The penalty for not having health insurance in 2016 is 2.5 % of your income / or / $695.00 per adult. Whichever amount is greater. Per child penalty, that’s each child in your family with no coverage is up to $347.50. A maximum penalty of $2,085 is set, but for the 2017 tax year then beyond, 2.5 percent will remain the penalty.

How much is the penalty for no health insurance?

For 2015, the penalty for no health insurance is $325 per person or 2% of your annual household income – whichever is higher. For 2016, the fee is $695 or 2.5% of your income — whichever is higher. For many people, that’s more than the yearly cost of health plans they can find on HealthCare.gov.

What happens if you don’t have health insurance?

When you file your federal income taxes, if you’re uninsured for more than 3 months despite having access to affordable coverage, you’ll be required to pay whichever amount is higher. Learn how to estimate the fee you’ll have to pay if you don’t have health insurance based on your situation. The fee is increasing for 2016.

Do I have to pay a tax penalty for health insurance?

A person will generally not have to pay a tax penalty if he or she has health insurance through their employer, purchases insurance directly from an insurance carrier, enrolls in a student health plan or buys coverage from the Federal or State Health Insurance Marketplace.

How is the fee for not having health insurance calculated?

Here are 5 quick facts about the fee for not having health coverage when you can afford it: The fee is calculated 1 of 2 ways, depending on your situation. It’s either a percentage of your annual household income or a set amount for each person in your household who doesn’t have health insurance.

What is the penalty for not having health insurance in the US?

“Since 2019, there is no federal penalty for not having health insurance,” says Brad Cummins, the founder and CEO of Insurance Geek. “However, certain states and jurisdictions have enacted their health insurance mandates.” The states with mandates and penalties in effect are: California. Massachusetts.

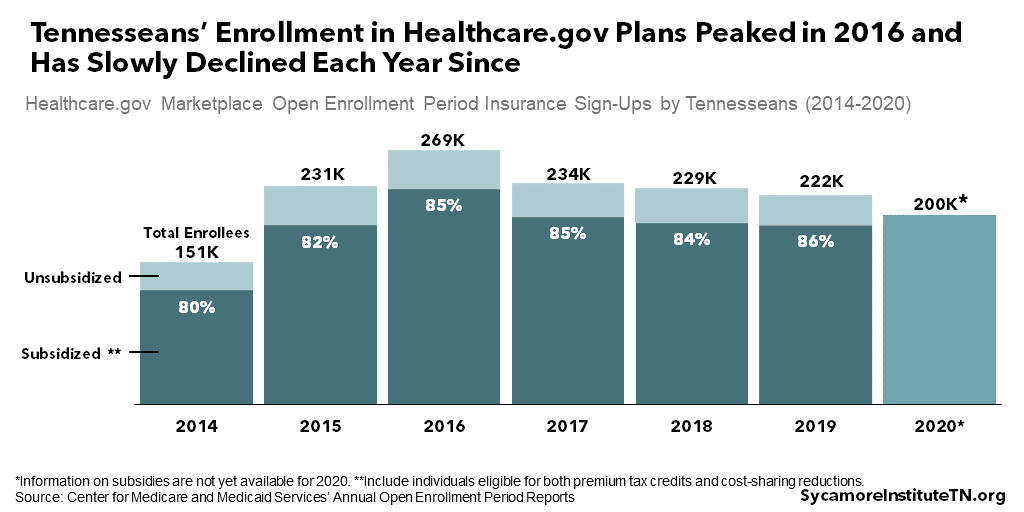

How many Americans didn't have health insurance in 2016?

28 millionThe number of uninsured nonelderly Americans fell from 48 million in 2010 to 28 million in 2016, before rising to 30 million in the first half of 2020. 30 million U.S. residents lacked health insurance in the first half of 2020, according to newly released estimates from the National Health Interview Survey (NHIS).

How much was the Obamacare penalty?

Calculating Obamacare tax penalties In 2018, the penalty for going uncovered was $295 per adult or 2.5% of your household income, whichever was higher.

What is the IRS penalty for not having health insurance in 2022?

There is no penalty for not having ACA mandated coverage in 2022 unless you live in a state like New Jersey or Massachusetts where it is mandated by the state.

How many people were uninsured in 2016?

26.7 millionIn spite of the recent increases, the number of uninsured individuals remains well below levels prior to enactment of the ACA. The number of uninsured nonelderly individuals dropped from more than 46.5 million in 2010 to fewer than 26.7 million in 2016 before climbing to 28.9 million individuals in 2019.

Why are some US citizens without health insurance?

uninsurance has been attributed to a number of factors, including rising health care costs, the economic downturn, an erosion of employer-based insurance, and public program cutbacks. Developing effective strategies for reducing uninsurance requires understanding why people lack insurance coverage.

Is there an IRS penalty for no health insurance?

BY Anna Porretta Updated on January 21, 2022 As of 2019, the Obamacare individual mandate – which requires you to have health insurance or pay a tax penalty –no longer applies at the federal level.

What happens if you don't file taxes for 3 years?

If you don't file within three years of the return's due date, the IRS will keep your refund money forever. It's possible that the IRS could think you owe taxes for the year, especially if you are claiming many deductions. The IRS will receive your W-2 or 1099 from your employer(s).

Can I get my Obamacare penalty back?

The amount you'll have to pay back depends on your family income. If your income is below 400% of the federal poverty level, there is a cap on the amount you'll have to pay back. However, at higher income levels, you'll have to pay back the entire excess credit, which could be a lot.

Is it mandatory to have health insurance in 2021?

Yes, medical insurance policy for employees is compulsory in India post the nation-wide COVID-19 lockdown in 2020.

Is health insurance mandatory in the US?

Key Takeaways. Health insurance coverage is no longer mandatory at the federal level, as of Jan. 1, 2019. Some states still require you to have health insurance coverage to avoid a tax penalty.

Is the Affordable Care Act still in effect for 2022?

According to a new ASPE report released today, an estimated 3.4 million Americans currently insured in the individual market would lose coverage and become uninsured if the ARP's premium tax credit provisions are not extended beyond 2022.

Is there a penalty for not having health insurance 2022 in Texas?

Bottom Line. There are no federal mandates for health insurance in 2022 or tax penalties in most states.

Is there a penalty for not having health insurance in 2022 in California?

For 2022, Californians without coverage for the entire year will likely pay a minimum penalty of $800 per adult and $400 per dependent child under the age of 18. A family of four who goes the whole year with no coverage will owe a minimum of $2,400 come tax time.

Is Obamacare still in effect for 2022?

New subsidies, lower premiums “All of that is still in effect for 2022, so people who are shopping now will tend to see larger subsidies than they saw during last fall's open enrollment period.” The new law expands subsidies to ensure that no family spends more than 8.5 percent of their income on a benchmark plan.

Is the Obamacare mandate still in effect?

Yes, the Obamacare is still the law of the land, however there is no more penalty for not having health insurance.

How much is the penalty for 2016?

For 2016, it will be $2,085. Each parent receives the full tax penalty. The penalty for a child under the age of 18 is half this amount; consequently, a family of four with two children will hit the maximum flat dollar penalty, although what they actually pay will depend on the percentage of income calculation.

What is the maximum tax penalty for 2016?

For this family, the maximum flat dollar tax penalty in 2016 will be $1,737.50.

What is the penalty for child tax in 2015?

For the 2015 tax year, the flat dollar penalty is $325 for each taxpayer and $162.5 for each child under the age of 18. The percentage of income penalty is 2% of the individual’s applicable household income.

What is the filing threshold for married couples?

The filing threshold for a married couple under age 65 filing jointly is $20,600. As stated above, the tax penalty is the greater of a flat dollar amount or a percentage of a person or family’s applicable income.

What is the Affordable Care Act?

A key provision of the Affordable Care Act is the Individual Mandate, which requires individuals to have insurance or pay a health insurance tax penalty, which the IRS calls the Shared Responsibility Payment. A person will generally not have to pay a tax penalty if he or she has health insurance through their employer, ...

What is the threshold for filing taxes for 2015?

They are also exempt from the Shared Responsibility Payment. The filing threshold for an individual under age 65 in 2015 is $10,300. This consists of the standard deduction of $6,300 and the personal exemption of $4,000.

Do employers have to notify the IRS of health insurance?

The IRS requires employers to notify it if an employee has health insurance. The health insurance carrier must also do so if an individual or family has a health insurance policy with them. If a person purchases insurance through the Federal or State Insurance Marketplace, the Marketplace will report the information.

What happens if you don't have health insurance in 2015?

If you did not have health insurance for three months or more in 2015, and you did not qualify for an exemption, the penalty when you file taxes will be the greater of:

Do you owe taxes if you are uninsured?

Note that if you had coverage for part of the year, the penalty will be pro-rated. Also, if you were without health insurance for two months or less, then more than likely you will not owe a tax penalty for being uninsured. Click on the following link and search for Types of Coverage Exemptions to see a list of exemptions that could protect you from having to pay a penalty. For more information and how this applies to your specific situation, we advise that you consult with your tax advisor or CPA.