Why is your Mortgage Payoff Higher than the Balance?

Your mortgage payoff is the amount of money that you owe to your mortgage provider taking into account the terms of your mortgage. This includes the interest you will be paying and other fees. Essentially, this is what the mortgage will cost you over the term of your mortgage when taking out the loan.

How Long Does it Take to Get a Payoff Statement?

The law says that your mortgage provider is required to send you your payoff statement within seven business days of you informing them that you require it. Many providers will supply you with it quicker than this, so it depends on the company you are using. This law is subject to very few exceptions. These exceptions include:

Why do mortgages have prepayment penalties?

Most mortgage agreements include these prepayment penalties to avoid the mortgage being paid off sooner than agreed within the contract. If your lender cannot collect interest from an early repayment then the penalty fee is enforced to recoup the loss.

What happens if you pay off your mortgage early?

However, interest will continue to accrue each day after that date. When paying a mortgage off early, it’s possible you can be subject to early repayment penalties . An early repayment penalty is a fee that is imposed by the lender if ...

How long does it take for a mortgage company to respond to a payoff request?

Your mortgage provider will have seven days to respond to your request. You can also send a notice of error in order to dispute the accuracy of your payoff statement if you believe that the amount is incorrect. If your mortgage provider doesn’t respond to the notice of error, it’s advisable to consult with an attorney.

What is the balance on a loan statement?

The balance on your loan statement is what is currently owed as of the date of the statement. However, interest will continue to accrue each day after that date.

Why is my mortgage cleared after selling my house?

If the sale of your property is worth more than your mortgage then your mortgage debts will be cleared because you will have paid off your mortgage. It’s advisable to have a property valuation to ensure that you’re not in negative equity before deciding to sell your property.

What is the payoff amount for a mortgage?

Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance.

What happens if you pay off your mortgage early?

If you are paying off your loan early, you may have to pay a pre-payment penalty. If you are considering paying off your mortgage, you can request a payoff amount from your lender or servicer.

Does the payoff statement apply to closed end loans?

This answer previously implied that the payoff statement requirements only applied to closed-end loans secured by a consumer’s principal dwelling. On August 13, 2020, the answer was corrected to note that these requirements apply to closed-end loans secured by a consumer’s dwelling. Read full answer.

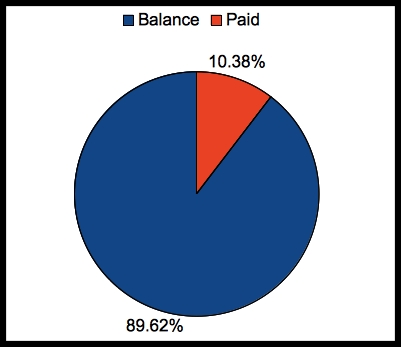

Why is the payoff balance higher than the statement balance?

That’s because the balance on your loan statement is what you owed as of the date of the statement. But interest continues to accrue each day after that date. The lender will want to collect every penny in interest due to him right up to the day you pay off the loan.

What does a payoff statement reveal?

Tip. When you get your regular loan statement, it will reveal the loan's current balance. The payoff amount, however, contains additional interest and is the total required to completely satisfy the loan.

What is the amount quoted by the lender to pay off a loan?

The amount quoted by the lender to pay off the loan is essentially an updated loan balance. The lender will add to the statement balance all unpaid interest accrued between the statement date and the intended payoff date, plus any payoff fees prescribed in the loan terms such as a prepayment penalty.

How to find out how much to pay off a loan?

If you plan to pay your entire loan balance, contact your lender for a payoff amount. This is the fastest and most accurate way to find out exactly how much it will cost to close out your loan. Some lenders may require that you ask in writing for a payoff quote. Others will provide you the quote over the phone. Others might quote you a payoff balance through their website. The amount quoted by the lender to pay off the loan is essentially an updated loan balance. The lender will add to the statement balance all unpaid interest accrued between the statement date and the intended payoff date, plus any payoff fees prescribed in the loan terms such as a prepayment penalty.

Does a payoff add interest to principal?

Your lender will quote a payoff balance as of a specific date, but it will continue to add interest to your principal until the day your payment actually reaches their processing center. Because your lender more than likely allows for electronic payments, it should post quickly.

Can you pay off a loan if you have been paying it off for a long time?

When you have been making payments on a loan for a long time, the balance you owe on the loan may come down to a point where you can seriously consider paying off the entire remaining balance listed on your current statement. But when you talk to the lender about doing a payoff, you might find out you owe more than the statement balance in order to close out the loan.

Day : Your Old Loans Are Closed

Once the check from Earnest is received, well send you an email letting you know that your Earnest loan is active. If you have multiple loans, interest only accrues on the payoffs that weve confirmed have been received.

What Are My Monthly Expenses

Paying off your mortgage is no small feat and it changes the way youll financially maintain ownership of your home. Lenders will often consolidate property taxes and homeowners insurance fees into your monthly payment through the escrow account. Once your relationship with the lender is dissolved, youll start making those payments yourself.

How Is The Current Mortgage Payoff Figured In The Sale Of A Property When The Original Mortgage Was Less

The original mortgage doesn’t factor into the calculation of the gain/loss. You might be able to exclude a gain. If you can exclude all of the gain, you don’t need to report the sale on your tax return, unless you received a Form 1099-S, Proceeds From RealEstate Transactions.

Summary: Paying Off Your Mortgage Requires A Few Extra Steps

While the process of paying off your mortgage typically takes decades, crossing the finish line requires a few extra steps:

How Do I Get My Escrow Refund

If theres money left in your escrow account after youve paid off your mortgage and/or you overpaid the loan , the extra money will be sent back to you.

So Should You Pay Off Your Mortgage Early

If you find yourself with a little extra cash at the end of the month, should you put it toward your mortgage loan? Theres no simple yes or no answer. There are both risks and benefits to paying off your loan early, and the right decision will be different for everyone.

What Happens After I Pay Off My Mortgage

After your mortgage has been paid off, it must be recorded with the county by sending whats called the Discharge of Mortgage document. Your lender is required to write up the document, but what happens next is up to local regulations.