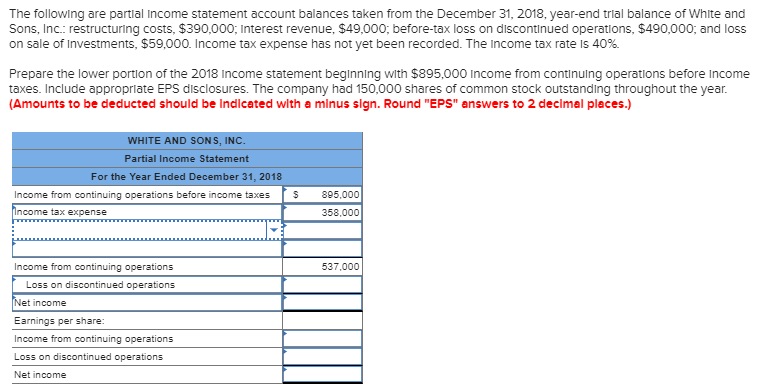

How to record discontinued operations?

Record this amount next to the "gains or losses from discontinued operations, including disposal" line. Calculate the tax-adjusted gain or loss from discontinued operations. If you have a profit from discontinued operations, your taxes payable will increase; if you show a loss, your total taxes payable will decrease.

What is meant by discontinued operations?

Discontinued operations is a term used in accounting to refer to the parts of a company’s business that have been terminated and are no longer operational. Often, business lines will be classified as discontinued operations if they are no longer operational, have been removed from the company, or have been, or will be sold in the near future.

What is the definition of discontinued operations?

Discontinued operations is an accounting term that refers to parts of a company’s core business or product line that have been divested or shut down. Discontinued operations are reported on the income statement separately from continuing operations.

Is income from operations the same thing as operating income?

Operating income–also called income from operations–takes a company's gross income, which is equivalent to total revenue minus COGS, and subtracts all operating expenses. A business's operating expenses are costs incurred from normal operating activities and include items such as office supplies and utilities.

How is discontinued operations reported on the income statement?

Discontinued operations are reported in a separate line item in the income statement and are not part of the ongoing operational activities. Income generated from these operations is therefore not included in operating profit and EBIT.

How do you record discontinued operations?

How to Account for Discontinued Operations on an Income StatementCreate a separate section titled "Discontinued operations" on the income statement. ... Calculate the profit or loss from the discontinued operation, which is equal to revenues minus expenses.More items...•

How are discontinued operations reported in the balance sheet?

“In the period(s) that a discontinued operation is classified as held for sale and for all prior periods presented, the assets and liabilities of the discontinued operation shall be presented separately in the asset and liability sections, respectively, of the statement of financial position.”

What is an income from discontinued operations?

Income from operations that used to be a part of the business but are not any longer. This could be due to the sale of a portion of a business, shutting down a division, or something else.

When an entity discontinued an operation should the transaction be reported?

Discontinued operations shall be shown as a line item after gross income with the related tax being shown as part of income tax expense.

Is Discontinued operations included in EPS?

This number is the company's earnings per share from the day-to-day operations of its business during the most recent complete fiscal year. It does not include discontinued operations, extraordinary items, and accounting changes.

Are Discontinued operations reported net of tax on income statement?

On the income statement, the results of discontinued operations are reported separately (net of income tax) from continuing operations in both the current and comparative periods.

When a discontinued operation is sold before the end of the reporting period the income or loss from operations and the?

The tax rate is 40%. What is the total income tax effect of the discontinued operations? When a discontinued operation is sold before the end of the reporting period, the or from operations and the gain or loss on the disposal of assets is included in the reported income.

Is Discontinued operations an extraordinary item?

Note: extraordinary items is a catch-all for irregular or non-recurring events, such as accidents or natural disasters. Discontinued operations refers to a unit or segment of a business that has been sold, abandoned or otherwise discontinued.

How do you account for loss from discontinued operations?

Discontinued operations refers to the shutdown of a division within a company. For accounting purposes, all the gains and losses for that division must be reported separately on the company's income statement. This is so that these amounts can be distinguished from those of continuing operations.

Is a loss on discontinued operations included in net income?

Income (or Loss) from Discontinued Operations is a line item on an income statement of a company below Income from Continuing Operations and before Net Income. It represents the after tax gain or loss on sale of a segment of business and the after tax effect of the operations of the discontinued segment for the period.

How the disposal of a component of the business should be disclosed in the income statement?

If a business concern disposes of its component, then the outcome must be disclosed in the income statement. Disposal may result in either gain or loss. If such a component belongs to business operations, the outcome can be reported in the continuing operation section.

Which accounting standard relates to discontinuing operations?

A reportable business segment or geographical segment as defined in Accounting Standard (AS) 17, Segment Reporting, would normally satisfy criterion (b) of the definition of a discontinuing operation (paragraph 3), that is, it would represent a separate major line of business or geographical area of operations.

What are examples of discontinued operations?

Examples of discontinued operations could include:Closure of unprofitable division.Redundancy due to merger.Sale of a product line.Discontinuation of outdated services.

How are discontinued operations that occur at midyear initially reported?

Discontinued operation items that occur at midyear are included in net income and disclosed in the notes to interim financial statements.

Which business components are reported in discontinued operations?

Parts of a company's business or product line will typically be classified as a discontinued operation if they are no longer operational, have been removed from the company, or have been, or will be sold (referred to as being “held for sale”).

What Are Discontinued Operations?

In financial accounting, discontinued operations refer to parts of a company’s core business or product line that have been divested or shut down, and which are reported separately from continuing operations on the income statement .

What happens when a company is discontinued?

When operations are discontinued, a company has multiple line items to report on its financial statements. Although the business component is being shut down, it still could generate a gain or loss in the current accounting period.

Why are discontinued operations segregated from continuing operations?

On a company's income statement, discontinued operations are segregated from continuing operations so that investors may see clearly what money is inflowing from current operations versus those which have ceased.

What happens when you shut down a divested business?

First, the transaction to shut down the divested business will result in eliminating the operations and cash flows of the divested business from company operations.

Why do companies make adjustments to their financial statements?

Adjustments may occur because of benefit plan obligations, contingent liabilities, or contingent contract terms.

What is the first requirement for a business to be disposed of?

First, the asset or business component must be disposed of or reported as being held for sale.

Is loss from discontinued operations reported?

The total gain or loss from the discontinued operations is thus reported, followed by the relevant income taxes. This tax is often a future tax benefit because discontinued operations often incur losses. To determine the company's total net income (NI), the gain or loss from discontinued operations is aggregated with that of continuing operations.

Why are discontinued operations listed separately from continuing operations?

In accounting, discontinued operations are listed separately from continuing operations on financial statements so that external users of the statements do not become confused and inappropriately evaluate the profitability of the company.

What is discontinued operations?

What are Discontinued Operations? Discontinued operations is a term used in accounting to refer to parts of a company’s business that have been terminated and are no longer operational. In accounting, discontinued operations are listed separately on financial statements.

What does it mean when a company discontinues operations?

However, it is common that discontinued operations are no longer generating any revenue and are operating at a loss, hence its discontinuation. It means that some money may be realized from taxes, but at the same time, the losses relating to the discontinued operation need to be weighed against all the other product lines that are still in operation and are generating revenue.

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are. from continuing operations.

Do discontinued operations have to be reported on taxes?

The issue of taxation with regards to discontinued operations can be rather complex. Discontinued operations often still make a gain or a loss in the accounting period in which it decided to cease operations. As such, the gains or losses need to be reported for tax purposes.

Is discontinued operation allowed to continue with parent company?

Secondly, the discontinued operation is not allowed to have significant continued involvement with the parent company, which is significantly different from IFRS. IFRS Standards IFRS standards are International Financial Reporting Standards (IFRS) that consist of a set of accounting rules that determine how transactions ...

Can a company report discontinued operations?

Similarly to IFRS, a company is allowed to report discontinued operations under GAAP when two criteria are met. The criteria for GAAP require that firstly, the transaction used to shut down the divested business will eliminate the operations and cash flow of the business from the overall operations of the company.

How to calculate profit from discontinued operations?

Calculate the profit or loss from the discontinued operation, which is equal to revenues minus expenses. Revenues include product and service sales, minus sales returns and allowances. Expenses include operating expenses, such as marketing and administration, and non-operating expenses, such as interest, taxes and unusual items. Show these calculations in the notes accompanying the income statement.

How to determine loss from discontinued operation?

Determine the gain or loss from the disposition of the discontinued operation only if the disposal occurred within the accounting period. The gain or loss is the difference between the selling price and the fair-market value of the discontinued operation, minus transaction costs. The fair-market value of an asset is a reasonable estimate of its worth.

What is discontinued operations?

A discontinued operation is a separate major business division or geographical operation that the company has disposed of or is holding for sale. Disclose the results from discontinued operations on the income statement or in accompanying notes.

What Are Discontinued Operations?

Discontinued operations are operations a company no longer requires, and that have been shut down. An operation may be discontinued due to any number of reasons, including: the closure of a division that cannot make or sustain a profit, the sale of a company’s product line or service, or a merger with another company (resulting in redundant roles).

What happens to Ned after selling the channel?

Upon selling it, Ned instructs accounting to discontinue operations for this channel. There will still be the same income and expenses as per the first scenario, but there will also be charges related to the physical transfer of some of the channel’s equipment to the new location, as per the agreement he has in place with the buyer. These costs will also be reflected under “Discontinued Operations” on the next income statement.

Is One Channel a money loser?

One channel, a specialty network devoted to everything fitness, has been a money loser. In the 18 months it has been on the air, it has only generated a profit once, and it was a small one. There’s just not enough interest from the viewing public to generate the advertising revenues Ned needs.

Can a discontinued business make a gain?

Yes and no. A discontinued operation may still make a gain or loss in the accounting period it ceased operations in. These gains or losses must be reported. However, often a discontinued operation was operating at a loss, so there may be some money realized from taxes at tax time.

What Are Discontinued Operations?

Understanding Discontinued Operations

- Discontinued operations are listed separately on the income statement because it's important that investors can clearly distinguish the profits and cash flowsfrom continuing operations from those activities that have ceased. This distinction is especially useful when companies merge, as parsing out which assets are being divestedor folded gives a c...

Disclosure on Income Statements

- When operations are discontinued, a company has multiple line items to report on its financial statements. Although the business component is being shut down, it still could generate a gain or loss in the current accounting period. The total gain or loss from the discontinued operations is thus reported, followed by the relevant income taxes. This tax is often a future tax benefit becau…

Reasons For Discontinued Operations

Discontinued Operations Under IFRS

- Under the International Financial Reporting Standards (IFRS), discontinued operations are reported when they meet two criteria. Specifically, it is addressed in IFRS 5. Firstly, the asset or business component in question needs to be already disposed of or reported as being held for sale. Secondly, the component needs to be identifiable as a separa...

Discontinued Operations Under GAAP

- Discontinued operations are treated slightly differently under the Generally Accepted Accounting Principles (GAAP). Similarly to IFRS, a company is allowed to report discontinued operations under GAAP when two criteria are met. The criteria for GAAP require that firstly, the transaction used to shut down the divested business will eliminate the operations and cash flow of the busi…

Taxation on Discontinued Operations

- The issue of taxation with regards to discontinued operations can be rather complex. Discontinued operations often still make a gain or a loss in the accounting period in which it decided to cease operations. As such, the gains or losses need to be reported for tax purposes. However, it is common that discontinued operations are no longer generating any revenue and a…

More Resources

- CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)™certification program, designed to transform anyone into a world-class financial analyst. In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful: 1. IFRS vs. US GAAP 2. Stakeholder vs. Shareholder 3. A…