Where does prepaid rent go on the balance sheet?

- You may have a rent deposit you paid up front, say $2,000. That would be a long-term asset (generally under a multi-year lease).

- If you paid one month ahead, you would have Prepaid Rent in current assets.

- Or, if you did not make last month's payment, you would have an accrual for Rent Payable (which would probably be in your accounts payable anyway).

Is prepaid rent on an income statement of balance sheet?

Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent typically represents multiple rent payments, while rent expense is a single rent payment. So, a prepaid account will always be represented on the balance sheet as an asset or a liability.

Is prepaid rent a normal credit balance?

Prepaid rent typically represents multiple rent payments, while rent expense is a single rent payment. So, a prepaid account will always be represented on the balance sheet as an asset or a liability. Additionally, what type of account is prepaid rent and what is its normal balance? It Is A Liability Account And Has A Credit Balance. It Is An Expense Account And Has A Debit Balance. It Is A Revenue Account And Has A Credit Balance.

Is prepaid rent an asset or liability?

Prepaid rent payments are classed as an asset when the organization makes a prepaid rent payment to a landlord or other third party. The payment becomes a liability when a company is given prepayment from tenants or third parties.

What is prepaid rent in balance sheet?

A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date.

Does prepaid rent go on the balance sheet or income statement?

Prepaid expenses are not recorded on an income statement initially. Instead, prepaid expenses are first recorded on the balance sheet; then, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is recognized on the income statement.

Is prepaid rent a current asset?

Is prepaid rent an asset? If you're making a rent payment before the period it's due, this is considered prepaid rent. It's a current asset that's reported on the balance sheet. The payment is considered a current asset until your business begins using the office space or facility in the period the payment was for.

How should prepaid rent be recorded?

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a company's balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

How do you record prepaid expenses on a balance sheet?

To do this, debit your Expense account and credit your Prepaid Expense account. This creates a prepaid expense adjusting entry. Let's say you prepay six month's worth of rent, which adds up to $6,000. When you prepay rent, you record the entire $6,000 as an asset on the balance sheet.

Is prepaid rent a liability on a balance sheet?

Prepaid rent is a current asset. In simple words, prepaid rent is recorded under current assets in the balance sheet because often businesses pay the rent before the due date and it is utilized within a few months of its payment, usually within the same financial period.

Is prepaid rent an investing activity?

Prepaid rent, as mentioned above, goes on the operating activities section. When companies pay rent to a landlord, they record it as an asset. Usually, these rents only cover the next 12 months or less. Therefore, they become a part of current assets in the balance sheet.

Is rent paid an asset on balance sheet?

For rental expense under the accrual method, when rent is paid ahead of schedule – which happens rather often – then the rent is recorded in the prepaid expenses account as an asset.

Is prepaid rent an asset on the balance sheet?

Prepaid rent is a current asset. In simple words, prepaid rent is recorded under current assets in the balance sheet because often businesses pay the rent before the due date and it is utilized within a few months of its payment, usually within the same financial period.

Does prepaid rent count as income?

Advance rent is considered taxable income to you in the year you receive it from tenants. This is true even if the advance payment isn't mentioned in the lease or rental agreement.

How does prepaid rent affect the income statement?

Prepaid rent, or any advance rent received before the period the payment is meant to cover, is included in the tax year received regardless of the period covered. This increases total taxable income.

Does rent expense go on the balance sheet?

Rent expense on the balance sheet As was the case under ASC 840, rent expense is not reported on the balance sheet. It is still only reported on the income statement and calculated on a straight-line basis.

Where are prepaid expenses found?

Prepaid Expenses are found on almost every financial statement across different companies . In this regard, it is essential to ensure that the treatment of prepaid expenses is adequately adhered to so that there are no inconsistencies in preparing financial statements.

What are Prepaid Expenses?

Prepaid Expenses are expenses that are paid more than the amount that the company owed. In this regard, it is important to consider that prepaid expenses comprise expenses that have already been paid in advance by the organization compare to the amount the company has not yet utilized the product (or service).

What is the difference between prepaid and accrued expenses?

Prepaid Expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes.

Why are prepaid expenses different from other types of assets?

Prepaid Expenses are different from all the different types of current assets because, in those classes of existing assets, the company is bound to receive cash (or it already has cash) against the given services.

When does amortization take place?

However, the amortization of this asset only takes place once the company utilizes the said service. This can be done across a period after the given year. As the company uses the offered service, then the amount gets expenses in the Income Statement.

Do accountants need to segregate expenses?

In this case, accountants need to segregate the expenses into categories of expenses incurred in the current year and expenses that are supposed to be carried forward.

Is a company's cash advance considered a current asset?

Therefore, it makes sense to treat it as a Current Asset until the company does not render the respective service. It is treated as a Current Asset (and not as Non-Current Asset) because in most business cases, the amount paid in advance lasts for a shorter duration than 12 months.

Prepaid Rent and Accounting

Accounting for your prepaid rent expenses doesn’t need to be complicated, but it is something that requires your attention at the end of the month. The accountant or bookkeeper records the prepaid asset to the balance sheet account with a basic general ledger system.

Prepaid Rent: Asset or Liability?

What type of account is prepaid rent? Is it an asset or liability? It depends on which side of the equation your company is on. Prepaid rent payments are classed as an asset when the organization makes a prepaid rent payment to a landlord or other third party.

Prepaid Rent vs Rent Expense

The key difference between prepaid rent and rent expenses is that prepaid rent is a balance sheet account while rent expenses go on the income statement. Prepaid rent generally covers multiple rent payments at once, while a rent expense only covers a single payment.

Example of Prepaid Rent Accounting

Company A pays six months of rent in advance. The cash on the balance sheet is credit and reduced accordingly. The prepaid rent asset account gets debited for the same amount of money. One rent payment goes from the prepaid rent asset account to the rent expense account as the months pass.

Prepaid Rent on The Balance Sheet

Prepaid rent is either an asset or a liability on the balance sheet. Either way, it is typically considered a current asset or liability rather than a long-term one. When reviewing prepaid rent normal balance, it’s important you substantiate the balance with supporting documents. Those documents include bank statements or bills.

Preparing Prepaid Rent Journal Entry

Preparing for a prepaid rent journal entry starts with knowing when to make one. You should always create a personal expenses journal entry when you make the purchase, regardless of when you actually use the goods or services. For prepaid rent, that means making an entry after paying the advance rent.

Final Thoughts

Prepaid rent is rent paid in advance. Companies record the overall amount at first and then remove individual payments month by month. Which type of account prepaid rent depends on whether your company pays prepaid rent or accepts it from someone else.

What is rent receivable?

Rent Receivable is the title of the balance sheet asset account which indicates the amount of rent that has been earned, but has not been collected as of the date of the balance sheet.

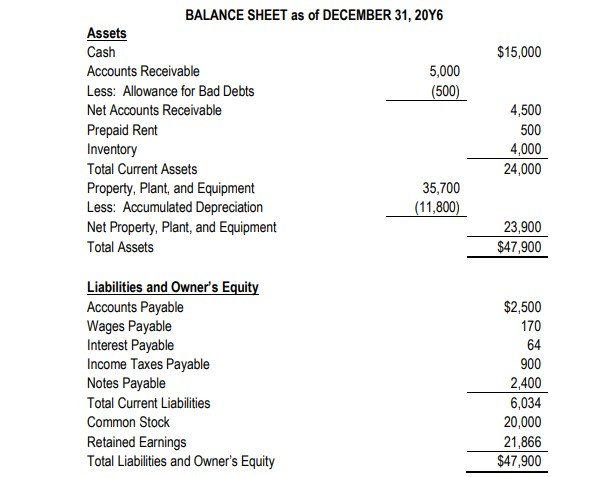

What is balance sheet statement?

A company’s balance sheet statement consists of its assets, liabilities, and shareholders’ equity. A company’s balance sheet statement consists of its assets, liabilities, and shareholders’ equity. Assets are divided into current assets and noncurrent assets, the difference for which lies in their useful lives.

What is revenue accounting?

Revenue is what comes when the company sells their products or deliver their services . Revenue is the income of the business, thus resulting in increasing of assets and decreasing of liabilities. Cash revenues lead to an increase in the revenue and credit sales lead to a decrease in the liabilities as your customer commits to pay you after a specific period of time. Accruals are an accounting method for recording revenues and expenses. Companies can report revenues and expenses on a cash basis or an accrual basis.

Why are expenses adjusted downward?

This means that its recorded value on the balance sheet is adjusted downward to reflect that its overvalued compared to the market value. Expenses are unavoidable events in the business to conduct business operations. For a period of time, expenses reduce the assets and increase the liabilities.

What is PP&E in business?

Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash. Purchases of PP&E are a signal that management has faith in the long-term outlook and profitability of its company.

When do companies report revenues?

While cash is eventually involved in revenue and expense transactions, using accruals, companies report revenues when earned and expenses when incurred without the exchange of cash at the time of a sale or a cost purchase. Companies may accrue revenues and expenses from prepayments and deferred payments.

Is fuel filled in a truck an expense?

For example, if you own a truck , then the fuel filled every time in the truck for business operation is an expense to the company. Expenses are usually repeating events which are unavoidable but can be cut down as per the business requirements.

What is prepaid rent?

Prepaid rent is an amount for rent which has been paid in advance. A business has an annual office rent of 12,000 and pays the landlord 3 months in advance on the first day of each quarter. On the 1 April it pays the next quarters rent in advance of 3,000 to cover the months of April, May and June. It has a prepaid rent of 3,000.

What is the accounting equation for prepaid rent?

The Accounting Equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business This is true at any time and applies to each transaction.

What is the equation for assets and liabilities?

The Accounting Equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business This is true at any time and applies to each transaction. For this transaction the Accounting equation is shown in the following table.

What is prepaid rent?

Prepaid rent is rent paid in advance of the rental period. The journal entries for prepaid rent are as follows: Initial journal entry for prepaid rent: 2. Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet.

When is prepaid rent adjusting journal entry done?

The adjusting journal entry is done each month, and at the end of the year, when the lease agreement has no future economic benefits , the prepaid rent balance would be 0.

Why are prepaid expenses recorded as assets?

Prepaid expenses are initially recorded as assets, because they have future economic benefits, and are expensed at the time when the benefits are realized (the matching principle).

What is prepaid insurance?

Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet. Balance Sheet The balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting. . Initial journal entry for prepaid insurance:

What happens when the benefits of the expenses are recognized?

As the benefits of the expenses are recognized, the related asset account is decreased and expensed.

Does prepaid expense affect financial statements?

Effect of Prepaid Expenses on Financial Statements. The initial journal entry for a prepaid expense does not affect a company’s financial statements. For example, refer to the first example of prepaid rent. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

Is prepaid rent an asset?

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

What is a Prepaid Expense?

As mentioned above, companies usually pay for expenses as they occur. In some cases, they may also repay the supplier after the initial transaction. Both parties agree to the terms of these payments in advance. For most companies, this difference between expenses and payments is crucial when accounting for them.

Does Prepaid Rent go on the Cash Flow Statement?

As mentioned above, prepaid rents primarily impact the balance sheet. When companies pay these rents in advance, they recognize them as a current asset. This amount remains in the balance sheet as long as the company does not use the underlying property. Once the period for the rent is over, companies can record the amount as an expense.

Example of Prepaid Rent on Cash Flow Statement

The cash flow statement includes three sections, cash flows from operating, investing and financing activities. Prepaid rent, as mentioned above, goes on the operating activities section. When companies pay rent to a landlord, they record it as an asset. Usually, these rents only cover the next 12 months or less.

Conclusion

Prepaid expenses occur when companies pay for a product or service in advance. These expenses may be mandatory in some cases. For example, landlords require tenants to pay for the underlying property in advance. Prepaid expenses constitute cash outflows for the business. However, companies report them in the statement as increases or decreases.