Hard inquiries, or hard credit checks, hurt your credit score because it can be viewed as financially irresponsible to apply for too many loans or forms of credit. If you apply for a lot of loans and the lenders are all running credit checks you will likely see your credit score take a dip.

Full Answer

How long do hard inquiries affect your credit score?

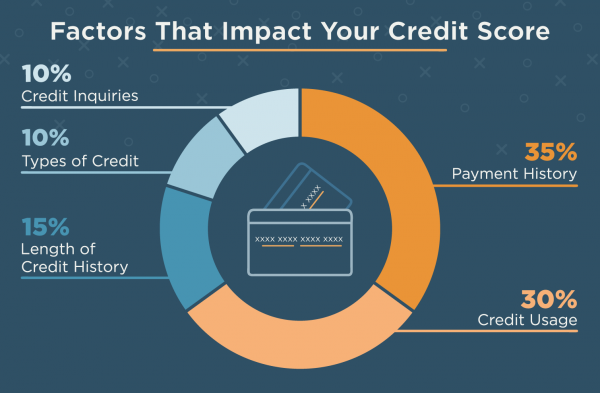

Those factors include:

- Payment history. Whether you pay your bills on time and as agreed accounts for around 35% of your credit score.

- Credit utilization. How much of your available revolving credit limit you’re actively using accounts for around 30% of your score.

- Credit age. ...

- Credit mix. ...

- Hard inquiries. ...

How do credit inquiries affect your credit score?

The reason that hard inquiries can lower your credit score is because a new application can represent more risk for the card issuer. The uncertainty that applying for new credit adds can be compounded if you have just a few accounts or not much in the way of credit history.

Does hard inquiry hurt credit?

It’s true that a hard inquiry can cause damage to a credit score – especially if you have a thin or short credit file. For those with more in their file, the impact may not be as great. What it all boils down to is that a hard inquiry is an indicator of uncertainty, which equates to a possible increase in risk for a lender. Let me explain.

What has the biggest impact on your credit score?

What Counts Toward Your Score

- Payment History: 35%. There is one key question lenders have on their minds when they give someone money: “Will I get it back?”

- Amounts Owed: 30%. So you might make all your payments on time, but what if you’re about to reach a breaking point? ...

- Length of Credit History: 15%. ...

- New Credit: 10%. ...

- Types of Credit in Use: 10%. ...

How many points does a hard inquiry affect credit score?

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant. As FICO explains: “For most people, one additional credit inquiry will take less than five points off their FICO Scores.”

Why did a hard inquiry raise my credit score?

If you see a hard inquiry listed on your credit report it is because you have applied for credit in the last two years. This could mean that you applied for a credit card, whether it be a rewards card, a cash-back card or even a balance transfer card like the U.S. Bank Visa® Platinum Card.

How long does a hard inquiry affect your credit score?

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year. Depending on your unique credit history, hard inquiries could indicate different things to different lenders.

Why do inquiries affect your credit score?

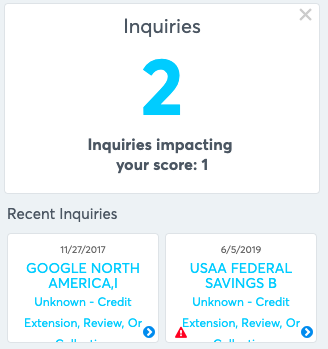

Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.

Can I get hard inquiries removed?

Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. Hard inquiries can't be removed, however, unless they're the result of identity theft. Otherwise, they'll have to fall off naturally, which happens after two years.

How do you get an 800 credit score?

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time. ... Keep Your Credit Card Balances Low. ... Be Mindful of Your Credit History. ... Improve Your Credit Mix. ... Review Your Credit Reports.

Will credit score go up after hard inquiry drops off?

Yes, your credit score does go up when a hard inquiry drops off. Hard inquiries are used to track how much credit you've applied for in the last two years. When lenders see you applying a lot during this period, they may deny you for new credit.

How many hard inquiries are too many?

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

Is Credit Karma accurate?

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Is 700 a good credit score?

FICO credit scores, the industry standard for sizing up credit risk, range from 300 to a perfect 850—with 670 to 739 labeled “good,” 740-799 “very good” and 800 to 850 “exceptional.” A 700 score places you right in the middle of the good range, but still slightly below the average credit score of 711.

Why did my credit score drop 40 points?

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

How can I get inquiries removed from my credit report fast?

One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry (or inquiries) were not authorized, and then request that those inquiries be removed. You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up.

What Is A Credit Inquiry?

An inquiry is created when your credit report is accessed by a business. Let’s say you apply for a car loan, and the lender requests your credit re...

What Is A Hard Credit Inquiry?

Hard inquiries, otherwise known as hard pulls, can affect your credit scores greatly. They show you have applied somewhere to get credit, whether t...

What Is A Soft Credit Inquiry?

Soft credit inquiries, otherwise known as soft pulls, are not generated by shopping for credit and do not affect your overall credit scores. For ex...

How Can I Keep My Credit Scores from Dropping?

There are several ways to minimize the likelihood that your scores will drop due to hard inquiries. Here are a couple of them:

Can You Remove Inquiries from Your Credit Report?

As mentioned earlier, soft credit inquiries do not negatively affect your credit score, but hard credit inquiries can. If you would like to remove...

How Do Hard Inquiries Impact Your Credit?

Hard inquiries are one of the five major factors that make up your credit score . Those factors include:

How long does a hard inquiry stay on your credit report?

According to Experian, hard inquiries remain on your credit report for 25 months. However, they only tend to impact your credit score the first 12 months. How much a hard inquiry impacts your credit depends on a variety of factors, including what your credit score was to begin with.

What is a hard inquiry?

Hard inquiries specifically refer to instances when a lender accesses your credit report for the purpose of evaluating you as a borrower. In other words, hard inquiries happen when lenders look at the information in your report to decide whether to approve or deny your application for credit.

Why is my credit card company checking my credit?

A credit card company checking your credit after you applied for a card. A bank checking your credit because you applied for a car loan. A company checking your credit before leasing you a car. The key thing to remember with hard inquiries is that you should know they’re about to happen.

How many inquiries are too many?

There’s no set number of inquiries that are too many. If you suddenly have a lot of inquiries, it can look bad to potential creditors. And if you’re losing up to 10 points for each one, you could drop from excellent or good credit to fair or poor credit with just five or more inquiries.

What does it mean when someone checks your credit?

Hard inquiries get reported on your credit report when someone checks your credit for the purpose of considering you for a loan or credit card. These items do impact your credit, so it’s important to understand what they are, why they’re there and how you can limit them. Find out more about hard inquiries and how to keep them from lowering your credit unnecessarily below.

Why do you have to space out credit inquiries?

Spacing out the inquiries and ensuring that your credit report doesn’t take a hit can help minimize these issues. It also gives your score time to recover before another inquiry.

What percentage of credit score is hard inquiries?

Hard inquiries fall under the “less influential” category when calculating credit scores using the VantageScore model, and they make up only 10% of a FICO score calculation. But they play a big part when it comes to credit card issuers and lenders assessing your potential risk.

Why is my credit score so hard?

If you spot a hard inquiry on your credit report, don’t sweat it too much. It’s there because your credit was pulled by an issuer or lender when you applied for a credit card or loan. And if your credit score does get dinged from it, it’s OK. It can bounce back in a few months if you use your card responsibly.

What is a hard inquiry?

When you apply for a credit card or any other type of loan (a mortgage, auto loan), you give the issuer or lender permission to check your credit report to assess your “creditworthiness.” In essence, your potential lender is looking to see how likely you are to pay back the money you borrowed. The healthier credit history you have, the less risk you demonstrate, and the greater the likelihood you’ll qualify for that new credit card or loan.

What is it called when a credit card company pulls your credit report from one of the three major credit bureaus?

When a credit card issuer or lender pulls your credit report from one of the three main credit bureaus (Experian, Equifax or TransUnion), this is called a hard inquiry ( or “hard pull”).

What is it called when a credit card company pulls your credit report?

When a credit card issuer or lender pulls your credit report from one of the three main credit bureaus (Experian, Equifax or TransUnion), this is called a hard inquiry ( or “hard pull”).

Why do lenders pull your credit report?

Lenders pull your credit report to see how credit worthy you are , but finding a bunch of inquiries on your credit report will show them you may be financially stressed and a bigger risk for borrowing in the future.

How long do hard inquiries stay on credit report?

Although hard inquiries remain on your credit report for two years , FICO only considers inquiries from the last 12 months when calculating your credit score.

How long do hard inquiries stay on your credit report?

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year.

What is a hard inquiry?

When a lender or company requests to review your credit reports after you've applied for credit, it results in a hard inquiry. Hard inquiries usually impact credit scores. Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry. Some consumers are reluctant to check their credit reports ...

How to establish smart credit behavior?

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a “hard” inquiry on your credit report.

How to get free credit report?

You’re entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting www.annualcreditreport.com. You can also create a myEquifax account to get six free Equifax credit reports each year. In addition, you can click“Get my free credit score” on your myEquifax dashboard to enroll in Equifax Core Credit ™ for a free monthly Equifax credit report and a free monthly VantageScore® 3.0 credit score, based on Equifax data. A VantageScore is one of many types of credit scores.

What is a vantage score?

A VantageScore is one of many types of credit scores. If you’re worried about the effect that multiple hard inquiries may have on your credit report, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. ...

How much does Equifax complete TM Premier cost?

For $19.95 per month, you can know where you stand with access to your 3-bureau credit report. Sign up for Equifax Complete TM Premier today!

Does a soft inquiry affect your credit score?

This is different from a “soft” inquiry, which can result when you check your own credit or when a promotional credit card offer is generated. Soft inquiries do not impact your credit score.

What is a credit inquiry?

Before you find out how and why hard inquiries can impact your overall credit score, you should know what an inquiry is exactly. When you apply for any new line of credit, you give those lenders permission to acquire your credit report. Some companies may pull an inquiry about you without you asking, these will have no impact on your score.

Will your credit score change after applying for new credit?

Your credit score will go down a few points when you apply for a new line of credit. This is because your risk level goes up for lenders if you are actively looking for more available credit, especially if you apply for multiple sources of credit at one time.

How much does a hard credit inquiry affect your credit score?

The impact on your individual credit score after applying for new credit will vary, depending on your own personal credit history. If you have very few accounts or a relatively short credit history, credit inquiries will have a more serious impact on your score.

How much will a hard inquiry affect your credit?

While a hard inquiry had a negligible impact on my credit, this won't necessarily be the case for every person who applies for new credit.

How to maintain a high credit score?

Using credit responsibly, and in moderation, is the key to maintain ing a high credit score . You never want to max out your cards or apply for too much credit at one time because this can raise red flags. Instead, keep your level of borrowing reasonable and always make payments on time. That way you should be able to earn ...

How long does a credit card stay on your credit report?

This is a common concern because when you apply for financing, the lender checks your credit report, triggering a hard inquiry that stays on your record for two years.

Why is it bad to have too many inquiries?

Too many inquiries can have a bigger impact on your score because it can make lenders nervous that you're borrowing too much and might get in over your head financially. You'll likely want to avoid applying for too much credit at one time to avoid raising red flags that could hurt your ability to borrow.

Does a hard credit check lower your credit score?

If you haven't applied for credit recently but are currently thinking about taking out a new loan or opening a new credit card, you probably shouldn't worry too much about getting an inquiry on your credit record. While it's true that a hard credit check will lower your score, the decline is likely to be so small that it won't pose any real problems.

Why do hard inquiries affect credit?

They can see this as you being unstable. Constantly needing loans or credit could mean that you are always behind and needing money. Because of this, credit bureaus have made their algorithm lower your credit score every time you have a hard inquiry on your account. It’s up to you to prove that you can be trusted. To your lender and the credit bureaus, you are guilty until proven innocent.

How Much Does a Hard Inquiry Impact You?

Hard inquiries are somewhat strange. Most of the time they are required but they still lower your score. This isn’t the only thing that can happen, however. While in the grand scheme of things these hard inquiries are pretty inconsequential, they can still cause an impact if you don’t pay attention. Let’s look at some of these impacts so we can understand hard inquiries some more.

What is a soft credit pull?

On the other hand, a soft credit inquiry or “soft credit pull” is performed by people you aren’t seeking loans or credit from. Even though soft inquiries can provide the same information as hard inquiries, they do not lower your credit score. They are often just used for small checks or updates on your credit.

Why do credit bureaus lower my credit score?

Because of this, credit bureaus have made their algorithm lower your credit score every time you have a hard inquiry on your account. It’s up to you to prove that you can be trusted.

What is a credit inquiry?

According to the Consumer Financial Protection Bureau, “an inquiry refers to a request to look at your credit file. ”. Anytime you try to get new credit or get a new loan, your lender will want to know if you are trustworthy enough to lend too.

Why do lenders want access to credit file?

They will want access to your credit file so they can see any relevant information about you and your ability to pay back loans and credit. This request for access is the inquiry. Once the inquiry is approved, they will then have the liberty to look at anything from your credit report to your credit score. A hard inquiry is one of these types of ...

How long does it take for a hard inquiry to come off your credit report?

For whatever reason, hard inquiries tend to linger on your credit report for some time. They can take around 2 years to come off of your credit report. This is one of the reasons why you should get loans and new credit sparingly. Too many hard inquiries on your credit won’t look so great to new lenders!