What is the IRS tax benefit?

What is a 1098-T?

How to contact student loan servicer?

About this website

Where do I get my 1098 mortgage interest statement?

You can get your mortgage info by going to your lender's website. Other documents, like your monthly mortgage bills and your Closing Disclosure (or HUD-1), will also have some of this info. Your lender should send you a 1098 by January 31. If you haven't received one by then, contact them for the info you need.

When should I get my 1098 mortgage form?

Your mortgage lender sends your Form 1098 to you, generally by the end of January of the filing year.

How do I claim 1098 on my taxes?

Deducting mortgage interest using Form 1098 You might be able to deduct the Form 1098 amounts if they meet the guidelines for that amount. Put Box 1, deductible mortgage interest, and Box 6, points, into your Schedule A (Form 1040), Line 8a.

Can you claim mortgage interest without a 1098?

You can still enter the mortgage interest in TurboTax, even if you didn't receive a 1098, if you itemize deductions and qualify for the mortgage interest deduction.

What happens if I don't get a 1098?

Even if you didn't receive a 1098-E from your servicer, you can download your 1098-E from your loan servicer's website. If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY 1-800-730-8913).

Can I get my 1098 form online?

You can download your 1098-E from your servicer's website. If you're not sure who your loan servicer is, you can log in to StudentAid.gov to get your servicer's contact information. You can also call the Federal Student Aid Information Center at 1-800-433-3243. Note: You can't download your 1098-E from StudentAid.gov.

Do you get money back from 1098?

Will I get a refund with my 1098-T, if I paid my college expenses with federal student loans? Yes, tuition paid with loan money (but not scholarships) counts toward the tuition credits. This is because loans eventually have to be paid back, so it really is YOUR money that paid the tuition.

How much do you get back from 1098?

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. The Lifetime Learning Credit offers up to $2,000 for qualified education expenses paid for all eligible students per return.

Does a 1098 count as income?

If the amount in Box 5 (your scholarships) is GREATER THAN the amount in Box 1 (or Box 2, whichever is filled in on your 1098-T), then you cannot use any expenses to reduce your tax bill. You must report the excess as taxable income on your federal return.

Do I need Form 1098 to file taxes?

Specific Instructions File a separate Form 1098 for each mortgage. The $600 threshold applies separately to each mortgage, so you are not required to file Form 1098 for a mortgage on which you have received less than $600 in interest, even if an individual paid you over $600 in total on multiple mortgages.

When should I expect mortgage tax documents?

When to Expect Your Mortgage Interest Statement. It's common to receive multiple 1098 forms from any mortgage company or loan servicer that you paid mortgage interest, points, or taxes in a tax year. While each company has their own mail delivery method, all are required to be sent out by January 31.

How long does it take to get a 1098?

Schools are supposed to give a Form 1098-T to students by Jan. 31 of the calendar year following the tax year in which the expenses were paid. Here's what to know about this form and what to do with it when you file your federal income tax return.

How long does it take to get a 1099 for mortgage?

two yearsConventional Mortgages for 1099 Earners Most traditional mortgage programs require two years of 1099 income and tax returns for self-employed borrowers; however, there may be some instances where a 1099 borrower may be able to get approved with only one year of 1099 income documented.

Will 1098 mortgage affect tax return?

The amount shown as interest paid on Form 1098 is the amount you use to determine how much to deduct on your tax return. Where do I take this deduction? Fill out Schedule A, Itemized Deductions, to take a deduction for mortgage interest.

2023 Form 1098-E

CORRECTED (if checked) Form . 1098-E. 2023. Student Loan Interest Statement. Copy B. For Borrower. Department of the Treasury - Internal Revenue Service. This is important tax

1098-E Tax Form | U.S. Department of Education

1098-E, Student Loan Interest Statement. If you made federal student loan payments in 2020, you may be eligible to deduct a portion of the interest you paid on your 2020 federal tax return.. 1098-E, Student Loan Interest Statement

2022 Instructions for Forms 1098-E and 1098-T

Page 2 of 4. Fileid: … s/i1098e&t/2022/a/xml/cycle02/source. 16:25 - 9-Sep-2021. The type and rule above prints on all proofs including departmental reproduction ...

What is a 1098-E Form? – Student Loan Interest Statement

Question: What is a 1098-E Form? Answer: If you are paying off your student loans, you’ll probably need to use Form 1098-E while completing your taxes. If you made student loan payments, you may be eligible to deduct a portion of the interest paid on your federal tax return. The student loan interest paid is reported to you by your loan servicers using Form 1098-E, Student Loan Interest ...

Welcome | Federal Student Aid

Welcome | Federal Student Aid

What is a 1098-E: Student Loan Interest - TurboTax

If you're currently paying off a student loan, you may get Form 1098-E in the mail from each of your lenders. Your lenders have to report how much interest you pay annually. Student loan interest can be deductible on federal tax returns, but receiving a 1098-E doesn't always mean you're eligible to take the deduction.

What is the IRS tax benefit?

The IRS provides tax benefits for education . They can be used on tuition or loan interest or to maximize your college savings. A list of Federal Student Aid servicers for the Direct Loan Program and for FFEL Program Loans purchased by the U.S. Department of Education is available on our Loan Servicer page.

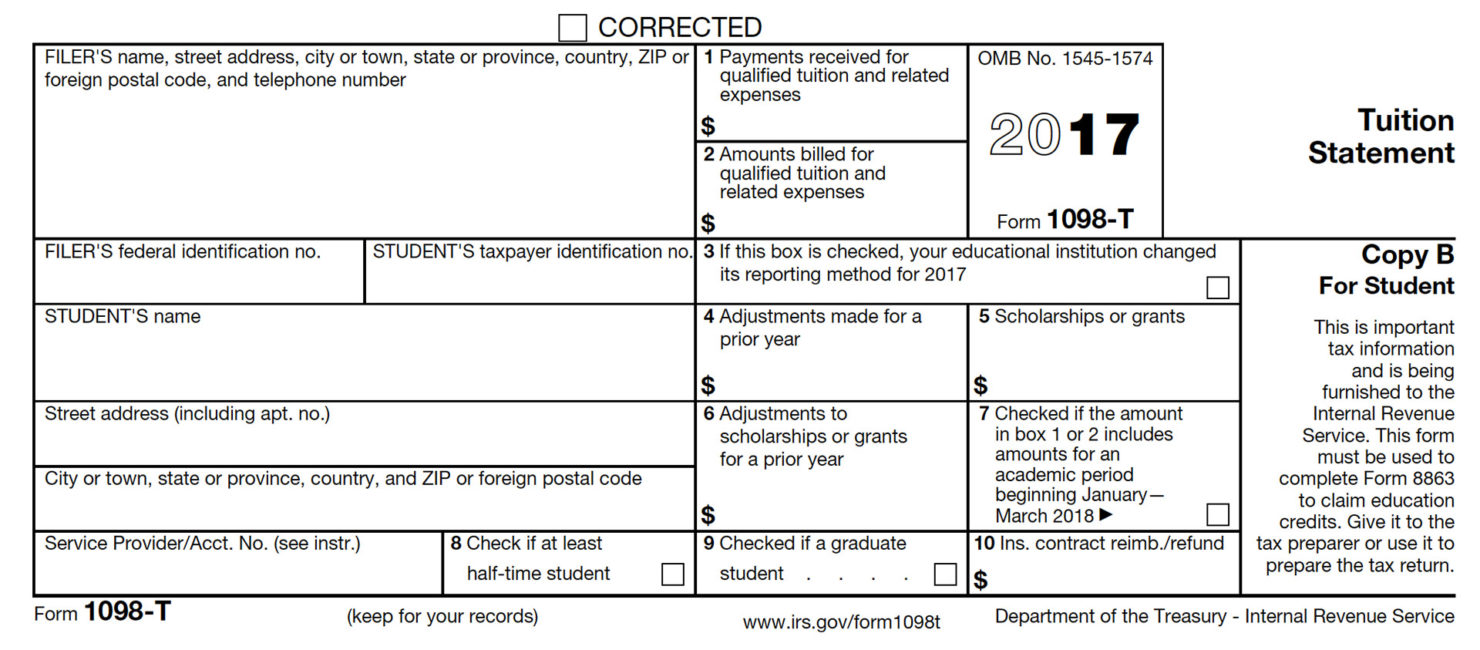

What is a 1098-T?

The 1098-T, Tuition Statementform reports tuition expenses you paid for college tuition that might entitle you to an adjustment to income or a tax credit. Information on the 1098-T is available from the IRS at Form 1098-T, Tuition Statement. Posted in: Student Loan ProgramsStudents.

How to contact student loan servicer?

If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY 1-800-730-8913) . Note: If you had multiple loan servicers in 2020, you will receive a separate 1098-E from each servicer. Additional Information.

Who files 1098-T?

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

Who files the tuition reimbursement form?

Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

What is a 1098 mortgage statement?

Mortgage lenders issue a 1098 Mortgage Interest Statement to let you know exactly how much you paid in interest, points, or private mortgage insurance for the year. The form does not always look like a tax form, but will say Form 1098 somewhere on it. Your 1098 may be included in your January statement from the lender.

What to do if you don't have a mortgage loan form?

If you do not have your form, request a duplicate before filing your tax return. See if the co-borrower received a form. Even if two names are on a mortgage, lenders only mail the form to the first borrower listed.

How to view IRS tax forms?

View electronic copies of your tax documents by going to your lender's website. Most lenders allow borrowers to access and print tax forms free of charge by logging into their accounts. IRS required tax documents are available on or before Jan. 31.

What to do if you never received a 1098?

If you never received your 1098, the lender may issue you one for free. Verify the lender has your correct mailing address if you are not living in the home. Ask the private party who is financing the home to issue you a 1098 form.

Can I file a 1098 without a 1098?

To proceed without a 1098 form, you must have the private party's full name, address, and tax identification number. You can calculate the amount of interest you paid during the year using an amortization schedule. Jeannine Mancini, a Florida native, has been writing business and personal finance articles since 2003.

Who is Jeannine Mancini?

Jeannine Mancini, a Florida native, has been writing business and personal finance articles since 2003. Her articles have been published in the Florida Today and Orlando Sentinel. She earned a Bachelor of Science in Interdisciplinary Studies from the University of Central Florida. Related Articles.

What is the IRS tax benefit?

The IRS provides tax benefits for education . They can be used on tuition or loan interest or to maximize your college savings. A list of Federal Student Aid servicers for the Direct Loan Program and for FFEL Program Loans purchased by the U.S. Department of Education is available on our Loan Servicer page.

What is a 1098-T?

The 1098-T, Tuition Statementform reports tuition expenses you paid for college tuition that might entitle you to an adjustment to income or a tax credit. Information on the 1098-T is available from the IRS at Form 1098-T, Tuition Statement. Posted in: Student Loan ProgramsStudents.

How to contact student loan servicer?

If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY 1-800-730-8913) . Note: If you had multiple loan servicers in 2020, you will receive a separate 1098-E from each servicer. Additional Information.