Why should i put my assets in a trust?

- Trusts avoid the probate process. …

- Trusts may provide tax benefits. …

- Trusts offer specific parameters for the use of your assets. …

- Revocable trusts can help during illness or disability – not just death. …

- Trusts allow for flexibility.

Why would you place your assets into a trust?

Top Three Reasons Your Trust Should Own Your Accounts

- If you become incapacitated, or you and your spouse become incapacitated, that account will be frozen.

- If you pass away, that account can be frozen.

- If your accounts are in the name of an individual, they are much easier fodder for identity theft in the exploitation of vulnerable adults.

What assets should be included in your trust?

- Identifying and protecting the trust assets

- Determining what the trust’s terms require in terms of management and distribution of the assets

- Hiring and overseeing an accounting firm to file income and estate taxes for the trust

- Communicating regularly with beneficiaries

Why should you set up trust to protect your assets?

Trusts 101: Why Have a Trust?

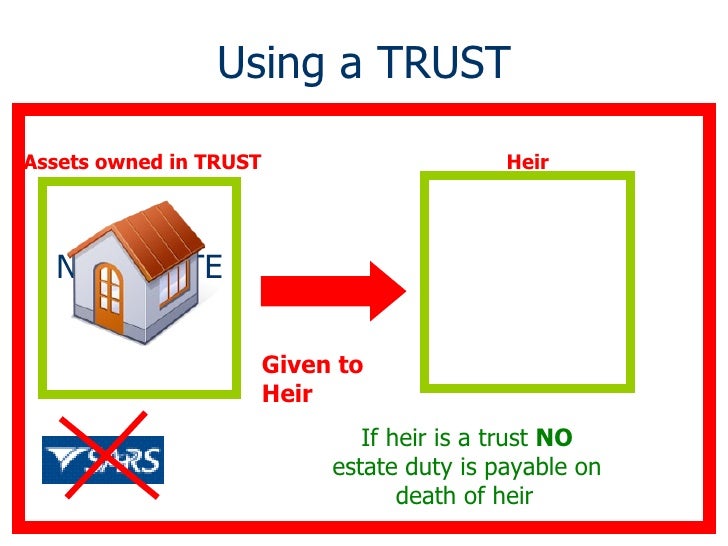

- Trusts can be established for a number of reasons. Among them: To reduce income taxes or shelter assets from estate and transfer taxes.

- Structuring a trust. Trusts may be structured to achieve your specific goals, while providing tools for the trustee to balance those goals with prevailing investment and economic factors.

- The typical living trust

Why you should invest in a real estate investment trust?

Why people invest in real estate

- Low bar to entry. Real estate investing is so popular primarily because it requires such little knowledge. ...

- The power of leverage. Banks are willing to lend out piles of money for real estate at near-historic low interest rates. ...

- Tax benefits. Nothing eats away at returns like taxes. ...

What are the benefits of putting your assets in a trust?

Here are five benefits of adding a trust to your estate planning portfolio.Trusts avoid the probate process. ... Trusts may provide tax benefits. ... Trusts offer specific parameters for the use of your assets. ... Revocable trusts can help during illness or disability – not just death. ... Trusts allow for flexibility.

Why would a person want to set up a trust?

The main purpose of a trust is to transfer assets from one person to another. Trusts can hold different kinds of assets. Investment accounts, houses and cars are examples. One advantage of a trust is that it usually avoids having your assets (and your heirs) go through probate when you die.

What assets should not be in a trust?

Assets That Can And Cannot Go Into Revocable TrustsReal estate. ... Financial accounts. ... Retirement accounts. ... Medical savings accounts. ... Life insurance. ... Questionable assets.

What are the disadvantages of trust?

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.

At what net worth do I need a trust?

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

Should I put my bank accounts in a trust?

To make sure your Beneficiaries can easily access your accounts and receive their inheritance, protect your assets by putting them in a Trust. A Trust-Based Estate Plan is the most secure way to make your last wishes known while protecting your assets and loved ones.

Do trusts pay taxes?

Yes, if the trust is a simple trust or complex trust, the trustee must file a tax return for the trust (IRS Form 1041) if the trust has any taxable income (gross income less deductions is greater than $0), or gross income of $600 or more.

What are the disadvantages of putting your house in a trust?

While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

Putting A House Into A Trust Or Last Will And Testament?

Estate planning is about creating a custom plan to allow you to transfer your money, property, and assets to your family in the most efficient way...

Putting A House Into A Trust - Why Do People Do It?

There are two main reasons why people put a house into a trust. The first reason is that they want their family to be able to inherit their home wi...

Putting A House Into A Trust - How Does It Work?

In order to avoid probate court, your assets need to be placed into a living trust. This called funding the trust. When you create a living trust,...

Putting A House Into A Trust - What Are The Benefits?

Avoid ProbateAs mentioned earlier, one of the biggest advantages of putting a house into a trust is that, unlike a will, a living trust allows you...

Putting A House Into A Trust - What Are The Disadvantages?

Additional PaperworkIn order to make your living trust effective, you need to make sure that the ownership of your house is legally transferred to...

is Putting A House Into A Trust Difficult?

Putting a house into a trust is actually quite simple and your living trust attorney or financial planner can help. Since your house has a title, y...

Besides Putting A House Into A Trust, Are There Other Assets I Should Consider Putting Into A Trust?

Aside from putting a house into a trust, there are other assets you should consider titling in the name of the trust. Usually it’s best to include...

Will I Lose Control Of My Home When Putting A House Into A Trust?

Not at all, you keep full control of all of the assets in your trust. As Trustee of your trust, you can do anything you could do before – buy and s...

What happens if you leave a trust in a will?

Many people don’t know this, but if you leave putting property in a trust in a will, your family will need to go through the probate process before they’re allowed to claim it.

How long does it take to get your property in a trust?

Your Beneficiary Receives Your Property Immediately. It could take weeks or a year for your intended to finally receive your property or land with a will as the probate process wraps up. But your designated beneficiary will receive the property in a trust immediately. Plus, he or she can also sell the property if they so choose without going ...

What is the difference between a revocable trust and an irrevocable trust?

Another key difference: a revocable trust keeps your assets tied to your estate. But when you have an irrevocable trust, your property or land is essentially removed from your estate’s value, which means you’ll save money in taxes after your passing.

What is a revocable trust?

A revocable or living trust allows you to maintain full legal control and ownership of the trust, including the properties and assets, until the time of your death. This means you can add/remove assets or properties anytime you want, change beneficiaries, and even dissolve the whole thing should your situation change.

Why do you need a financial advisor for estate planning?

That’s why working with a financial advisor and attorney you trust is so crucial for your estate planning. You’ll want someone to deeply asses your portfolio and goals to figure out if putting your property in a trust is the optimal solution for your needs.

Can an irrevocable trust be changed?

An irrevocable trust works just like it sounds: once you and your financial advisor or attorney draft a final version, an irrevocable trust cannot ever be changed. This means you won’t be able to add or remove assets and properties, or even dissolve the trust if you so wish.

Do you have to pay probate costs with a trust?

No probate, no probate costs with a trust. In fact, you’ll take care of all the costs of your trust for your loved ones because you putting ...

Why do we need trusts?

But let's back up and discuss WHY you need a trust in the first place. Well, the simplest explanation is to protect your assets. Here are the two main reasons you need to create a trust to protect yourself, your business, your investments and everything else that's important to you.

How can a trust protect your assets from lawsuits?

How a trust can protect your assets from lawsuits. By setting up an irrevocable trust you can protect your assets from legal challenges and creditors. This is a living trust, or inter vivos trust, since it's created while you are alive. An irrevocable trust requires three provisions:

What type of trust is a revocable trust?

The other type of trust is a revocable trust, which is a trust you control, that can be amended or canceled, and allows income to flow to you personally for income tax purposes. In most states, revocable trusts won’t provide protection from lawsuits and creditors.

How long does it take for a trust to be probated?

Most importantly, a trust will enable your estate to pass without having to go through probate. Probate can take months to complete, and sometimes more than a year.

What is the purpose of a lawsuit?

The basic purpose of a lawsuit is to gain control of your assets as a form of remuneration to compensate for a real or perceived loss. For the most part, when you’re talking about lawsuits, you’re talking about protecting yourself from an assault on your assets. How a trust can protect your assets from lawsuits.

Can an estate be protected by a will?

An estate — especially a complicated one — won’t always be best protected and dispersed as a result of having a will. And that’s where trusts come in. How a trust can protect your assets in the event of your death. If disbursement of your estate is the primary reason for the trust, you can use either a revocable or an irrevocable trust.

Is probate a trust?

Just as important, probate is a process you don’t want your family to go through, especially on top of your death. The delay can be taxing on the emotions, and cause a financial hardship. A trust is worth having for avoiding probate alone.

Why put a house in a trust?

The first reason is that they want their family to be able to inherit their home without having to go through the long, stressful, and expensive probate court process.

How to make a living trust effective?

In order to make your living trust effective, you need to make sure that the ownership of your house is legally transferred to you as the trustee. Since your house has a title, you need to change the title to show that the property is now owned by the trust.

What is the name of the trust you set up to avoid probate court?

In order to avoid probate court, your assets need to be placed into a living trust. This called funding the trust. When you create a living trust, you are known as the settlor or grantor, depending on what state you live in. When you set up the living trust, you also assign yourself as the trustee.

How long does it take to get money from a living trust?

This means that your family can receive your money, property and assets in a matter of days or weeks after you pass instead of months or potentially years.

What happens to your assets when you die?

Probate is the legal process through which the court ensures that, when you die, your debts are paid and your assets are distributed according to the law. Legal fees, executor fees, inventory fees (county taxes), and other costs have to be paid before your assets can be fully distributed to your heirs.

What is estate planning?

Estate planning is about creating a custom plan to allow you to transfer your money, property, and assets to your family in the most efficient way possible. The two most common estate planning documents are the last will and testament and the revocable living trust.

What is probate process?

Probate is a public process, so anyone can see the size of your estate (often what you actually owned), who you owed debts to, who will receive your assets, and when they will receive them. The process invites upset heirs to contest your will and can expose your family to greedy creditors and potential fraudsters.

Why do you put your home in a trust?

One of the main reasons you may place your home in a trust is so your family can avoid a lengthy and expensive probate process after you die. Without a trust, divvying up your assets could take a few months to a year at an estimated cost of 3% to 7% of the estate value.

How to get a trust in place?

But, to get the trust in place, determine who the beneficiaries will be (those who will receive some or all of your assets), how your assets will be divided among them and when, and who will be the trustee (the person responsible for carrying out your wishes). If you assign yourself as the trustee — as is common with revocable trusts — you may also ...

What is a trust in a divorce?

A trust allows you to divvy up the amount of your estate as you wish — you can designate assets be directed for a specific purpose, or over a set period of time. Speaking of tricky family stuff, trusts can also protect your assets from beneficiaries' creditors or loss from divorce settlements.

What is a trust in 2021?

May 10th, 2021. Updated May 10th, 2021. SHARE. A trust is simply an arrangement that lets a third party — or trustee — hold assets on behalf of the beneficiary. Here's why you might want to put your home in one.

What happens if a home is not in a trust?

If a home is not in a trust, it will likely be sold at a probate sale, similar to a trust sale. The main difference is that the court will usually review all offers.

Can a trustee do as they wish?

Technically, legal ownership of a property is transferred to the trustee when it is placed in a trust. But, this doesn't mean the trustee can do as they wish. They manage the property for the benefit of the beneficiary based on the wishes of the grantor (you!).

Can you add assets to a trust after you die?

Plus, you may wish to add other assets to the trust as you acquire them. Otherwise, these assets will still be subject to probate. Also, depending on your situation, there could be an added expense after your death, as trusts must file tax returns.

Why is a trust important?

Why exactly is a trust a good idea for your wealth? Here are five important reasons: Keeps Your Estate Out of Probate. When you die, your entire estate will have to go through “probate,” a long, arduous, and expensive process, whereby the court system determines how to divvy up your property.

What are the benefits of a trust?

One of the biggest benefits of a trust is that it allows you to control exactly how you want your assets distributed. For example, let’s say that Jane simply hands her entire estate to her son Bill after she dies. Bill is not the most conscientious person in the world.

What happens if a beneficiary runs into financial trouble?

The trust is its own entity. That means that if your beneficiary should run into financial trouble, the money in the trust is safe. Let’s say that Bill has more problems than just a tendency to hit the casinos too hard.

Why do you need an irrevocable trust?

Certain types of irrevocable trusts can help you avoid expensive estate taxes, which can take a big chunk out of the legacy you want to leave your children if your estate is worth enough money. If you’d rather leave your money to your children instead of Uncle Sam, a trust can help with that. You Maintain Control.

What happens if you are in probate?

Privacy. If your estate goes through probate, it becomes a matter of public record. Everyone can see what you owned and how much you owed. A trust keeps your financial affairs private, as they should be. Protection. Your beneficiaries do not own the assets in your trust until they are distributed.

Who controls a trust?

The trust is controlled by a “trustee.”. A trustee can be one of your adult children (though this may cause family squabbling), a sibling, a good friend, or a professional whom you pay to oversee the trust. The trustee protects and actively manages the funds in the trust according to your wishes. The trustee can also make distributions ...

Is a trust right for everyone?

A trust is not right for everyone. It can cost several thousands of dollars to create and even more if you hire a professional trustee. If you only have $10,000 to leave behind, then you could end up spending most of it just to create the trust itself.

Why do people use trusts?

A trust can give you better control than a will over how your assets are transferred, and a trust may offer other advantages, like helping you qualify for Medicaid . Many people use their last will and testament to pass on money and belongings after they die, but some people could benefit from using a trust to pass on their house or other valuable ...

Why put your house in a trust?

To help you make your decision, here are eight common reasons to put your house into a trust: Your house (and everything else in the trust) will avoid probate after you die. Ownership of the house can transfer to your heirs faster from a trust than through probate.

What does a trust do for a house?

Trusts help you pass on your house before you die. Trusts make it possible for the grantor (the trust’s creator) to place conditions on when and how beneficiaries will receive the trust assets. That means you could move your house into a trust and then transfer ownership to someone else even before you die.

What does a trust do?

A trust can give you more control than a will over who gets your assets after you die and how they get the assets. Assets in a trust do not go through probate, unlike everything passed on via your will. Trusts can also help you pass on your assets before you die. Putting your house in certain types of trusts also decrease your taxable estate, ...

Why does probate drag out?

Situations where probate may drag out include if your estate is large; if you left unclear instructions for bequeathing your assets; or if you have assets in multiple states. (Each state has its own probate laws so moving a house from another state into a trust could especially simplify things for your heirs.)

What is the purpose of a trust after you die?

Trusts can offer greater control than a will over who will get your money and possessions after you die. Unlike a will, trusts can also include instructions for how or when your beneficiaries will receive the assets. If you want to pass on certain assets before you die, a trust may also help.

Why do people put their house in a revocable trust?

Many people use a revocable living trust because it gives them more control over the trust assets. Putting your house in a revocable trust still allows you to change the terms of the trust or remove the house from the trust if you want to. Taxes and personal finances are generally easier to manage with a revocable trust.

How to avoid probate for daughter?

You can avoid having to obtain a grant of probate for your daughter by putting your property into trust during your lifetime. If you give an asset away while you are alive, this asset will not form part of your estate on your death and so a grant of probate will not be needed for someone to access that asset. ...

Do you have to put a gift in a trust?

While a gift does not have to be in trust – if circumstances allow, you could simply give it outright – a trust does give you more control. This is particularly useful if beneficiaries are young. If you wish to benefit from the trust during your lifetime you will need to set up a simple trust with “fixed interests”.

Is a trust a legal arrangement?

It is a formal legal arrangement and will mean that the property is no longer yours, but instead belongs to trustees. There will be costs of creating the trust and administering it properly; accounts should be prepared each year and a tax return will need to be filed if the trust assets produce any income, or if they are disposed of.

What happens if you take away your trust?

If, however, you take away your ability to change the trust and name a Trustee who is unrelated to the Beneficiary, you have given up a substantial amount of control over the trust. Under these circumstances the government acknowledges you have divested yourself of enough power to grant the Beneficiaries of the trust certain benefits.

What are the parties to a trust?

Whether they are revocable or irrevocable, all trusts have three parties: 1 The Creator, who creates the trust document and transfers property or assets to the trust, 2 The Trustee, who follows the trust’s instructions, invests trust funds, uses trust property for the beneficiary’s needs, and pays the trust’s administrative expenses, and 3 The Beneficiary, who sits back and enjoys the benefits from the trust’s assets and/or income.

How many times should you create an irrevocable trust?

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors. If none of these applies, you should not have one.

What are the benefits of an irrevocable trust?

The Only Benefits of Irrevocable Trusts. 1. Minimizing Estate Taxes: People who are willing to gift money every year can use these funds to purchase life insurance in an “irrevocable life insurance trust” that may avoid paying estate taxes when they die.

What states have asset protection trusts?

These are commonly referred to as “asset protection trusts” and are usually only created in states that have favorable trust laws, such as Delaware, Nevada and North Dakota. For people who frequently face lawsuits (such as surgeons, architects and real estate developers) these protections are incredibly meaningful.

Can you transfer Medicaid to an irrevocable trust?

If you do not plan on qualifying for Medicaid (Medicaid benefits are not particularly lavish) there is no reason to have the majority of your assets transferred to an irrevocable trust and controlled by a Trustee who may deny you use of the funds in the trust.

Is it bad to have an irrevocable trust?

The Many Negatives of Irrevocable Trusts. If you are not wealthy, there is no good reason to fund an irrevocable trust with life insurance, create charitable remainder trusts, or gift substantial property to avoid estate taxes prior to your death.