Is fees earned an asset or liability?

Liabilities are amounts the business owes to creditors. Owner's equity is the owner's investment or net worth. Revenue consists of amounts earned by a business, such as fees earned for performing services, income from selling merchandise, rent income for the use of property, or inter- est earned for lending money.

Is fees earned a debit or credit?

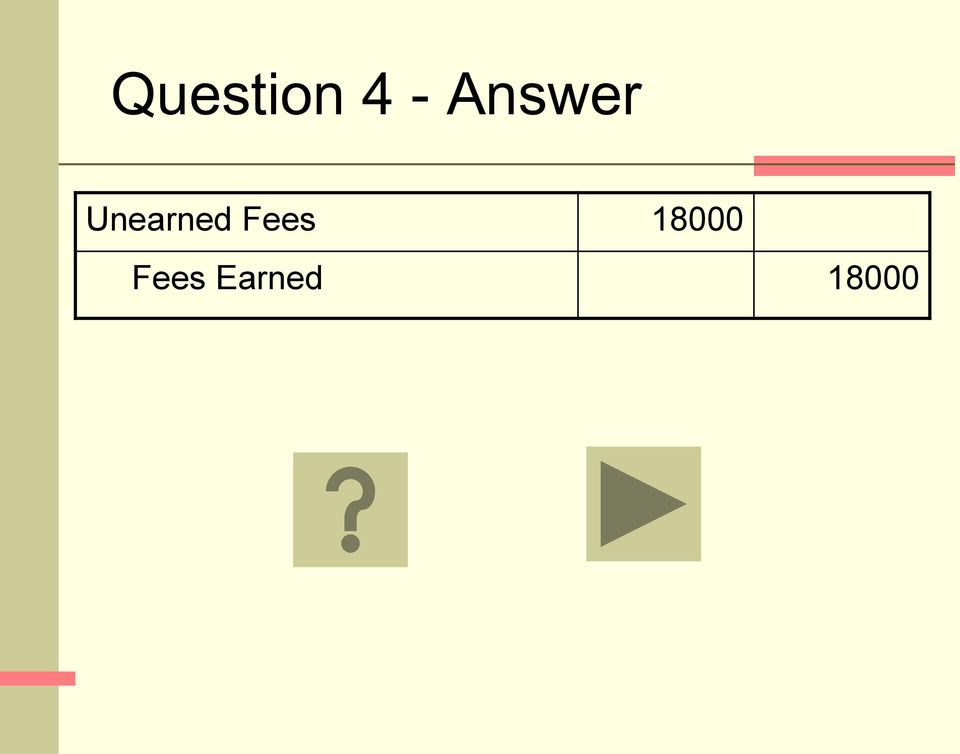

Fees Earned is a CREDIT balance account. Therefore, it increase with a CREDIT and decreases with a DEBIT. Notes Payable is a CREDIT balance account. License Fee Revenue is a CREDIT balance account. Also, are fees earned asset or liabilities? Liabilities are amounts the business owes to creditors.

Does fees earned go on an income statement?

Fees earned. Fees earned is a revenue account that appears in the revenue section at the top of the income statement. The amount reported as fees earned would be the amount of cash received from customers during the reporting period, if the reporting entity is operating under the cash basis of accounting.

Are there any fees to open an account?

There are no fees to open an individual account. Open An Individual Account. Open A Corporate Account. Open A Superannuation/Trust Account. Risk Warning: Our service includes products that are traded on margin and carry a risk of losses exceeding deposited funds, if you are a professional client. The products may not be suitable for all investors.

What is fee earned?

Where is fees earned on an income statement?

How does a business receive income?

Why is income separated into categories?

Do businesses use accrual accounting?

Is fees earned a debit or credit account?

Fees Earned is a CREDIT balance account. Therefore, it increase with a CREDIT and decreases with a DEBIT. Notes Payable is a CREDIT balance account. License Fee Revenue is a CREDIT balance account.

Is fees earned an account receivable?

For a public accounting firm, accounting fees earned remain accounts receivable -- or accounting fees receivable, to be more specific -- until the customer settles the debt.

Is fees earned owner's equity?

Revenue (or sales or fees earned) increases Owners' Equity because the company receives assets for providing its goods or services, increasing what the company is worth to the owners.

Are service fees earned an asset?

No, service revenue is not an asset. Assets are defined as resources with economic value that a business owns. Whereas service revenue is a business' earnings from providing goods and services to its customers. So, service revenue is considered a revenue (or income) account and not an asset.

Is fees earned a expense?

Fees earned is an accounting category that appears in the revenue section of an income statement. It reflects revenue earned through the delivery of services during the time period indicated at the top of the statement.

Do fees earned go on balance sheet?

Income Statements A commission is a revenue or an expense, depending on whether it is incoming or outgoing. Revenues and expenses are not listed on a balance sheet but appear on a company's income statement instead.

Is fees earned a nominal account?

Correct Answer: d. Drawing Account, Fees Earned, Rent Expense. The nominal accounts include income, expenses, capital drawings, and dividends.

What is fee earned normal balance?

credit balanceExplanation: The fees earned account has a normal credit balance and is a revenue account. It is increased with a credit and decreased by a debit.

What belongs in owner's equity?

Owner's equity is the amount that belongs to the business owners as shown on the capital side of the balance sheet, and the examples include common stock, preferred stock, and retained earnings. Accumulated profits, general reserves, other reserves, etc.

Where does service fees earned go on the balance sheet?

It can be found in the current assets section of a company's balance sheet or near the bottom of the liabilities column if service revenues are used to pay for expenses before they're billed.

What are service fees considered in accounting?

An amount imposed on the customer including automatic gratuities added to the bill is considered a service charge.

What all is included in accounts receivable?

Definition: Accounts Receivable (AR) is the proceeds or payment which the company will receive from its customers who have purchased its goods & services on credit. Usually the credit period is short ranging from few days to months or in some cases maybe a year.

What's included in receivables?

Accounts receivable are the funds that customers owe your company for products or services that have been invoiced. The total value of all accounts receivable is listed on the balance sheet as current assets and include invoices that clients owe for items or work performed for them on credit.

How to Calculate Fees Earned in Accounting | Bizfluent

Fees earned is an account that represents the amount of revenue a company generated by providing services during an accounting period. Companies such as law firms and other service firms report fees earned on their income statement as a part of revenues. According to the accrual basis of accounting, a company must ...

fees earned definition and meaning | AccountingCoach

fees earned definition. An income statement account that reports the amount of service revenues earned during the time interval indicated in the heading of the income statement.

Fees earned definition — AccountingTools

Fees earned is a revenue account that appears in the revenue section at the top of the income statement. It contains the fee revenue earned during a period.

How does an expense affect the balance sheet? | AccountingCoach

Definition of Expense An expense is a cost that has been used up, expired, or is directly related to the earning of revenues. Most of a company's expenses fall into the following categories: cost of goods sold sales, general and administrative expenses interest expense How an Expense Affects the ...

What is fee earned?

Fees earned is an accounting category that appears in the revenue section of an income statement. Fees earned is an accounting category that appears in the revenue section of an income statement. It reflects revenue earned through the delivery of services during the time period indicated at the top of the statement.

Where is fees earned on an income statement?

Fees earned is an accounting category that appears in the revenue section of an income statement .

How does a business receive income?

A business can receive income from many different sources. It can sell products, deliver services or generate passive income from investments. Each source of income is recorded in its own revenue account in the company's accounting system, so the appropriate tax rules can be applied to the income when the business prepares its annual income tax ...

Why is income separated into categories?

More importantly, the separation of income into categories allows business owners to properly analyze factors that affect increases and decreases in revenue by income source. Service-oriented businesses do not sell products. Instead, they deliver services for fees that are usually set by contractual agreements.

Do businesses use accrual accounting?

Many businesses that generate income through fees use accrual-based accounting, so they can record fees earned when work is performed for the client, rather than when the bill is paid.

What does "fees earned" mean?

Fees earned signifies the revenue an entity that is generally engaged in rendering services to its clients generates during the reporting period. When an entity deals in both goods and services it charges fees for the part of services rendered and for the goods delivered it charges the predetermined price.

What does debit mean in accounting?

Debit the increase in an asset. To Advance Fees A/c. Credit. Credit the increase in liability. To Fees Earned A/c. Credit. Credit the increase in income. It appears in the income statement and balance sheet as –. In case if only part of fees earned is received in a reporting period:

What is a journal entry for the same?

Journal Entry for the same shall be: Debit the increase in an asset. Credit the increase in income. If an entity follows Accrual System of Accounting only that part of the receipts shall form a part of fees earned which has been accrued in the reporting period.

What happens if you follow the Golden Rule of Accounting?

Even if you follow the golden rule of accounting there will be no change in the answer this is because as per golden rule about a nominal account debit the expenses and losses and credit all incomes and gains.

What is a debit in a reporting period?

In case if only part of fees earned is received in a reporting period: Debit the increase in an asset. Debit the increase in an asset. Credit the increase in income. As it can be seen in all of the cases above that fees earned being an income is credited.

Is fees earned income credited?

As it can be seen in all of the cases above that fees earned being an income is credited.

What is a drawing account?

A drawing account represents the amount of withdrawals made by the owner. Revenues are equal to the difference between cash receipts and cash payments. Expenses result from using up assets or consuming services in the process of generating revenues. Owner's equity will be reduced by the amount in the drawing account.

What does GAAP stand for in accounting?

The initials GAAP stand for. Generally Accepted Accounting Principles. The business entity concept means that. the entity is an individual economic unit for which data are recorded, analyzed, and reported. For accounting purposes, the business entity should be considered separate from its owners if the entity is.

What do accounting information users need?

Accounting information users need reports about the economic activities and condition of businesses.

What is a corporation in accounting?

Terms in this set (101) A corporation is a business that is legally separate and distinct from its owners. True. The role of accounting is to provide many different users with financial information to make economic decisions.

How many transactions affect owner's equity?

There are four transactions that affect owner's equity.

Should the chart of accounts be the same for each business?

The chart of accounts should be the same for each business.

What is fee earned?

Fees earned is an accounting category that appears in the revenue section of an income statement. Fees earned is an accounting category that appears in the revenue section of an income statement. It reflects revenue earned through the delivery of services during the time period indicated at the top of the statement.

Where is fees earned on an income statement?

Fees earned is an accounting category that appears in the revenue section of an income statement .

How does a business receive income?

A business can receive income from many different sources. It can sell products, deliver services or generate passive income from investments. Each source of income is recorded in its own revenue account in the company's accounting system, so the appropriate tax rules can be applied to the income when the business prepares its annual income tax ...

Why is income separated into categories?

More importantly, the separation of income into categories allows business owners to properly analyze factors that affect increases and decreases in revenue by income source. Service-oriented businesses do not sell products. Instead, they deliver services for fees that are usually set by contractual agreements.

Do businesses use accrual accounting?

Many businesses that generate income through fees use accrual-based accounting, so they can record fees earned when work is performed for the client, rather than when the bill is paid.