What Is a Gift Letter for a Mortgage?

- Gift for Down Payment. While mortgage loan underwriting requirements vary, most mortgage lenders will allow you to use gift money for a down payment if you’re purchasing an owner-occupied property, ...

- Minimum Borrower Contribution Sometimes Necessary. ...

- You Must Use an Acceptable Donor. ...

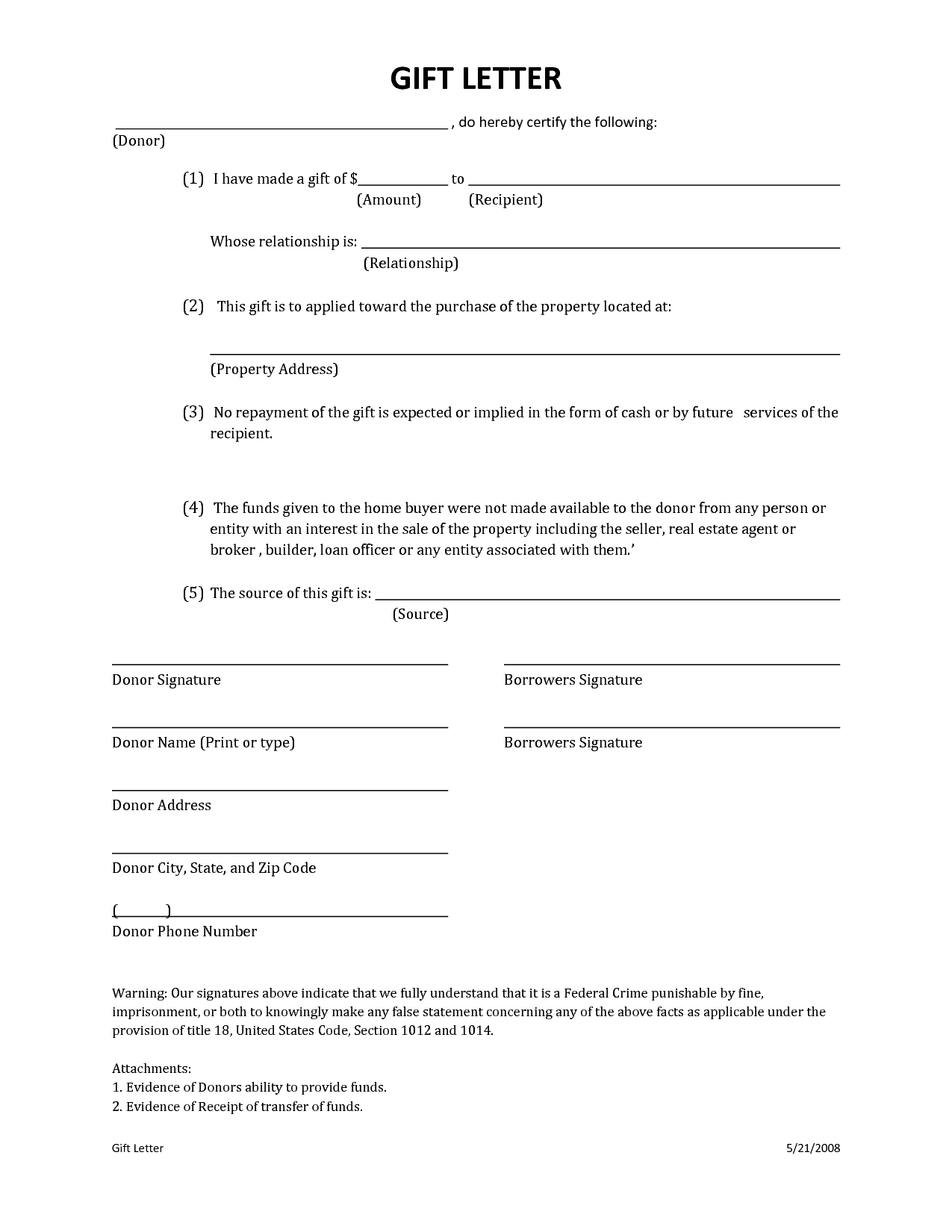

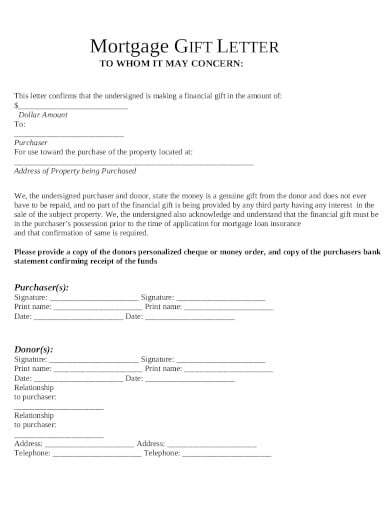

- Mortgage Gift Letter Requirements. ...

- It’s a Gift, Not a Loan…. ...

How to write a mortgage gift letter?

How to write Mortgage Gift letter. A mortgage gift letter includes the following: Name of donor of the gift. Name of the recipient. Relationship between the donor and recipient. Cash amount gifted. Address of the property for which gift is made. Source of the funds (bank account, brokerage account etc) as offered by the donor.

How to give a gift for a mortgage payment?

A gift letter for a mortgage should include the following: Full name, address, phone number, and email address of the donor and the recipient. Name of the financial institution or bank where the donor has an account in which the funds were transferred out of.

How do you write a money gift letter?

Your gift letter should be:

- Dated.

- Signed.

- Contain the name of the person who signed the letter.

- Contain the name of the person receiving the gift.

- Confirm the gift amount.

- Confirm that the gift is “unconditional, non repayable and non refundable”.

Is gift letter a legal document?

The writing of gift letters is regulated by several regulations and requirements. The provisions may also vary from state to state. Additionally, a gift letter is a legal document that can be used in legal processes. Because of the nature of this correspondence, it is best to practice care when drafting one.

Do all lenders require a gift letter?

Do all lenders require a gift letter? Yes, all lenders will require a gift letter. Although you may have the funds, the lender needs to confirm that you won't have to repay the gift. Plus, the lender must ensure that the funds came from a legitimate source.

What do I need for a gift letter for mortgage?

A mortgage gift letter must include:Donor's name and contact information.Address of property being purchased.Donor and buyer's relationship.Gift amount.Date of gift transfer.A statement that repayment isn't expected by the donor.Donor's bank, account number, and type of account.Donor's signature.

Why do lenders need bank statements for gifts?

Mortgage bankers will want to verify that donors can afford to give money toward down payment or closing costs. "They want to track the sourcing of the funding of the gifter and make sure the person offering the gift has the ability to provide it without putting themselves in financial hardship," Joseph says.

How do you prove gift money for a mortgage?

How do I prove I received the gift money?A copy of the gift giver's check or withdrawal slip and the homebuyer's deposit slip.A copy of the gift giver's check to the closing agent.A settlement statement showing receipt of the donor's monetary gift.Copy of certified check.Proof of wire transfer.

Does a mortgage gift letter get reported to the IRS?

Does a Mortgage Gift Letter Get Reported to the IRS? According to the IRS gift tax exclusions in 2022, any down payment gift below $16,000 does not have to be reported. Beyond that amount, the funds must be reported on the donor's gift tax return.

How do you prove money is a gift?

The main thing when you're using a gifted deposit is that you must prove the money is a gift, without expectation of repayment. A Gifted Deposit Letter is usually all that's required.

Do mortgage lenders check all bank accounts?

Yes, a mortgage lender will look at any depository accounts on your bank statements — including checking accounts, savings accounts, and any open lines of credit.

Do mortgage lenders look at spending habits?

Mortgage lenders will often look at your spending habits to determine if you are a responsible borrower. They will look at things like how much you spend on credit cards, how much you spend on groceries, and how much you spend on entertainment.

Do mortgage lenders check your bank account after closing?

Yes, they do. One of the final and most important steps toward closing on your new home mortgage is to produce bank statements showing enough money in your account to cover your down payment, closing costs, and reserves if required.

What does a gift letter need to say?

Gift Letter Template[Donor name, address, phone number and relationship to recipient][Recipient name and new property address][Dollar amount of the donated gift and date the gift was or will be given][Indicate whether the recipient will use (or has used) a portion of the gift for their earnest money deposit]More items...

Can my parents give me $100 000?

Under current law, the parent has a lifetime limit of gifts equal to $11,700,000. The federal estate tax laws provide that a person can give up to that amount during their lifetime or die with an estate worth up to $11,700,000 and not pay any estate taxes.

Can I borrow money from my parents to buy a house?

Providing a letter from Mom and Dad (or whoever their lender is) or from their financial planner or adviser confirming that they really do intend (and are in a position) to provide financing for the home purchase.

What does Fannie Mae require for gift funds?

a copy of the donor's check and the borrower's deposit slip, a copy of the donor's withdrawal slip and the borrower's deposit slip, a copy of the donor's check to the closing agent, or. a settlement statement showing receipt of the donor's check.

What is the source on a gift letter?

When dealing with gift funds, “sourcing” gift funds means providing a bank statement showing that the donor does in fact have enough money to give.

How do you write a down payment letter for a gift?

A gift letter for a mortgage should include the following: Relationship of the donor to the gift recipient. Monetary amount of the gift funds. Date when funds were deposited or transferred. Name of the financial institution or bank where the donor has an account in which the funds were transferred out of.

How do you write a property gift letter?

I/We [name of gift-giver(s)] intend to make a GIFT of $ [dollar amount of gift] to [name(s) of recipient(s)] , my/our [relationship, such as son or daughter], to be applied toward the purchase of property located at: [address of the house you're buying, if known] .

What is a gift letter for a mortgage?

A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan.

What happens if you give a gift for a mortgage?

If you have a large gift you want to use for your down payment, you might run into trouble during the underwriting stage of getting your mortgage. Underwriting is the process that lenders use to verify your income and assets before they give you a loan.

What does a gift slip tell you?

These slips tell the lender your relative had the money in their account before they gave it to you and that they haven’t taken out a loan to fund your down payment. You can take a few steps ahead of time to make sure your gift letter passes your lender’s standards.

What happens if a lender sees a sudden influx of cash?

If a lender sees a sudden influx of cash, it could trigger some red flags. The lender needs to know the money that came into your account is a gift, not a loan. Loans hinder your ability to pay back your mortgage and add an additional layer of risk for the lender. Can’t prove the money you’re using for your down payment is a gift and not a loan? ...

Why do lenders want to see what kind of money you have in your account?

This is because lenders want to see what kind of money you’ve had in your account for a long time and which assets are new. Large financial gifts create a problem if they’ve been in your account for less than 2 months. If a lender sees a sudden influx of cash, it could trigger some red flags.

How long do you have to wait to apply for a mortgage?

If you have a major financial gift you want to use for a down payment, it’s a good idea to wait to apply for a mortgage until that 60-day limit passes. From there, your mortgage company is less likely to be suspicious of the money in your account.

Can you gift money to someone who bought a home with a USDA loan?

Almost anyone can give you gift funds to use when you buy a home with a USDA or VA loan. The only exceptions are parties who have a vested interest in the sale, including: The person selling the home you’re buying. The person or company who built the home you’re buying. The developer of the home you’re buying.

Why do you need a gift letter for a mortgage loan?

That’s because the gift letter needs to explicitly state that the donor will not accept any repayment. Again, it’s to ensure the legitimacy of the monetary gift. Keep in mind that the mortgage loan gift letter may not be sufficient evidence for your mortgage lender.

What Is A Gift Letter For Your Mortgage?

A gift letter as it pertains to your mortgage is a document from your donor that mentions the money given is a gift . That means if you’re using the money for your down payment. Even if it’s a partial payment, the letter needs to explicitly state that the money was given to you and it’s not a loan.

Are There Limits On Down Payment Gifts?

Technically, no. However, there can be limitations depending on the type of loan you take out and the type of property you intend to purchase.

Why is it important to have proper documentation for a mortgage?

This is why it’s important to ensure you have proper documentation to help the mortgage underwriting process go as smoothly as possible.

What does it mean when a donor says no repayment is expected?

Statement from the donor saying no repayment is expected. Language stating that the gift didn’t come from an unacceptable source (seller, real estate agent/broker, loan officer, builder or anyone associated with these parties) Your signature and that of your donor.

How to contact Rocket Mortgage?

If you’re ready to get started, you can do so online with Rocket Mortgage ® by Quicken Loans ® 1 or give one of their Home Loan Experts a call at (800) 785-4788. For more articles, visit our Home Buying and Personal Finances pages.

How much can you gift someone?

The lifetime exclusion is currently $11.4 million and applies to gifts given to people either during your lifetime or after you pass in your estate.

What is a gift letter?

A gift letter is written by the giver to explain that you do not need to pay the money back to them, but it also includes a few other important details. Here are the main things the letter should include:

What happens after you apply for a home loan?

After you’ve applied for a home loan, an underwriter takes your complete application and goes through your financial information to make sure you actually qualify for the loan. Basically, the underwriter is deciding how risky it is to lend you the money you’re applying for.

What does an underwriter look for in a loan?

The underwriter will look at your income, credit score, and your assets to determine your worthiness for a loan.

Can you use gift money for a down payment?

This is actually not true. Using gift money for a down payment isn ’t as cut-and-dried as it seems . The source of the money in your bank account matters just as much as the money that’s actually in that account. The bank needs to be able to see exactly where the down payment came from before you can use it to close on a home.

Do you need a down payment for a VA loan?

For instance, VA loans, which are available to active and veteran members of the U.S. military, don’t need a down payment at all, so any or all of the money can come from gifts. The requirements for proving the source of these funds tend to be more lenient, as well.

Can you give money to a friend on a FHA loan?

FHA mortgages have low down payments (3.5%), and down payment gifts can come from family members or friends. These loans do require proof of transfer and the donor must prove the source of the funds for the gift.

Gifted Funds

You might assume that money given to you is fair game to go toward your new mortgage, right? Surely the bank doesn’t care where you get your money as long as you have the right amount.

How Underwriting Works

After you’ve applied for a home loan, an underwriter takes your complete application and goes through your financial information to make sure you actually qualify for the loan. Basically, the underwriter is deciding how risky it is to lend you the money you’re applying for.

Why Does Any of This Matter?

A bank needs to look at any large amounts of money that were given to you to make sure lending you money is a good decision. If the down payment funds in your account were a loan, you’d have the additional financial stress of that loan, and this would make it less likely that you could pay the mortgage back.

Establishing the Gift with a Letter

Here’s where that gift letter comes in. A gift letter is written by the giver to explain that you do not need to pay the money back to them, but it also includes a few other important details. Here are the main things the letter should include:

Loan Types and Gift Letters

Different loan types have different requirements about gift funds and gift letters. This is especially true for government-backed loans.

How to tell your lender you're receiving a gift?

Tell your lender you’re receiving a gift if there’s an expectation to pay back the funds. Keep a paper trail of the funds changing hands. Fail to disclose a gift you’ve already received to your lender. Make sure the gift is coming from an allowed relationship depending on your loan.

Who is responsible for gift tax?

The person receiving the gift will not be responsible for any tax liability, but the gift giver may be liable if the amount exceeds the gift tax exclusion limit.

What can you do if a down payment gift isn’t an option?

Gift funds are a lifeline if you are ready to purchase a home but don’t have sufficient cash. Of course, not everyone is fortunate to receive a mortgage gift. Only 28% of first-time home buyers make use of a gift or loan from family and friends, according to a 2021 NAR survey. The good news for the remaining majority is that there are other possibilities available for when you’re facing low down payment funds.

Why do lenders ask for bank statements?

The purpose of reviewing your bank statements is to ensure you have enough in reserves for mortgage expenses. But sometimes, a family member offers to pay these expenses as a gift to you.

What documents are needed to get a down payment?

This could include: Bank statements. A copy of the check and the buyer’s deposit slip. A copy of the gift giver’s check to the title agent. Proof of wire transfer.

Can you give a down payment gift to a VA loan?

USDA and VA loans: USDA and VA loans have the least restrictions on mortgage gifts. Anyone you have a relationship with can provide a down payment gift, but the one caveat is that they can’t be an interested party. An interested party is someone involved in your home purchase transaction, for example, your real estate agent.

Can a parent give money to a mortgage company?

If a parent, sibling, or grandparent offers to gift funds for your mortgage expenses, you may not think to disclose this information to your lender. From your perspective, as long as you arrive at closing with enough funds, you should be okay, right? Unfortunately, it's not that simple.

What's a mortgage gift letter?

A mortgage gift letter is a form from your donor declaring that the down payment funds have been given to you as a gift.

When would you use a mortgage gift letter?

Young couples might look into first-time home buyer programs or — sometimes more likely — the lovebirds will turn to their parents for some help.

Mortgage gift rules and restrictions

The main restriction implemented by the IRS limits the amount of money that’s gifted from one person to another.

When can you use down payment gifts?

Down payment assistance from friends or family can move forward on a primary or sometimes even a second property without being a tax liability for the person receiving the gift.

What is a gift letter for a mortgage?

A gift letter is a statement from a donor (usually a relative or friend) explaining that the money is being given without expectation of repayment. Knowing how to complete a gift letter for a mortgage down payment will prevent mistakes that could delay or sabotage your loan approval.

What is a mortgage gift?

A gift is a gift, and anything indicating the money must be repaid is unacceptable. If you use a standard mortgage gift letter template, the pre-printed language includes a statement that no repayment is expected. Your relationship to the gift donor must be clear.

What is a gift letter for a mortgage down payment?

A gift letter for a mortgage down paymentis a written statement that the funds are a gift rather than a loan that has to be repaid. The letter must specify who is gifting the money and where the donor’s funds are coming from, as well as explain the relationship between the donor and the recipient. Gift letter template.

How many pieces of information are required in a gift letter?

Mortgage lenders require at least eight pieces of information in a gift letter, including:

When someone offers to help you make a down payment on a house, will your lender require a gift letter?

When someone offers to help you make a down payment on a house, your lender will require a gift letter for a mortgage. Here’s what it includes.

Do you have to pay tax on a gift?

In most cases, the donor has to pay the gift tax, but there may be special cases when the gift recipient can agree to pay it instead. Check with a tax professional for advice on your specific situation.

Does lending tree include all lenders?

LendingTree does not include all lenders, savings products, or loan options available in the marketplace.