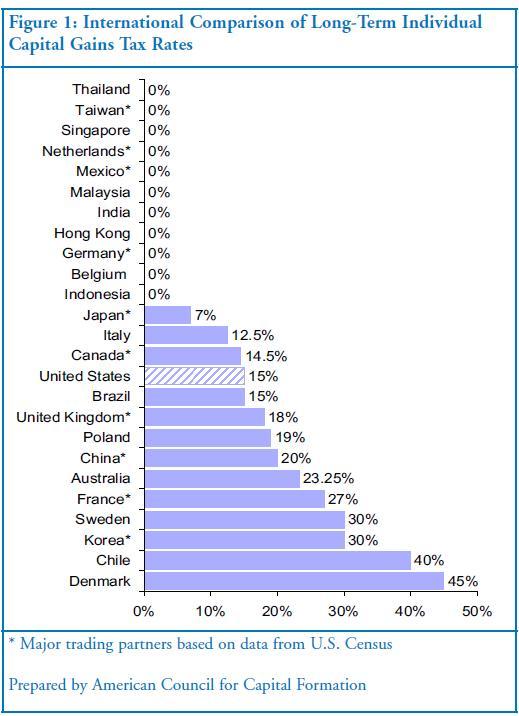

For most of us in 2016 (and until further notice), the tax rate on long-term capital gains is 15%, while those in the top bracket pay 20% and those in the 10% or 15% tax brackets pay 0%. Those earning more than $200,000 for single filers and more than $250,000 for joint filers may also have to pay a 3.8% "Net Investment Income Tax

Form 1095

Form 1095 is a collection of Internal Revenue Service tax forms in the United States which are used to determine whether an individual is required to pay the individual shared responsibility provision. Individuals can also use the health insurance information contained in the form/forms to help them fill out their tax returns. The individual forms are Form 1095-A "A Health Insurance Marketplace Statement"…

How are capital gains taxed on long-term gains?

Long-term capital gains are taxed at a lower rate than you might expect. While short-term gains are taxed at the same percentage rate as your U.S. federal income tax bracket, long-term gains get a haircut of no more than 20%, and usually just 15%. In fact, in some circumstances, you may pay nothing at all in taxes on your long-term gains.

How are NETnet capital gains taxed?

Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gain may be taxed at 0%, if an individual is in the 10% or 15% marginal tax bracket.

What is the capital gains tax rate on collectibles?

Capital gains rates for individual increase to 15% for those individuals in the 25% - 35% marginal tax brackets and increase even further to 20% for those individuals in the 39.6% marginal tax bracket. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate.

What is the difference between short-term and long-term gains tax?

While short-term gains are taxed at the same percentage rate as your U.S. federal income tax bracket, long-term gains get a haircut of no more than 20%, and usually just 15%. In fact, in some circumstances, you may pay nothing at all in taxes on your long-term gains. Let's start with some definitions.

What was the capital gains tax rate in 2017?

Capital gains rates for individual increase to 15% for those individuals in the 25% - 35% marginal tax brackets and increase even further to 20% for those individuals in the 39.6% marginal tax bracket. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate.

When was CGT 18%?

6 April 2011 to 5 April 2016. The following Capital Gains Tax rates apply: 18% and 28% tax rates for individuals (the tax rate you use depends on the total amount of your taxable income, so you need to work this out first)

What was the capital gains tax rate in 2014?

15 percentIndividual Income Tax Returns 2014 Also, the rate for most long-term capital gains was reduced from 20 percent to 15 percent. Further, qualified dividends were taxed at this same 15-percent rate.

What was capital gains in 2015?

Capital gains rates for individual increase to 15% for those individuals in the 25% - 35% marginal tax brackets and increase even further to 20% for those individuals in the 39.6% marginal tax bracket....2015 Capital Gains Rates.Capital AssetHolding PeriodTax RateSection 1202 qualified small business stock.More than five years.28%.4 more rows

How has capital gains tax changed over the years?

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. In 1978, Congress eliminated the minimum tax on excluded gains and increased the exclusion to 60%, reducing the maximum rate to 28%. The 1981 tax rate reductions further reduced capital gains rates to a maximum of 20%.

Do I pay 18% or 28% CGT?

Capital gains tax rates for 2022-23 and 2021-22. If you make a gain after selling a property, you'll pay 18% capital gains tax (CGT) as a basic-rate taxpayer, or 28% if you pay a higher rate of tax. Gains from selling other assets are charged at 10% for basic-rate taxpayers, and 20% for higher-rate taxpayers.

What was the capital gains tax in 2013?

Fortunately, the IRS just released preliminary data on tax year 2013, the year the top tax rate on capital gains and dividends went from 15 percent to 23.8 percent. The fiscal cliff deal raised the top rate to 20 percent and the Obamacare investment surtax added 3.8 percentage points.

What was the capital gains rate in 2000?

21.19Federal Capital Gains Tax Collections, Historical Data (1954-2018)Tax YearTotal Realized Capital Gains ($ millions)Maximum Tax Rate (%)2000644,28521.192001349,44121.172002268,61521.162003323,30621.05/16.0562 more rows

What are the tax rates for 2021?

How We Make MoneyTax rateSingleMarried filing jointly or qualifying widow10%$0 to $9,950$0 to $19,90012%$9,951 to $40,525$19,901 to $81,05022%$40,526 to $86,375$81,051 to $172,75024%$86,376 to $164,925$172,751 to $329,8504 more rows•Apr 7, 2022

What was capital gains tax in 2019?

Capital gains rates for individual increase to 15% for those individuals with income of $39,376 and more (($78,751 for married filing joint, $39,376 for married filing separate, and $52,751 for head of household) and increase even further to 20% for those individuals with income over $434,550 ($488,850 for married ...

What was the highest capital gains tax rate in history?

A Historical Look at Capital Gains RatesYEARINDIVIDUALSCORPORATIONS1997 (after May 6)–2003 (May 5)20.0%35.0%2003 (after May 5)–201215.0%35.0%2013–201720.0%35.0%2018-202220.0%21.0%22 more rows

What will capital gains tax be in 2026?

Assume the Federal capital gains tax rate in 2026 becomes 28%. On December 31, 2026, the taxpayer will receive a $100,000 (10%) step-up in basis, so the 28% capital gains tax rate will be applied to $900,000 of the deferred gain. This will result in $252,000 of tax due by April 15, 2027.

When did capital gains go to 15 %?

A Historical Look at Capital Gains RatesYEARINDIVIDUALSCORPORATIONS1997 (after May 6)–2003 (May 5)20.0%35.0%2003 (after May 5)–201215.0%35.0%2013–201720.0%35.0%2018-202220.0%21.0%22 more rows

What was the capital gains tax rate in 2010?

Of course, the tax cuts might get extended for all Americans, including high-income taxpayers. That's what happened in 2010. In that case, the increase in the capital gains rate will be smaller. Because of the health reform tax, the top capital gains tax rate will increase from 15% to 18.8%.

What was the old capital gains tax?

The capital gains exclusion increased from 50 percent to 60 percent in 1979. As a result of the exclusion and rate cut, capital gains tax rates fell from a maximum of 39.875 percent including an add-on minimum tax, which was widely applicable in 1978, to 20 percent in 1982.

What was the capital gains tax in 2001?

Beginning in 2001, capital gains in the 15 percent bracket on assets held at least five years will be taxed at 8 percent. Capital gains in the 28 percent and higher brackets on assets purchased in 2001 or later and held for at least five years will be taxed at 18 percent.

What is the tax rate on capital gains?

For short-term gains, the capital gains tax rate is your ordinary income tax rate, which could be in the 33% to 40% range if you're a high earner. (For most of us, it will be 25% or maybe 28%.) If paying even 15% on your long-term capital gains seems unpleasant, buck up -- because you don't always have to pay it.

When was the capital gains tax article updated?

This article was updated on January 6, 2017. It was originally published on December 14, 2015. Click here to learn more about long-term capital gains tax rates in 2017. Long-term capital gains are taxed at a lower rate than you might expect.

How to avoid paying capital gains tax?

Another way to avoid paying long-term capital gains taxes is to offset your gains with losses. If you have $6,000 in long-term capital gains and $2,000 in capital losses, you can subtract that $2,000 and only be taxed on $4,000, saving $500 if you're in the 25% tax bracket. If you have more losses than gains, you can wipe out all your gains ...

How much tax do you pay on long term gains?

While short-term gains are taxed at the same percentage rate as your U.S. federal income tax bracket, long-term gains get a haircut of no more than 20%, and usually just 15%. In fact, in some circumstances, you may pay nothing at all in taxes on your long-term gains. Image source: Flickr user Global X.

What is the maximum tax rate for long term gains?

While short-term gains are taxed at the same percentage rate as your U.S. federal income tax bracket, long-term gains face a maximum rate of 20%, with most people paying just 15% and some paying nothing.

What does 20% gain mean?

Having gains means you've been investing effectively, ideally accumulating critical retirement assets or achieving other financial goals. If you're among those who face a 20% tax rate, that's likely because you're already on solid financial ground, with a hefty income.

What was the tax rate in the 1950s?

Overall, that's rather low, historically speaking. Between the 1950s and the late 1970s, for example, the rates rose from about 20% to nearly 40%, and for a short period in the late 1980s, they were the same as the taxpayer's income tax rates, which could top 30%.

What is capital gain?

Capital Gains. A capital gain, in its simplest form, is what you get when you sell an investment for more than you paid for it. If you sell it for less than you paid, you get a capital loss. When I buy one share of an index fund for $20 and sell it for $30, I have a $10 capital gain, which I have to pay tax on.

How much capital loss can offset gains?

The rule of thumb on capital losses is – capital losses first offset gains of the same type, then gains of the other type, and lastly, your income (up to $3,000 ). You can use any leftover capital losses to offset gains (or income) in future tax years.

What does marginal tax mean?

Your marginal tax rate decides your investment tax rate. Anytime you can drop into a lower tax bracket, you not only pay a lower tax overall, you might significantly lower your dividend and capital gains tax rates. This is why dividends, and to a lesser extent long-term capital gains, are part of an income investment strategy ...

Why do you use the same concept to harvest gains today?

You can use the same concept to harvest gains today to avoid higher taxes in the future. For example: anyone in the 15% tax bracket, who knows they’ll have a higher income next year, would pay a long-term capital gains rate of 0%, which is better than anything they’d pay in the future.

Does adding to 401(k) lower your tax rate?

Something as simple as adding to your 401k lowers your taxable income, can drop you into a lower tax bracket, and lower your investment tax rates too. A little planning and foresight can have a big impact when you’re tax averse. Below are the dividend and capital gains tax rates for each income tax bracket. The rates you pay are based on your ...

Do capital gains grow tax free?

Final note: Essentially, capital gains grow tax-free until you sell. Keep that in mind before selling anything, especially shares you might want to buy back later. The price you sell at could be the last time you see that price again. Be aware of the 30-day wash sale rule before using any tax avoidance tip.

Is interest income taxed?

Interest income is the easiest to deal with since almost all interest is taxed as ordinary income. Interest you earn from checking, savings, and money market accounts, CDs, bonds, and bond funds are all taxed at your marginal tax rate. There are exceptions.