Why should cash be maintained at minimum level? Steven Fiorini| QnA A minimum cash balance enables companies to avoid cash shortages caused by cash outflows exceeding cash inflows in a given accounting period. It is the lowest amount of cash a company keeps on hand to meet cash maintenance and planning objectives.

Why do companies maintain a minimum cash balance?

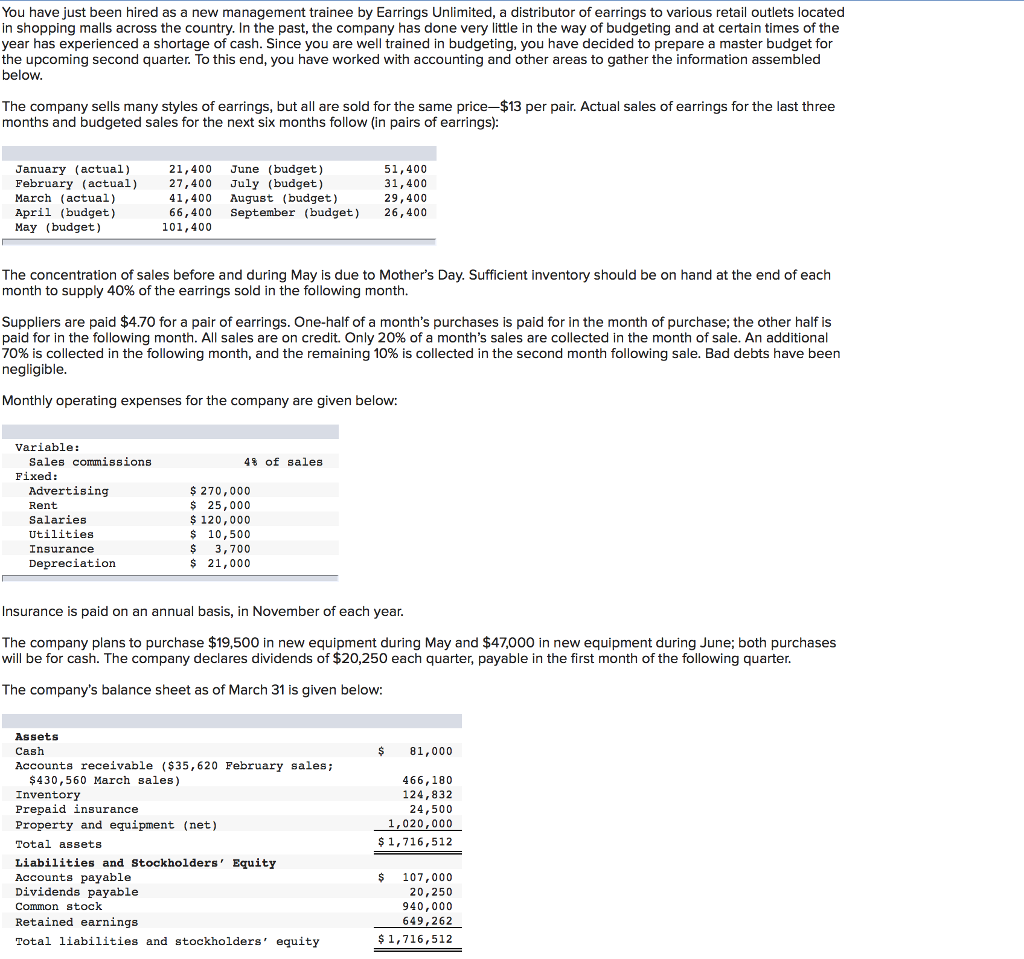

But the minimum cash balance would be maintained by the company’s management team to avoid shortfalls resulting from differences in cash inflows and cash outflows. This is a bit abstract so I thought I would attempt to provide some context… Consider the following: Let’s say you own a business subject to seasonality.

How to determine the minimum cash need of a company?

For new enterprises, rapidly growing ones, or companies in distress, a review of the company’s history may indicate the absolute minimum cash with which management has made do in the past. This amount can be used as the estimate for minimum future cash needs. A third approach is to set a minimum cash balance at one or two weeks’ cash disbursements.

How do you set a minimum cash operating balance?

Another way of setting a minimum cash operating balance is to plan to maintain sufficient cash to cover disbursements during a period in which the company’s receipts might be interrupted for some reason.

Can the forecasts give an exact answer to the minimum cash balance?

The forecasts cannot give an exact answer, however. The minimum cash balance decision is one that requires skilled managerial interpretation of the figures. How to set up a minimum cash operating balance?

Why is it not easy to figure out the minimum cash needed at any one time?

What factors affect the minimum cash balance?

How to set up a minimum cash operating balance?

Why do business owners hold large cash balances even if the company has no debt?

Why is risk preference important?

What would happen if a company could sell all of its goods for cash and pay cash for all purchases on?

When should an analyst take these dimensions into account?

See 2 more

How do You Determine the Minimum Cash Balance? | A Simple Model

Note: I thought it would be a good idea to start posting answers to questions I receive via email. I try to answer all of them but occasionally my job gets in the way…

Bank Account Minimum Deposit And Minimum Balance Requirements

When you open an account at a bank or credit union, you may come across minimum requirements. Some banks and credit unions require you to deposit a minimum amount of money to open a checking ...

5 Ways for the Management of Cash Balance (With Diagram)

ADVERTISEMENTS: The following points highlight the five ways for the management of cash balance. The ways are: 1. Setting Cash Balance 2. Cash Cycle 3. Zero Balance Account 4. Money Market Banking 5. Petty Cash Imprest System. Way # 1. Setting Cash Balance: The level of cash holding of a firm depends upon number of […]

Minimum cash balance definition — AccountingTools

A minimum cash balance is a cash reserve kept on hand to offset any unplanned cash outflows. It is needed to ensure that bills are paid.

Why is it not easy to figure out the minimum cash needed at any one time?

It is not easy to figure out the minimum cash needed at any one time because of a second, conflicting objective in managing cash. Besides the desire for potential profitability, there is need for liquidity. Liquidity, in the form of a large cash balance (or, less certainly, a line of credit), provides the firm with the ability to handle unfavorable ...

What factors affect the minimum cash balance?

Factors affecting the level of minimum cash balance. Another factor affecting the level of the cash balance is a company’s banking relationships. The number of banks used and the types and quantity of bank services needed affect the size of the cash balances that must be carried with the banks. A company may keep more than one bank account ...

How to set up a minimum cash operating balance?

Another way of setting a minimum cash operating balance is to plan to maintain sufficient cash to cover disbursements during a period in which the company’s receipts might be interrupted for some reason. A company located in a region where weather can block mail for several days, but which must pay local suppliers and employees despite the weather, might typically hold an additional week’s cash disbursements in its balance as a buffer “cash inventory”,

Why do business owners hold large cash balances even if the company has no debt?

Other business owners elect to hold large cash balances even if the company has no debt because having cash makes fund management less stressful than not having cash.

Why is risk preference important?

Risk preference in establishing minimum cash balance. Finally, your own risk preferences are important. Some business owners prefer to arrange a loan and then draw down the full amount even though no immediate need requires the funds. The rationale is that it is easier to borrow when it is not necessary than when it is.

What would happen if a company could sell all of its goods for cash and pay cash for all purchases on?

If a company could sell all of its goods for cash and pay cash for all purchases on a daily basis, it could operate with a “zero” cash balance. This would be an ideal situation, because the lower the investment in cash (or any other asset), the higher the return on the entrepreneur’s investment.

When should an analyst take these dimensions into account?

An analyst must take these dimensions into account when budgeting or forecasting the minimum-cash component. If the enterprise has shown a stable relationship between cash and sales or cash and cost of sales, it is an appropriate ratio to select for a minimum balance.

Why is cash control important?

Cash Control is an important part of business as it is required for proper cash management, monitoring and recording of cash flow and analyzing cash balance. Cash is the most important liquid asset of the business. A business concern cannot prosper and survive without proper control over cash. In accounting, cash includes coins; currency; deposited ...

Why should idle cash be minimal?

Idle cash should be minimal because additional cash investment earns more revenue. Loss caused due to misappropriation and forgery is to be controlled and stopped. The necessity of cash control is very clear and it has many sides. A business cannot survive without time-related cash flow and proper cash management.

How to control cash flow?

Steps of Cash Control are; 1 Cash transactions of a business are to be accounted for properly to know cash flow and cash balance. 2 Cash sufficiency is to be ensured on due dates of notes payable. 3 Idle cash should be minimal because additional cash investment earns more revenue. 4 Loss caused due to misappropriation and forgery is to be controlled and stopped.

What are the principles of cash disbursement control?

In a cash disbursement control system, principles of segregation of job responsibility are followed. Some basic principles of cash payments are mentioned below: All payments are to be made by cheques or petty cash. Payments are to be approved and every payment is to be recorded.

How does a business concern receive cash?

A business concern receives cash through cheques from customers after the expiry of a certain period. Cash receipts cycle of merchandise sale of a business concern is as follows: Although the control system of cash receipts of all business concerns is not similar the following principles are generally followed by all.

What is a certificate of deposit?

A certificate of deposit (CD) is an interest-bearing deposit ...

What is a CD in banking?

A certificate of deposit (CD) is an interest-bearing deposit that can be withdrawn from a bank at will (demand CD) or at a fixed maturity date (time CD). Cash only includes demand CDs that may be withdrawn at any time without prior notice. Cash does not include postage stamps, IOUs, time CDs or notes receivable.

What is stock level?

Stock level refers to the amount of goods or raw materials that should be maintained by businesses to continue their activities and avoid any situations like understocking or overstocking. Every organization should always keep an optimum amount of inventory to ensure the regular operation of its production activities.

What does "average level" mean?

It is the level of an average of minimum level and Maximum level. It means the average level is maintained in states.

What should an inventory manager do?

Inventory managers should properly control the inventory and determine the optimum size to be always kept within the organization. Managers should consider various factors like storage space of firm, the frequency with which inventory is sold or used, risk of inventory getting outdated before it is used, insurance cost on inventory, etc. for deciding the right amount of stock. Major types of stock levels of inventory are as follows:

What is the purpose of inventory?

Inventory acts as a bridge between production and sales of business and ensures a regular supply of finished goods to customers. Raw materials, work-in-progress, finished goods and various consumables like fuel and stationery are three important types of inventories that every firm needs to maintain.

Why is it not easy to figure out the minimum cash needed at any one time?

It is not easy to figure out the minimum cash needed at any one time because of a second, conflicting objective in managing cash. Besides the desire for potential profitability, there is need for liquidity. Liquidity, in the form of a large cash balance (or, less certainly, a line of credit), provides the firm with the ability to handle unfavorable ...

What factors affect the minimum cash balance?

Factors affecting the level of minimum cash balance. Another factor affecting the level of the cash balance is a company’s banking relationships. The number of banks used and the types and quantity of bank services needed affect the size of the cash balances that must be carried with the banks. A company may keep more than one bank account ...

How to set up a minimum cash operating balance?

Another way of setting a minimum cash operating balance is to plan to maintain sufficient cash to cover disbursements during a period in which the company’s receipts might be interrupted for some reason. A company located in a region where weather can block mail for several days, but which must pay local suppliers and employees despite the weather, might typically hold an additional week’s cash disbursements in its balance as a buffer “cash inventory”,

Why do business owners hold large cash balances even if the company has no debt?

Other business owners elect to hold large cash balances even if the company has no debt because having cash makes fund management less stressful than not having cash.

Why is risk preference important?

Risk preference in establishing minimum cash balance. Finally, your own risk preferences are important. Some business owners prefer to arrange a loan and then draw down the full amount even though no immediate need requires the funds. The rationale is that it is easier to borrow when it is not necessary than when it is.

What would happen if a company could sell all of its goods for cash and pay cash for all purchases on?

If a company could sell all of its goods for cash and pay cash for all purchases on a daily basis, it could operate with a “zero” cash balance. This would be an ideal situation, because the lower the investment in cash (or any other asset), the higher the return on the entrepreneur’s investment.

When should an analyst take these dimensions into account?

An analyst must take these dimensions into account when budgeting or forecasting the minimum-cash component. If the enterprise has shown a stable relationship between cash and sales or cash and cost of sales, it is an appropriate ratio to select for a minimum balance.