Is the Sarbanes-Oxley Act of 2002 effective?

Nearly two decades after its passage, SOX is recognized around the globe for its effectiveness in promoting trusted financial reporting and high levels of audit quality. SOX reshaped corporate oversight and governance in the US.

What caused Sarbanes-Oxley Act of 2002?

The Sarbanes-Oxley Act of 2002 was passed by Congress in response to widespread corporate fraud and failures. The act implemented new rules for corporations, such as setting new auditor standards to reduce conflicts of interest and transferring responsibility for the complete and accurate handling of financial reports.

What is Sarbanes-Oxley Act and why was it passed?

The Sarbanes-Oxley Act of 2002 is a federal law that established sweeping auditing and financial regulations for public companies. Lawmakers created the legislation to help protect shareholders, employees and the public from accounting errors and fraudulent financial practices.

What triggers SOX compliance?

SOX Compliance Requirements SOX requires that all financial reports include an Internal Controls Report. This report should show that the company's financial data is accurate (a 5% variance is permitted) and that appropriate and adequate controls are in place to ensure that the data is secure.

What events led to the creation of the Sarbanes-Oxley Act in 2002 quizlet?

The Public Company Accounting Oversight Board (PCAOB) was established by the Sarbanes-Oxley Act of 2002 in the wake of multiple accounting scandals and alleged audit failures, including those of Enron and WorldCom.

Who created the Sarbanes-Oxley Act of 2002?

The Sarbanes-Oxley Act was passed by Congress to curb widespread fraudulence in corporate financial reports, scandals that rocked the early 2000s. The Act now holds CEOs responsible for their company's financial statements. Whistleblowing employees are given protection. More stringent auditing standards are followed.

What is the maximum sentence for obstructing justice?

The Sarbanes-Oxley Act imposes harsher punishment for obstructing justice, securities fraud, mail fraud, and wire fraud. The maximum sentence term for securities fraud was increased to 25 years, while the maximum prison time for the obstruction of justice was increased to 20 years.

Why was the Sarbanes Oxley Act passed?

The Sarbanes-Oxley Act of 2002 was passed by Congress in response to widespread corporate fraud and failures.

How often do audit partners rotate?

Finally, the Sarbanes-Oxley Act established the Public Company Accounting Oversight Board, which promulgates standards for public accountants, limits their conflicts of interest, and requires lead audit partner rotation every five years for the same public company.

What is audit committee?

The audit committee, a subset of the board of directors consisting of non-management members, gained new responsibilities, such as approving numerous audit and non-audit services , selecting and overseeing external auditors, and handling complaints regarding the management's accounting practices. The Sarbanes-Oxley Act changed management's ...

What happens if a director is convicted of a securities violation?

If the director or officer is convicted of a securities law violation, they can be prohibited from serving in the same role at the public company. The Sarbanes-Oxley Act significantly strengthened the disclosure requirement.

How does the Sarbanes-Oxley Act affect corporate governance?

The Sarbanes-Oxley Act requires public companies to strengthen audit committees, perform internal controls tests, make directors and officers personally liable for the accuracy of financial statements, and strengthen disclosure. The Sarbanes-Oxley Act also establishes stricter ...

What is the costliest part of the Sarbanes-Oxley Act?

The costliest part of the Sarbanes-Oxley Act is Section 404, which requires public companies to perform extensive internal control tests and include an internal control report with their annual audits.

What are the sections of the Sarbanes Oxley Act?

Three of its key provisions are commonly referred to by their section numbers: Section 302, Section 404, and Section 802. 1 .

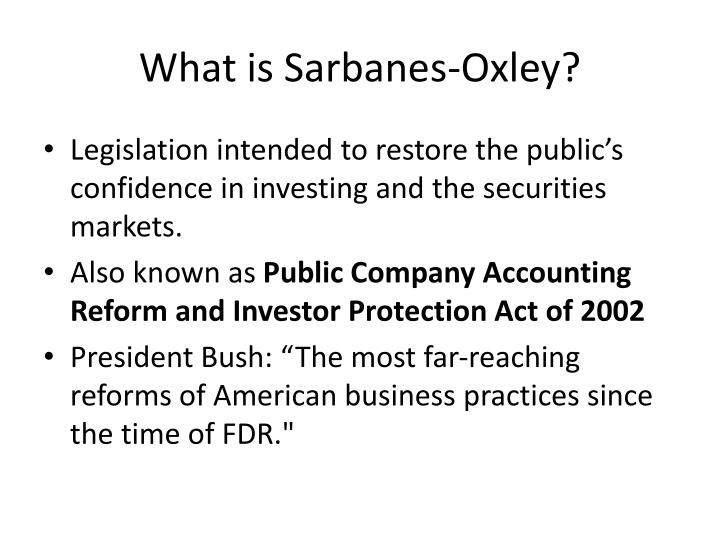

What Is the Sarbanes-Oxley (SOX) Act of 2002?

The Sarbanes-Oxley Act of 2002 is a law the U.S. Congress passed on July 30 of that year to help protect investors from fraudulent financial reporting by corporations. 1 Also known as the SOX Act of 2002 and the Corporate Responsibility Act of 2002, it mandated strict reforms to existing securities regulations and imposed tough new penalties on lawbreakers.

Why is Section 404 bad?

Some critics of the law have complained that the requirements in Section 404 can have a negative impact on publicly traded companies because it's often expensive to establish and maintain the necessary internal controls. Section 802 of the SOX Act of 2002 contains the three rules that affect recordkeeping.

What is the SOX Act?

Section 802 of the SOX Act of 2002 contains the three rules that affect recordkeeping. The first deals with destruction and falsification of records. The second strictly defines the retention period for storing records. The third rule outlines the specific business records that companies need to store, which includes electronic communications.

What is the purpose of Section 404?

Section 404 of the SOX Act of 2002 requires that management and auditors establish internal controls and reporting methods to ensure the adequacy of those controls. Some critics of the law have complained that the requirements in Section 404 can have a negative impact on publicly traded companies because it's often expensive to establish and maintain the necessary internal controls.

What is the third rule of the SOX Act?

The third rule outlines the specific business records that companies need to store, which includes electronic communications. Besides the financial side of a business, such as audits, accuracy, and controls, the SOX Act of 2002 also outlines requirements for information technology (IT) departments regarding electronic records.

Can a corporate officer go to jail for certifying false financial statements?

Because of the Sarbanes-Oxley Act of 2002, corporate officers who knowingly certify false financial statements can go to prison. Section 302 of the SOX Act of 2002 mandates that senior corporate officers personally certify in writing that the company's financial statements "comply with SEC disclosure requirements and fairly present in all material ...

How does SOA affect the board of directors?

The impact on the Boards of Directors has been profound. The results of SOA seem, unintendedly, to be weakening the quantity and quality of willing board members at a time when to do so is extremely counter-productive. Most boards are not equipped to take on the compliance burden imposed. To comply with the new requirements, boards must have resources that were not previously needed to discharge the duties of protecting stockholder interests. Whistle blowers must be afforded protection from retribution, and that burden also falls on the Board of Directors to assure that it actually happens. Under SOA, it is much harder to recruit board members because of the increased scrutiny and accountability. Board members who have the ability to really help a company are, by and large, not motivated by the money involved. They want to contribute to the success of a company, and are not necessarily willing to get involved in the new personal liability and federal oversight issues now associated with board membership. (4)

What is the role of internal audit?

They are different and separate from the external auditors but have a role in supporting them. (3) The expansion of the internal audit responsibility has added staff to most corporations and cost to the shareholders EPS, as a result.

How does the Sarbanes Oxley Act affect businesses?

Their overhead costs have been increased, not to support the needs of business activities, but to satisfy the requirements of a Federal law. Additionally, an unexpected consequence of the law has been to adversely affect the willingness of highly qualified current and potential members of Boards of Directors to continue their involvement on the Boards.

When is the deadline for certifying financial controls?

According to PricewaterhouseCoopers, the third-largest accounting firm in the United States, 80 percent of the 700 client companies which it surveyed were either struggling to meet or would probably miss the November 15th deadline for certifying financial controls.

Does SOA require external auditors to report quarterly?

The law requires CEO/ CFO certification of quarterly and annual reports, as well as placing new regulations on external auditors. SOA also changed the responsibility and liability exposure of the Boards of Directors of publicly traded companies. The external auditor now must report to the Audit Committee of the Board of Directors. The Audit Committee is now required to have a “Financial Expert” and it is subject to the compliance procedures established for the Audit Committee. Additionally, all audit and non-audit services by the external auditor must be pre-approved by the Audit Committee. (2)

Is SOA counterproductive?

The results of SOA seem, unintendedly, to be weakening the quantity and quality of willing board members at a time when to do so is extremely counter-productive. Most boards are not equipped to take on the compliance burden imposed.

What is the most important piece of legislation that has ever happened in the financial securities arena?

“Sarbanes-Oxley is, by far, one of the most important pieces of legislation that has ever happened in the financial securities arena,” declares White. “There has been such great significance in what SOX has done for auditor independence and the integrity of financial statements.”

How many words are in SOX section 404?

The most infamous edict within SOX lies in section 404, according to Reese Blair ’98, audit partner at Deloitte. Section 404 is a mere 180 words long, but still manages to be split into three parts, each of which sent shockwaves through the business world.

What is SOX 2021?

The Sarbanes-Oxley Act of 2002, or SOX as it is known in the financial world, is a federal law that established sweeping auditing and financial regulations for public companies. Lawmakers created the legislation to help protect shareholders, employees and the public from accounting errors and fraudulent financial practices, ...

Who is Tom Coyne?

New York Times bestselling author and Saint Joseph's Professor of English, Tom Coyne, released his newest book, “A Course Called America,” last month. Coyne golfed 301 rounds at 295 courses in all 50 states in the span of eight months.

What is the purpose of the auditing profession?

To strengthen and restore confidence in the auditing profession; To improve executive responsibility and the “tone at the top” at companies; To improve disclosure and financial reporting; and. To improve the performance of gatekeepers, such as accounting firms, research analysts and attorneys.

What was the Sarbanes Oxley Act?

Congress had acted swiftly in the face of this breakdown by enacting the Sarbanes-Oxley Act , which called for the most significant reforms affecting our capital markets since the Securities Exchange Act of 1934. Since its enactment in the summer of 2002, the Act has effected dramatic change across corporate America and beyond, ...

What is fair funds?

The Fair Funds provision authorizes the Commission to take civil penalties collected in enforcement cases and add them to disgorgement funds for the benefit of victims of securities law violations. Before the Act, by law, all civil penalties were paid into the U.S. Treasury.

Why is internal control important?

An effective system of internal control over financial reporting is very important in producing reliable financial statements and other financial information used by investors. The establishment and maintenance of internal control over financial reporting has been required of public companies since the enactment of the Foreign Corrupt Practices Act of 1977. The Sarbanes-Oxley Act has brought a new focus to internal controls and encouraged companies to devote adequate resources and attention to the maintenance of those controls. The requirements of Section 404 may have the greatest long-term potential to improve financial reporting by public companies by helping to identify potential weaknesses and deficiencies in internal controls. In addition, although no system of internal controls can detect every instance of fraud, good internal controls may help companies deter fraudulent financial or accounting practices or detect them earlier and perhaps minimize their adverse effects.

What is public reporting?

Public reporting on companies’ internal control over financial reporting by both management and auditors.

What is the purpose of the tone at the top?

The tone set by top management of a company contributes greatly to the integrity of a company’s financial reporting process. The provisions of the Act that the Commission has implemented addressing this theme include:

Is the Sarbanes Oxley Act a positive effect?

In addition to addressing auditors and the accounting profession, as discussed above, the Sarbanes-Oxley Act and our new rules have required better focus by other gatekeepers in our capital markets on their proper roles, and I believe we are seeing a positive effect as a result. The effective operation of gatekeepers in the marketplace is fundamental to preserving the integrity of our markets. Unfortunately, revelations from the recent corporate and accounting scandals revealed that these parties did not always fulfill their role. The actions the Commission took in response to the Act in this area included:

What is the difference between SOX and HIPAA?

They both require internal security controls, reporting systems, and annual audits, yet they are different. SOX defines which business records a company must store and for how long (data retention policy). HIPAA defines who can view stored data as well as when the data must be destroyed (data privacy policy).

What is the Sarbanes Oxley Act?

The Sarbanes-Oxley Act mandates a wide-sweeping accounting framework for all public companies doing business in the US. What companies need to comply with Sarbanes-Oxley? All publicly-traded companies in the United States, including all wholly-owned subsidiaries, and all publicly-traded non-US companies doing in business in the US are effected.

How many pages are there in the Sarbanes-Oxley Act?

The Sarbanes-Oxley Act itself is organized into eleven sections that span over 60 pages, but sections 302, 401, 404, 409, 802, and 906 are the most important in terms of compliance. Section 404 seems to cause the most difficulties for compliance. More specifically, Sarbanes-Oxley established new accountability standards for corporate boards ...

Does HIPAA require audit trail?

HIPAA must provide an audit trail of who has accessed what data and when, then prove the data was properly disposed of when the retention period is up. For more information on HIPAA regulations, see HIPAA 101.

What is the Sarbanes Oxley Act?

Widely deemed the most important piece of security legislation since formation of the Securities and Exchange Commission in 1934, the landmark Sarbanes-Oxley Act of 2002 was born into a climate still reeling from the burst of the high-tech bubble and fraud scandals at Enron and WorldCom. Its intent was to improve corporate governance ...

How much was the Dodd-Frank Act deferred?

The cost of this requirement, he says, was felt most acutely by smaller companies, although it was ultimately deferred for companies with market caps of less than $75 million and made permanent in the Dodd-Frank Act.

Did SOX increase investor confidence?

A 2005 survey by the Financial Executives Research Foundation found that 83 percent of large company CFOs agreed that SOX had increased investor confidence, with 33 percent agreeing that it had reduced fraud. And yet—the financial crisis of 2008 still happened.

Does SOX reduce risk?

The research does not support the fear that SOX would reduce levels of risk-taking and investment in research and growth. Another concern that the act would shrink the number of IPOs has not been borne out either; in fact, the pricing of IPOs post-SOX became less uncertain. The cost of being a publicly traded company did cause some firms to go private, but research shows these were primarily organizations that were smaller, less liquid, and more fraud-prone.

Who is Julia Hanna?

Julia Hanna is an associate editor of the HBS Alumni Bulletin.

Is internal control testing cost effective?

"Markets have been able to use the information to assess companies more effectively, managers have improved internal processes, and the internal control testing has become more cost-effective over time," according to Srinivasan.

Is Forbes opinion their own?

Opinions expressed by Forbes Contributors are their own.

What Is The Sarbanes-Oxley (SOX) Act of 2002?

Understanding The Sarbanes-Oxley (SOX) Act

- The rules and enforcement policies outlined in the Sarbanes-Oxley Act of 2002 amended or supplemented existing laws dealing with security regulation, including the Securities Exchange Act of 1934 and other laws enforced by the Securities and Exchange Commission (SEC).5The new law set out reforms and additions in four principal areas: 1. Corporate responsibility 2. Increase…

Major Provisions of The Sarbanes-Oxley (SOX) Act of 2002

- The Sarbanes-Oxley Act of 2002 is a complex and lengthy piece of legislation. Three of its key provisions are commonly referred to by their section numbers: Section 302, Section 404, and Section 802.1 Section 302 of the SOX Act of 2002 mandates that senior corporate officers personally certify in writing that the company's financial statementscomply with SEC disclosure …

Section 404 and Certification

Requirements

Internal Controls

Whistleblower

Effect on The U.S. Economy

Why Congress Passed Sarbanes-Oxley

- The Securities Act of 1933 regulated securities until 2002. It required companies to publish a prospectus about any publicly-traded stocks it issued. The corporation and its investment bank were legally responsible for telling the truth. That included audited financial statements.2526 Although the corporations were legally responsible, the CEOs wer...

Bottom Line