority of the income tax base, receiving 87 percent of all income tax revenue in FY 2006. The federal government does not levy a general sales tax, nor does it tax property.

What are the 5 major sources of revenue for the government?

The 5 major sources of revenue for the Government are Goods and Services Tax (GST), Income tax, corporation tax, non-tax revenues, union excise duties .

What does the federal government spend the most money on?

The official source of government spending data$256.19 Billion. on Veterans Benefits.$29.00 Billion. on Agriculture.$15.11 Billion. on Energy.

What are the two main sources of income for the federal government?

The primary sources of revenue for the U.S. government are individual and corporate taxes, and taxes that are dedicated to funding Social Security, and Medicare. This revenue is used to fund a variety of goods, programs, and services to support the American public and pay interest incurred from borrowing.

What are the different types of taxes?

Taxes on What You EarnIndividual Income Taxes. ... Corporate Income Taxes. ... Payroll Taxes. ... Capital Gains Taxes. ... Sales Taxes. ... Gross Receipts Taxes. ... Value-Added Taxes. ... Excise Taxes.More items...

What are 5 things taxes pay for?

The country's budget. All citizens must pay taxes, and by doing so, contribute their fair share to the health of the government and national economy. ... Defense and security. ... Social Security. ... Major health programs. ... Safety net programs. ... Interest on the national debt. ... Other expenditures.

What are 3 ways the state government uses tax dollars?

How Are My State Taxes Spent?State taxes.Education spending.Health care allocation.

What are 3 facts about taxes?

Everyone who earns a paycheck pays a federal income tax. Forty-three of the 50 states charge their citizens an income tax. The seven states that do not have a state income tax are Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. In 1691, England taxed the number of windows on a house.

What does the federal government spend the most money on?

The official source of government spending data$256.19 Billion. on Veterans Benefits.$29.00 Billion. on Agriculture.$15.11 Billion. on Energy.