Top 5 Banks Offering International Debit Cards:

- SBI International Debit Cards

- ICICI Bank International Debit Cards

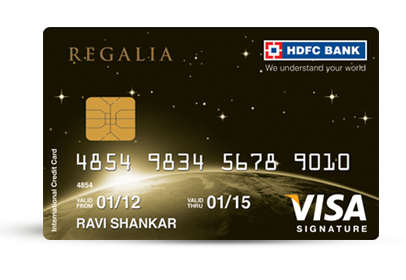

- HDFC Bank International Debit Cards

- Axis Bank International Debit Cards

- Yes Bank International Debit Cards

- Schwab Bank High Yield Investor Checking® Account. ...

- Fidelity® Cash Management Account with Fidelity®Visa®Gold Check Card. ...

- Capital One® 360 Checking® Account.

What is the best credit card for international use?

- Holland America Line credit card: Great cruise rewards

- JetBlue Business credit card: For corporate travel

- AAdvantage Aviator Red World Elite Mastercard: The Choice Privileges Visa card: Best for Choice Privileges rewards

- AAdvantage Aviator Red World Elite Mastercard: Earn airline miles

Which prepaid debit card is the best?

What are the best prepaid debit cards?

- Netspend Premier prepaid debit card. Premier is an upgrade from Netspend’s starter prepaid debit card. ...

- Walmart Money Card. Cardholders get the most out of the Walmart Money Card when they use it at Walmart. ...

- Green Dot Load & Go prepaid debit card. Green Dot Load & Go is ideal for someone who doesn't rely on their card for everyday purchases. ...

How to enable your debit card for international use?

- Using your username and password, log in to SBI Anywhere.

- Select “debit card services” from the app’s menu.

- Then select “manage debit card”.

- Select the debit card for which worldwide usage is desired. ...

- Then, select “international usage” option. ...

- After that, turn on the E-Commerce (CNP) txns to make international fund transfers.

Can I buy online with a debit card?

When you make a purchase online with your debit card, you’ll need to provide the 16-digit card number that’s located on the front or back of your card, the expiration date, and your billing address. You’ll likely also be asked for a CCD, CVV or ‘security code,’ which is a three or four-digit number found on the back of the card.

:max_bytes(150000):strip_icc()/GettyImages-182800841-5894f4825f9b5874ee438219.jpg)

Which debit card is best for international use?

Best International Debit Cards Offered by Indian BanksSBI Global International Debit Card.ICICI Bank Sapphiro International Debit Card.Axis Bank Burgundy Debit Card.HDFC EasyShop Platinum Debit Card.Yes World Debit Card.HSBC Premier Platinum Debit Card.

Which bank is best for international transactions?

What are the top 5 international banks in India?Citibank. Citibank is one of the oldest banks in India. ... HSBC BANK. HSBC Bank India, a subsidiary of HSBC Holdings plc., is among the world's largest banking and financial organizations. ... Standard Chartered Bank. ... Royal Bank of Scotland. ... Barclays Bank.

Which bank debit card is international?

State Bank of India, HDFC Bank, Axis Bank, and Yes Bank are some of the banks which offer international debit cards.

Which debit cards have no international fees?

Banks With No Foreign Transaction FeesAmerican Express: certain credit cards.Bank of America: certain credit cards.Barclays: certain credit cards.Capital One: all credit cards, certain debit cards, certain ATM transactions.Charles Schwab Bank: certain debit cards, certain ATM transactions.Chase: certain credit cards.More items...

Which card works internationally?

Visa and Mastercard are widely accepted worldwide. If an establishment takes credit cards, it's a good bet that your Visa or Mastercard will work. American Express and Discover have an international presence, too, but they are accepted by fewer merchants.

How can I get an international debit card?

0:532:01Enable your Debit Card for international use | HDFC BankYouTubeStart of suggested clipEnd of suggested clipSelect debit card click on request. Then click on set international usage select the card numberMoreSelect debit card click on request. Then click on set international usage select the card number choose the second option card to be enabled for domestic and international usage.

Which is better Visa or RuPay?

Card Type: RuPay card associate offers only the option of debit cards, whereas VISA offers debit as well credit cards. Safety and security: With regard to safety and security of transactions, both RuPay and VISA card associates are equally good.

Which SBI debit card is best for international use?

With your SBI Platinum International Debit Card you get access to your account whenever and wherever you want. You can use it to purchase goods at merchant establishments, for making payment online and withdraw cash in India as well as across the globe.

Which bank has the lowest international ATM fees?

Here are the best banks and best checking accounts that don't charge ATM foreign transaction fees:Aspiration.Betterment.Charles Schwab.Capital One.Alliant Credit Union.First Republic Bank.Fidelity.USAA.

Can I use ATM card internationally?

Yes, your debit card and credit card are accepted internationally! If your ATM card is linked to a checking account, it can also be used at ATMs internationally.

How do I avoid international fees on my debit card?

How to avoid foreign transaction feesOpen a bank account with a foreign transaction fee-free institution. You can get slapped with a foreign transaction charge if you use your debit card outside of your native country. ... Exchange currency before traveling. ... Avoid using foreign ATMs. ... Avoid the Dynamic Currency Conversion.

Which bank is the most international?

Top International BanksRankBankNumber of Employees1JPMorgan Chase & Co243,3552Bank of America Corp208,0003Industrial & Commercial Bank of China461,7494Wells Fargo269,10039 more rows

How do I avoid international transfer fees?

In this article:Watch Out for Conversion and Transaction Fees.Open a Credit Card That Doesn't Have a Foreign Transaction Fee.Exchange Currency Before You Travel.Open a Bank Account That Doesn't Charge Foreign Fees.Pay With the Local Currency.Finding Cards With No Foreign Transaction Fees.

Which bank is best for travelling?

The Best Bank Accounts for TravellingRevolut. Pros: Simple to set up and get started with. ... N26. Pros: No set-up or running costs. ... Wise Borderless Account. Pros: Allows you to spend anywhere with real exchange rates. ... Monese. Pros: Quick and easy to set up. ... Monzo. Pros: Incredibly simple to set up. ... Starling. Pros:

Which bank is best for international transfers in India?

Sending money from India to overseas is made easy and convenient, with ICICI Bank's Money2World, an online outward remittance facility, to transfer money abroad. Transfer money abroad either through an online channel or through ICICI Bank's Branch network.

Where is Citizens Bank located?

Citizens Bank is a great regional bank that services a large portion of the northeastern United States. Based in Rhode Island, they service states from Vermont to Delaware.

Can a debit card be tucked away?

A debit card, on the other hand, can be safely tucked away and easily replaced in case it’s lost or stolen.

Does SoFi pay for ATM fees?

Similar to Schwab, SoFi Money reimburses you for all ATM fees incurred, no matter where in the world you use your Visa debit card. SoFi offers a cash management account that earns you 1.80% APY and has zero fees.

Does Schwab have a debit card?

When you sign up for a bank account, you’ll receive a Schwab Bank Visa Platinum debit card. Anytime you use it, you don’t have to worry about any foreign exchange transaction fees.

Does Betterment have a debit card?

And your checking account will come with a Visa debit card that’s equipped with tap-and-go technology. Plus, Betterment’s intuitive mobile app makes it easy for you to manage your account no matter where you are .

Can you use prepaid debit cards anywhere?

Prepaid debit cards used to be a great way to move money across borders. They’re cheap, anonymous, and you can purchase and redeem them almost anywhere. While they had limits on the amount of cash you could load onto them, you could just buy a whole bunch of them at once.

Do debit cards have foreign transaction fees?

Best Debit Cards with No Foreign Transaction Fees. A lot of the big banks may make you pay through the nose to take out some spending cash when you’re on an overseas trip. However, there are some banks that offer debit cards with no foreign transaction fees.

What is the best debit card for international travel?

As a customer of the Fidelity Cash Management Account, you'll receive the Fidelity Visa Gold Check Card , which is one of the best debit cards for international travel. You'll pay a low 1% foreign transaction fee on transactions completed outside the United States. 4

Why do you swipe a debit card over a credit card?

Using a debit card over a credit card can be beneficial because it's linked to your bank account. When you swipe, the funds are taken out of your checking account. This means you won't have to worry about repaying a credit card balance.

How many ATMs are there in Allpoint?

The Allpoint network includes over 55,000 ATMs all over the world. You can download an app to your smartphone to locate an Allpoint ATM near you. 11. You can open a Capital One 360 Checking Account with no minimum deposits and no minimum balance requirements. You can also earn 0.10% APY on your balance. 12.

What is EMV card?

EMV technology ensures your information is safely transmitted when you're making purchases and withdrawals from ATMs, protecting your account from future fraud. 5. The card doesn't just save on ATM fees, it also includes a few extra perks that may come in handy while you're traveling internationally.

Do debit cards charge foreign ATM fees?

For example, some debit cards charge a foreign ATM fee when you use an ATM in another country. You might also have to pay additional currency conversion or foreign transaction fees on each transaction you make. The best debit cards for international travel will help you reduce or even eliminate those fees. 1 2.

Can you avoid the ATM fee?

You can't avoid the ATM fee, but Charles Schwab will refund it with no limits on the refunds. There are also no service fees or account minimums.

Does Fidelity have monthly fees?

With the Fidelity Cash Management Account, you'll pay no monthly fees. You don't have to maintain a minimum monthly balance. Plus, your deposits are insured up to $1.25 million, which is more than traditional checking and savings accounts at other banks. 6.

What is the best credit card for travel?

The Chase Sapphire Preferred card is one of the best travel credit cards available. With Sapphire Preferred, you get two points for travel and dining and one point for all other purchases.

Which bank is the best for wire transfers?

Citibank is considered by many to be the best for wire transfers.

How much does Citibank charge for wires?

If the recipient doesn’t have a Citibank account, then the bank has been known to charge as much as $35 per wire. You don’t always know when you’ll have to wire money, but if it’s a routine practice for you, Citibank is the way to go — especially if you both bank with them.

How much does HSBC charge?

For starters, it charges a $50 monthly service fee — which isn’t exactly pocket change for a lot of people. You can avoid this fee if you have a minimum of $100,000 in your account, but, again, that’s not most people. Even with the high monthly fee, HSBC still ranks as the number one bank for globetrotters.

How many countries does HSBC have?

After all, when it comes to your money, you want as smooth of a transition as possible. HSBC helps make moving abroad easier by having 3,900 offices in 67 countries and territories in Asia, Australia, Europe, the Middle East, North America, and South America.

How to prove you are actually abroad?

Proving that you are actually abroad can be quite an ordeal while you’re trying to navigate foreign subways or getting a taxi to your hotel. Save yourself the hassle and let your bank know in advance when you’re leaving and when you’re returning. Give yourself a few minutes to do this.

What happens if you swipe a credit card in another country?

So the moment you swipe your card in another country, a red alert is sent out immediately, and your card could be declined on the spot. Don’t put yourself in this situation by letting the bank think that your card has been stolen!

How to find out which ATM is the least expensive?

Research your destination online using resources like Tripadvisor and Reddit to see which ATM will charge you the least, especially in popular tourist destinations. Do not take out cash too often to avoid excessive fees.

How much is the foreign transaction fee on a prepaid MasterCard?

There are fees which vary by card type, including costs for using your card overseas. For the prepaid MasterCard for example, there’s a 2.95% foreign transaction fee, and extra charges of $2.95 in addition to this when you are using an ATM or requesting an over-the-counter withdrawal in a foreign currency.¹².

What is a prepaid card and how does it work?

In many ways, prepaid cards work similarly to your regular debit card. You’ll be able to use a prepaid card to make ATM withdrawals or payments in stores, and you’ll avoid overdraft fees because you can’t spend more than you’ve topped up. Carrying a card is convenient, and safer than having a lot of cash on you.

What is Travelex card?

Travelex Money Cards can be used for spending in stores and restaurants and ATM withdrawals. The card has contactless technology so you can tap and go where contactless is available. You may need to pay a fee to get the card, and there’s an exchange fee of 5.5% added to currency exchange.

What is the N26 bank?

N26. If you live in Europe, the UK or US, you can open an account with N26, a German online bank which offers a smart card option for international spending.⁶. This is a little different to some of the other options above, in that you won’t necessarily be switching your money to hold a balance in a foreign currency.

Can a prepaid card be linked to a bank account?

Your prepaid card isn’t linked to any of your other accounts, so even in the unlikely event that you’re a victim of fraud or lose your card and PIN, the thieves wouldn’t be able to get to your regular bank balance. This gives you extra peace of mind, no matter where you are in the world.

Where can I open a wise multi currency account?

Wise multi-currency Mastercard. If you’re based in the US, UK, Australia, New Zealand, or in a broad range of countries in Europe and beyond, you can open a free Wise multi-currency account online, and get a linked Mastercard debit card.