What is the difference between a 1040A and 1040EZ?

The key differences between IRS 1040, 1040A and 1040EZ are as follows. IRS1040 is a detailed form of the Internal Revenue Service (IRS) that taxpayers use to file their annual income tax returns whereas IRS 1040A is a simplified version of the IRS1040 form to report individual income tax.

Should I file a 1040A or a 1040EZ?

Should I be filing 1040A or 1040EZ ? Form 1040EZ is the simplest of the three tax forms you can use to file your federal income taxes. If your taxable income is less than $100,000, you don’t claim any dependents and you file as single or are married filing jointly, then you may be eligible to file Form 1040EZ.

Who should use 1040A?

You can use 1040A regardless of your filing status (head of household, qualified widow/widower, and married filing separately can use 1040A). Form 1040A allows you to claim adjustments to income, such as for IRA contributions and student loan interest.

What is the difference between a 1040 and a 1040EZ?

The only real difference between the forms is in the amount of information reported. The IRS has a list of items, which if reported on your return, require using either the Form 1040A or Form 1040 instead of Form 1040EZ.

What is the easiest tax form to file?

Form 1040-EZForm 1040-EZ is, not surprisingly, the easiest to fill out....Form 1040-EZYou are filing as single or married filing jointly.Your taxable income is less than $100,000.You don't claim any dependents.You don't itemize deductions.More items...

What is the easiest 1040 form?

Use Form 1040EZ (Quick & Easy) if:You don't claim dependents.Your interest income is $1,500 or less.You are claiming the standard deduction only (Can't itemize using Schedule A)You do not have any adjustments to income.You are not claiming any tax credits other than the Earned Income Credit.Other Tips:More items...•

Why would a taxpayer choose to use Form 1040 rather than form 1040EZ?

Form 1040EZ vs. For example, if you needed to file a simple return, but you were also claiming the standard deduction and the earned income tax credit (EITC), you could use Form 1040EZ. Form 1040 asks you to include information about dependents, while 1040EZ didn't allow you to claim any.

When should form 1040A be used?

All taxpayers can use Form 1040; however, to use Form 1040A you must satisfy a number of requirements, such as having taxable income of $100,000 or less and claiming the standard deduction rather than itemizing.

Who can file 1040A or EZ?

As with Form 1040EZ, you can only use Form 1040A if your taxable income is less than $100,000. Other income requirements for Form 1040A differ from 1040EZ in that they allow you to include a broader category of income.

Does the IRS still use 1040EZ?

The Form 1040EZ no longer exists for use by taxpayers, but previous EZ filers may still qualify for a “simple return.”

What is the minimum income to file a 1040EZ?

To use the form, a taxpayer had to have taxable income of less than $100,000, less than $1,500 of interest income, and claim no dependents. 2 Other requirements for filing the Form 1040EZ included: The taxpayer and their spouse, if married filing jointly, had to be under age 65 at the end of the relevant filing period.

What is the most common 1040 tax form?

The most common of these forms are: Form W-2. It's filled out by your employer to document your earnings for the calendar year. This tax form supplies you with some of the most important information you'll need when you fill out your 1040 including the wages you earned and the taxes your employer withheld.

Why is the 1040EZ gone?

The 1040EZ was eliminated as part of the Tax Cuts and Jobs Act.

What tax form do most people use?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What form do most Americans use to file their taxes?

Form 1040: This is the one the majority of taxpayers will use to report income and determine their tax for the year and any refund or additional tax owed. Form 1040-SR: This version is for senior taxpayers (age 65 and older).

What is the difference between a 1040 1040A and 1040EZ?

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

How much does it cost to file a 1040A?

Your taxable income must be less than $100,000 to use the 1040A.

How do I know which tax forms I need?

The others are IRS forms that you might need to fill out as part of preparing your tax return.Form 1040 and Form 1040-SR. ... Schedule A: For itemizing. ... Schedule B: Reporting interest and dividends. ... Schedule C: For freelancers or small business. ... Schedule D: Capital gains. ... The W-2: Income from a job.More items...•

Which condition disqualifies a person from using Form 1040 EZ?

Having one or more of the following items means you cannot File Tax Form 1040EZ: A filing status of head of household, qualifying widow(er) with dependent child, or married filing separately. Over age 65 or blind at the end of the year.

What is the most advantageous filing status?

Generally, the married filing jointly filing status is more tax beneficial. You can choose married filing separately if you are married and want to be responsible only for your own tax liability and not your spouse's liability.

Who typically files form 1040EZ?

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Simply select your tax filing status and enter a few other details to estimate your total taxes.

Is there a 1040ez form for 2022?

Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Does the IRS destroy old tax returns?

Unfortunately, a recent report by the IRS watchdog, the Treasury Inspector General for Tax Administration (TIGTA), tells us the IRS destroyed an estimated 30 million paper-filed tax documents without processing them.

Where can I get a 1040 Easy form?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS).Download them from IRS.gov.Order by phone at 1-800-TAX-FORM (1-800-829-3676)

What forms do I need for a simple tax return?

Related ItemsSchedules for Form 1040 and Form 1040-SR.About Publication 17, Your Federal Income Tax (For Individuals)About Form 1040-ES, Estimated Tax for Individuals.About Form 1040-V, Payment Voucher.About Form 1040-X, Amended U.S. Individual Income Tax Return.About Form 2106, Employee Business Expenses.More items...

What is a basic 1040 tax return?

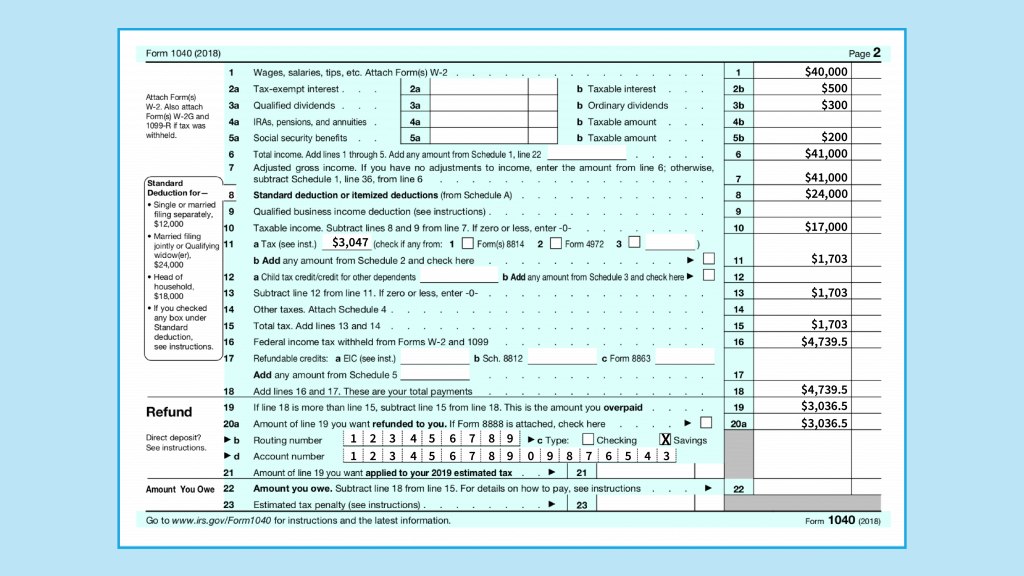

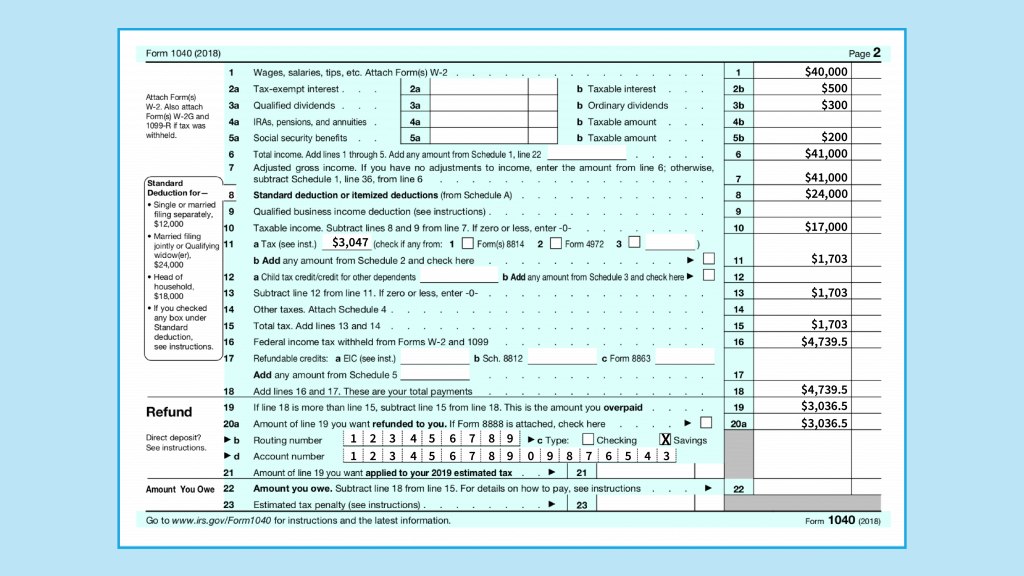

Form 1040. The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Is it better to file a 1040 or a 1040sr?

Since these forms are virtually identical in function, the main reason to use Form 1040-SR is if you're filling out your tax return by hand rather than online. Form 1040-SR has larger type and larger boxes to write numbers in, making it slightly easier for seniors to read and fill out.

Which is easier to fill out, 1040-EZ or 1040-A?

Form 1040-EZ is, not surprisingly, the easiest to fill out. 1040-A is longer and a bit more complex, and Form 1040 is the most detailed and challenging of the lot. While anyone can file Form 1040, you must meet certain requirements to use the shorter 1040-EZ or 1040-A forms. Here’s a quick rundown to help you choose the correct form ...

What are the requirements for a 1040?

This is the most complex of the forms for individual tax filers—it was simplified, starting in 2018—but it also gives you the most options for claiming deductions and credits. You should file Form 1040 if: 1 Your taxable income is greater than $100,000 2 You itemize deductions 3 You receive income from the sale of property 4 You have certain types of income, including that from unreported tips, self-employment, certain non-taxable distributions, a partnership or S corporation, or if you’re a beneficiary of an estate or trust 5 You owe taxes for the use of a household employee 6

What is the shortest 1040 form?

IRS Form 1040-EZ was the shortest of the 1040 forms and the easiest to fill out. You could take the standard deduction, but you wouldn't be able to itemize deductions, claim adjustments to income (such as contributions to an IRA) or claim any tax credits except for the Earned Income Tax Credit ...

What is the only form you can use for 2018 taxes?

And starting with tax year 2018, 1040 is the only form you can use unless you qualify for the seniors form, 1040-SR. This is the most complex of the forms for individual tax filers—it was simplified, starting in 2018—but it also gives you the most options for claiming deductions and credits. You should file Form 1040 if:

What are the only adjustments to income?

Your only adjustments to income are deductions for an IRA, student loan interest, educator expenses, and tuition and fees

Is 1040-A the same as 1040-EZ?

Still, it was limited in terms of allowable deductions and credits compared to the standard 1040. If you couldn't use Form 1040-EZ—for example, because you had dependents to claim—you would have been able to use 1040A if:

Can you itemize deductions on stock options?

You don’t itemize deductions. You didn’t have an alternative minimum tax (AMT) adjustment on stock you acquired by exercising a stock option. Your only adjustments to income are deductions for an IRA, student loan interest, educator expenses, and tuition and fees.

What is Form 1040?

The Form 1040 is the general form that individuals use to report their income back to the IRS. As touched on above, there are a few variations to the 1040 form.

Who qualifies for Form 1040A?

The Form 1040A is only slightly lengthier, but it is still intended to be relatively simple. Form 1040A allows you to claim more deductions and credits It also permits you to include more types of income than you can on Form 1040EZ.

What is the most complex form to file?

The main form filers use is called the Internal Revenue Service (IRS) Form 1040, U.S. Individual Income Tax Return. Anyone is eligible to file Form 1040, however, it is the most complex. Fortunately, for individuals who have a simple tax situation, there are two variations of Form 1040 – Form 1040EZ and Form 1040A.

What is a 1040EZ?

As you may have guessed from the name, Form 1040EZ is the simplified version of the original 1040 tax form. While it may be the least complex, it has the most restrictive qualifications. In order to file Form 1040EZ, people must meet all of the following qualifications, as outlined by the IRS: Your filing status is single or married filing jointly.

What is the benefit of filling out a 1040?

Depending on your tax situation, the full Form 1040 allows you to claim all of your desired credits and deductions. . Luckily, no matter what form you need to fill out, TaxAct helps make filing your taxes as easy as possible.

What deductions can you claim on your taxes?

The only adjustments to income you can claim are the IRA deduction, the student loan interest deduction, the tuition and fees deduction, and the educator expenses deduction.

Can you have an alternative minimum tax adjustment on stock you acquired from an incentive stock option?

You didn’t have an alternative minimum tax adjustment on stock you acquired from the exercise of an incentive stock option. While Form 1040A is simpler than the standard 1040 form, it still may not be advantageous to you.

What Is Form 1040?

Form 1040 is the basic IRS form needed to file taxes, the form in which your taxable income for the year is calculated . In addition to basic information (name, filing status, Social Security number, dependents) the 1040 form has room for your wages and salary as well as other forms of income, such as:

What are the three Schedules that can be added to a 1040?

The three main schedules that let you add new information to Form 1040 are: Schedule 1. Schedule 1 lets you add additional sources of or adjustments to income that aren't on Form 1040. Income sources on Schedule 1 include taxable refunds, alimony received, unemployment, business income and rental real estate.

What is a 1040EZ?

Prior to the 2018 tax season, the 1040A and 1040EZ were options in lieu of 1040 for those with less than $100,000 of taxable income and fewer specifics to deal with. They were each much shorter than the 1040.

How many schedules are on a 1040?

Part of this revamped 1040 form included six different "Schedules" last year that can be attached to the initial 1040 to provide the additional necessary information. This year, they have been pared down to three schedules with certain information that had been on 2018 schedules (like capital gains or losses) now either on the initial 1040 form or merged into the three remaining schedules.

What are the items that can be itemized deductions?

Expenses that can qualify as itemized deductions include mortgage interest, investment interest and medical expenses. If you are eligible for tax credits, like the Child Tax Credit, the 1040 form is also where you would claim those.

What is Schedule 2?

The Schedule 2 form is included if the taxpayer owes additional taxes like the Alternative Minimum Tax (AMT), self-employment tax, household employment taxes and unreported Social Security or Medicare taxes. Schedule 2 also factors in if the taxpayer has to make an excess advance premium tax credit repayment.

What is covered by Form 1040?

Something like the child tax credit is covered in Form 1040, as are refundable tax credits, but the foreign tax credit, education credit, residential energy credit, retirement savings contribution credit and general business credit can be claimed with this schedule.

What is IRS 1040A?

IRS1040A is a simplified version of the IRS 1040 form to report individual income tax and is unofficially referred to as the short form.

What is the Difference Between IRS1040, 1040A and 1040EZ?

IRS 1040 is a detailed form of the Internal Revenue Service (IRS) that taxpayers use to file their annual income tax returns.

What is the shortest form to fill out?

IRS 1040EZ is the shortest form that can be used to file taxes and is quite straightforward and easy to fill. All three forms require general information such as the name, address and Social Security Number (SSN) of the taxpayer.

Which is the most detailed form?

IRS 1040 is the most detailed and thus, is complex in nature compared to the other two forms. IRS 10 40A is a shorter version of IRS 1040. IRS 1040 EZ is the form that requires minimum details out of the three forms.

What is Dili's degree?

Dili has a professional qualification in Management and Financial Accounting. She has also completed her Master’s degree in Business administration. Her areas of interests include Research Methods, Marketing, Management Accounting and Financial Accounting, Fashion and Travel.

Who fills out the IRS 1040EZ?

IRS1040EZ should be filled by taxpayers who earn an income or joint income below $50,000.

Is adjustment to net income available in IRA?

Adjustment to net income is only available in the form of educational loans or IRA ( Individual Retirement Account) adjustments

What is the simplest form to file taxes?

Form 1040EZ is the simplest of the three tax forms you can use to file your federal income taxes. If your taxable income is less than $100,000, you don’t claim any dependents and you file as single or are married filing jointly, then you may be eligible to file Form 1040EZ.

What form do you file if you have alimony?

If you have income from sources other than these, such as alimony or dividends, then you will have to file your taxes on either Form 1040 or Form 1040A. Form 1040 A is used when you have dependents and/or if you have more complicated items in your tax return.

When to use 1040A?

Form 1040 A is used when you have dependents and/or if you have more complicated items in your tax return. • You can also use Form 1040A if you received dependent care benefits or if you owe tax from the recapture of an education credit or the alternative minimum tax.

When will the IRS accept 1040EZ?

If you are just wanting to change to a 1040EZ because you heard you can e-file a 1040EZ already--the IRS will not be accepting returns until January 29. So even if you manage to e-file a return, all it will do is sit on a server until January 29. You will not get your refund faster.

What Is Form 1040A?

Another option for taxpayers prior to the new tax law was form 1040A, which was easier than the 1040 but covered more information than the 1040EZ. Just as the difference between 1040 and 1040EZ was that the 1040EZ was shorter, the 1040A was different because it struck a compromise between the two. The 1040A has gone by the wayside as well, since you’ll simply use the appropriate schedules to capture the extra information if you need to claim certain tax credits but you don’t have any need to itemize your deductions. Since the standard deduction has now increased to $12,000 for individual taxpayers and $24,000 for married couples filing jointly, you may find that even if you itemized in the past, you now won’t need to, which could push you back toward fitting all of your information on the short form and maybe one or two schedules.

What is a 1040?

A 1040 is the main form used by U.S. taxpayers to report their income and taxes paid throughout the year. Prior to the 2019 filing season, taxpayers had the option of a 1040 vs 1040EZ. The 1040 was nicknamed “the long form,” since the 1040EZ was much shorter and simpler. With the shorter version, though, you didn’t have the option of claiming credits for your dependents and your taxable income had to be less than $100,000.

What is the difference between 1040 and 1040EZ?

Starting with the 2019 filing season, though, the difference between 1040 and 1040EZ is no longer relevant. The new tax law promises a shorter, simpler version of the 1040 that will fit on a two-sided postcard. However, there are complications with this new tax form in that most of the information that was on the original 1040 has been transferred to schedules, which are numbered 1 through 6. This means if your information can be covered fully in lines 1 through 23 of the 1040, you’ll be able to skip the schedules and simply complete a form that’s the size of a double-sided postcard.

Who is Stephanie Faris?

Stephanie Faris has written about finance for entrepreneurs and marketing firms since 2013. She spent nearly a year as a ghostwriter for a credit card processing service and has ghostwritten about finance for numerous marketing firms and entrepreneurs. Her work has appeared on The Motley Fool, MoneyGeek, Ecommerce Insiders, GoBankingRates, and ThriveBy30.