Why is the cost of debt lower than equity?

Since Debt is almost always cheaper than Equity, Debt is almost always the answer. Debt is cheaper than Equity because interest paid on Debt is tax-deductible, and lenders' expected returns are lower than those of equity investors (shareholders). The risk and potential returns of Debt are both lower.

Is cost of debt ever higher than cost of equity?

While the Cost of Debt is usually lower than the cost of equity (for the reasons mentioned above), taking on too much debt will cause the cost of debt to rise above the cost of equity.

What is the cost of debt?

The cost of debt is the rate of return the average firm must pay to issue bonds; the cost of equity is the rate of return needed to pay to issue shares. In the past two cycles, we have seen a new phenomenon where firms are conducting excessive amounts of stock buybacks. Normally, buybacks are used to return excess profits to shareholders. The other way firms return capital is through dividends, but buybacks have a tax advantage since cash dividends are taxed when you get them, while the theoretical stock appreciation that buybacks bring allow you to avoid taxes until you sell the stock and take a profit.

Why wouldn't defaults happen if stocks were to have zero volatility?

In theory, if stocks were to have a volatility of zero, defaults wouldn’t happen because firms could always issue shares to pay bondholders. As you can see in the chart, the 12 month moving average of the VIX leads the high yield default rate.

Why do companies do buybacks?

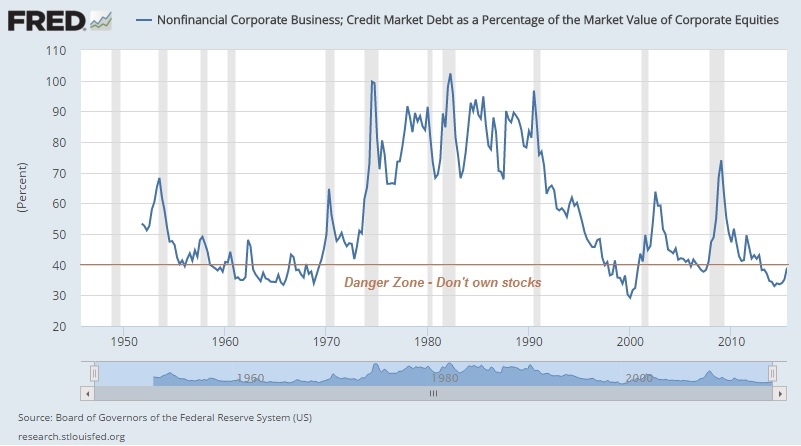

Some firms have gotten overzealous in their buyback programs by putting more into buybacks than they make in profits. The number of firms that do this increases when earnings start to fall. Usually, issuing debt to finance cash dividends means the dividend is likely to be suspended; it’s a risky activity which isn’t sustainable. With buybacks, there is an equity for debt swap which makes sense for some firms because corporate interest rates are so low. The cost of equity is also relatively low, but it’s higher than debt, so the swap makes sense. The low cost of capital helps explain why corporate profit margins for the top firms are near their records. The other reasons margins are high are bigger firms are taking share from smaller companies and technology companies which are beginning to dominate the major indices tend to have higher margins.

Why do buybacks look bad?

The trend is that every move looks bad before a recession. Buybacks only look specifically bad because you can see the stock falling in real-time. The only way to avoid poorly timed investments is to never take business risks before recessions. This requires firms to either never take risks or predict recessions.

Why are margins high?

The other reasons margins are high are bigger firms are taking share from smaller companies and technology companies which are beginning to dominate the major indices tend to have higher margins.

Why is a buyback swap good?

With buybacks, there is an equity for debt swap which makes sense for some firms because corporate interest rates are so low. The cost of equity is also relatively low, but it’s higher than debt, so the swap makes sense. The low cost of capital helps explain why corporate profit margins for the top firms are near their records.

Why is equity financing more expensive than debt?

Why is debt cheaper than equity? Simply put, because equity carries a higher risk for investors. Individuals and institutions that purchase a company’s equity shares have no guaranteed capital gains or dividend payments, limited claims to assets if the company goes bankrupt, and greater exposure to volatility than in the debt market. To compensate for these risks, investors expect higher rates and more benefits in return (a concept called the equity risk premium).

Why do companies prefer equity vs debt?

Many businesses prefer equity vs. debt because it does not carry the upfront expense of interest repayment. Avoiding the financial obligation that comes with debt makes it easier to invest in the growth of the company but carries the expenses of sharing profits with your investors. The timing and form of repayment represent a key difference between equity and debt.

What to do if you want to offer equity?

If you decide to offer equity in your enterprise, research the applicable state and federal regulations in advance as part of your due diligence when weighing the difference between equity financing and debt financing. For example, depending on the size and structure of your company, along with other factors, you may need to get shareholder approval for certain business actions, hold regular shareholder meetings, and send frequent information to investors by mail.

What is the difference between equity and debt?

While both equity and debt allow business owners to acquire financing, equity involves selling interests in the company, while debt is the practice of borrowing money and repaying that amount plus interest. In this guide, we explore the advantages and potential drawbacks of both equity and debt financing so you can make an informed decision when raising capital for your enterprise.

What is a mezzanine debt?

Mezzanine or subordinate debt, in which a secondary lender bridges the gap between available financing and the company’s need for funds at a higher interest rate with a longer term and lower amortization

What happens when you raise money for your company?

When you raise money for your company with equity, you sell each shareholder an ownership stake in the firm in exchange for a capital investment. While we tend to think of large corporations that make initial public offerings of their stock on the public market when we hear the term “equity financing,” even small businesses can offer shares to interested parties in exchange for future profits in the firm.

Why do lenders not have the same power?

Complete separation from the daily operations of your business; unlike equity shareholders, who may expect input into how the company is run, lenders do not have the same power because they lack ownership of the business.

Why do firms use cost of equity?

A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities. Companies typically use a combination of equity and debt financing, with equity capital being more expensive.

Why is WACC used instead of debt?

The WACC is used instead for a firm with debt. The value will always be cheaper because it takes a weighted average of the equity and debt rates (and debt financing is cheaper).

What is ROE in accounting?

Return on Equity (ROE) Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders' equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity.

How to find the share price of a company?

The share price of a company can be found by searching the ticker or company name on the exchange that the stock is being traded on, or by simply using a credible search engine.

Does dividend capitalization model account for investment risk?

The model does not account for investment risk to the extent that CAPM does (since CAPM requires beta).

Why is debt cheaper than equity?

Debt is cheaper than equity for several reasons. The primary reason for this, however, is that debt comes without tax. This simply means that when we choose debt financing, it lowers our income tax. Because it helps removes the interest accruable on the debt on the Earning before Interest Tax. This is the reason why we pay less income tax ...

Why Should I Choose Debts Over Equity?

We have been able to establish that debt trumps equity when it comes to financing. When it comes to a time when owners of startup companies think about growth capital, they seldom think about debt financing. One thing about venture capital is that they usually have higher mindshare. Because of this, several founders are quite anxious about collecting funds with have a repayment cap or interest rates.

What Is The Cost Of Debt Financing?

In the case of debts, the company does not only promise to pay the loan, but it does so with interests. The cost of payment of the debt instruments is simply the cost of borrowing.

What Does The Debt-Equity Ratio Mean?

It, therefore, translates to higher investor confidence in the business. in a case where the debt-equity ratio is high, it means that the company has too much borrowings on a comparatively small investment base.

Why is debt financing important?

1. Unique tax benefits. In a case where your company is faced with financial issues, debt financing gives you what equity financing will not be able to. For instance, if your company uses accrual accounting, the interest of the payment is often a part of the loss and profit payments.

What is the cost of capital?

The cost of capital is the sum of the cost of debt financing and equity financing. The capital cost simply represents the lowest return which a company has to make on the capital if it seeks to please its creditors, shareholders, and capital providers.

What are the drawbacks of equity financing?

One of the major drawbacks of equity financing is that it usually takes a lot of time for the funds to be raised. Also, it takes a whole lot of effort to raise the funds, with phone calls, pitches, coffee meetings and the likes. Debt financing is usually quite quick. Debt helps save you the time needed to run your business. Also, lenders are never interested in keeping up with each decision you make and they usually do not need board meetings. Furthermore, money lenders do not bother themselves with your strategy or hiring process.