Present value is the concept that states an amount of money today is worth more than that same amount in the future. In other words, money received in the future is not worth as much as an equal amount received today. Receiving $1,000 today is worth more than $1,000 five years from now.

Full Answer

What is ultimately the value of any money?

The value of money is ultimately determined by the intersection of the money supply, as controlled by the Fed, and money demand, as created by consumers. Figure 1 depicts the money market in a sample economy. The money supply curve is vertical because the Fed sets the amount of money available without consideration for the value of money.

How to calculate present value?

Explanation

- Firstly, figure out the future cash flow which is denoted by CF.

- Next, decide the discounting rate based on the current market return. ...

- Next, figure out the number of years until the future cash flow starts and it is denoted by t.

- Finally, the formula for present value can be derived by discounting the future cash (step 1) flow by using a discount rate (step 2) and a number of ...

- The concept of present value is primarily based on the time value of money which states that a dollar today is worth more than a dollar in the ...

What is the current value of a future sum of money called?

Present value (PV) is the current value of a future sum of money or stream of cash flows given a specified rate of return. Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the future cash flows.

How to calculate the future value of an investment?

The formula for future value is PV (1+r)n, where:

- PV = present investment value

- r = rate of return

- n = the number of years invested

What is the present value of money?

Present value (PV) is the current value of a future sum of money or stream of cash flows given a specified rate of return. Present value takes the future value and applies a discount rate or the interest rate that could be earned if invested.

What is meant by the present value of money quizlet?

The present value is the value today of one or more future cash flows discounted to today at an appropriate interest rate. The future value is the value at some point in the future of a present amount or amounts after earning a rate of return, for a period of time.

What best describes the time value of money quizlet?

The time value of money is the concept that money invested today can grow into a larger amount in the future.

What best explains the time value of money?

The time value of money (TVM) is the concept that a sum of money is worth more now than the same sum will be at a future date due to its earnings potential in the interim. The time value of money is a core principle of finance. A sum of money in the hand has greater value than the same sum to be paid in the future.

How do you calculate present value quizlet?

MatchPresent Value. the value you give today to money you will recieve in the future is called the future payments present value.Formula for Present value. PV= FV/(1+i)^t.Formula for Bond Price. BP= Coupon/(1+i)^t + Face value/(1+i)^n.Expkain why a dollar today is worth more than a dollar tomorrow.

Why are present value calculations used quizlet?

It is the inverse of calculating the future value of a sum of money. Such calculations are useful for determining today's price or the value today of an asset or cash flow that will be received in the future.

Which of the following is an example of the time value of money?

Time Value of Money Examples If you invest $100 (the present value) for 1 year at a 5% interest rate (the discount rate), then at the end of the year, you would have $105 (the future value). So, according to this example, $100 today is worth $105 a year from today.

Why is time value of money important quizlet?

Why does money have a time value? Money has a time value because funds received today can be invested to reach a greater value in the future. A person would rather receive $1 today than $1 in ten years, because a dollar received today, invested at 6 percent, is worth $1.791 after ten years.

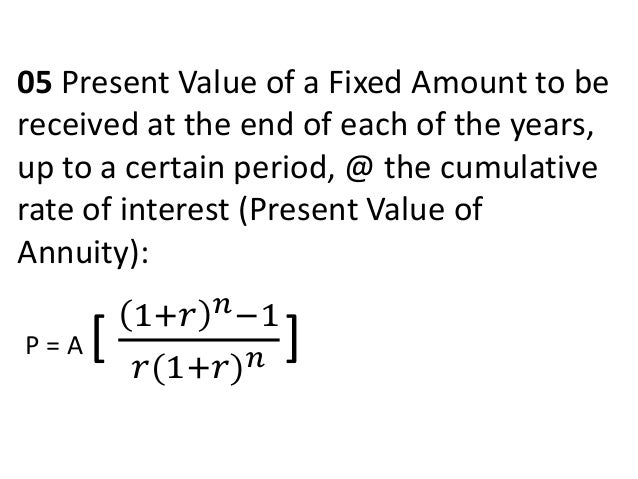

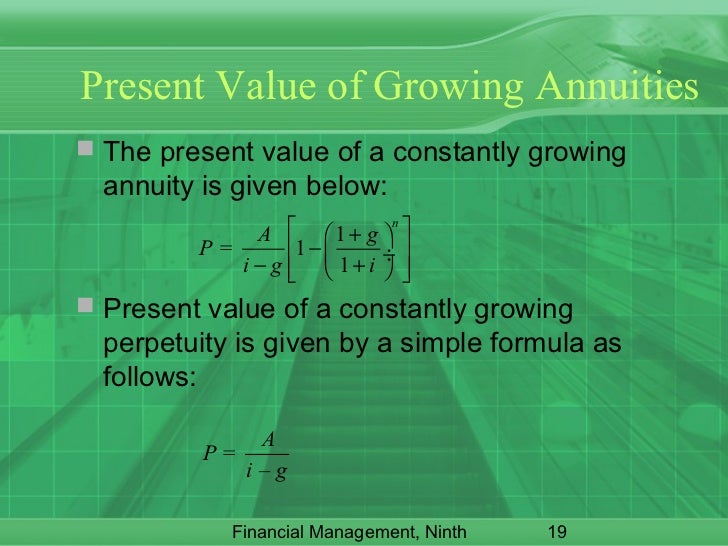

What is the relationship between the present value factor of an ordinary annuity?

The factor for the present value of an annuity due is found by multiplying the ordinary annuity table value by one minus the interest rate.

What does value of money mean?

The value of money is its purchasing power, i.e., the quantity of goods and services it can purchase. What money can buy depends on the level of prices. When the price level rises, a unit of money can purchase less goods than before. Money is then said to have depreciated.

What is time value of money also called?

The time value of money (TVM) states that a sum of money held today is more valuable than a future payment. This money concept is true because dollars held today can be invested to earn a rate of return. The time value of money is also referred to as the net present value of money.

What is the difference between present value and future value?

Present value is the sum of money that must be invested in order to achieve a specific future goal. Future value is the dollar amount that will accrue over time when that sum is invested. The present value is the amount you must invest in order to realize the future value.

What is meant by the value of an annuity quizlet?

The future value of an ordinary annuity is the value of equal periodic payments or deposits, at some point in the future. This calculation is useful to determine the value of saving contributions made over time at the end of a period and earning a constant compounded rate of return.

What is the process of determining the present value called?

discounting is the process of finding the present value in todays dollars of some future amount. A discount rate of interest is used and a period of time must be given. Discounting is compounding in reverse.

What is the value of M1 quizlet?

M1 = $850 billion, M2 = $4, 900 billion.

What is interest payment for the use of money quizlet?

Interest is the price paid for the use of money. It is the price that borrowers need to pay lenders for transferring purchasing power to the future.

What is interest rate?

a. The interest rate charged on a loan.

What is the meaning of "payment"?

a. Payment for the use of money.

What is capital lease?

a. A capital lease is entered into with the initial lease payment due upon the signing of the lease agreement.

What is the time value of money?

The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future. This is true because money that you have right now can be invested and earn a return, thus creating a larger amount of money in the future. (Also, with future money, there is the additional ...

How to calculate NPV in Excel?

It's important to understand exactly how the NPV formula works in Excel and the math behind it. NPV = F / [ (1 + r)^n ] where, PV = Present Value, F = Future payment (cash flow), r = Discount rate, n = the number of periods in the future

Why do you need to factor inflation in when investing?

Inflation and purchasing power must be factored in when you invest money because to calculate your real return on an investment, you must subtract the rate of inflation from whatever percentage return you earn on your money.

Why is inflation important?

Why is this important? Because inflation constantly erodes the value, and therefore the purchasing power, of money. It is best exemplified by the prices of commodities such as gas or food. If, for example, you were given a certificate for $100 of free gasoline in 1990, you could have bought a lot more gallons of gas than you could have if you were given $100 of free gas a decade later.

Why is time value important?

The time value of money is an important concept not just for individuals, but also for making business decisions . Companies consider the time value of money in making decisions about investing in new product development, acquiring new business equipment or facilities, and establishing credit terms#N#Sale and Purchase Agreement The Sale and Purchase Agreement (SPA) represents the outcome of key commercial and pricing negotiations. In essence, it sets out the agreed elements of the deal, includes a number of important protections to all the parties involved and provides the legal framework to complete the sale of a property.#N#for the sale of their products or services.

What happens if inflation is higher than investment return?

If the rate of inflation is actually higher than the rate of your investment return, then even though your investment shows a nominal positive return, you are actually losing money in terms of purchasing power. For example, if you earn a 10% on investments, but the rate of inflation is 15%, you’re actually losing 5% in purchasing power each year ...

How to find present value of a payment?

This is the reverse of determining the future value of a payment, because in this case, we already know the future value. It is found by dividing the future value by the same interest factor, (1 + r)n, used to determine future value. Since FV = PV × (1+r) n, then, dividing both sides by (1+r) n yields:

Why does money have a time value?

And the money that money makes makes more money. — Benjamin Franklin. Money has a time value because it can be invested to make more money. Thus, a dollar received in the future has lesser value than a dollar received today.

What are some examples of money?

Gold and bitcoins are 2 prominent examples of money where the creation or destruction cannot easily be controlled, causing the value of individual units of money to vary widely in price. When the value of money itself fluctuates unpredictably, then present value or future value have no meaning, since the price of the money itself will be unknown. So, if I deposit 100 bitcoins in a savings account, earning 5% interest annually, then I will have 105 bitcoins at the end of the year, but I will have no idea what the value of those 105 bitcoins will be, since the bitcoin itself will probably have a very different value 1 year from now.

How long is the interest rate compounded?

This interval of time is assumed to be 1 year, but, if it is less than 1 year, as it frequently is, then there are 2 adjustments that must be made to the formulas:

How much interest is paid on $100 in savings?

If $100 is deposited in a savings account that pays 5% interest annually, with interest paid at the end of the year, then after the 1 st year, $5 of interest will be added to the $100 of principal for a total of $105. In the 2 nd year, interest will be earned not only on the principal of $100, but also on the $5 of interest earned. Thus, at the end of the 2 nd year, there will be 5 more dollars of interest earned from the principal added to the account, plus 25¢ earned from the previous year's interest of $5. Thus, at the end of the 2nd year there will be $105 + $5 + $.25 = $110.25 total in the account. This is an example of compounding interest, interest that is paid on interest previously earned. This process can be continued for any number of years.

Why is a dollar received today more valuable than a dollar received in the future?

Conversely, a dollar received today is more valuable than a dollar received in the future because it can be invested to make more money. Formulas for the present value and future value of money quantify this time value, so that different investments can be compared.

Why does the value of money decline?

Although the value of money usually declines due to inflation, inflation is kept low and predictable by the central bank. However, if the government prints money irresponsibly, then the value of that money at some future date cannot be known, so the present value or the future value cannot be reliably calculated.

What is present value?

The initial amount of the borrowed funds (the present value) is less than the total amount of money paid to the lender . Present value calculations, and similarly future value calculations, are used to value loans, mortgages, annuities, sinking funds, perpetuities, bonds, and more.

Why is the present value less than the future value?

The present value is usually less than the future value because money has interest -earning potential, a character istic referred to as the time value of money , except during times of zero- or negative interest rates, when the present value will be equal or more than the future value.

How to determine if a bond is sold at par?

The purchase price is equal to the bond's face value if the coupon rate is equal to the current interest rate of the market , and in this case, the bond is said to be sold 'at par'. If the coupon rate is less than the market interest rate, the purchase price will be less than the bond's face value, and the bond is said to have been sold 'at a discount', or below par. Finally, if the coupon rate is greater than the market interest rate, the purchase price will be greater than the bond's face value, and the bond is said to have been sold 'at a premium', or above par.

What is cash flow?

A cash flow is an amount of money that is either paid out or received, differentiated by a negative or positive sign, at the end of a period. Conventionally, cash flows that are received are denoted with a positive sign (total cash has increased) and cash flows that are paid out are denoted with a negative sign (total cash has decreased). The cash flow for a period represents the net change in money of that period. Calculating the net present value,#N#N P V {displaystyle ,NPV,}#N#, of a stream of cash flows consists of discounting each cash flow to the present, using the present value factor and the appropriate number of compounding periods, and combining these values.

How to value future income streams?

The traditional method of valuing future income streams as a present capital sum is to multiply the average expected annual cash-flow by a multiple, known as "years' purchase". For example, in selling to a third party a property leased to a tenant under a 99-year lease at a rent of $10,000 per annum, a deal might be struck at "20 years' purchase", which would value the lease at 20 * $10,000, i.e. $200,000. This equates to a present value discounted in perpetuity at 5%. For a riskier investment the purchaser would demand to pay a lower number of years' purchase. This was the method used for example by the English crown in setting re-sale prices for manors seized at the Dissolution of the Monasteries in the early 16th century. The standard usage was 20 years' purchase.

What is the operation of evaluating a present value into the future value called?

The operation of evaluating a present value into the future value is called a capitalization (how much will $100 today be worth in 5 years?). The reverse operation—evaluating the present value of a future amount of money—is called a discounting (how much will $100 received in 5 years—at a lottery for example—be worth today?).

What is the most commonly applied model of present valuation?

The most commonly applied model of present valuation uses compound interest. The standard formula is: