CAPM is generally preferred out of the 2 methods The dividend growth model allows the cost of equity to be calculated using empirical values readily available for listed companies.

Is CAPM an efficient model?

IS CAPM AN EFFICIENT MODEL? ADVANCED VERSUS EMERGING MARKETS Iulian IHNATOV *, Nicu SPRINCEAN** Abstract: CAPM is one of the financial models most widely used by the investors all over the world for analyzing the correlation between risk and return, being considered a milestone in financial literature. However, in recently years it has

What is the difference between CAPM and WACC?

- Earnings yield is probably relevant in residual income valuation. But it’s not used as an discount rate, at least I’ve never used it as a discount rate.

- CAPM is an imperfect, yet the most popular method to develop Re, it is NOT a discount rate. And you use Re to discount FCFE. ...

- WACC is used to discount FCFF.

What is capital asset pricing model CAPM?

What is a capital asset pricing model? The capital asset pricing model (CAPM) is a formula used in investing to calculate risk and apply it to an expected return on an asset. CAPM can be used to construct a diversified portfolio to reduce risk.

What is the constant dividend growth model?

The constant dividend growth rate model assumes that the present value of a stock's determines the value of the stock. Dividends One of the assumptions of the constant-growth valuation model is that the growth rate is Less than the required return

Is there a better model than CAPM?

The arbitrage pricing theory is an alternative to the CAPM that uses fewer assumptions and can be harder to implement than the CAPM. While both are useful, many investors prefer to use the CAPM, a one-factor model, over the more complicated APT, which requires users to quantify multiple factors.

Why is CAPM better than DVM?

The CAPM as derived by Sharpe (1964) is a single period security pricing model i.e. the rate of return is calculated over a single time period while the DVM is a multi time period model. The CAPM is also a single-factor model i.e. it may not be capturing all the determinants of the return.

How does CAPM compare and interact with dividend valuation model?

The CAPM model values the stock from the perspective of market risk, while the DDM model evaluates the stock by seeking the present value of future dividends. These two models are used as our research methods to study whether stocks are overvalued.

Does CAPM account for dividends?

The expected return of the CAPM formula is used to discount the expected dividends and capital appreciation of the stock over the expected holding period. If the discounted value of those future cash flows is equal to $100 then the CAPM formula indicates the stock is fairly valued relative to risk.

Why CAPM is a better method?

The CAPM has several advantages over other methods of calculating required return, explaining why it has been popular for more than 40 years: It considers only systematic risk, reflecting a reality in which most investors have diversified portfolios from which unsystematic risk has been essentially eliminated.

Why is CAPM not good?

The major drawback of CAPM is it is difficult to determine a beta. This model of return calculation requires investors to calculate a beta value that reflects the security being invested in. It can be difficult and time-consuming to calculate an accurate beta value. In most cases, a proxy value for beta is used.

What are the weaknesses of the dividend growth model?

The downsides of using the dividend discount model (DDM) include the difficulty of accurate projections, the fact that it does not factor in buybacks, and its fundamental assumption of income only from dividends.

What are the advantages and disadvantages of CAPM?

The CAPM is a widely-used return model that is easily calculated and stress-tested. It is criticized for its unrealistic assumptions. Despite these criticisms, the CAPM provides a more useful outcome than either the DDM or the WACC models in many situations.

Why is the market portfolio efficient according to CAPM?

Because the supply of securities must equal the demand for securities, the CAPM implies that the market portfolio of all risky securities is the efficient portfolio.

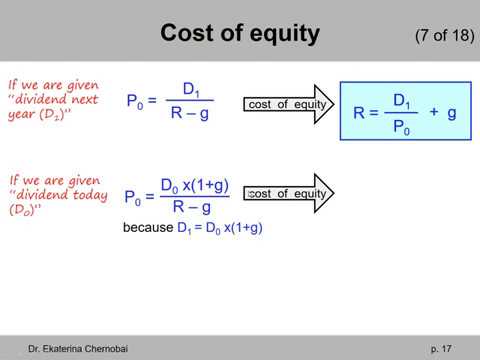

What is dividend growth model of cost of equity?

The Dividend growth model links the value of a firm's equity and its market cost of equity, by modelling the expected future dividends receivable by the shareholders as a constantly growing perpetuity.

What is the cost of equity based on the dividend growth model?

There are two primary ways to calculate the cost of equity. The dividend capitalization model takes dividends per share (DPS) for the next year divided by the current market value (CMV) of the stock, and adds this number to the growth rate of dividends (GRD), where Cost of Equity = DPS ÷ CMV + GRD.

Is CAPM and DDM the same?

The dividend discount model and the capital asset pricing model are two methods for appraising the value of your investments. DDM is based on the value of the dividends a share of stock brings in, whereas CAPM evaluates risks and returns compared to the market average.

Why is CAPM superior to DDM?

The capital asset pricing model (CAPM) is considered more modern than the DDM and factors in market risk. The value of a security in the CAPM is determined by the risk free rate (most likely a government bond) plus the volatility of a security multiplied by the market risk premium.

How do you calculate cost of capital using the dividend growth model?

The dividend capitalization model is the traditional formula for calculating the cost of equity (COE). The formula is: CoE = (Next Year's Dividends per Share/ Current Market Value of Stocks) + Growth Rate of Dividends For example, ABC, inc will pay a dividend of $5 next year. The current market value per share is $25.

What are the assumptions of CAPM?

CAPM assumes the availability of risk-free assets to simplify the complex and paired covariance of Markowitz's theory. The risk-free asset leads to the curved efficient frontier of MPT and makes the linear efficient frontier of the CAPM simple.

The Dividend Growth Model

The dividend growth model is an approach that assumes that dividends grow at a constant rate in perpetuity. The value of one stock equals next year's dividends divided by the difference between the total required rate of return and the assumed constant growth rate in dividends.

The Use of CAPM

The Capital Asset Pricing Model (CAPM) has numerous restrictions in comparison to the dividend growth model, but it is a better alternative in calculating the cost of equity.

Why CAPM is Better

We have already mentioned two assumptions of the dividend growth model that restrict it in becoming the preferred choice of financial analysts and accountants. The CAPM, on the other hand, has many its own set of restrictions, but in practice, it is a better way to deal with the cost of equity in general.

What is CAPM model?

CAPM is a model which enables investors to determine the expected return from a risky security. It observes the relationship between the risk of an asset (Mobil Oil) and its return. The model uses Beta as the main measure of risk. This model works under the following situations: • In a perfectively competitive market where they are many price-takers’ investors, who have a small market share each. • Investors behaviour is myopic • Also investments included in the model are publicly...

What is CAPM in financial analysis?

The Capital Asset Pricing Model commonly known as CAPM defines the relationship between risk and the return for individual securities. CAPM was first published by William Sharpe in 1964. CAPM extended “Harry Markowitz’s portfolio theory” to include the notions of specific and systematic risk. CAPM is a very useful tool that has enabled financial analysts or the independent investors to evaluate the risk of a specific investment while at the same time setting a specific rate of return with respect...

What is the dividend growth model?

1. Dividend Growth ModelThe basic assumption in the Dividend Growth Model is that the dividend is expected to grow at a constant rate. That this growth rate will not change for the duration of the evaluated period. As a result, this may skew the resultant for companies that are experiencing rapid growth. The Dividend Growth Model is better suited for those stable companies that fit the model. Those that are growing quickly or that don't pay dividends do not fit the assumption parameters, and thus...

How to use CAPM?

2 the greater the risk, the greater the expected reward. 3 there is a consisted trade off between risk and reward. In finance, It is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk. The CAPM says that...

What is dividend growth model?

The dividend growth model allows the cost of equity to be calculated using empirical values readily available for listed companies.

What would happen if a company cut its dividends?

All that would happen is that a cut in dividends or dividend growth rate would cause the market value of the company to fall to a level where investors obtain the return they require.

Is the current share price and dividend based on historical growth?

it is very difficult to find an accurate value for the future dividend growth rate. using a historic growth rate as a predictor of the future isn't based on fact.

Do all investors have diversified portfolios?

Here, all investors are assumed to hold diversified portfolios and as a result only seek return for the systematic risk of an investment.

Is the historical dividend growth rate a substitute for the future dividend growth rate?

The historic dividend growth rate is used as a substitute for the future dividend growth rate. The model also assumes that business risk, and the cost of equity, are constant in future periods, but reality shows us that companies are subject to constant change.

How to use dividend discount model?

The dividend discount model bases the current value of your stock shares on the total future value of their dividends. To value a stock using DDM, you combine a company's announced dividends with detailed financial projections to measure the dividend value over the next five years. Beyond that point, you have to make do with less detailed projections. Then you use the model's mathematical formula to discount the value of the future dividends to the present, giving a value for the stock now.

Can you use CAPM and DDM together?

CAPM, however, is much more widely useful. DDM can' t do anything for you if your investments aren't dividend-issuing stocks but you can apply CAPM to any sort of investment.

Is CAPM a good investment tool?

Neither DDM nor CAPM is a perfect investment tool, because both rely on assumptions about the future. Long-term financial forecasts are always challenging and DDM is especially so: to be accurate, you have to predict dividend policy five or 10 years down the road. CAPM also makes assumptions. For example, when it measures the relationship between returns and risks, it ignores unsystematic risks -- risks that only affect stocks in one particular industry. If you have a highly specialized portfolio, CAPM may not be as effective a predictor.

What is CAPM in finance?

The capital asset pricing model ( CAPM) is considered more modern than the DDM and factors in market risk. The value of a security in the CAPM is determined by the risk free rate (most likely a government bond) plus the volatility of a security multiplied by the market risk premium. This model stresses that investors who choose to purchase assets ...

What are the two models used to determine intrinsic stock value?

Attempting to value securities may be a fruitless task, however two models that have been used to determine intrinsic stock values are the dividend discount model and capital asset pricing model .

Why is DDM important?

The DDM is most useful for dividend paying companies, however one glitch in the model is the prediction of future dividend payments. Regardless of skill and resources, it is nearly impossible to determine dividend payments of a firm due to a variety of risk factors, such as macroeconomic risk, industry risk and high inflation.

Is DDM obsolete?

The DDM is obsolete for the vast majority of individual equities. Utilizing the DDM for blue chip firms that have paid consistent dividends for many years may assist in determining the intrinsic value of a security. The capital asset pricing model (CAPM) is considered more modern than the DDM and factors in market risk.