Common reasons your escrow payment might be going up include:

- An increase in homeowners insurance premium

- An increase in property taxes in your area

- Your servicer miscalculated fees

Why did my monthly mortgage payment go up or change?

Why Does My Mortgage Payment Keep Changing?

- Property Tax Changes. Your property taxes going up or down can cause a mortgage payment change. ...

- Homeowners Insurance. ...

- Mortgage Insurance Removal. ...

- Adding An Escrow Account. ...

- Interest Rate Adjustments. ...

- Servicemember Benefits. ...

- New Fees Were Charged. ...

- Preparing For Changes To Your Monthly Mortgage Payment. ...

Does escrow pay taxes?

In real estate, escrow accounts are used to pay property taxes and insurance. Your mortgage lender sets up an escrow account for you. The escrow account tax deduction is limited to the amount of taxes you paid in that tax year. 1. do i claim escrow on my taxes?

Why do I have to pay an escrow waiver fee?

What happens if you waive it?

- Waiver fees. A fee is often charged for waiving escrow if it’s optional for your mortgage. These fees can be up to about one-quarter point of interest.

- Investment options. Escrow funds often do not earn interest while being held in an account. ...

- Avoid more upfront costs. You won’t have to pay property taxes or homeowners insurance up front at closing. ...

Why was my payment declined and what can I do?

Why was your card declined online and what to do about it

- Common debit and credit card decline messages. Most retailers around the world, whether online or offline, accept credit and debit card payments. ...

- Prepaid cards. Prepaid cards work in the same way as to store gift cards; you top up with money and use them to pay for goods in-store or online.

- Mobile payment apps. ...

- WorldRemit payment methods. ...

Why did escrow payment increase?

The most common reason for a significant increase in a required payment into an escrow account is due to property taxes increasing or a miscalculation when you first got your mortgage. Property taxes go up (rarely down, but sometimes) and as property taxes go up, so will your required payment into your escrow account.

How can I lower my escrow payment?

There are few ways to lower your escrow payments:Dispute your property taxes. Call your local assessor if you think your property tax bill is too high, and ask about the process to dispute your bill.Shop around for homeowners insurance. ... Request a cancellation of your private mortgage insurance.

What affects escrow payment?

Your tax bill and insurance premiums can change from year to year. Your servicer will determine your escrow payments for the next year based on what bills they paid the previous year. To ensure there's enough cash in escrow, most lenders require a minimum of 2 months' worth of extra payments to be held in your account.

Why does my escrow keep coming up short?

An escrow shortage occurs when there is a positive balance in the account, but there isn't enough to pay the estimated tax and insurance for the future. An escrow deficiency is when there's a negative balance in your escrow account. This happens when we've had to advance funds to cover disbursements on your behalf.

Can you remove escrow from your mortgage?

Lenders also generally agree to delete an escrow account once you have sufficient equity in the house because it's in your self-interest to pay the taxes and insurance premiums. But if you don't pay the taxes and insurance, the lender can revoke its waiver.

What happens if I pay an extra $200 a month on my mortgage?

If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000. Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment.

Does escrow increase every year?

Lenders can estimate increases in the escrow account that have not yet occurred. The lender can add a percentage to the prior year's actual tax or insurance payments when calculating the escrow for the next year, resulting in the escrow balance increasing.

Is it better to pay escrow shortage in full?

Should I pay my escrow shortage in full? Whether you pay your escrow shortage in full or in monthly payments doesn't ultimately affect your escrow shortage balance for better or worse. As long as you make the minimum payment that your lender requires, you'll be in the clear.

Why does my mortgage balance keep going up?

If your monthly mortgage payment includes the amount you have to pay into your escrow account, then your payment will also go up if your taxes or premiums go up. Learn more about escrow payments. You have a decrease in your interest rate or your escrow payments.

What happens if there is not enough money in escrow?

If you have an escrow deficiency, that means that your escrow account has a negative balance. This can happen if your tax or insurance bills came due and you didn't have enough money in your account to cover them, so your lender had to pay the remaining balance for you using their own funds.

How can I lower my house payment without refinancing?

Here are four ways to lower your mortgage payment without refinancing.Cancel your mortgage insurance. ... Request a loan modification. ... Lower your property taxes or homeowners insurance. ... Recast your mortgage. ... Make one extra payment per year. ... Round up your mortgage payment each month. ... Enter a bi-weekly mortgage payment plan.

Should you pay off escrow shortage?

If you are concerned about affording your escrow shortage payments, the better option is to pay off your escrow shortage monthly with your mortgage lender. This way, you can pay off the debt over a longer period of time, rather than draining all of your financial resources at once.

Why is my escrow more than my taxes and insurance?

Property Tax Changes Most people pay their taxes and insurance into an escrow account. Escrow accounts are helpful because they mean you don't have to pay your entire tax bill in one shot. Instead, your taxes are spread out in equal payments over the course of the year.

Should you pay extra on escrow?

It's a good idea to pay money into your escrow account each month, but if you want to pay down your mortgage, you will need to pay extra money on your principal. The more you pay on the principal, the faster your loan will be paid off. Choosing which one to make an additional payment on is up to you.

Why is my escrow payment going up?

The most common reason for a significant increase in a required payment into an escrow account is due to property taxes increasing or a miscalculation when you first got your mortgage. Property taxes go up (rarely down, but sometimes) and as property taxes go up, so will your required payment into your escrow account.

Why is my escrow payment decreasing?

When your property is assessed at a lower value due to decreased property values , your lender will notify you that your property tax bill went down and, as a result, your escrow payment decreased.

Why is there a shortage of escrow?

The other possible reasons for having a shortage in your escrow account include a rise in homeowners insurance fees (usually small) and a miscalculation of your escrow payment when you originally took out your loan , which could be big or small depending on the error.

Can you roll escrow into your mortgage?

Also, by rolling an escrow payment into your monthly mortgage payment, a homeowner only has to worry about one monthly bill rather than a separate bill for a principal and interest payment, a taxes payment and a homeowners insurance payment.

Why does escrow go up?

Any changes to the insurance premiums can cause the escrow balance to go up or down, even if the loan has fixed-rate payments. The rates can increase because of yearly adjustments by the insurance company or because the homeowner improved the home and raised the home's replacement value. Additional coverage, such as flood insurance, ...

Why are escrow balances adjusted higher?

Balances in escrow accounts that are projected by the lender for the upcoming escrow year may be adjusted higher to prevent the possibility of a shortage of funds, even if the mortgage loan has a fixed payment schedule. Lenders can estimate increases in the escrow account that have not yet occurred.

Why do insurance rates fluctuate?

Why Insurance Rates Fluctuate. Hazard insurance that covers the structure and protects the lender from loss of the investment due to damage is usually included as a required part of your homeowner's insurance policy. The policy charge to protect both you and your lender can get paid through an escrow account.

What happens if you don't pay your mortgage on time?

When you've made all your mortgage payments on time but the lender failed to pay an escrow item on time , such as a tax bill, the lender is responsible for any late penalties and cannot increase the escrow to cover the fees. Other errors made by the lender when listing escrow items, such as the omission of a tax bill, can result in an escrow increase to cover the shortfall. If you think your lender made an error in raising your escrow account payments, contact the mortgage servicing center in writing with copies of statements for the cost of taxes and insurance and request a review.

How long does escrow pay for a mortgage?

Escrow payments are commonly bundled into the monthly mortgage loan payment. This billing allows the fees to be spread out over a period such as 12 months. The lender takes care of property tax and homeowner's insurance bills as they arise as both a convenience to the homeowner and to help ensure that these bills are paid, protecting the lender's investment from tax liens or physical loss. An increase in the escrow needed to cover these bills means your monthly mortgage payment will go up to cover the expenses.

What happens if property taxes increase?

Rising property taxes will cause an increase in the escrow on a fixed-rate mortgage loan. A higher property tax assessment typically reflects increasing property values in the area or an improvement made to the home, such as a new garage. Voters also can elect to increase property taxes.

How often do banks evaluate escrow?

You may not immediately see a decrease in escrow payments, as your bank may only evaluate escrow once or twice a year.

Why does my escrow come up short?

When a servicer estimates the escrow, they may not take into consideration such a big increase in the property taxes. Because of this, your escrow may come up short.

Why do we need escrow?

In real estate, escrow is typically used for two reasons: To protect the buyer’s good faith deposit so the money goes to the right party according to the conditions of the sale. To hold a homeowner’s funds for taxes and insurance. Because of the different purposes it serves, there are two types of escrow accounts.

What Is Escrow?

Escrow is a legal arrangement in which a third party temporarily holds money or property until a particular condition has been met (such as the fulfillment of a purchase agreement).

What Is An Escrow Account?

To protect the buyer’s good faith deposit so the money goes to the right party according to the conditions of the sale.

What happens after you purchase a home?

After you purchase a home, your lender may establish an escrow account to pay for your taxes and insurance. After closing, your lender (or mortgage servicer, if your lender isn’t servicing your loan) takes a portion of your monthly mortgage payment and holds it in the escrow account until your tax and insurance payments are due.

How long does it take for escrow to change?

To ensure there’s enough cash in escrow, most lenders require around 2 months’ worth of extra payments to be held in your account.

What happens if a contract falls through?

If the contract falls through due to the fault of the buyer, the seller usually gets to keep the money. If the home purchase is successful, the deposit will be applied to the buyer’s down payment. To protect both the buyer and the seller, an escrow account will be set up to hold the deposit. The good faith deposit will sit in ...

Why is there an escrow shortage when buying a new home?

This can at many times cause an escrow shortage because the taxes used were estimated and typically are underestimated.

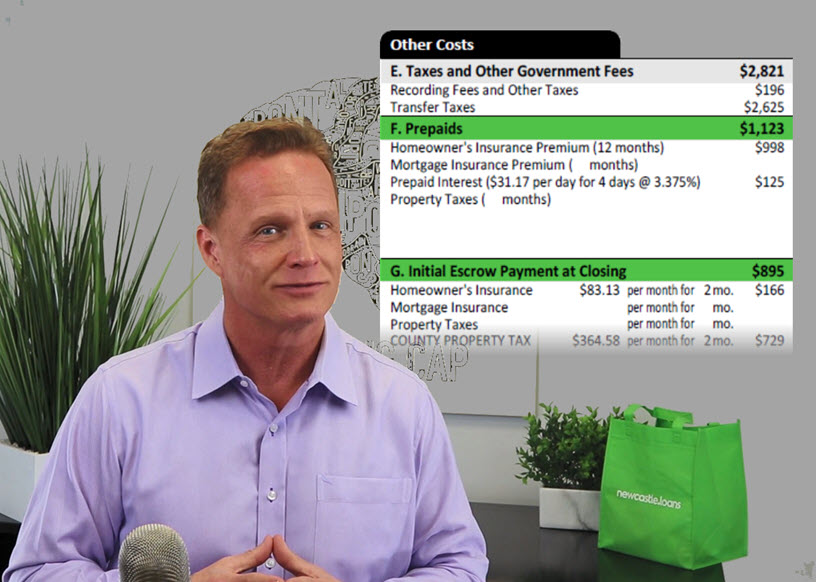

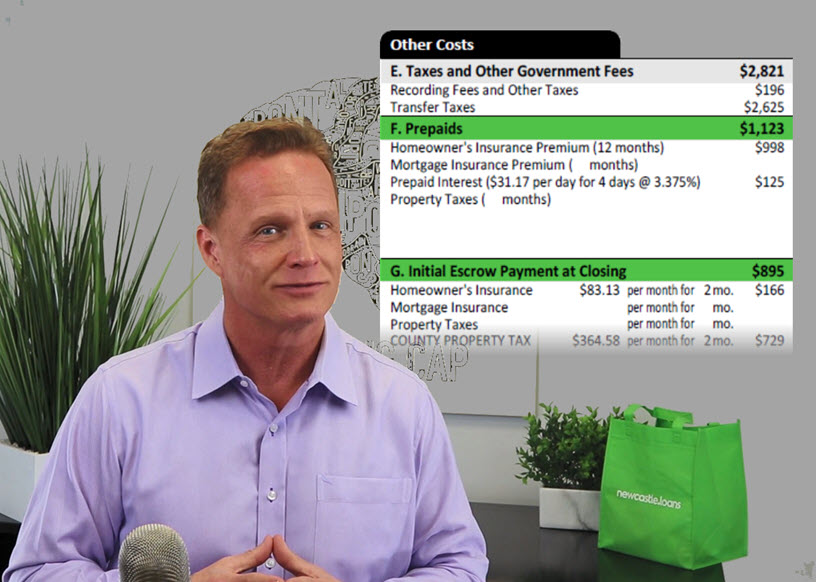

What is an escrow account?

Let’s start with a quick refresher, an escrow account is an account held with your servicer that holds the funds needed to pay your property taxes and homeowners insurance. An escrow account is set up at the time of your purchase and/or refinance. It is in your prepaid items (closing costs) on your loan.

What is escrow deficiency?

An escrow deficiency is when there is a negative balance in your escrow account. This happens when the investor/bank has had to advance funds in order to cover the disbursements. When this happens you will either have to pay the amount you are negative to bring to current or will have to divide your negative amount into a year and make a monthly payment in addition to your existing new escrow payment. For example; escrow payment $300/mo, negative balance $800, 800 divided by 12 = 66.67, so now your new escrow payment will be $366.67. Note: If the deficiency is less than one month’s escrow payment, you will have 30 days to repay the amount. If the amount exceeds one month’s escrow payment, you have 12 months to repay it.

How long do you have to pay escrow if you have a property?

If the amount exceeds one month’s escrow payment, you have 12 months to repay it. Again, the key to preventing escrow shortage and/or deficiencies is to keep an eye out for your property tax assessment, as well as your homeowner’s insurance.

What happens if you adjust your mortgage?

If there is an increase in your taxes and/or insurance then you can end up with an escrow shortage.

What to do if your mortgage premium has increased?

Double check if your premium has increased. If you see that anything has changed plus/minus, you will want to call your servicer and ask for an escrow analysis. Should you be short then you know your mortgage payment will increase and this will then cover your shortage.

What is it called when an escrow account doesn't have enough money?

When that account doesn’t have enough money in it to cover these costs, however, that’s called an escrow shortage . Why does this happen? Let’s take a look.

What is escrow shortage?

When you have a mortgage, your escrow account enables you to make payments toward your property taxes and insurance in more manageable, monthly increments, rather than having to cover these costs all in one big lump sum each year. When that account doesn’t have enough money in it to cover these costs, however, that’s called an escrow shortage.

How often do escrow analysts go out?

Escrow analyses are sent out to borrowers once per year. However, it’s possible for a lender or servicer to complete more than one analysis in a year if there are issues with the first one or if the borrower disputes their analysis. Typically, though, they’ll do just one escrow analysis each year.

How often do you need escrow analysis?

Escrow analyses are performed by your lender or servicer at least once per year. This analysis will tell you if you have a shortage and if your monthly payments will be increasing in the next year due to an increase in your taxes or insurance rate. In your escrow analysis, your servicer will project how much you’ll owe out ...

How is escrow funded?

Your escrow account is funded by your monthly mortgage payments. Let’s look at an example: You buy a home that has an annual property tax bill of $4,500 and costs $1,500 per year to cover with a homeowners insurance policy. Paying all of this in one lump sum, or even divided into semiannual payments, can be tough on your wallet.

How long does it take to pay escrow shortage?

Many lenders, including Rocket Mortgage®, allow borrowers to either pay their escrow shortage in one lump sum or to spread out the payment in equal monthly installments over a 12-month period.

What does it mean when you have an escrow deficiency?

If you have an escrow deficiency, that means that your escrow account has a negative balance. This can happen if your tax or insurance bills came due and you didn’t have enough money in your account to cover them, so your lender had to pay the remaining balance for you using their own funds.

Why do banks set up escrow?

The bank sets up the escrow to protect their investment in the house. If you can show them you pay your bills and aren't a risk, they're likely to remove the payments. Don't forget you'll pay those taxes and insurance once or twice a year, so you'll still need to budget for them.

Does canceling escrow save you money?

Cancelling escrow does give you more control, but I'd argue that it doesn't actually save you any meaningful amount of money. You get to keep your money in your own savings account until the insurance/tax bill is due, but with savings accounts paying <1%, you'll probably save less than $5 a year.

Do you have to pay escrow on a mortgage?

When you mortgage your home, you'll likely have escrow payments added on to the bill each month. This money sits in an account to pay the taxes and insurance. You don't get to say how much goes in each month. If you've got an established history with the bank, you can save by paying these expenses yourself.

How often does escrow go up?

Your mortgage servicer only does an escrow analysis once a year, and it won’t necessarily be the same time that your property tax is evaluated.

Why is escrow important?

Escrow accounts are helpful because they mean you don’t have to pay your entire tax bill in one shot. Instead, your taxes are spread out in equal payments over the course of the year. If there’s a shortage in your account because of a tax increase, your lender will cover the shortage until your next escrow analysis.

What does it mean when your mortgage insurance is removed?

The removal of your mortgage insurance payment might be one of the few instances where you’ll be glad to hear your monthly payment is changing, as it generally means your payment will go down a bit.

Why is my mortgage payment changing?

The answer to why your payment changed may simply be that your lender has added new fees to your monthly bill, increasing your payment. To find out, check your monthly mortgage statement to see if any new items were added.

What happens if you don't have a mortgage insurance policy?

If you don’t have a current policy or yours has expired, your lender may find one for you. If your lender finds the insurance, it may be more expensive than it would be if you shopped around for your own policy. This can cause your mortgage payment to increase.

What happens if you change your homeowners insurance?

A shortage can occur in your escrow account if you change homeowners insurance policies, and your lender has to make unanticipated payouts. This may also happen if there are increases in the cost of premiums, even if you have the same insurance carrier.

How long do you have to pay MIP?

If your loan term is greater than 15 years, you must also have paid MIP for at least 5 years.