Key Takeaways

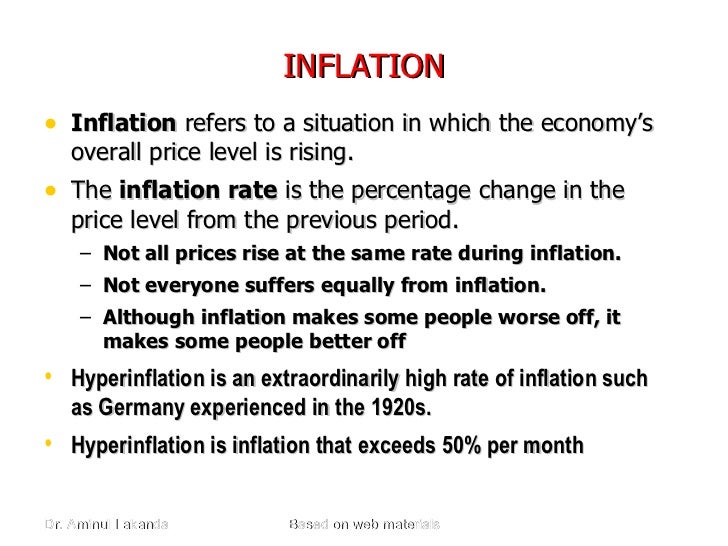

- Inflation is a measure of the rate of rising prices of goods and services in an economy.

- Inflation can occur when prices rise due to increases in production costs, such as raw materials and wages.

- A surge in demand for products and services can cause inflation as consumers are willing to pay more for the product.

What is an acceptable level of inflation?

What is an acceptable level of inflation? The Federal Reserve has not established a formal inflation target, but policymakers generally believe that an acceptable inflation rate is around 2 percent or a bit below.

How does the BLS calculate inflation?

Using this methodology, the BLS calculates CPI inflation by taking the average price of goods over a given month and dividing by the same basket as a month ago. Consumer Expenditure Surveys, which provide information on what real Americans are buying, provide the BLS with raw data that constitutes CPI inflation calculations.

What is inflation, and is it good or bad?

Inflation at an acceptable low stable rate is good because it increases economic output and productivity while generating employment opportunities. Inflation at extremely high levels, also known as runaway inflation, is bad because essential goods and services become too expensive and unemployment increases, which destabilizes the economy. Deflation is bad for an economy as it keeps prices at low levels, reduces employment opportunities and increases the debt burden on consumers.

How do I calculate the inflation rate?

See how rising costs impact you and your family

- Determine your monthly expenses for the following categories: food and beverages, housing, clothing, transportation, medical care, recreation, education, communication and other goods and services. ...

- Subtract your monthly spending a year ago from your current monthly spending.

- Divide that sum by your monthly spending from a year ago.

Why it is important to measure inflation?

Broadly considered, there are two main rationales for measuring inflation. First, inflation reduces welfare. Second, inflation provides an indication of the degree of slack or short-term developments in the economy. 2 The weight given to these respective elements will determine the definition of inflation used.

Why do economists measure inflation?

Economists think that the benefits of those goods should also be captured in price indexes so we can distinguish between price increases that reflect better quality and those that reflect true price inflation.

What do we use to measure inflation?

The two most frequently cited indexes that calculate the inflation rate in the U.S. are the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE). These two measures take different approaches to measuring and calculating inflation.

What's the difference between CPI and inflation?

Inflation is an increase in the overall price level. The official inflation rate is tracked by calculating changes in a measure called the consumer price index (CPI). The CPI tracks changes in the cost of living over time. Like other economic measures it does a pretty good job of this.

Who benefits from inflation?

Savers can be protected from inflation if they can gain an interest rate higher than the rate of inflation. For example, if inflation is 5%, but banks are giving an interest rate of 7%, then those who save in a bank will still see a real rise in the value of their savings.

How does the government measure inflation?

The U.S. Bureau of Labor Statistics (BLS) uses the Consumer Price Index (CPI) to measure inflation. The index gets its information from a survey of 23,000 businesses. 2 It records the prices of 80,000 consumer items each month. 3 The CPI will tell you the general rate of inflation.

Who decides inflation rate?

The Federal Reserve is the central bank of the U.S., and the Fed—like central banks around the world—is tasked with maintaining a stable rate of inflation. The Federal Open Markets Committee (FOMC) has determined that an inflation rate around 2% is optimal employment and price stability.

What are the 5 causes of inflation?

Here are the major causes of inflation:Demand-pull inflation. Demand-pull inflation happens when the demand for certain goods and services is greater than the economy's ability to meet those demands. ... Cost-push inflation. ... Increased money supply. ... Devaluation. ... Rising wages. ... Policies and regulations.

How do economists measure inflation quizlet?

There are two main ways economists measure inflation - the Consumer Price Index (CPI), and the Gross Domestic Product (GDP) Deflator. The Consumer Price Index is the most basic way to measure inflation. Economists pick a set "basket" of goods, and simply compare their prices between years.

What is inflation and how is it measured in economics?

Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of those prices. Typically, prices rise over time, but prices can also fall (a situation called deflation).

Why is it difficult to measure inflation?

Difficulties in measuring inflation include. Changes in the quality of goods. Changes in the quality of goods mean that price rises may not reflect inflation, but just the fact it is an improved good.

How does inflation affect the economy?

An overall rise in prices over time reduces the purchasing power of consumers, since a fixed amount of money will afford progressively less consumption. Consumers lose purchasing power whether inflation is running at 2% or at 4%; they just lose it twice as fast at the higher rate.

Inflation is rising. What does that mean? Does anyone know?

The concept of inflation is closely related to the assessment of living standards and the “cost-of-living.” Economists (and everyone else) want to know if living standards are improving. This should be easy to measure – just count the goods and services that people consume each year.

Which inflation calculation should we use?

Which inflation estimate is “right?” Is inflation 25% or 30%? In general, using this year’s quantities tends to produce a lower inflation estimate, as people tend to increase their spending on items with smaller price increases (also called relative price decreases).

Inflation is relative

Our simple example illustrates the difficulty of disentangling relative price changes from inflation. If we spoke with someone who subsisted solely on chicken, they would say that inflation is overstated – the price they care about most has increased less (only 10%) than the reported inflation rate of 25% or 30%.

Why does inflation occur?

Inflation can occur when prices rise due to increases in production costs, such as raw materials and wages. A surge in demand for products and services can cause inflation as consumers are willing to pay more for the product.

Who Benefits From Inflation?

While consumers experience little benefit from inflation, investors can enjoy a boost if they hold assets in markets affected by inflation. For example, those who are invested in energy companies might see a rise in their stock prices if energy prices are rising.

What causes cost push inflation?

Cost-push inflation occurs when prices increase due to increases in production costs, such as raw materials and wages. The demand for goods is unchanged while the supply of goods declines due to the higher costs of production. As a result, the added costs of production are passed onto consumers in the form of higher prices for the finished goods.

Why do companies charge higher prices for selling their homes?

Some companies reap the rewards of inflation if they can charge more for their products as a result of a surge in demand for their goods. If the economy is performing well and housing demand is high , home-building companies can charge higher prices for selling homes.

What are the factors that drive inflation?

Typically, inflation results from an increase in production costs or an increase in demand for products and services.

Why do companies reap the rewards of inflation?

Some companies reap the rewards of inflation if they can charge more for their products as a result of the high demand for their goods.

What happens when the unemployment rate is low?

When the economy is performing well, and the unemployment rate is low, shortages in labor or workers can occur. Companies, in turn, increase wages to attract qualified candidates, causing production costs to rise for the company. If the company raises prices due to the rise in employee wages, cost-plus inflation occurs.

Why is inflation good?

The biggest reason behind this argument in favor of inflation is the case of wages. In a healthy economy, market forces will, at times, require that companies reduce real wages, or wages after inflation. In a theoretical world, a 2% wage increase during a year with 4% inflation has the same net effect to the worker as a 2% wage reduction in periods of zero inflation. But out in the real world, nominal (actual dollar) wage cuts rarely occur because workers tend to refuse to accept wage cuts at any time. 4 This is the primary reason that most economists today (including those in charge of U.S. monetary policy) agree that a small amount of inflation, about 1% to 2% a year, is more beneficial than detrimental to the economy. 5

Why is inflation important for stock market?

Keeping a close eye on inflation is most important for fixed-income investors because future income streams must be discounted by inflation to determine how much value today's money will have in the future. 8 For stock investors, inflation, whether real or anticipated, is what motivates us to take on the increased risk of investing in the stock market, in the hope of generating the highest real rates of return. Real returns (all of our stock market discussions should be pared down to this ultimate metric) are the returns on investment that are left after commissions, taxes, inflation, and all other frictional costs are taken into account. As long as inflation is moderate, the stock market provides the best chances for this compared to fixed income and cash .

How Much Inflation Is Too Much?

There are those who insist that advanced economies should aim to have 0% inflation , or in other words, stable prices. The general consensus, however, is that a little inflation is actually a good thing.

What does it mean to find a level of understanding of GDP and inflation?

Individual investors need to find a level of understanding of gross domestic product (GDP) and inflation that assists their decision-making without inundating them with too much unnecessary data. If the overall economic output is declining, or merely holding steady, most companies will not be able to increase their profits ...

What do individual investors need to know?

Individual investors need to find a level of understanding that assists their decision-making without inundating them with too much unnecessary data. Find out what inflation and GDP mean for the market, the economy, and your portfolio.

Why is inflation a feedback loop?

This is because, in a world where inflation is increasing, people will spend more money because they know that it will be less valuable in the future.

How much inflation is good for the economy?

Most economists today agree that a small amount of inflation, about 1% to 2% a year, is more beneficial than detrimental to the economy.

How does inflation work?

The government measures inflation by comparing the current prices of a set of goods and services to previous prices. That turns out to be more complicated than it sounds. Here’s how inflation measures work.

Why does CPI overstate inflation?

The primary CPI can overstate inflation because it prices the same basket of goods from one month to the next (although items are updated every two years), and it doesn’t take into account substitutions between similar goods. So, if a good (say, apples) becomes more expensive, and people choose to buy more of its substitutes (like peaches), the CPI calculates the price level as though people are still buying the same amounts of each item, just at a different price.

What is the Consumer Price Index?

The Consumer Price Index (CPI), produced by the Bureau of Labor Statistics (BLS), is the most widely used measure of inflation. The primary CPI (CPI-U) is designed to measure price changes faced by urban consumers, who represent 93% of the U.S. population. It’s an average, though, and doesn’t reflect any particular consumer’s experience.

How does the government get price data for the CPI?

The BLS collects price data each month by conducting two surveys: one records the prices of most goods and services, the other the price of housing. For most goods and services, BLS representatives visit (online or in person) or call various stores across the country and record what different items cost. During each trip, the data collector records the prices of the same goods and services as last month. Prices in New York, Los Angeles, and Chicago are collected every month, as are food and energy prices across the country. Prices for commodities from all other places (which tend to represent a smaller chunk of the overall basket) are updated every other month.

What is the price index for Personal Consumption Expenditures (PCE)?

The price index for Personal Consumption Expenditures (the PCE price index) is another measure of inflation, this one produced by the Bureau of Economic Analysis (BEA) using data on prices from BLS. The PCE price index measures the change in prices for all consumption items, not just those paid for out-of-pocket by consumers. For example, the weight on health care in the PCE reflects what consumers pay out-of-pocket for premiums, deductibles, and copayments as well as the costs covered by employer-provided insurance, Medicare, and Medicaid. In the CPI, only the direct costs to consumers are reflected. This difference in scope means that the PCE deflator and the CPI have very different weights. For example, the weight on health care is 22% in the PCE index, but just 9% in the CPI. The weight on housing is 42% in the CPI, but just 23% in the PCE index. That means that a given increase in health care prices will affect the PCE index much more than it will affect the CPI.

What is core inflation?

Core inflation, whether the CPI or the PCE price index, is defined as the change in prices excluding food and energy prices, which tend to be volatile. While food and energy are, of course, major parts of any household’s budget, core inflation is often seen as a better indicator of the underlying pace of price changes.

How do price indexes account for quality change?

Accounting for quality change is one of the thorniest issues in price measurement. Tracking the price of the same good over time works well when the exact same good —a dozen large eggs, for instance—is sold from one period to the next. But often that isn’t the case. For example, new versions of the iPhone are introduced to the market on a regular basis. The iPhone someone buys today is of better quality than the one bought five years ago. In addition, entirely new goods are sometimes introduced that might make people much better off.

Why are inflation expectations important?

Inflation expectations are simply the rate at which people—consumers, businesses, investors—expect prices to rise in the future. They matter because actual inflation depends, in part, on what we expect it to be. If everyone expects prices to rise, say, 3 percent over the next year, businesses will want to raise prices by (at least) 3 percent, and workers and their unions will want similar-sized raises. All else equal, if inflation expectations rise by one percentage point, actual inflation will tend to rise by one percentage point as well.

How to track inflation?

There are three primary ways to track inflation expectations: surveys of consumers and businesses, economists’ forecasts, and inflation-related financial instruments.

How can the Fed influence inflation expectations?

However, the Fed can also influence expectations with its words, particularly by elaborating on how it intends to use its monetary policy tools in the future to achieve the 2 percent goal.

What happens if inflation is anchored at target?

When inflation expectations are anchored at target, it is easier for the Fed to steer inflation to 2 percent. If inflation expectations move down from 2 percent, inflation could fall as well—a reverse wage-price spiral. In the extreme, this process can increase the risk of deflation, a damaging economic condition in which prices fall over time rather than rise.

Why does the Fed worry about inflation?

Another reason that the Fed worries about low inflation expectations is that they are closely related to interest rates.

Why is it important to have well anchored inflation expectations?

Well-anchored inflation expectations are critical for giving the Fed the latitude to support employment when necessary without destabilizing inflation. But if inflation expectations fall below our 2 percent objective, interest rates would decline in tandem.

What happened to inflation in the 1970s?

As a result of the persistently high inflation in the 1970s and 1980s, inflation expectations became unanchored and rose with actual inflation—a phenomenon known at the time as a wage-price spiral.

Why is inflation important?

According to the International Monetary Fund, inflation is an important economic statistic because it affects the value of money and indicates the overall stability of a country's economy. Inflation is a gradual continuous increase in the price of goods and services.

How is inflation calculated?

The International Monetary Fund notes that inflation is calculated using a country's consumer price index (CPI) which measures the average amount of consumers' cost of living expense for the year. Inflation is measured as the percent change in CPI over time, usually one year.

What is the measure of GDP?

GDP takes into account all of the goods produced in an economy, not just the consumed goods. Core consumer inflation is measured by excluding prices that are set by the government and those of volatile products, including food and energy, that may change frequently.

Does inflation affect the economy?

Economics Help notes that high rates of inflation increase costs and make a country's exports less competitive in the global marketplace. Fluctuations in inflation, such as a large increase in prices followed by a decrease, can cause decreases in economic growth, reduce spending, decrease investments and increase interest rates. Any inflation over 10 percent per year is potentially problematic for the country's economy.

What is the CPI?

The CPI, is “sort of the headline measure of inflation in the U.S. economy” said Erica Groshen a visiting scholar at Cornell University and former commissioner of the Bureau of Labor Statistics, the organization that calculates the CPI.

Do you need a complicated math problem to measure inflation?

You don't need a complicated math problem to measure inflation; the CPI and PCE will do. Three Lions/Getty Images

Does PCE use CPI?

The PCE actually uses some information from the CPI as inputs. It just uses them a little bit differently. David Wasshausen, chief of the national income and wealth division at the Bureau of Economic Analysis said the CPI and the PCE “are largely consistent with each other” and tend to “tell the same story from period to period.”

What is the most accurate measure of inflation?

Another measure of inflation that economists look at to get the most accurate read on inflation is the Personal Consumption Expenditures index, or PCE. At first the PCE and CPI look pretty similar, but they are not.

What is inflation in business?

Inflation is when the cost of goods and services goes up.

What has made the economy less inflation prone?

There are a few things that have made the economy less inflation prone, like globalization and the so-called Amazon effect, economists believe. Amazon has really changed the way that people shop. With most of its sales taking place online, it doesn’t have huge overhead costs and therefore can offer cheaper prices.

Why does the Fed raise interest rates?

If the Fed raises interest rates to keep the economy from overheating, you might have to pay more to borrow money or you might be getting a higher return on all those savings you’ve got stashed in the bank. The government also uses inflation to determine how to adjust Social Security payments and other benefits.

Why does the Fed keep a close eye on inflation?

That’s why the Fed keeps such a close eye on these numbers. Low inflation numbers also indicate that the economy is not completely healthy yet. Either people are not being paid enough or the labor market is not as tight as the Fed think it is.

What is CPI in grocery stores?

The CPI is not just limited to the things you can buy at your local supermarket. It includes tangible items like food or clothes or cars, but it also includes more intangible costs like your electricity bill, gas prices, your health insurance costs and so on. Let’s face it, we spend money on a lot of stuff.

How does the Fed help the economy during a recession?

One of the ways that the Fed helps the economy during the recession is by lowering interest rates. But if the interest rates remain low, then the Fed has little room to work with when the next financial crisis hits. If inflation is near or at 2 percent, the Fed can continue raising interest rates.

Why is it important to state inflation goals?

Therefore, stating an inflation goal—and maintaining credibility with respect to that goal— helps the FOMC manage the public’s expectations when it comes to inflation. In turn, this helps in achieving price stability as per the Fed’s mandate.

Why do inflation expectations matter?

Why do inflation expectations matter? They are important for actual inflation, as Bullard explained in a 2016 Regional Economist article. “Modern economic theory says that inflation expectations are an important determinant of actual inflation,” he wrote.

Why does FOMC target inflation?

As Bullard wrote in a 2012 Regional Economist article, “The FOMC will target the headline inflation rate as opposed to any other measure (e.g., core inflation, which excludes food and energy prices) because it makes sense to focus on the prices that U.S. households actually have to pay.”. Furthermore, the inflation target is meant ...

Why do people give positive inflation targets?

Another reason that some people give for having a positive inflation target is that interest rates and inflation tend to be proportional, Wheelock noted. That means that a higher inflation rate tends to be associated with higher interest rates.

When did the Fed set an inflation target?

Although the FOMC didn’t explicitly name an inflation target until 2012, St. Louis Fed President James Bullard has argued that the U.S. had “an implicit inflation target of 2 percent after 1995.” (See Bullard’s presentation from Sept. 12, 2018. In that presentation, he also noted that 2 percent became an international standard in the inflation targeting era that began in the 1990s.)

How to calculate inflation rate?

The inflation rate can be estimated using a price index, which gives a sense of how overall prices in the economy are evolving. A common calculation is the percentage change from a year ago. For instance, if a price index is 2 percent higher than a year ago, that would indicate an inflation rate of 2 percent.

What is the price index for personal consumption expenditures?

Produced by the Bureau of Economic Analysis, this index accounts for prices that U.S. consumers pay for a wide range of goods and services. It includes various prices associated with cars, food, clothing, housing, health care and so on.

Inflation Is Rising. What Does That Mean? Does Anyone Know?

- The concept of inflation is closely related to the assessment of living standards and the “cost-of-living.” Economists (and everyone else) want to know if living standards are improving. This should be easy to measure – just count the goods and services that people consume each year. If the counts are higher this year than last, people are better o...

Which Inflation Calculation Should We use?

- Which inflation estimate is “right?” Is inflation 25% or 30%? In general, using this year’s quantities tends to produce a lower inflation estimate, as people tend to increase their spending on items with smaller price increases (also called relative price decreases). That’s chicken in this example – its 10% price increase is smaller than either inflation estimate. People tend to reduce spendin…

Inflation Is relative.

- Our simple example illustrates the difficulty of disentangling relative price changes from inflation. If we spoke with someone who subsisted solely on chicken, they would say that inflation is overstated – the price they care about most has increased less (only 10%) than the reported inflation rate of 25% or 30%. On the other hand, someone who buys only rice would say that the r…

Basic Terminology

The Relationship Between Inflation and GDP

- There are a few metrics that are used to measure the inflation rate. One of the most popular is the Consumer Price Index (CPI), which measures prices for a basket of goods and services in the economy, including food, cars, education, and recreation. Another measure of inflation is the Producer Price Index (PPI), which reports the price changes that...

How Much Inflation Is Too Much?

The Federal Reserve and Monetary Policy

- Inflation

Inflation can mean either an increase in the money supply or an increase in price levels. When we hear about inflation, we are hearing about a rise in prices compared to some benchmark. If the money supply has been increased, this will usually manifest itself in higher price levels—it is sim… - Gross Domestic Product

Gross domestic product (GDP) in the United States represents the total aggregate output of the U.S. economy. It is important to keep in mind that the GDP figures, as reported to investors, are already adjusted for inflation. In other words, if the gross GDP was calculated to be 6% higher th…

Calculating GDP and Inflation

- The relationship between inflation and economic output (GDP) plays out like a very delicate dance. For stock market investors, annual growth in the GDP is vital. If the overall economic output is declining, or merely holding steady, most companies will not be able to increase their profits (which is the primary driver of stock performance). However, too much GDP growth is als…

Implications For Investors

- So how much inflation is "too much"? Asking this question uncovers another big debate, one argued not only in the U.S but around the world by central bankersand economists alike. There are those who insist that advanced economies should aim to have 0% inflation, or in other words, stable prices. The general consensus, however, is that a little inflation is actually a good thing. T…