How many states ratified the 16th Amendment?

There were 48 states in the Union in 1913 — the year when the Sixteenth Amendment was finally ratified — which meant that the Amendment required ratification by the legislatures of 36 states to become effective. See also How To Attach A Phone Charm To A Samsung Galaxy S7? Where was the 16th Amendment ratified?

What did the 16 and 17 Amendment do?

The 16th Amendment allows for the collection on income taxes for all citizens by the federal government. The 17th Amendment states that the Senators must be elected by majority vote.

What is the 16th Amendment in simple terms?

Key Takeaways

- The 16th Amendment to the U.S. ...

- The change was generally supported by States in the South and West.

- Prior to the 16th Amendment, the constitution required direct taxes to be proportionate to each state's population. ...

- The first national income tax was enacted in 1894 but was struck down by the Supreme Court in the case of Pollock v. ...

When was the 16th Amendment became law?

Passed by Congress on July 2, 1909, and ratified February 3, 1913, the 16th amendment established Congress's right to impose a Federal income tax. Far-reaching in its social as well as its economic impact, the income tax amendment became part of the Constitution by a curious series of events culminating in a bit of political maneuvering that ...

Why was 16th amendment passed?

The ratification of the Sixteenth Amendment was the direct consequence of the Court's 1895 decision in Pollock v. Farmers' Loan & Trust Co. holding unconstitutional Congress's attempt of the previous year to tax incomes uniformly throughout the United States.

What was the 16th Amendment and what did it do?

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

How many states passed the 16th Amendment?

There were 48 states in the Union in 1913 — the year when the Sixteenth Amendment was finally ratified — which meant that the Amendment required ratification by the legislatures of 36 states to become effective.

Is the 16th amendment unconstitutional?

The Law: The constitutionality of the Sixteenth Amendment has invariably been upheld when challenged. Numerous courts have both implicitly and explicitly recognized that the Sixteenth Amendment authorizes a non-apportioned direct income tax on United States citizens and that the federal tax laws are valid as applied.

What rights does the 16th amendment Protect?

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

Who created the 16th Amendment?

An income tax amendment to the Constitution was first proposed by Senator Norris Brown of Nebraska. He submitted two proposals, Senate Resolutions Nos. 25 and 39. The amendment proposal finally accepted was Senate Joint Resolution No.

What is the only amendment to be repealed?

Although the Constitution has been formally amended 27 times, the Twenty-First Amendment (ratified in 1933) is the only one that repeals a previous amendment, namely, the Eighteenth Amendment (ratified in 1919), which prohibited “the manufacture, sale, or transportation of intoxicating liquors.” In addition, it is the ...

What is the 16th Amendment in simple terms?

What Is the 16th Amendment? The 16th Amendment to the U.S. Constitution was ratified in 1913 and allows Congress to levy a tax on income from any source without apportioning it among the states and without regard to the census.

What is the 16th amendment in simple terms?

What Is the 16th Amendment? The 16th Amendment to the U.S. Constitution was ratified in 1913 and allows Congress to levy a tax on income from any source without apportioning it among the states and without regard to the census.

What is the 16th amendment quizlet?

The 16th amendment is an important amendment that allows the federal (United States) government to levy (collect) an income tax from all Americans.

Where was the 16th amendment ratified?

On this date, the states of Delaware, Wyoming, and New Mexico approved the Sixteenth Amendment to the U.S. Constitution, ratifying it into law. The amendment empowered Congress to impose an income tax on individuals and corporations.

What amendments were passed to impose income tax?

On this date, the states of Delaware, Wyoming, and New Mexico approved the 16th Amendment to the U.S. Constitution, ratifying it into law. The amendment empowered Congress to impose an income tax on individuals and corporations. During the House debates of S.J. Res. 40, Members had debated the merits of collecting income taxes. Representatives Sereno Payne of New York and Samuel McCall of Massachusetts argued that income taxes should only be levied to raise revenue during times of war. Congressman Ebenezer Hill of Connecticut also worried that the tax could be unfairly levied on constituents in poorer states: “We are ready to vote for an income tax to meet any emergencies which may arise…and to stand by the Government in time of war; but do not ask us…without consultation with our people at home, to put this burden on them in addition to one already severe because of local expenditures… ” Representative William Sulzer of New York, a supporter of the tax, said, “I have been the constant advocate of an income tax along constitutional lines… I reiterate that through it only…will it ever be possible for the Government to be able to make idle wealth pay its just share of the ever-increasing burdens of taxation.” After a brisk debate on July 12, 1909, lasting for five hours, the bill passed 318–14, with 1 voting “present,” and 55 not voting. The 16th Amendment was the first change to the Constitution since the passage of the 15th Amendment, which guaranteed African-American male suffrage, 43 years earlier, in 1870.

Which amendment guaranteed African American male suffrage?

The 16th Amendment was the first change to the Constitution since the passage of the 15th Amendment, which guaranteed African-American male suffrage, 43 years earlier, in 1870.

When was the 16th amendment ratified?

The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in Pollock . Prior to the early 20th century, most federal revenue came from tariffs rather than taxes, although Congress had often imposed excise taxes on various goods.

Why did the South support the 16th amendment?

Supporters of the income tax believed that it would be a much better method of gathering revenue than tariffs, which were the primary source of revenue at the time. From well before 1894, Democrats, Progressives, Populists and other left-oriented parties argued that tariffs disproportionately affected the poor, interfered with prices, were unpredictable, and were an intrinsically limited source of revenue. The South and the West tended to support income taxes because their residents were generally less prosperous, more agricultural and more sensitive to fluctuations in commodity prices. A sharp rise in the cost of living between 1897 and 1913 greatly increased support for the idea of income taxes, including in the urban Northeast. A growing number of Republicans also began supporting the idea, notably Theodore Roosevelt and the "Insurgent" Republicans (who would go on to form the Progressive Party). These Republicans were driven mainly by a fear of the increasingly large and sophisticated military forces of Japan, Britain and the European powers, their own imperial ambitions, and the perceived need to defend American merchant ships. Moreover, these progressive Republicans were convinced that central governments could play a positive role in national economies. A bigger government and a bigger military, they argued, required a correspondingly larger and steadier source of revenue to support it.

What was the first federal income tax?

Until 1913, customs duties (tariffs) and excise taxes were the primary sources of federal revenue. During the War of 1812, Secretary of the Treasury Alexander J. Dallas made the first public proposal for an income tax, but it was never implemented. The Congress did introduce an income tax to fund the Civil War through the Revenue Act of 1861. It levied a flat tax of three percent on annual income above $800. This act was replaced the following year with the Revenue Act of 1862, which levied a graduated tax of three to five percent on income above $600 and specified a termination of income taxation in 1866. The Civil War income taxes, which expired in 1872, proved to be both highly lucrative and drawing mostly from the more industrialized states, with New York, Pennsylvania, and Massachusetts generating about sixty percent of the total revenue that was collected. During the two decades following the expiration of the Civil War income tax, the Greenback movement, the Labor Reform Party, the Populist Party, the Democratic Party and many others called for a graduated income tax.

How many states ratified the Constitution?

Ratification (by the requisite 36 states) was completed on February 3, 1913, with the ratification by Delaware. The amendment was subsequently ratified by the following states, bringing the total number of ratifying states to forty-two of the forty-eight then existing:

Why did Congress not try to implement another income tax?

For several years after Pollock, Congress did not attempt to implement another income tax, largely due to concerns that the Supreme Court would strike down any attempt to levy an income tax. In 1909, during the debate over the Payne–Aldrich Tariff Act, Congress proposed the Sixteenth Amendment to the states.

Which amendment allows Congress to levy income tax without apportioning it among the states on the basis of?

The Sixteenth Amendment ( Amendment XVI) to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers' Loan & Trust Co.

When did the federal income tax start?

On June 16, 1909 , President William Howard Taft, in an address to the Sixty-first Congress, proposed a two percent federal income tax on corporations by way of an excise tax and a constitutional amendment to allow the previously enacted income tax.

When was the 16th amendment signed into law?

Other Significant Dates: February 25, 1913 (16th Amendment certified as part of the U.S. Constitution), October 3, 1913 (Revenue Act of 1913, imposing the federal income tax is signed into law)

What is the 16th amendment?

The 16th Amendment: Establishing Federal Income Tax. Robert Longley is a U.S. government and history expert with over 30 years of experience in municipal government and urban planning. The 16th Amendment to the United States Constitution gives Congress the power to collect a federal income tax from all individuals and businesses without sharing ...

Why was the 16th amendment enacted?

The 16th Amendment did not “create” income tax in the United States. In order to fund the Civil War, the Revenue Act of 1862 imposed a 3% tax on the incomes of citizens earning more than $600 per year, and 5% on those making over $10,000. After the law was allowed to expire in 1872, ...

Which amendment gives Congress the power to collect federal income tax?

The 16th Amendment to the United States Constitution gives Congress the power to collect a federal income tax from all individuals and businesses without sharing or “apportioning” it among the states or basing the collection on the U.S. Census.

Which amendment overturned the Pollack decision?

The 16th Amendment overturned the effect of the Court’s Pollack decision. In 1908, the Democratic Party included a proposal for a graduated income tax in its 1908 presidential election campaign platform. Viewing it as a tax mainly on the wealthy, the majority of Americans supported enactment of an income tax.

When was the tax on real estate reestablished?

While Congress briefly re-established a limited income tax in 1894 , the Supreme Court, in the case of Pollock v. Farmers’ Loan & Trust Co., ruled it unconstitutional in 1895. The 1894 law had imposed a tax on personal income from real estate investments and personal property such as stocks and bonds. In its decision, the Court ruled that the tax was a form of “direct taxation” and was not apportioned among the states on the basis of population as required by Article I, Section 9, Clause 4 of the Constitution. The 16th Amendment overturned the effect of the Court’s Pollack decision.

How long is the tax code?

Little Known Fact: The first U.S. tax code, as enacted in 1913, was about 400 pages long. Today, the law regulating the assessment and collection of federal income tax spans over 70,000 pages. Ratified in 1913, the 16th Amendment and its resulting nationwide tax on income helped the federal government meet the growing demand for public services ...

When was the 16th amendment passed?

The House of Representatives passed the 16th Amendment on July 12, 1909 , after a five-hour debate, according to the U.S. House of Representatives, with a vote of 318 in favor and 14 against. The Senate approved the resolution with a vote of 77-0.

When did the 16th amendment come into force?

The amendment came into force when the states of Delaware, Wyoming, and New Mexico ratified it on Feb. 3, 1913 . 2.

What Is the 16th Amendment?

Constitution was ratified in 1913 and allows Congress to levy a tax on income from any source without apportioning it among the states and without regard to the census.

Which amendment allows Congress to levy a tax on income from any source without apportioning it among?

The 16th Amendment to the U.S. Constitution was ratified in 1913 and allows Congress to levy a tax on income from any source without apportioning it among the states and without regard to the census.

What page is Amendments to the Constitution?

U.S. Senate, Committee on the Judiciary, Subcommittee on the Constitution. " Amendments to the Constitution: A Brief Legislative History ," Page 41. Accessed Jan. 25, 2020.

What was the Constitution before the 16th amendment?

Prior to the 16th Amendment, the constitution required direct taxes to be proportionate to each state's population. Most Federal revenues came from tariffs and excise taxes.

Which amendment removed the direct tax requirement?

11. The 16th Amendment removed that requirement.

What was the U.S. government like before the income tax?

Before the advent of the income tax, the U.S. government relied exclusively on tariffs and user fees to finance operations.

When did expansive government come back?

Soon, ideas of expansive government, which were routinely scoffed at by intellectuals, politicians, and the American population at large throughout the first half of the 19th century, made a fierce comeback during the latter half of the 19th century.

Why were taxes temporary in the 19th century?

Upon further inspection, there is reason to believe that taxes in the 19th century tended to be temporary in nature given the American people’s ideological propensities. Most people were still skeptical of government overreach, especially during the Civil War – a time where habeas corpus was suspended, and the first income tax was implemented. Shell-shocked from a horrific experience that laid waste to countless urban centers and left hundreds of thousands of Americans dead, the American populace wanted a return to normalcy. And that meant scaling back government as much as possible.

What states did the income tax crowd work in?

Some of these states included: Pennsylvania: 1840 to 1871. Maryland: 1841 to 1850.

Why did Abraham Lincoln sign the Revenue Act of 1861?

Abraham Lincoln signed the Revenue Act of 1861 as a means to finance the expensive war effort. This was followed up with other measures like the Revenue Act of 1862 and Revenue Act of 1864, which created the nation’s first progressive income tax system and the precursor to the Internal Revenue Service (IRS).

How did the American Revolution start?

The American Revolution was sparked in part by unjust taxation. After all, the colonists in Boston rebelled against Britain for imposing “taxation without representation,” and summarily tossed English tea into the harbor in protest in 1773.

When did progressive income tax start?

Enter the idea of a progressive income tax – based on the British Tax Act of 1798 (which should have been our first warning). Fortunately for the time, the War of 1812 came to a close in 1815, and the discussion of enacting an income tax was tabled for the next few decades.

Why was the 16th Amendment passed?

It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers’ Loan & Trust Co.

What does the 16th Amendment do?

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Why the 16th Amendment is unconstitutional?

Referring to the explicit prohibition against direct taxation in Article I, the court argued that the income tax would excessively enhance federal power in relation to state power.

What would happen if the 16th Amendment was repealed?

This history demonstrates that if the Sixteenth Amendment were repealed today, Congress would still have the power to tax wages and salaries, although not property income .

How did the 16th Amendment lead to the 18th Amendment?

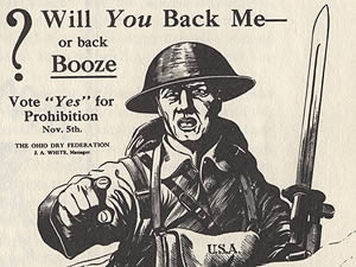

The 16th Amendment of 1913, allowing Congress to levy a federal income tax, helped pave the way for Prohibition, but World War I helped stir up the pot.

Is the 16th Amendment a law?

There were 48 states in the Union in 1913 — the year when the Sixteenth Amendment was finally ratified — which meant that the Amendment required ratification by the legislatures of 36 states to become effective. According to Congressional analysis, a total of 42 states had ratified the amendment as of 1992.

What was the 16th amendment?

Strange as it may seem, the Sixteenth Amendment (which gave the American people the affliction of confiscatory income taxes) was never supposed to have passed. It was introduced by the Republicans as part of a political scheme to trick the Democrats, but it backfired. Background.

When was the tax bill passed?

The tax bill which the Sixteenth Amendment authorized was introduced as House Resolution 3321 on October 3, 1913. It turned out to be somewhat of a legislative potpourri for tax attorneys, accountants and the federal courts.

Why did people not file taxes in the beginning?

In the beginning, hardly anyone had to file a tax return because the tax did not apply to the vast majority of America’s work-a-day citizens. For example, in 1939, 26 years after the Sixteenth Amendment was adopted, only 5% of the population, counting both taxpayers and their dependents, was required to file returns. Today, more than 80% of the population is under the income tax.

What happened to the Republicans when the Bailey bill was about to pass?

At the very moment when their Bailey bill was about to pass, the Republicans were coming out for an amendment to the Constitution which would probably be defeated by the states.

When was the withholding tax system created?

Withholding Taxes. The collection process was greatly facilitated in 1943 by a device created by FDR to pay the costs of WWII. It was called “withholding from wages and salaries”. In other words, the tax was collected at the payroll window before it was even due to be paid by the taxpayer.

When did Taft send the message to Congress?

Thus, the Democrats were off guard when President Taft unexpectedly sent a message to Congress on June 16th, 1909 , recommending the passage of a constitutional amendment to legalize federal income tax legislation.

Who was the conservative senator who opposed income tax?

In April 1909, Senator Joseph W. Bailey, a conservative Democrat from Texas who was also opposed to income taxes, decided to further embarrass the Republicans by forcing them to openly oppose an income tax bill similar to those which had been introduced in the past.

Overview

Adoption

On June 16, 1909, President William Howard Taft, in an address to the Sixty-first Congress, proposed a two percent federal income tax on corporations by way of an excise tax and a constitutional amendment to allow the previously enacted income tax.

Upon the privilege of doing business as an artificial entity and of freedom from a general partnership liability enjoyed by those who own the stock.

Text

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Other Constitutional provisions regarding taxes

Article I, Section 2, Clause 3:

Representatives and direct taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers ...

Article I, Section 8, Clause 1:

The Congress shall have Power to lay and collect Taxes, Duties, Imposts and Excises, to pay the …

Income taxes before the Pollock case

Until 1913, customs duties (tariffs) and excise taxes were the primary sources of federal revenue. During the War of 1812, Secretary of the Treasury Alexander J. Dallas made the first public proposal for an income tax, but it was never implemented. The Congress did introduce an income tax to fund the Civil War through the Revenue Act of 1861. It levied a flat tax of three percent on annual income above $800. This act was replaced the following year with the Revenue Act of 1862, …

The Pollock case

In 1894, an amendment was attached to the Wilson–Gorman Tariff Act that attempted to impose a federal tax of two percent on incomes over $4,000 (equal to $125,000 in 2021). The federal income tax was strongly favored in the South, and it was moderately supported in the eastern North Central states, but it was strongly opposed in the Far West and the Northeastern States (with the exception of New Jersey). The tax was derided as "un-Democratic, inquisitorial, and wro…

Pollock overruled

The Sixteenth Amendment removed the precedent set by the Pollock decision.

Professor Sheldon D. Pollack at the University of Delaware wrote:

On February 25, 1913, in the closing days of the Taft administration, Secretary of State Philander C. Knox, a former Republican senator from Pennsylvania and attorney general under McKinley and Roosevelt, certified that the amendment had been properly ratified by the requisite number of st…

Case law

The federal courts' interpretations of the Sixteenth Amendment have changed considerably over time and there have been many disputes about the applicability of the amendment.

In Brushaber v. Union Pacific Railroad, 240 U.S. 1 (1916), the Supreme Court ruled that (1) the Sixteenth Amendment removes the Pollock requirement that certain income taxes (such as taxes on income "derived from real property" that were the subject of the Pollock decision), be apporti…