Accrual Accrual (accumulation) of something is, in finance, the adding together of interest or different investments over a period of time. It holds specific meanings in accounting, where it can refer to accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual-based accounting.Accrual

What are the disadvantages of accrual basis accounting?

Disadvantages of Accrual basis of Accounting. Following are some of the disadvantages of accrual basis of accounting: 1. Accrual basis of accounting can be complicated requiring more skill, time and resources. 2. It can give a skewed view of the short term financial position of the company.

Is accrual basis more reliable than cash basis accounting?

indicated that accrual basis accounting is more reliable than cash basis accounting because it could fulfill his needs. Cash basis accounting is more reliable than accrual basis accounting according to theory, however, this is different from what the professional (C.F.O.) suggested.

How to choose between cash and accrual accounting?

- It makes it easy to see future revenue and expenses. Unlike cash accounting, accrual basis accounting lets you see a full picture of your business’s finances. ...

- It provides a more accurate picture than cash basis accounting. ...

- It allows tax savings for depreciation. ...

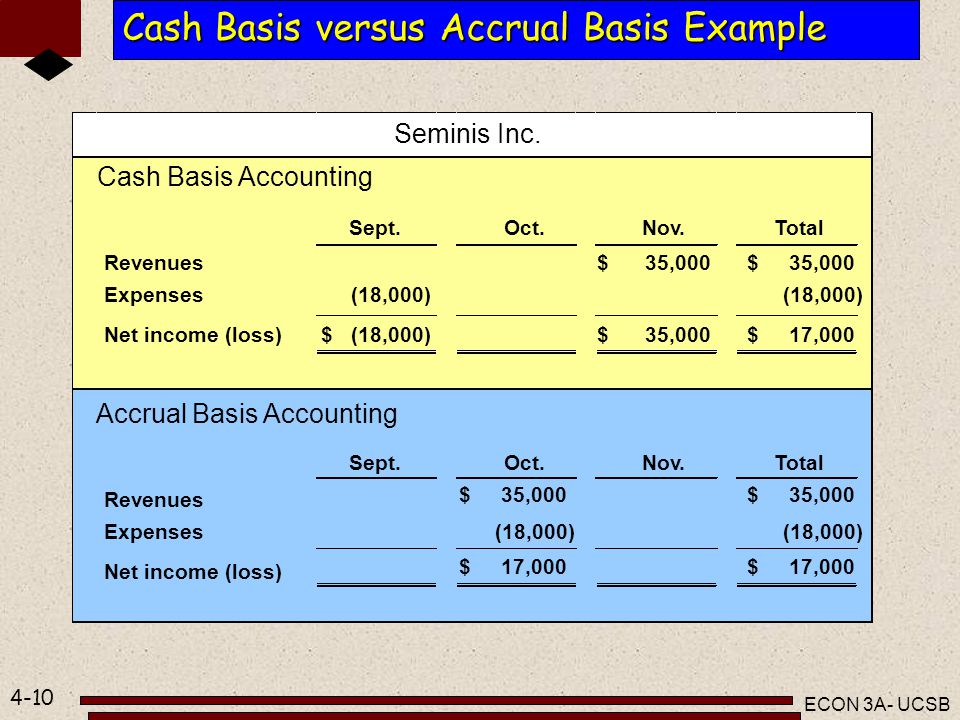

What is the difference between accrual accounting and cash accounting?

What’s the Difference Between Cash Accounting and Accrual Accounting?

- Timing. Cash accounting occurs when revenue and expenses are stated at the time money changes hands. ...

- Accuracy. Accrual accounting is generally considered to provide a more accurate long-term picture of the firm’s financial health.

- Complexity. Cash accounting is simple for a small business, as it’s just like taking care of your checkbook. ...

Is accrual accounting more accurate than cash accounting?

Cash basis accounting records revenue and expenses when cash related to those transactions actually is received or dispensed. Accrual accounting provides a more accurate view of a company's health by including accounts payable and accounts receivable.

Why is accrual basis of accounting is considered to be more realistic than the cash basis of accounting?

Accrual basis accounting This method is more commonly used than the cash method. The upside is that the accrual basis gives a more realistic idea of income and expenses during a period of time, therefore providing a long-term picture of the business that cash accounting can't provide.

What makes accrual accounting more relevant and cash flows more reliable?

While cash-based accounting can give a point-in-time picture of the business cash flow, accrual-based accounting offers a more accurate picture of the longer-term state of the business; revenues and expenses are immediately recorded, allowing the business to more properly analyze trends and manage finances.

Which basis of accounting is most accurate?

the accrual basis of accountingTherefore, the accrual basis of accounting provides a more accurate measure of a company's profitability during an accounting period, and a more accurate picture of a company's assets and liabilities at the end of an accounting period.

What are some of the benefits of using accrual accounting?

Key Takeaways of the Benefits of Accrual AccountingReal-time view of finances.Accurate assessment of finances.Good management of debt and income.A clear picture of a company's financial health.The ability to increase revenue.

Which accounting system most accurately reflects profitability?

The accrual accounting method provides a more accurate picture of a company's profitability, growth and overall financial health at any point in time.

Is accrual accounting effective?

Accrual accounting is effective for financial management and monitoring activities. In an accrual accounting system, companies receive a more immediate reflection of how much money they have coming in, and what they can expect to see on future expense reports.

Why do accrual basis financial statements provide more information than cash basis statements?

Accrual accounting provides more useful information than cash basis because it records a transaction as it occurs. It does not wait for cash payment and cash receipt.

Why do accountants use the accrual basis method?

Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. If you want to see if a particular month was profitable, accrual will tell you. Some businesses like to also use cash basis accounting for certain tax purposes, and to keep tabs on their cash flow.

Which method is better cash or accrual?

Accrual basis accounting applies the matching principle - matching revenue with expenses in the time period in which the revenue was earned and the expenses actually occurred. This is more complex than cash basis accounting but provides a significantly better view of what is going on in your company.

What statements about the accrual based method of accounting are true?

Answer and Explanation:OptionExplanationa. Accrual-basis accounting recognizes revenues when they are received in cash.Revenues are recognized in the accrual system when they are earned. Hence, it is an incorrect option.3 more rows

What is better cash basis or accrual basis?

Accrual basis accounting applies the matching principle - matching revenue with expenses in the time period in which the revenue was earned and the expenses actually occurred. This is more complex than cash basis accounting but provides a significantly better view of what is going on in your company.

Why do accrual basis financial statements provide more information than cash basis statements?

Accrual accounting provides more useful information than cash basis because it records a transaction as it occurs. It does not wait for cash payment and cash receipt.

Why is the accrual based income statement superior to a cash based income statements in measuring profitability select all that apply?

Why is the accrual-based income statement superior to a cash-based income statements in measuring profitability? It reports the expenses incurred in generating the revenues regardless of when the cash was paid.

What is difference between cash basis and accrual basis?

While the cash basis method of recording involves immediate recognising of any expenses and revenues, the accrual basis is based on anticipation of the expenses and revenues....Difference between Cash Basis and Accrual Basis of Accounting.Cash Basis of AccountingAccrual basis of AccountingCash basis is simple in natureAccrual basis is complex in natureAccounting system followed12 more rows•Mar 1, 2021

What Is An Accrual (In Plain English)?

What exactly is an “accrual”? If companies received cash payments for all revenues at the same time when they were earned, and made cash payments f...

Categories in Accrual Accounting

In accounting, accruals in a broad perspective fall under either revenues (receivables) or expenses (payables).

Prepaid Expenses vs. Accrued Expenses

Prepaid expenses differ from accrued expenses in one significant way – in the case of prepaid expenses, the company pays upfront for services and g...

Impact of Accrual Accounting

Despite accruals adding another layer of accounting information to existing information, it changes the way accountants do their recording. In fact...

The Relationship Between Accrual Accounting and Cash Accounting

Even though both accrual accounting and cash accounting methods serve as a yardstick of performance and the economic position of a company in a giv...

What Is Accrual Accounting?

Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold or expenses are recorded as incurred before the company has paid for them.

What are the different types of accrual accounts?

There are various types of accrual accounts. The most common include accounts payable, accounts receivable, goodwill, accrued interest earned, and accrued tax liabilities.

When is an accrued expense recorded?

The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet and as an expense in the income statement. On the general ledger, when the bill is paid, the accounts payable account is debited, and the cash account is credited.

Is accrual accounting accurate?

However, accrual accounting says that the cash method is not accurate because it is likely, if not certain, that the company will receive the cash at some point in the future because the services have been provided.

Is revenue earned recognized on the company's accounting books?

In other words, the revenue earned is recognized on the company's accounting books regardless of when cash transactions have occurred. Accrual accounting is one of two accounting methods; the other is cash accounting. Cash accounting only records the revenue when the cash transaction has occurred for the goods and services.

When is revenue recorded for consulting services?

As a result, if the company uses the cash accounting method, the $5,000 in revenue would be recorded on Nov. 25, which is when the company receives the payment.

Is accrual method more expensive?

The accrual method does provide a more accurate picture of the company's current condition, but its relative complexity makes it more expensive to implement.

How does accrual accounting work?

Let's say you wrap up a project for a client at the end of January. You send off the invoice immediately, but the client takes a few weeks to pay their bill, so the money doesn't arrive in your account until mid-February. So when do you add the financial transaction to your books—January or February?

Which accounting method is more accurate?

For most businesses, accrual-based accounting is more accurate. Want to know how and why? Keep reading—we have the answers.

Does accounting software use accrual accounting?

Here's another reason to try accrual-basis accounting: most accounting software defaults to accrual-basis rather than cash-basis accounting.

What is the accounting method used to keep books in order?

Most businesses use one of two main accounting methods to keep their books in order: accrual accounting and cash accounting. If you use the accrual method, you record financial transactions when they occur, not when money actually leaves or enters your account. With cash accounting, the opposite is true: you won't create a journal entry ...

What is accrual basis accounting?

Accrual-basis accounting is a secure, accurate way to log business transactions and keep tabs on income and expenses. Of course, if your business makes under $5 million a year or you're an individual freelancer with a handful of small yearly projects, cash-basis could work for you. Otherwise, we say stick with accrual.

Is accrual accounting more complex than cash accounting?

In other words, accrual-based accounting is much more complex than cash based. That isn't to say it's beyond the grasp of most small-business owners—just that there's a learning curve, and it can feel a little steep for the non-accountants among us.

Is accrual method better than cash method?

Most notably, the accrual method paints a better long-term picture of business trends and growth than the cash method. If your construction business gets most of its contracts in the spring and summer, you might not be paid the full amount until fall, but fall isn't actually when you did most of your business—and your books need to reflect that.

Why do we need accruals?

In fact, accruals help in demystifying accounting ambiguity relating to revenues and liabilities. As a result, businesses can often better anticipate revenues while keeping future liabilities in check.

What is the purpose of accrual accounting?

The purpose of accrual accounting is to match revenues and expenses to the time periods during which they were incurred, as opposed to the timing of the actual cash flows related to them.

How to record accruals?

To record accruals, the accountant must use an accounting theory known as the accrual method. The accrual method enables the accountant to enter, adjust, and track “as yet unrecorded” earned revenues and incurred expenses. For the records to be usable in the financial statement reports, the accountant must adjust journal entries systematically ...

What is account payable?

Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. Accounts payables are. , liabilities and non-cash-based assets, goodwill, future tax liabilities, and future interest expenses, among others.

What is prepaid vs accrued?

Prepaid Expenses vs. Accrued Expenses. Prepaid expenses are the payment opposite of accrued expenses. Rather than delaying payment until some future date, a company pays upfront for services and goods, even if it does not receive the total goods or services all at once at the time of payment.

What is interest expense accrual?

Interest expense accruals – Interest expenses that are owed but unpaid.

What is accrued revenue?

Accrued Revenues. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received. In this case, a company may provide services or deliver goods, but does so on credit.

What is accrual accounting?

Accrual accounting is the alternative to the cash accounting method, where businesses only record revenues and expenses during occasions when cash is actually received or paid out.

How does cash accounting work?

Under the cash accounting method, where revenues and expenses are only recorded if and when cash is actually received or paid, companies can obtain more accurate snapshots of their cash flows. Simply put: if a company bills its clients on credit terms, it waits until that debt is officially paid before recording this revenue on its balance sheet. For example, if a furniture store sells a customer a leather sofa on credit in February, but does not receive payment until April, the revenue for this sale is not recorded until April. This method lets cash-strapped companies know precisely the amount of cash they have on hand, to prevent over-extension and allow for shrewder budgeting.

Why is accrual accounting used?

Accrual accounting is used because of it’s benefits. As a business owner, experiencing growth can be a double-edge sword. Why?

Why do businesses use accrual accounting?

In order to expand, or even to survive, most businesses will depend on credit. Accrual accounting allows companies to record and measure credit – both credit owing as well as owed.

What is the difference between cash and accrual accounting?

Cash accounting is an “after the fact” accounting style, while accrual accounting is done in real time. According to World Bank, accrual accounting makes it easy for business managers to plan the future.

Why do professionals strategize ways to improve sales or generate more revenue as they spot financial plateaus?

They do not have to wait to receive the cash to see what their profits are. Because of this, professionals can strategize ways to improve sales or generate more revenue as they spot financial plateaus. This keeps a company progressive, which is crucial to viability. (smallbusiness.chron.com)

What is hybrid accounting?

Between the two types of accounting, it is important to note that a 3rd option exists that is an additional component – but not for every business. “The hybrid method of accounting allows your business to use any combination of cash, accrual, and special methods of accounting. Generally, the IRS allows businesses to use this method ...

What is an accrual?

The term “accrual” refers to any individual entry recording revenue or expense in the absence of a cash transaction. ”. Entrepreneur magazine. In other words, you get to count your eggs before they hatch – but you also have to go collect the eggs!

When is accrual required?

Entrepreneur Magazine makes this valid point: “The accrual method is required if your business’s annual sales exceed $5 million and your venture is structured as a corporation. In addition, businesses with inventory must also use the accrual method. It’s also highly recommended for any business that sells on credit, as it more accurately matches income and expenses during a given time period.”

Why is accrual accounting important?

Accrual accounting is the preferred method of accounting for most businesses because it offers a more accurate representation of a company’s finances. Investors and lenders may require this method, and even if they don’t, the consistency of key metrics could make your business look more stable and increase ...

Why do companies use accrual accounting?

Products-based businesses that carry inventory, even if they’re small, usually use accrual accounting because the cash method doesn’t properly account for cost of goods sold and sinks gross profit. In addition, any companies with more than $25 million in revenue or that are publicly traded must use accrual accounting.

What Is Accrual Basis Accounting?

Accrual basis accounting combines two key accounting principles: the matching principle and the revenue recognition principle. The matching principle says that expenses should be recognized in the same period as the revenue they help generate. The revenue recognition principle states that revenue should be recognized when it is earned or realized, i.e. when a business performs the actions that entitles it to the revenue.

How Does Accrual Accounting Work?

In accrual accounting, a company recognizes revenue during the period it is earned, and recognizes expenses when they are incurred. This is often before—or sometimes after—it actually receives or dispenses money.

How Does Accounting Software Help With Accrual-Based Accounting?

One of the biggest reasons businesses hesitate to use accrual accounting is the time and effort required to maintain the books and records. It is more complex to manage accounts receivable, accounts payable and prepaid or deferred assets than to simply track cash in and cash out under the cash basis method. Additionally, the accrual method requires companies to close the books more frequently (i.e. monthly, rather than annually). Further, companies generally manage subsidiary ledgers like accounts receivable and accounts payable more frequently, on a weekly or biweekly basis.

What is the difference between cash and accrual accounting?

The differences between accrual and cash accounting also have significant tax implications. For example, a potential tax consequence of accrual accounting is that tax payments may be due on revenue that has been recognized, even though the company has not yet received the cash for some of those transactions.

How does accrual accounting affect financial records?

Since accrual accounting doesn’t factor in when money actually changes hands, it reduces the impact of timing on a company’s financial records. For instance, consider a software company that sells a five-year subscription to its solution and receives the full payment as a cash sum at the start of the subscription. With cash-based accounting, it would record all the revenue during the first period and nothing for the next five years, which could lead to vastly different numbers in two consecutive reporting periods. With accrual-based accounting, the company spreads out that revenue over the length of the subscription to smooth out the impact of that transaction.