Full Answer

Should you buy a conventional or FHA loan?

Lastly, a home seller may favor a buyer with a conventional loan, knowing it’s a safer bet to close. This is related to the mandatory home inspection on FHA-backed loans, along with a stricter appraisal process, especially if the property happens to come in below value.

Why don’t sellers take FHA loans?

There tends to be more “red tape” involved with an FHA loan. This is why some sellers do not want FHA loan offers from home buyers. They sometimes view the government’s involvement as a disadvantage to them.

What are the pros and cons of an FHA loan?

FHA loans are a government-insured loan. They are typically easier to qualify for, with lower down payment and credit score requirements, making them a perfect solution for those that can’t qualify for a conventional loan. They also generally have lower closing costs than conventional loans.

Are FHA loans a good option for first-time buyers?

But FHA loans can be a good option for those with bad credit and little set aside for down payment who are determined to get a mortgage. Want a fast, free rate quote? Quickly get matched with a top mortgage lender today! Chances are if you’re a first-time home buyer, you’ll use an FHA loan over a conventional loan.

Why would a seller choose conventional over FHA?

"Conventional loans have higher minimum requirements than FHA and require a larger down payment," Yates said. "Sellers prefer a buyer with conventional financing over FHA financing because they feel the buyer is in a better financial position."

Are sellers less likely to accept FHA loans?

Sellers might be less likely to accept offers coming from FHA buyers when they can instead choose a cash offer or an offer from buyers relying on traditional mortgage financing.

Why do sellers not like FHA buyers?

Reasons Sellers Don't Like FHA Loans Both reasons have to do with the strict guidelines imposed because FHA loans are government-insured loans. For one, if the home is appraised for less than the agreed-upon price, the seller must reduce the selling price to match the appraised price, or the deal will fall through.

What are the disadvantages of an FHA loan for the seller?

Another potential turn-off for sellers is that FHA loans have stricter criteria than conventional mortgages do. The appraisal must look at the home more closely, and the sale can be blocked by things like chipped paint, broken windows or nonworking appliances.

Is conventional loan better than FHA?

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option.

How often do FHA loans fall through?

In fact, about 73% of all FHA loans successfully close within 90 days, according to Ellie Mae's Origination Insight Report from May 2019. For comparison's sake, about 75% of all conventional loans successfully close within 90 days. That's only a 2% difference.

How can I make my FHA offer more attractive?

Strengthening an offer Increasing the deposit, if possible, can often make an offer more appealing to sellers. Writing a letter to the sellers about how much you love their home can sometimes help, too, although these “love letters” do not always make it to the seller.

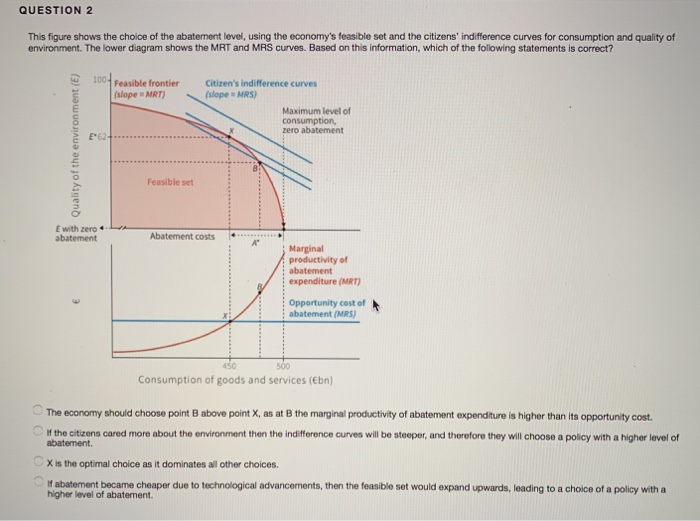

Do FHA appraisals come in lower than conventional?

An FHA appraisal will typically result in a lower home value than a conventional appraisal. This is because the FHA has stricter guidelines for what properties they will insure.

Can a buyer switch from conventional to FHA?

Should a Seller allow a Buyer to switch to an FHA loan? First, a buyer that includes a conventional loan contingency in a contract cannot switch to an FHA insured loan (or VA or USDA) without an amendment to the contract. That is, the Seller has to agree.

How soon can you sell a house after buying it FHA?

FHA Appraisal Issues Connected With Resale Dates The sale of real estate 91 days after purchase (up to 180 days after purchase) requires a new appraisal if the resale price is 100% or more above the original cost of the property.

Do FHA loans take longer to close?

The short answer is yes. Industry data show that FHA loans do take longer to close than conventional, at least on average. But the difference between their average closing times is typically just a matter of days.

What will fail an FHA inspection?

The overall structure of the property must be in good enough condition to keep its occupants safe. This means severe structural damage, leakage, dampness, decay or termite damage can cause the property to fail inspection. In such a case, repairs must be made in order for the FHA loan to move forward.

How often is FHA underwriting denied?

How often do underwriters deny loans? Underwriters deny loans about 9% of the time. The most common reason for denial is that the borrower has too much debt, but even an incomplete loan package can lead to denial.

What will fail a FHA appraisal?

Structure Quality. The overall structure of the property must be in good enough condition to keep its occupants safe. This means severe structural damage, leakage, dampness, decay or termite damage can cause the property to fail inspection. In such a case, repairs must be made in order for the FHA loan to move forward.

Do FHA loans take longer to close?

The short answer is yes. Industry data show that FHA loans do take longer to close than conventional, at least on average. But the difference between their average closing times is typically just a matter of days.

Are FHA appraisals more strict?

FHA mortgage appraisals are more rigorous than standard home appraisals. Whether you're looking at refinancing an FHA loan, buying a house with an FHA loan or even selling to someone who will be using an FHA loan, you'll want to understand what these appraisals entail.

Both Loans Offer A Great Low Down Payment Option

1. You can get an FHA loan with 3.5% down 2. Or a conventional loan with just 3% down 3. FHA is more flexible in terms of credit score 4. But also...

FHA Loans Good For Those With Poor Credit

1. There’s not one clear winner 2. It will depend largely on your credit score 3. FHA loans benefit those with low scores 4. Conventional loans che...

Are FHA Mortgage Rates Lower Than Conventional?

1. FHA rates are typically lower than conventional rates 2. But the spread can vary and not be all that different 3. You also have to consider the...

FHA Loans Subject to Mortgage Insurance

1. Mortgage insurance is unavoidable on an FHA loan 2. And will often remain in force for the entire loan term 3. Conventional loans allow you to d...

Conventional Loans Offer Many More Options and Just 3% Down!

1. Access to more loans programs (fixed, ARMs, etc.) 2. And you can get financing on more property types 3. Including vacation homes and investment...

No Mortgage Insurance Requirement on Conventional Loans

1. If you put down 20% or have 20% equity 2. You won’t have to pay mortgage insurance 3. Some lenders may even waive MI regardless of the LTV 4. By...

You Can Get Conventional Loans Anywhere

1. All mortgage lenders offer conventional loans 2. Whereas only some banks originate FHA loans 3. You also won’t have to worry about a condo 4. Be...

Final Word: Is An FHA Loan Better Than Conventional?

1. There is no definitive yes or no answer 2. You have to look at your loan scenario specifically 3. Consider how long you’ll keep the loan and wha...

What to consider when approaching conventional versus non conventional lending?

One final factor to consider when approaching conventional versus non-conventional lending is the appraisal . It has been found that homes appraised under an FHA loan have the potential to appraise lower than those evaluated for a conventional mortgage, and unlike a conventional appraisal, an FHA appraisal takes into account factors beyond current market values. The last thing a seller wants is to have their property appraise for less than asking price, especially half-way through a sale. A higher appraisal is always in the seller’s best interest, and if a conventional loan will bring the biggest value, then a conventional loan is what they are going to favor.

How to increase your chances of making a house your home?

Increase your chances of making that house your home by educating yourself on conventional loans and understanding why sellers tend to favor them when choosing between multiple offers .

Do house hunters have better credit?

There is also a perception by sellers that house-hunters utilizing conventional lending have better credit and are thus more reliable than other buyers, as conventional loans tend to require higher credit scores and larger down payments.

Does FHA require more documentation?

Lending backed by the government, like FHA loans, comes with stringent regulations and can require substantially more documentation. Many times, these extra steps result in extended wait times to sign on the dotted line. Other times, the added steps can derail the sale entirely.

Is a conventional loan more reliable than a conventional loan?

As explained above, the lengthy and involved process for non-conventional loans results in a lower probability of buyers surviving the race to close. Regulations surrounding government-backed loans can get in the way of the bigger picture and take a particular house or buyer out of the running completely. There is also a perception by sellers that house-hunters utilizing conventional lending have better credit and are thus more reliable than other buyers, as conventional loans tend to require higher credit scores and larger down payments. By securing an approval letter for conventional financing, homebuyers put themselves at an advantage over their competitors.

What are the advantages of FHA loans?

If you’re looking to buy a house, an FHA loan can be an attractive option. It offers two key advantages over a conventional loan: 1 Low credit score requirement 2 Low down payment option

What happens if you choose the wrong FHA lender?

Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

WHAT IS AN FHA LOAN?

The Federal Housing Administration (FHA) backs the FHA loan program. It lowers some of the down payment and credit restrictions to make buying a house easier for low- to middle-income earners.

What is the down payment requirement for a conventional loan?

It offers two key advantages over a conventional loan: Low credit score requirement. Low down payment option. Some conventional loans allow a 3% minimum down payment, which is lower than FHA’s 3.5% requirement, but that’s generally reserved for borrowers with credit scores in the 700s or better.

How much down payment do you need to put on a mortgage to pay mortgage insurance?

Conventional loans only make you pay private mortgage insurance if you put less than 20% down for a down payment.

When did mortgage insurance premiums go down?

The good news is the Federal Housing Administration lowered the mortgage insurance premiums in 2015, so borrowers pay less to buy a house with an FHA loan.

Is it risky to accept an offer from a potential buyer on an FHA loan?

If you’re a seller, accepting an offer from a potential buyer relying on an FHA loan can seem risky.

Who dominated the FHA?

As you can see, the FHA was dominated by FTHB with an 82.8% share in October 2018. Yes, nearly 83% of those who used an FHA loan for a home purchase were first-timers.

Why is the FHA considered a subprime loan?

Some even claim FHA loans are the “new subprime” due to the dubious mix of low down payment and credit score requirements, despite originally being geared toward low and moderate-income borrowers.

How much down do you need to get a FHA loan?

You need just 3.5% down for FHA loans and only 3% for conventional. So you don’t need much in your bank account to get approved for either type of loan.

What is the minimum down payment for FHA loans?

The main selling point of an FHA loan is the 3.5% minimum down payment requirement coupled with a low credit score requirement. That’s a one-two punch. However, in order to qualify for the government loan program’s flagship low down payment option, you need a minimum credit score of 580.

What FICO score do you need to get a conventional loan?

Conversely, conventional loans begin to make a lot more sense financially when you have a 740+ FICO score, and even more sense with larger down payments.

Is it cheaper to get an FHA loan early or later?

Also consider the long term picture. While an FHA loan might be cheaper early on, you could be stuck paying the mortgage insurance for life.

Is FHA financing cheaper?

We can see that FHA financing is remarkably cheaper for borrowers with credit scores between 620-679, and marginally cheaper for scores between 680-719. The blue shaded sections show when you’re better off going with a conventional home loan. The biggest benefit seems to be for borrowers with credit scores of 760+.

Why would a seller not accept an FHA loan?

Whether they are justified or not, there are two primary reasons why a seller might not want to accept an FHA loan offer from a buyer: Underwriting concerns. Some sellers believe that FHA loans are more likely to fall through during the underwriting stage, since the program attracts borrowers with lower credit scores and other issues.

Why is the government involved in FHA loans?

But with an FHA loan, the government is more involved because they insure the lender against default-related financial losses. So it’s the government — and specifically HUD — that establishes all guidelines for home appraisals, property requirements, and mortgage underwriting. And let’s be honest.

How long does it take for a FHA loan to close?

In most cases (more than 70% of the time) loans that were originated went on to close successfully within 90 days. Underwriting concerns are one reason why a seller might not want to accept offers from an FHA borrower. But this is often a perceived disadvantage of FHA loans that doesn’t reflect reality.

What is an FHA appraisal?

An FHA home appraisal is different from one where a conventional loan is being used, because it includes a property evaluation. FHA-approved home appraisers will determine the value of the property, but they also must ensure that it meets HUD requirements for health and safety.

What are the requirements for an FHA appraisal?

When it comes to home appraisals, FHA guidelines and requirements are primarily focused on the health and safety of the occupant. For example, all bedrooms must have a window that allows egress in the event of a fire or other emergency. Most homes today meet this requirement, so it’s usually not an issue.

What is the job of a conventional appraiser?

With a conventional loan, the home appraiser is entirely focused on determining the value of the property.

Does FHA have red tape?

FHA Loans Have Government Involvement (Red Tape) With a conventional mortgage loan, the government is not directly involved in the appraisal, underwriting or loan approval process. Even if the loan is insured, it is done through a private-sector company (hence the term “private mortgage insurance”). But with an FHA loan, the government is more ...

Why don't sellers accept FHA loans?

Both reasons have to do with the strict guidelines imposed because FHA loans are government-insured loans.

What are the defects in a home before selling?

Some of the most common defects, include: Homes built prior to 1978 need to have all peeling or chipping paint on the property scraped and repainted. Safety handrails must be installed in open staircases with 3 or more stairs.

How long does an appraisal stay with a FHA loan?

If they do decide to list the home again, the appraisal stays with the property for 120 days. The other major reason sellers don’t like FHA loans is ...

Is FHA loan good for first time homebuyers?

All of these factors make FHA loans an ideal choice for first-time homebuyers. While they do offer borrowers more flexibility, they often have higher interest rates than their conventional counterparts. Most FHA loans also require borrowers to purchase mortgage insurance.

Is it harder to qualify for a conventional loan than a FHA loan?

Conventional Loans. Conventional loans are generally more difficult to qualify for than FHA loans. People that usually qualify for a conventional mortgage possess three qualities: good credit, steady income, and funds for a down payment. It is possible to qualify for a conventional loan without putting 20% down.

Is a FHA loan a government loan?

FHA Loans. FHA loans are a government-insured loan. They are typically easier to qualify for, with lower down payment and credit score requirements, making them a perfect solution for those that can’t qualify for a conventional loan. They also generally have lower closing costs than conventional loans.

Can windows be broken in a FHA loan?

Windows cannot be broken and must function properly. The property must have running water and working heating and cooling systems, depending on the region. As you can see, there are a couple real reasons why sellers don’t like FHA loans. While all sellers don’t feel this way, we like to ensure our clients know the details of their loan.

Why do sellers worry about FHA financing?

Why is that? Sellers worry that if they accept an offer from a borrower with FHA financing, they'll run into problems during both the home appraisal and home inspection processes.

Why are FHA deals less likely to close?

They worry that FHA deals are less likely to close because of this. Other sellers believe that FHA home inspections are too stringent, and that they'll need to spend thousands of dollars on repairs that they could avoid if they work instead with a borrower taking out a conventional loan that isn't insured by the federal government.

What did Morenza say about conventional appraisals?

Morenza said that he once represented a seller in which the buyers' mortgage lender first ordered a conventional appraisal. In that appraisal, the appraiser valued the home at just above the purchase price. The lender then realized that the buyers needed FHA financing.

What is the FHA loan?

Loans insured by the Federal Housing Administration, better known as FHA loans, are attractive to buyers. That's mainly because they require down payments of just 3.5 percent of a home's purchase price for borrowers with FICO credit scores of 580 or higher. But will applying for an FHA loan hurt your chances of landing your dream home?

How much insurance does an FHA loan have?

FHA loans also come with an annual mortgage insurance premium that ranges from 0.45 percent to 1.05 percent of your mortgage amount, depending on your loan's term and down payment. You'll pay this amount for 11 years or until you pay off your entire mortgage loan, again depending on your down payment and the length of your loan.

What are the drawbacks of FHA loans?

A financial drawback. Randall Yates, founder and president of Dallas-based The Lenders Network, said that mortgage insurance payments are the biggest drawback of FHA loans. Mortgage insurance protects your lender, not you, in case you stop making payments. With conventional mortgage loans, you can drop mortgage insurance after building up enough ...

Do FHA loans require a low down payment?

If you are worried that sellers will balk at your FHA offer, here’s some good news: FHA loans aren’t the only ones that require low down payments. You can qualify for a conventional loan backed by Fannie Mae that requires down payments as low as 3 percent of your home’s purchase price for borrowers with good credit.