What is real business cycle model?

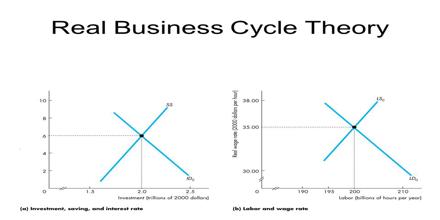

Real business cycle theory is the latest incarnation of the classical view of economic fluctuations. It assumes that there are large random fluctuations in the rate of technological change. In response to these fluctuations, individuals rationally alter their levels of labor supply and consumption.

What is the source of real business cycle?

Abstract: Real business cycles are recurrent fluctuations in an economy's incomes, prod- ucts, and factor inputs—especially labor—that are due to nonmonetary sources. These sources include changes in technology, tax rates and government spending, tastes, govern- ment regulation, terms of trade, and energy prices.

What would real business cycle theorists say?

Real business cycle models state that macroeconomic fluctuations in the economy can be largely explained by technological shocks and changes in productivity. These changes in technological growth affect the decisions of firms on investment and workers (labour supply).

What are the assumptions of real business cycle theory?

The real business cycle theory assumes than wages and prices are flexible. They adjust quickly to clear the markets. There are no market imperfections. It is the “invisible hand” that clears the market and leads to an optimal allocation of resources in the economy.

How is the real business cycle theory different from the Keynesian school of thought?

Keynesian theory explains the reduction in welfare by a failure in economic coordination: because wages and prices do not adjust instantaneously to equate supply and demand in all markets, some gains from trade go unrealized in a recession. In contrast, real business cycle theory allows no unrealized gains from trade.

What is the real business cycle theory of unemployment?

Real-business-cycle theory uses the inter-temporal substitution of labour to explain why employment and output fluctuate. Shocks to the economy that cause the interest rate to rise or the wage rate to be temporarily high cause people to want to work more—which raises employment and output.

What are the main criticisms of the real business cycle?

Criticisms of Real Business Cycle Theory: First, the RBC theory stresses more on supply-side variables than on demand side variables. Second, the RBC theory assumes that output is always at its natural level. The theory does not make room for stickiness of wages and prices.

What is life cycle hypothesis theory of Franco Modigliani?

The theory states that individuals seek to smooth consumption throughout their lifetime by borrowing when their income is low and saving when their income is high. The concept was developed by economists Franco Modigliani and his student Richard Brumberg in the early 1950s.

What are the 4 phases of business cycle?

An economic cycle is the overall state of the economy as it goes through four stages in a cyclical pattern. The four stages of the cycle are expansion, peak, contraction, and trough. Factors such as GDP, interest rates, total employment, and consumer spending, can help determine the current stage of the economic cycle.

What are the main criticisms of the real business cycle?

Criticisms of Real Business Cycle Theory: First, the RBC theory stresses more on supply-side variables than on demand side variables. Second, the RBC theory assumes that output is always at its natural level. The theory does not make room for stickiness of wages and prices.

What are the types of business cycle?

There are two types of business cycle: The classical cycle refers to rises and falls in total production. The growth cycle is concerned with fluctuations in the growth rate of production.

What are the 4 stages of the business cycle with diagram?

business cycle, the series of changes in economic activity, has four stages—expansion, peak, contraction, and trough. Expansion is a period of economic growth: GDP increases, unemployment declines, and prices rise. The peak marks the end of an expansion and the beginning of the next stage, the contraction.

Who developed the real business cycle theory?

It is the outcome of research mainly by Kydland and Prescott, Barro and King, Long and Plosser, and Prescott. Later, Plosser, Summers, Mankiw and many other economists gave their views of the real business cycles.

What is recession in business theory?

A recession in the real business theory is just the reverse of the expansion. A shock of decline in-technology reduces Z and shifts the production function downward and decreases the available resources. This starts a process of decline in investment, consumption, output and employment.

What is the role of technological shocks in business?

Role of Technological Shocks: The theory of real business cycles explains short-run economic fluctuations based on the assumptions of the classical theory. According to this theory, business cycles are the natural and efficient response of the economy to economic environment.

What causes a shock in the form of a technological advance?

They are primarily caused by real or supply side shocks that involve exogenous large random changes in technology. An initial shock in the form of a technological advance shifts the production function upward. This leads to increase in available resources, investment, consumption and real output.

What happens to investment in the long run?

In the long run, there is a gradual decline in investment and consumption even when output continues to increase at a decreasing rate till the economy reaches the new steady state. The paths of this real business cycle are illustrated in Figure 2.

What is the role of real interest rate in response to a technological shock?

The real business cycle theory also takes into account the role of real interest rate in response to a technological shock. The real interest is equal to the marginal product of capital. When a favourable technological change leads to a boom, the marginal product of capital and the real interest rate rise.

Is the existence of large technological shocks an unjustified assumption of real business cycle theory?

According to them, technological shocks leading to changes in total factor productivity are hard to find. There is also no direct evidence of the existence of large technological shocks. Therefore, the existence of large changes in technology is an unjustified assumption of real business cycle theory. 2.

Who developed the economic cycle?

In the 19 th century, French economist and physician Clement Juglar articulated the idea of economic cycles where he identified economic trends that eventually developed business cycle theory. He found that he could recognise the trends in investment and unemployment within an economic cycle between seven and eleven years. Juglar further analysed this phenomenon over three periods of prosperity, crises, and liquidation.

What is the real business cycle?

The real business cycle, also known as the boom-and-bust cycle, is a term that illustrates how an economy evolves over time. The real business cycle shows that macroeconomic fluctuations within an economy can be described by technological shocks and changes in productivity. The change in growth affects the decision making of firms on investment. In RBC theory, business cycles are created by agents responding optimally to real shocks. These fluctuations could be changes in productivity growth or fluctuations in government spending and imports. However, the theory has pragmatic flaws, such as the fact that the model is accelerated by sudden changes in available technology which may not seem very realistic. RBC theory assumes that macroeconomic outcomes stem from individual microeconomic decisions and that individuals are seen as rational, seeking to maximise utility.

What is Hayek's theory of overinvestment?

Furthermore, Hayek’s Monetary version of over-investment theory suggests that business cycles are caused by fluctuations in investment. For example, as there is lower demand for bank credit in times of recession, the money rate of interest decreases under the natural rate. Then, it will lead to businesses being able to borrow funds, encouraging them to invest more. Thus, an increase in investment and income leads to greater production of consumer goods. Hence, the production of consumer goods rises, leading to an expansion in the business cycle.

What is the Sunspot theory?

He suggested that sunspots affected the weather on the earth and that past economies were dependent on agriculture. As a result, weather cycles may impact agricultural output, which can lead to uncertainty within an economy. In reality, some economies are not as heavily dependent on the agricultural industry as others.

Who wrote the book "Measuring Business Cycles"?

In their book, Measuring Business Cycles, Arthur Burns and Wesley Mitchell described ‘Business cycles are a type of fluctuation found in the aggregate economic activity of nations’ (Measuring Business Cycles, 1946). Thus, it was given the name the ‘business cycle’. Now that we understand what the Business Cycle is, we can consider how it is caused.

Do economists agree on the root cause of the real business cycle?

Ultimately, economists do not yet agree on the root cause of the real business cycle. Despite its importance within macroeconomics, I believe I have shown that in order to fully understand the nature of business cycles, micro-foundations will have to be clarified and weighed up.

Why do firms have cycles?

For industries featuring strong competition, some argue that gamelike competitive behaviors of firms may cause cycles of the industries ( Dearden et al., 1999 ). Firms may simultaneously engage in capacity addition or deletion activities, for reasons such as strategic preemption or ‘herd’ behavior; thus the industry as a whole is likely to end up with excess or insufficient capacity. The succeeding overcapacity or undercapacity behaviors lead to cycles in other market dynamics such as price and sales.

How does a system dynamics model drive the manufacturing cycle?

For manufacturing industries, especially those producing durable goods, a profound mechanism in driving the cycles is associated with the time lag of capacity building in response to demand from downstream industries. From a system dynamics perspective, a substantial time delay in feedback loops consisting of processes of information collection, decision making, and action is largely responsible for industry cycles; and the swings tend to amplify when moving up along the supply chain from downstream to upstream industries ( Sterman, 2000 ). For example, based on an analysis of the feedback structure of the commercial jet aircraft industry involving time lags between travel demand, order backlog, airline capacity, fares, and manufacturer production capacity, Lyneis (2000) established a system dynamics model to forecast the cycles in orders for aircraft, and found that the model describes historical cycles well.

What is needed in Hayek's theory?

What is needed, Hayek argued, is a theory that accounts for “the unavoidable imperfections of man's knowledge and the consequent need for a process by which knowledge is constantly communicated and acquired” ( 1948: p. 91). He called on his colleagues in the economics profession to turn their attention from the formal statements of equilibrium analysis to empirical “propositions about what happens in the real world” ( 1948: p. 46), propositions about how knowledge is actually acquired and communicated. Whereas his call did not find much response in the profession for a long time, in his own work Hayek himself pursued the research agenda that he had suggested. He specifically addressed the issue of how we acquire knowledge in his work The Sensory Order – An Inquiry into the Foundations of Theoretical Psychology ( 1952a ), a most unlikely book for an economist and one of his least known works. However, it is, of great systematic significance for his entire work. In this book – which was in fact based on an early unpublished manuscript from Hayek's student days ( Hayek, 2006 [1920]) – Hayek developed a theory of the human mind, the essence of which, as has been recognized by renowned experts in the field (e.g., Fuster, 1995: pp. 87ff.), is in amazing accord with modern cognitive and neurological science. Seeking to explain how the human mind establishes its connections “between the input of (external and internal) stimuli and the output of action” ( 1982: p. 288), Hayek interpreted the working of the mind as an adaptive process of constant classification and reclassification on many levels (sensory perceptions, emotions, concepts), a process in which conjectural internal models of the outside world are adaptively formed and guide actions.

Why did Basel II fail?

Inadequate capital regulation provided by Basel II is often cited as a reason for Basel II’s failure. Large international banks were able to systematically manipulate outcomes in Basel II’s regulatory process to their advantage. For banks, holding regulatory capital comes at a cost. The tied-up funds could be put into more profitable use, such as lending to prospective borrowers.

What is Hayek's view on equilibrium?

In Hayek's view, the models of mathematical equilibrium economics provide only a pseudo-answer to the question that they are meant to illuminate, namely, how markets work. As he put it, with the “assumption of a perfect market where every event becomes known instantaneously to every member” ( 1948: p. 45), formal equilibrium analysis begs the very question that an empirically meaningful theory of market processes would have to answer, namely how “a solution is produced by the interaction of people each of whom possesses only partial knowledge” ( 1948: p. 91). Ironically, the failure committed in concepts of central planning is of a very similar kind. By assuming perfect knowledge on part of the planners, advocates of central planning provide only a pseudo-answer to the practical problem of how effective coordination of economic activities can be achieved in the absence of markets. The assumption that all relevant knowledge is available to, and can be administered by, a planning agency, raises the question of how such an agency is supposed to come to terms with the fact that much of the relevant knowledge “never exists in concentrated or integrated form, but solely as the dispersed bits of incomplete … knowledge which all the separate individuals possess” ( 1948: p. 77), i.e. knowledge that can be activated only by these very individuals.

How are sales and price cycles influenced by technology?

For high-technology industries, sales and price cycles are strongly influenced by technological changes in the industry. It is well-known that technological changes usually occur at an uneven pace, with radical and slow innovations being introduced alternately, a notion that goes back to Schumpeter (1939). In particular, Anderson and Tushman (1990) argue that sales of the industry tend to peak after a ‘dominant design’ has emerged because uncertainties associated with competing design paths are diminished. An examination of the cyclical dynamics in sales of the global semiconductor industry against the introductions of generations of integrated circuit technology seems to support the argument ( Tan and Mathews, 2010a ).

What are the drivers of cyclical industrial dynamics?

In searching the drivers of cyclical industrial dynamics, researchers naturally look into existing theories for business cycles. Early theorists tended to attribute the business cycle s to exogenous factors such as the periodicity of sunspots or movement of the planet Venus. Later economists, including Adam Smith, believed that business cycles arose as a result of the self-correcting mechanism of the economy. Contemporary work explains business cycles in terms of the role of governments in executing problematic monetary policies, or random technology shocks as proposed by the Real Business Cycle theory. By contrast, the school of thought that sees cycles as being endogenously generated takes inspiration from Joseph A. Schumpeter, who distinguished four types of business cycles and attributed them to different mechanisms, ranging from excessive inventory by firms (for the 3–5 year Kitchin cycle), to lags in fixed investment spending (for the 7–11 year Juglar cycle), fluctuations in infrastructure investments (for the 15–25 year Kuznets cycle), and some long-term factors affecting the human society (for the 45–60 year Kondratieff cycle) (Schumpeter, 1939 ). These are all endogenous mechanisms.

CYCLES AND EQUILIBRIUM

Almost anyone who counted anything in economics in the first three decades of the twentieth century contributed to the debate on the causes of the business cycle. Not surprisingly, there are as many theories as there are economists, each emphasizing different mechanisms capable of explaining how the system could go out of gear.

BIBLIOGRAPHY

Aftalion, Albert. 1913 Les crises périodiques de surproduction. 2 vols. Paris: Marcel Rivi è re.

What is the real business cycle?

Real-business-cycle theory assumes that the economy experiences fluctuations in its ability to turn inputs into outputs, and that these fluctuations in technology cause fluctuations in output and employment. When the available production technology improves, the economy produces more output with the same inputs. Because of inter-temporal substitution of labour, the improved technology also leads to greater employment.

What is Samuelson's trade cycle theory?

Samuelson’s trade cycle theory is based on the interaction between the multiplier process and the accelerator principle. This model concentrates on the real sector of the economy and so excludes monetary variables.

What is the most important assumption in microeconomics?

Most of microeconomic analysis is based on the assumption that prices adjust quickly to equate demand and supply. Advocates of this theory believe that macroeconomists should base the analysis on the same assumption. Critics argue that money wages and prices are inflexible—which explains both the existence of unemployment and monetary non-neutrality. To explain stickiness of prices, they rely on the various new Keynesian theories.

Why can't classical models explain short run economic fluctuations?

Most Economists believe that the classical model cannot explain the short- run economic fluctuations because in this model prices are flexible.

What do theorists believe about the economy?

By contrast, the theorists believe that the government’s ability to stabilise the economy is limited. They view the business cycle as the efficient and natural response of the economy to technological changes. Most models of this theory do not include any market imperfection and believe that the invisible hand guides the economy to an optimal allocation of resources. These two views of economic fluctuations are a source of frequent and heated debate. It is this kind of debate that makes macroeconomics an attractive field of study.

What is the theory of economic fluctuations?

The leading new classical explanation of economic fluctuations is called the theory of real business cycles. According to this analysis, the assumption that have been used for long-run may also apply for short-run study. Most importantly, real-business-cycle theory holds that the economy obeys the classical dichotomy nominal variables are assumed ...

Why do output and employment fall during recessions?

According to this theory, output and employment fall during recessions because the available production technology deteriorates, which reduces output and the incentive to work.

Who studied business cycles?

However, in nineteenth century, many of the classical economists, such as Adam Smith, Miller, and Ricardo, have conducted a study on business cycles. They linked economic activities with the Say’s law, which states that supply creates its own demand. They believed that stability of an economy depends on market forces.

What are the three theories of business cycles?

1. Pure Monetary Theory 2. Monetary Over-Investment Theory 3. Schumpeter’s Theory of Innovation 4. Keynes Theory 5. Samuelson’s Model of Multiplier Accelerator Interaction 6. Hicks’s Theory. A number of theories have been developed by different economists from time to time to understand the concept of business cycles.

How does Hicks explain business cycles?

Hicks explains business cycles by assuming that the economy has reached to Po point of equilibrium path and autonomous investment is the result of innovation. The autonomous investment results in the increase of output.

What is the monetary theory of business cycle?

The monetary theory states that the business cycle is a result of changes in monetary and credit market conditions. Hawtrey, the main supporter of this theory, advocated that business cycles are the continuous phases of inflation and deflation.

How long does investment and consumption lag?

Investment and consumption has a time lag of one year; therefore, the investment function can be expressed a follows:

Which theory of innovation advocates that business innovations are responsible for rapid changes in investment and business fluctuations?

The other theories of business cycles lay emphasis on investment and monetary expansion. The Schumpeter’s theory of innovation advocates that business innovations are responsible for rapid changes in investment and business fluctuations.

Which theory of business cycles is associated with Harrod Domar?

Hicks’s Theory: Hicks has associated business cycles to the growth theory of Harrod-Domar. According to him, business cycles take place simultaneously with economic growth; therefore, business cycles should be explained in association with the growth theory .

Who introduced the business cycle theory?from en.wikipedia.org

The one which currently dominates the academic literature on real business cycle theory was introduced by Finn E. Kydland and Edward C. Prescott in their 1982 work Time to Build And Aggregate Fluctuations.

Who developed the economic cycle?from etonomics.com

In the 19 th century, French economist and physician Clement Juglar articulated the idea of economic cycles where he identified economic trends that eventually developed business cycle theory. He found that he could recognise the trends in investment and unemployment within an economic cycle between seven and eleven years. Juglar further analysed this phenomenon over three periods of prosperity, crises, and liquidation.

What is the RBC theory?from en.wikipedia.org

Real business-cycle theory ( RBC theory) is a class of new classical macroeconomics models in which business-cycle fluctuations are accounted for by real ( in contrast to nominal) shocks . Unlike other leading theories of the business cycle, RBC theory sees business cycle fluctuations as the efficient response to exogenous changes in the real economic environment. That is, the level of national output necessarily maximizes expected utility, and governments should therefore concentrate on long-run structural policy changes and not intervene through discretionary fiscal or monetary policy designed to actively smooth out economic short-term fluctuations.

What is the real business cycle?from etonomics.com

The real business cycle, also known as the boom-and-bust cycle, is a term that illustrates how an economy evolves over time. The real business cycle shows that macroeconomic fluctuations within an economy can be described by technological shocks and changes in productivity. The change in growth affects the decision making of firms on investment. In RBC theory, business cycles are created by agents responding optimally to real shocks. These fluctuations could be changes in productivity growth or fluctuations in government spending and imports. However, the theory has pragmatic flaws, such as the fact that the model is accelerated by sudden changes in available technology which may not seem very realistic. RBC theory assumes that macroeconomic outcomes stem from individual microeconomic decisions and that individuals are seen as rational, seeking to maximise utility.

What is Hayek's theory of overinvestment?from etonomics.com

Furthermore, Hayek’s Monetary version of over-investment theory suggests that business cycles are caused by fluctuations in investment. For example, as there is lower demand for bank credit in times of recession, the money rate of interest decreases under the natural rate. Then, it will lead to businesses being able to borrow funds, encouraging them to invest more. Thus, an increase in investment and income leads to greater production of consumer goods. Hence, the production of consumer goods rises, leading to an expansion in the business cycle.

What is the RBC model?from en.wikipedia.org

Overall, the basic RBC model predicts that given a temporary shock, output, consumption, investment and labor all rise above their long-term trends and hence formulate into a positive deviation. Furthermore, since more investment means more capital is available for the future, a short-lived shock may have an impact in the future. That is, above-trend behavior may persist for some time even after the shock disappears. This capital accumulation is often referred to as an internal "propagation mechanism", since it may increase the persistence of shocks to output.

What is the main assumption of RBC theory?from en.wikipedia.org

The main assumption in RBC theory is that individuals and firms respond optimally over the long run. It follows that business cycles exhibited in an economy are chosen in preference to no business cycles at all. This is not to say that people like to be in a recession. Slumps are preceded by an undesirable productivity shock which constrains the situation. But given these new constraints, people will still achieve the best outcomes possible and markets will react efficiently. So when there is a slump, people are choosing to be in that slump because given the situation, it is the best solution. This suggests laissez-faire (non-intervention) is the best policy of government towards the economy but given the abstract nature of the model, this has been debated.