What are the most common types of foreclosure?

Types of Foreclosures in the U.S

- Judicial Sale. What are the types of foreclosures? ...

- Non-judicial sale. Another popular type of foreclosure is called foreclosure by power of sale or non-judicial sale. ...

- Other types of Foreclosure. Meanwhile, other types of foreclosure are accepted only in selected states. ...

- Act Quickly. ...

What are the different types of property deeds?

What Types of Deeds Are There?

- General Warranty Deed. The “covenant of seisin” is the grantor’s promise that they own the property and that they have the legal right to transfer the property.

- Special Warranty Deed. ...

- Quitclaim Deed. ...

- Special Purpose Deeds. ...

- Beneficiary Deeds/”Transfer on Death” Deeds. ...

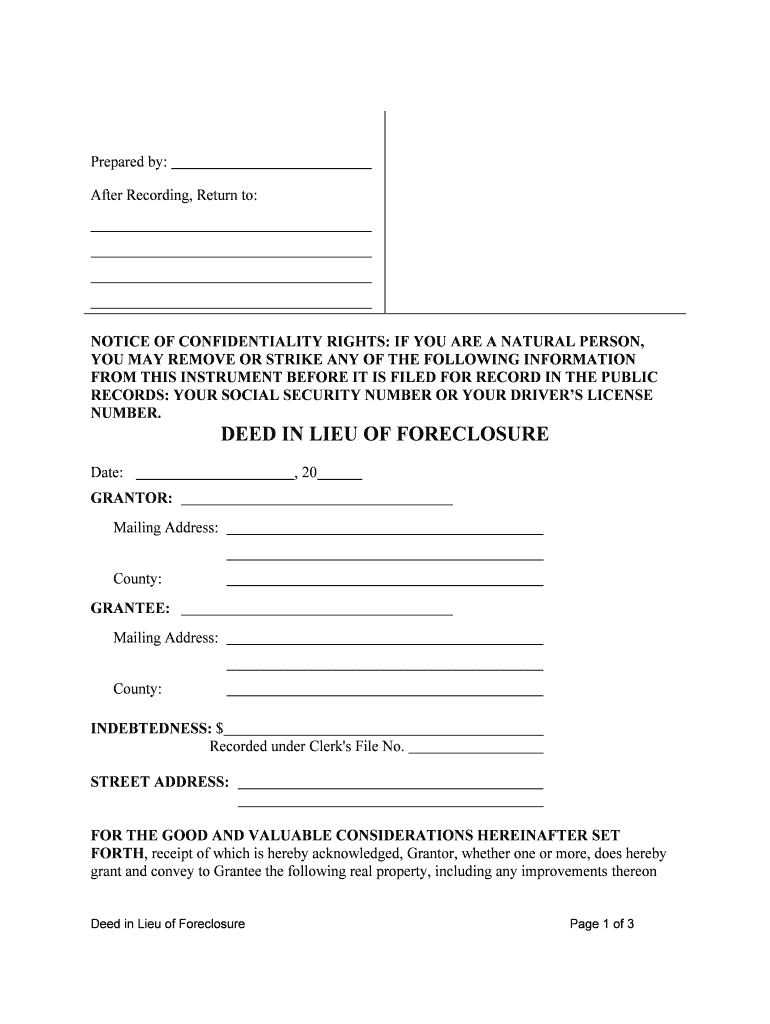

Is it possible to do deed in lieu of foreclos?

Several repayment options exist; however, if the loan balance exceeds the current property value of the home when repayment is due, the borrower or heirs may opt to sign a deed in lieu of foreclosure. A deed in lieu (DIL) signs the property back to the lender to avoid foreclosure.

What are the steps in deed in lieu of foreclosure?

Step 1: Lender or borrower in default offers deed in lieu of foreclosure option. Either party may propose a deed in lieu, though often, it’s the borrower who initiates it. In this case, the lender may require title status information and evidence of financial hardship before considering or accepting a deed in lieu arrangement.

Which type of deed is used in foreclosures quizlet?

Sheriff's Deed (Deed in foreclosure).

What type of deed is best for the seller?

general warranty deedA general warranty deed is the most common. Most home sales between strangers involve a general warranty deed. With it, the seller warrants that he has good title from the people who owned it before him, and he has the right to pass on good title to the buyer.

What is meant by deed in lieu of foreclosure?

A deed-in-lieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. A deed-in-lieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

What's a referee's deed?

Referee's Deed: Used in judicial foreclosures to transfer ownership of the foreclosed property to the. person who bids the highest amount of money at a foreclosure auction. Executor's Deed: Used by the executor of a will, either for selling a house or distributing it to heirs.

What type of deed is most commonly used?

General warranty deedGeneral warranty deed: A general warranty deed is the most common type of deed used to transfer fee simple ownership of a property. Unlike a quitclaim deed, a general warranty deed does confirm a grantor's ownership and a legal right to sell.

What are the types of deed?

A conveyance deed is a legal instrument that transfers ownership of property from one person to another as a gift, an exchange, a lease, or a mortgage, among other things. A conveyance deed can also be referred to as a gift deed, mortgage deed, lease deed, or sale deed.

Which is better foreclosure or deed in lieu?

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

How is a deed in lieu of foreclosure reported on credit?

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

What are foreclosure alternatives?

Probably the most common alternative to a foreclosure is a mortgage loan modification. This is a permanent solution for a homeowner who is unable to keep up with monthly payments.

What is a referee's deed New York?

A referee's report of sale for use in a residential or commercial foreclosure action in New York. When the court-appointed referee auctions foreclosed real property, the referee provides the court with an accounting of the costs and expenses of the sale.

How much do probate referees make in California?

For any appraisal required by statute, Probate Referee fees are 1/10th of 1% (. 001) of the total assets listed on Attachment 2.

Who benefits the most from a warranty deed?

The buyerThe buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

What type of deed transfers title from the seller to the buyer quizlet?

A quitclaim deed. NOTE: the standard real estate sales contract calls for the seller to deliver marketable title to the buyer at closing by way of a general warranty deed. In a real estate sale, the transfer tax stamps are generally paid for by the: escrow agent.

Which type of deed provides the greatest amount of protection?

The general warranty deed provides the buyer with the greatest protection. A bargain and sale deed carries no warranties against liens or other encumbrances, but assures that the grantor has the right to sell or convey the property. The quitclaim deed provides the buyer with the least amount of protection.

Which deed provides the greatest protection?

Although many types of deeds exist, title is usually transferred by a warranty deed. A warranty deed provides the greatest protection to the purchaser because the grantor (seller) pledges or warrants that she legally owns the property and that there are no outstanding liens, mortgages, or other encumbrances against it.

How does a lender foreclose on a loan?

The lender seeks to foreclose by filing a civil lawsuit against the borrower and serving the borrower with a formal summons and foreclosure complaint. The foreclosure process is handled through the local court system.

Who has the authority to initiate foreclosure proceedings?

The trustee has the authority to initiate foreclosure proceedings by virtue of a power of sale clause included in the mortgage or deed of trust. The trustee records a Notice of Default (NOD) with the county clerk where the property is located.

What is NFS in foreclosure?

The Notice of Foreclosure Sale (NFS), which announces date, time and place of the auction, is published and sometimes posted (depending on the locale) for a certain period of time prior to auction. Generally, the borrower can stop the foreclosure by repaying what he owes up to the moment of sale.

How long does it take to get a foreclosure?

It can take up to 12 months to complete a foreclosure, depending upon the state. It is important to remember that neither judicial nor nonjudicial foreclosures are one-size-fits-all. Each state follows its own established foreclosure laws and procedures.

Can a borrower stop foreclosure?

The borrower may not stop the foreclosure after the expiration of this time period. Following the expiration of a predetermined amount of time (which varies from state to state), the trustee records a Notice of Trustee’s Sale (NTS) with the county clerk.

Is foreclosure judicial or nonjudicial?

In the United States, individual states follow either a judicial or nonjudicial foreclosure process, typically depending upon whether they are a mortgage state or deed of trust state. However, you may safely assume that all states allow some form of judicial foreclosure process.

What type of deed is used to transfer a property?

5. Bargain and Sale Deed. This type of real estate deed is used in the sale or transfer of residential real estate; however, it offers no guarantee that the property is free of debts or liens. It only states that the grantor is the title-holder, and little else.

What is mortgage deed?

A mortgage deed is a document signed between a homeowner and a bank or lending institution, allowing said institution to put a lien on the property if the loan isn’t repaid. This deed secures property as collateral for a loan — meaning a “mortgage payment” is paid towards a loan debt, with the house serving as security in the event of a default.

What is a deed of trust?

2. Deed of Trust. A deed of trust transfers the title of an asset from a trustor to the trustee for the benefit of a third party, known as the beneficiary. Most often, a deed of trust is used instead of a mortgage, acting as security against a loan that a trustor has transferred to a trustee.

What is a quit claim deed?

1. Quitclaim Deed. A quitclaim deed is used to transfer property between familiar parties, such as family members or even divorced spouses. That’s because unlike other types of deeds, a quitclaim deed offers little legal protection to the grantee (the recipient of the transfer).

What is a warranty deed?

Typically used in residential real estate transactions, a general warranty deed guarantees that the seller has the full legal right to sell the property, and that the property is completely free and clear of debts, liens, or other encumbrances.

What is a deed in 2020?

Published January 21, 2020 | Written by Mollie Moric. A deed is a legal document used to transfer ownership of property from one party to another. There are different types of deeds, and each serves a specific legal purpose depending on the known and unknown history of the property, the existence of a lien, and/or other encumbrance like a mortgage. ...

What is a guarantee of property?

Guarantee that the property was not somehow encumbered during the time when the grantor had ownership.

What Are Deeds?

Deeds are legal documents which people use to transfer the title of a property from one party to another. They must be made in writing. In order for courts to consider deeds as legally binding, people must register them as a matter of public record. People usually record them at local assessor’s office in the county where the property is located.

How does a deed work?

The deed is the tool people use to transfer the title of real property. There are a variety of types deeds that are legal in each state. In order for the courts to recognize their validity, they must be in writing and publicly recorded. The recordation is typically done in the county recorder’s office in the county where the property is located. If you have decided on the type of deed that you need and have the necessary property information, contact us and we can prepare it for you.

What is a warranty deed?

General warranty deeds offer the strongest protection for the grantee. This type of deed offers several warranties made by the grantor on behalf of the grantee. The first warranty is that the grantor holds the title in good standing when the transfer is made. The guarantee of a clear title remains after the property is transferred to the grantee. Another warranty made by the grantor is the freedom from encumbrances except those explicitly stated in the deed. General warranty deeds also usually include a third guarantee that the grantor will defend the right of possession to the grantee above all others. Claims arising during or prior to the grantor’s ownership are covered by a general warranty deed.

What is a bargain and sale deed?

A bargain and sale deed with covenants makes a single warranty that the grantor has not committed any act which would encumber the title of the property. In all other ways, a bargain and sale deed with covenants is the same as a traditional bargain and sale deed.

What is a gift deed?

A gift deed is a deed which allows a property to be transferred without any money changing hands. In this case, the grantor and grantee of the deed are referred to as the donor and donee. Donors must be legally solvent in order to make a gift of property.

What is a quitclaim deed?

Quitclaim deeds allow a person to relinquish their interest in a property without explicitly naming their interest. It does so without making any warranties about their interest or rights while they owned the property. Quitclaim deeds are most frequently used to transfer property between family members.

What is an easement deed?

The easement deed is a written agreement which specifies what part of the land may be used and how it may be used. An easement deed does not convey any rights of ownership to the grantee.

What is a deed to a house?

What is the deed to a house? A house deed is a written document showing who owns the property. It legally indicates the transfer of the original property owner to you, the new property owner. What most homeowners do not know — there are many types of deeds, and their levels of protection vary.

What is a deed given to the successful bidder at an execution sale?

These types of deeds include: sheriff’s deed - given to the successful bidder at an execution sale. tax deed - when a property is sold for delinquent taxes. executor’s deed - when someone passes away but has a will. Administrator’s deed - when someone passes away but does not have a will.

How does the property deed differ from a deed of trust?

While the property deed conveys ownership, the deed of trust does not. The holder of the deed of trust is an accredited third party who holds the property until the loan is repaid.

What is a general warranty deed?

When committing to a general warranty deed, the seller is promising there are no liens against the property, and if there were, the seller would compensate the buyer for those claims. Mainly for this reason, general warranty deeds are the most commonly used type of deed in real estate sales.

What is property ownership?

Property ownership is transferred from the seller to the buyer with certain guarantees against future claims or problems. These guarantees live in the form of written deeds, and they can include:

What does it mean to have a deed in your name?

Having a property deed in your name shows you hold legal ownership, and that comes with protections — though the level of protection can vary based on the type of deed you choose. Let’s take a look at what property deeds are, what options you have, and how you’re protected as a homeowner.

Why is it important to have a deed in your name?

Having a property deed in your name shows you hold legal ownership, and that comes with protections — though the level of protection can vary based on the type of deed you choose.

First, Note the Main Types of Foreclosure

Banks open the foreclose process in two different ways, usually depending on whether the homeowner holds a mortgage or a deed of trust. To confirm, ask an official at your county courthouse which foreclosure process is followed in your area.

Buying an REO House Means the Bank Is the Seller

What if no one makes the minimum bid at the auction? Then the bank buys the house back. The property now has a real estate owned (REO) title. REO properties also include those homes returned to banks that have accepted deeds in lieu of foreclosure.

Successful Foreclosure Purchases Rely on Thorough Inspections

Water and electricity could be shut off, so you might not be inspecting every element, but as far as possible, the home will need to be examined.

Government-Backed Mortgages Are Available for Buying Foreclosed Homes

You can get a conventional mortgage to buy a bank-owned home. Alternatively, for slightly higher interest rates, a government-backed mortgage could do the job. Here are some federal perks to know about:

Taking the Plunge? Here Are a Few Final Words to the Wise

If you’re a first-time buyer, you’re embarking on a new adventure already. A low-maintenance home probably makes the most sense. After all, when seasoned investors buy foreclosures, they can afford some built-in risk.