Key Takeaways

- Form 5329 is required for individuals with retirement plans or education savings accounts who owe an early distribution or another penalty.

- Taxpayers who do not file the form could end up owing more in penalties and taxes.

How to fill out form 5329?

- In forms mode, go to the top of the list and you will see OPEN form and ERRORS.

- Click on open form.

- Wait patiently, May need to click it again and wait

- search box opens up

- Type in 5329 pause,

- the federal will dropdown and show 5329-T, Taxpayer an 5329-S for Spouse.

- Click open form

When do I get form 5329?

You don't receive the 5329; TurboTax creates it for you when you have excess contributions that are carried over to the next year. The HSA end of year value is on form 5498-SA. You may or may not have received this yet, because the HSA plan administrator is not required to send it to you until May 31st.

Who must file Form 5329?

When to File Retirement Plan Tax Form 5329. The IRS requires individuals to complete Form 5329 if they receive a retirement account distribution before the age of 59½. You are required to fill out Form 5329 if you exceed the eligible contributions allowed for an IRA.

What is the purpose of federal tax form 5329?

Form 5329 is the tax form used to calculate possibly IRS penalties from the situations listed above and possibly request a penalty waiver. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form.

When do you receive qualified retirement plan distributions?

What line do you include recapture amount on?

When do you receive your IRA distributions?

When will the 10% tax on early distributions be imposed?

Do you have to file Form 5329 for prior years?

See 2 more

About this website

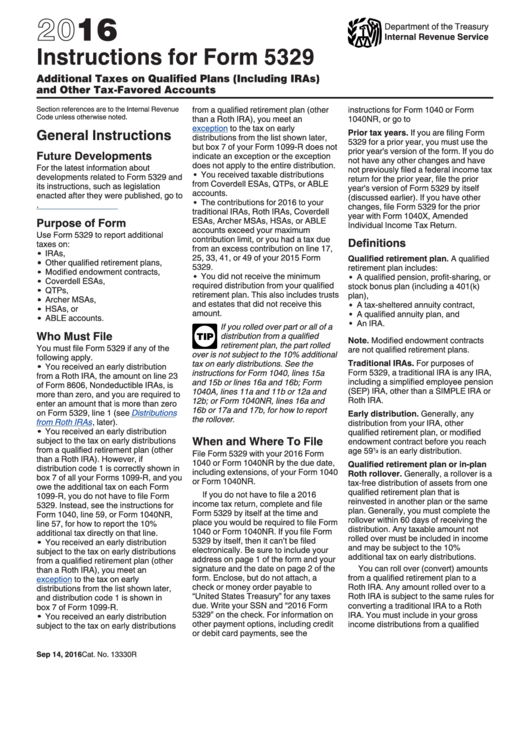

What is the purpose of IRS form 5329?

Use Form 5329 to report additional taxes on IRAs, other qualified retirement plans, modified endowment contracts, Coverdell ESAs, QTPs, Archer MSAs, or HSAs.

What are the exceptions on form 5329?

Form 5329 Exceptions Use the corresponding number to indicate which exception you are claiming: 01 – Distributions from a qualified retirement plan (not an IRA) after reaching age 55 and separating from employment. 02 – Distributions made as part of a series of equal periodic payments, at least annually.

Why is Turbo Tax asking me about form 5329?

Form 5329 is the tax form used to calculate possibly IRS penalties from the situations listed above and possibly request a penalty waiver. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form.

Can I file form 5329 separately?

If both you and your spouse are required to file Form 5329, complete a separate form for each of you.

What is the 5329 penalty?

“If an individual takes money from their retirement account earlier than the age limit and it does not fall within the list of exceptions, then they are liable to face a 10% penalty and must file Form 5329,” Dayan says. This 10% early withdrawal penalty applies on top of any income tax due on the withdrawal.

How do I submit form 5329?

Tips for Filing Tax Form 5329 Tax Form 5329 must be filed in conjunction with Form 1040 or Form 1040NR. All tax forms must be filed by the due date, typically on or about April 15, including extensions. If you do not have to file an income tax return, Form 5329 can be completed and filed on its own.

How do I fill out form 5329 for missed RMD?

Attach a letter of explanation to Form 5329. The letter should include why the RMD was missed, the fact that it has now been taken, and describe the steps taken to ensure that future RMDs will be taken as required.

Where do I mail IRS form 5329?

You can write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001.

What happens if you don't take a required minimum distribution?

What happens if a person does not take a RMD by the required deadline? If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at 50%.

What happens if RMD is not taken in year of death?

The IRS imposes a strict penalty when RMDs are required but not taken by beneficiaries. If you inherit an IRA or 401(k) and fail to take the RMD for the year of the account owner's death, a 50% tax penalty applies. There's an exception if the estate is named as the beneficiary of an IRA.

How do you avoid a RMD penalty?

While the excise penalty will generally apply if you did not withdraw the RMD amount on time, the penalty may be waived if you switch to the five-year rule and withdraw the full balance of the account by Dec. 31 of the fifth year following the year when the retirement account owner died.

Can the penalty for not taking the full RMD be waived?

This penalty can be waived if the taxpayer establishes, to the satisfaction of the IRS, that the shortfall in the amount of distributions was due to reasonable error and that reasonable steps are being taken to remedy the insufficient RMDs.

What are the exceptions to the early withdrawal penalty?

You may be exempted from the IRA early withdrawal penalty if you are withdrawing money to pay qualified medical expenses, pay health insurance if you are unemployed, pay qualified education expenses, fulfill an IRS levy, or because you are disabled and unable to work.

What are the exceptions to the IRS imposed 10% penalty for early withdrawals from a qualified annuity?

The following distributions are not subject to the 10% penalty tax: Death of the IRA owner. Distributions to your designated beneficiaries after your death. Most non-spouse beneficiaries must liquidate the inherited accounts within 10 years.

What are exceptions to IRA early withdrawal penalty?

Generally, early withdrawal from an Individual Retirement Account (IRA) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay your medical insurance premium after a job loss.

What early distribution exception applies?

Code 2. Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn't require using codes 1, 3, or 4.

When to File Retirement Tax Form 5329 | Retirement Living

The IRS requires individuals to complete Form 5329 if they receive a retirement account distribution before the age of 59½. The early distribution penalty is 10 percent of the distributed amount, but some exceptions apply. For example, if a person rolls over part or all of a distribution from a qualified retirement plan, the portion rolled over is not subject to the 10 percent additional tax.

2021 Form 5329

Form 5329 (2021) Page . 2 Part V Additional Tax on Excess Contributions to Coverdell ESAs. Complete this part if the contributions to your Coverdell ESAs for 2021 were more than is allowable or you had an amount on line 33 of your 2020 Form 5329.

About Form 5329, Additional Taxes on Qualified Plans (including IRAs ...

Information about Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts, including recent updates, related forms and instructions on how to file. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond.

How do i file a form 5329? - Intuit

An excess deferral in a 401(k) CANNOT be remedied with a 5329 form. Because you failed to request a return of the excess before April 15 and because it is no longer possible for the 401(k) plan to return the excess, you will have to report that excess as taxable income on the 2019 1040 form line 1 as if it has been returned.

When To Use Form 5329 | H&R Block

Editor’s Note: How much of an early distribution can I take from my IRA without having to pay the 10% penalty?This post explains the answer. Unless you qualify for a retirement-plan early-distribution penalty exception, you must pay the 10% additional tax for IRA amounts you withdrew before age 59 1/2.

What line do you file 5329?

If both you and your spouse are required to file Form 5329, complete a separate form for each of you. Include the combined tax on Schedule 2 (Form 1040), line 6.

When do you receive qualified retirement plan distributions?

Qualified retirement plan distributions (doesn’t apply to IRAs) you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees).

What line do you have to put Roth IRA contributions on?

If you contributed more to your Roth IRA for 2020 than is allowable or you had an amount on line 25 of your 2019 Form 5329 , you may owe this tax. But you may be able to avoid the tax on any 2020 excess contributions (see the instructions for line 23, later).

When do you receive your IRA distributions?

IRA (other than a Roth IRA). You must start receiving distributions from your IRA by April 1, 2020, if you reached age 701/2 before 2020. If you reach age 701/2 after 2019, you can postpone receiving distributions until April 1 of the year following the year in which you reach age 72. See the Note for calendar year 2020 exception, earlier. At that time, you can receive your entire interest in the IRA or begin receiving periodic distributions. If you choose to receive periodic distributions, you must receive a minimum required distribution each year. You can figure the minimum required distribution by dividing the account balance of your IRAs (other than Roth IRAs) on December 31 of the year preceding the distribution by the applicable life expectancy. For applicable life expectancies, see Figuring the Owner's Required Minimum Distribution under When Must You Withdraw Assets? in Pub. 590-B.If the trustee, custodian, or issuer of your IRA informs you of the minimum required distribution, you can use that amount.

Can you owe taxes on a 5329?

If you contributed more for 2020 than is allowable or you had an amount on line 17 of your 2019 Form 5329, you may owe this tax. But you may be able to avoid the tax on any 2020 excess contributions (see the instructions for

What is Form 5329?

Form 5329, entitled "Additional Taxes on Qualified Retirement Plans (including IRAs) and Other Tax-Favored Accounts," is filed when an individual with a retirement plan or ESA needs ...

What is the 1099-Q?

Generally, the issuer (the IRA or ESA custodian or qualified plan administrator) will indicate on Form 1099-R (used for qualified plans and IRAs) or Form 1099-Q (used for education savings accounts and 529 plans) whether the distributed amount is exempt from the early-distribution penalty. 3 4 If an exception to the early-distribution penalty applies, the issuer should note it in Box 7 of Form 1099-R.

How old do you have to be to take RMD?

11 . Starting in 2020, the latest age for RMDs is 72 years old. Prior to 2020, it was 70½ years old.

Does the SEPP owe interest?

Consequently, it appears that the individual has violated the SEPP program and now owes the IRS penalties plus interest on all past distributions that occurred as part of the SEPP. Fortunately, the individual is able to rectify this error by filing Form 5329.

Can you waive Form 5329?

According to the instructions for filing Form 5329, the IRS may waive this tax for individuals who can show that the shortfall was due to reasonable error and that they are taking appropriate steps to remedy the shortfall.

Is there an exception to the early distribution penalty on a 1099-R?

The individual receives a distribution from the retirement plan that meets an exception to the early distribution penalty, but the exception is not indicated on Form 1099-R. The individual must complete Part l of Form 5329.

Is the SEPP part of the 1099-R?

Sometimes, for various reasons, the issuer may not make the proper indication on the form. Say, for instance, an individual received distributions via a substantially equal periodic payment (SEPP) program from the IRA. However, instead of using Code 2 in Box 7 of Form 1099-R, the issuer used Code 1, which means that no exception applies. This could lead the IRS to believe the amount reported on Form 1099-R is not part of the SEPP.

What is Form 5329?

This form is called “Additional Taxes on Qualified Retirement Plans (including IRAs) and Other Tax-Favored Accounts,” and indicates whether you owe the IRS the 10% early-distribution or other penalty.

What is the exception to Form 5329?

Use the corresponding number to indicate which exception you are claiming: 01 – Distributions from a qualified retirement plan (not an IRA) after reaching age 55 and separating from employment.

What form do you use to report RMD?

If you have a 1099-r (the form for distributions from pensions, annuities, retirement plans, IRAs, or insurance contracts of at least $10) to report, then the RMD question in the interview will go to the form 5329 interview, if you indicate that the RMD wasn’t taken.

How to report a missed RMD?

Prepare and file Form 5329 for each year you had a shortfall. If the income tax return for that year has not yet been filed, Form 5329 can be attached to that return. For years when the income tax has already been filed, send in 5329 as a separate return. Take your missed RMD as soon as possible, so you can tell the IRS in the explanation statement that it has now been taken. If you have a 1099-r (the form for distributions from pensions, annuities, retirement plans, IRAs, or insurance contracts of at least $10) to report, then the RMD question in the interview will go to the form 5329 interview, if you indicate that the RMD wasn’t taken.

How to view Form 5329?

To view Form 5329 instructions, visit IRS.gov. Note: Under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the early distribution penalty for distributions from retirement accounts does not apply to any coronavirus related distribution up to $100,000, for distributions made between January 1 and December 31, 2020.

What age do you have to pay 10% tax on IRA withdrawals?

Unless you qualify for a retirement-plan early-distribution penalty exception, you must pay the 10% additional tax for IRA amounts you withdrew before age 59 1/2. You’ll claim the exception on form 5329.

Do you have to itemize your deductions to claim the exception?

You don’t have to itemize your deductions to claim the exception. 07 — IRA distributions made to individuals who were on unemployment compensation for 12 consecutive weeks to pay for health insurance premiums. 08 — IRA distributions made for qualified higher-education expenses.

When do you need to file Form 5329?

Ordinarily, you’d need to file Form 5329 if you take an early distribution from a qualified retirement plan before age 59.5, says Jacob Dyan, CEO and co-founder of Community Tax.

What is a 5329?

The official title for IRS Form 5329 is “Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts.” It’s used by taxpayers who are under age 59.5 that have received a distribution from a qualified plan or similar account. The types of accounts covered by the form for distributions include: 1 Qualified retirement plans (including IRAs) 2 Coverdell Education Savings Accounts (ESAs) 3 Qualified Tuition Programs (QTPS) 4 ABLE Accounts

What age do you have to take required minimum distributions?

Required minimum distributions kick in for traditional 401(k)s and IRAs starting at age 70.5. Failing to take required minimum distributions on schedule can result in a steep tax penalty; the IRS can tax the amount not withdrawnat 50%.

What is the age limit for a QTPS?

It’s used by taxpayers who are under age 59.5 that have received a distribution from a qualified plan or similar account. The types of accounts covered by the form for distributions include: Qualified retirement plans (including IRAs) Coverdell Education Savings Accounts (ESAs) Qualified Tuition Programs (QTPS)

How much of your AGI can you take out of a qualified retirement plan?

You can avoid the early withdrawal penalty if you took money from a qualified retirement plan up to the amount you paid for unreimbursed medical expenses, minus 7.5% of your adjusted gross income (AGI) for the year.

When can you withdraw from a qualified retirement plan?

Distributions from qualified retirement plans, excluding IRAs, won’t incur a penalty if you make the withdrawal after leaving from your employer in or after the year you reach age 55. This rule drops the age requirement to 50 for qualified public safety employees.

Can you file a 5329 if you have an early distribution?

If you took an early distribution from a retirement account, failed to take RMDs on time or you think you might have contributed too much money to a tax-favored plan, not filing Form 5329 isn’t an option .

What line do you file 5329?

If both you and your spouse are required to file Form 5329, complete a separate form for each of you. Include the combined tax on Schedule 2 (Form 1040), line 6.

When do you receive qualified retirement plan distributions?

Qualified retirement plan distributions (doesn’t apply to IRAs) you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees).

What line do you have to put Roth IRA contributions on?

If you contributed more to your Roth IRA for 2020 than is allowable or you had an amount on line 25 of your 2019 Form 5329 , you may owe this tax. But you may be able to avoid the tax on any 2020 excess contributions (see the instructions for line 23, later).

When do you receive your IRA distributions?

IRA (other than a Roth IRA). You must start receiving distributions from your IRA by April 1, 2020, if you reached age 701/2 before 2020. If you reach age 701/2 after 2019, you can postpone receiving distributions until April 1 of the year following the year in which you reach age 72. See the Note for calendar year 2020 exception, earlier. At that time, you can receive your entire interest in the IRA or begin receiving periodic distributions. If you choose to receive periodic distributions, you must receive a minimum required distribution each year. You can figure the minimum required distribution by dividing the account balance of your IRAs (other than Roth IRAs) on December 31 of the year preceding the distribution by the applicable life expectancy. For applicable life expectancies, see Figuring the Owner's Required Minimum Distribution under When Must You Withdraw Assets? in Pub. 590-B.If the trustee, custodian, or issuer of your IRA informs you of the minimum required distribution, you can use that amount.

Can you owe taxes on a 5329?

If you contributed more for 2020 than is allowable or you had an amount on line 17 of your 2019 Form 5329, you may owe this tax. But you may be able to avoid the tax on any 2020 excess contributions (see the instructions for

What is Form 5329?

Form 5329 is the tax form used to calculate possibly IRS penalties from the situations listed above and possibly request a penalty waiver. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form.

What form do you need to file for early distribution?

Whether you owe the penalty or qualify for an exception, if you take an early distribution from a qualified account, you need to complete Part 1 or 2 of Form 5329.

When is the minimum distribution for 2020?

The deadline for taking your required minimum distribution is usually December 31 of each year, although the Coronavirus Aid, Relief, and Economic Security (CARES) Act temporarily waived RMDs for all types of retirement plans for the 2020 calendar year.

Can you get a waiver of a RMD if you missed it?

You may be able to get the penalty waived if you missed taking your RMD due to an illness, mental incapacity, or bank error. You'll calculate that penalty in Part 9 of Form 5329. To request a waiver, enter “RC” (for reasonable cause) and the amount of shortfall you want waived on the dotted line next to Line 54.

Can you use a 529 ESA to pay for education?

Other distributions can also lead to a 10% penalty, including funds taken from a 529 plan or Coverdell educational savings account (ESA) that you don't use to pay for qualified educational expenses. However, you may qualify for an exception if the account beneficiary receives a tax-free scholarship or educational assistance from an employer, or attends a U.S. Military Academy.

Do you need a 5329 for a retirement account?

Certain retirement account transactions require you to fill out an additional form with the IRS. Here's when you might need a Form 5329 and how to complete this document.

What is Form 5329?

The 2015 Form 5329 is set forth. The title of this form is, “Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts. Form 5329 is a two page form. The individual tax-payer has the duty to prepare this form. An IRA or HSA custodian does not prepare this form.

Is Form 5329 written as clearly as it should be?

As with other IRS forms, the instructions for Form 5329 are not written as clearly as they should be. The IRS requires the individual to report that he or she has made an excess contribution by completing Form 5329. However, in a number of places, the IRS discusses the tax rule -if a person withdraws some or all of his/her excess contribution ...

Do you need to complete Form 5329?

The discussion of the tax rule does not mean the individual does not need to complete Form 5329 to inform the IRS that he or she made an excess contribution. Note that there are nine sections to this form. Four sections apply to IRAs, three sections apply to Coverdell ESA and ABLE accounts and two apply to HSAs.

Is a distribution used to pay a qualified medical expense tax free?

A distribution used to pay a qualified medical expense is tax-free. A distribution not used to pay a qualified medical expense must be included in income (and taxes paid) and a 20% penalty tax is owed if the individual is not age 65 or disabled.

When do you receive qualified retirement plan distributions?

Qualified retirement plan distributions (doesn’t apply to IRAs) you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees).

What line do you include recapture amount on?

The recapture amount that you must include on line 1 won’t exceed the amount of your early distribution; and, for purposes of determining this recapture amount, you will allocate a rollover amount (or portion thereof) to an early distribution only once.

When do you receive your IRA distributions?

You must start receiving distributions from your IRA by April 1, 2020, if you reached age 70½ before 2020. If you reach age 70½ after 2019, you can postpone receiving distributions until April 1 of the year following the year in which you reach age 72. See the Note for calendar year 2020 exception, earlier. At that time, you can receive your entire interest in the IRA or begin receiving periodic distributions. If you choose to receive periodic distributions, you must receive a minimum required distribution each year. You can figure the minimum required distribution by dividing the account balance of your IRAs (other than Roth IRAs) on December 31 of the year preceding the distribution by the applicable life expectancy. For applicable life expectancies, see Figuring the Owner's Required Minimum Distribution under When Must You Withdraw Assets? in Pub. 590-B.

When will the 10% tax on early distributions be imposed?

Individuals who reach age 70½ on January 1, 2020, or later may delay distributions until April 1 of the year following the year in which they turn age 72.

Do you have to file Form 5329 for prior years?

Prior tax years. If you are filing Form 5329 for a prior year, you must use the prior year's version of the form. If you don’t have any other changes and haven’t previously filed a federal income tax return for the prior year, file the prior year's version of Form 5329 by itself (discussed earlier).