Why was the use of credit uncommon prior to 1917? Laws prevented lenders from charging high interest rates, borrowing money was not socially acceptable, and lending money to others was not profitable.

How has the credit industry changed since 1917?

B.the credit industries has not changed much since 1917. C. After 1970, consumer debt skyrocketed. D. As banks made higher profits, they were willing to lend more money to consumers. When it comes to managing money, success is about 20% knowledge and 80% behavior.

Why do most Americans avoid the use of credit?

Most Americans avoid the use of credit when it comes to buying big ticket items like a car or furniture for their home. T or F. Learning the language of money is not that important because you will be able to depend on financial planners to manage your money. T or F. Having debt keeps you from building wealth.

Why is credit marketed heavily to consumers in the United States?

Why is credit marketed heavily to consumers in the United States? The credit industry has become extremely profitable, there is strong consumer demand for big ticket items, and since 1920, credit laws in the United States have been relaxed in an attempt to create a mainstream alternative to loan sharks for the working class.

Why is the credit industry so profitable?

The credit industry has become extremely profitable, there is strong consumer demand for big ticket items, and since 1920, credit laws in the United States have been relaxed in an attempt to create a mainstream alternative to loan sharks for the working class.

Why was buying credit uncommon prior to 1917?

Buying things on credit was not common before 1917. Why? Because it was never legal for lenders to charge interest rates high enough to make a profit.

Why did banks get into the credit business before 1920?

Banks got into the credit business before 1920 because charging exceptionally high interest rates was legal.

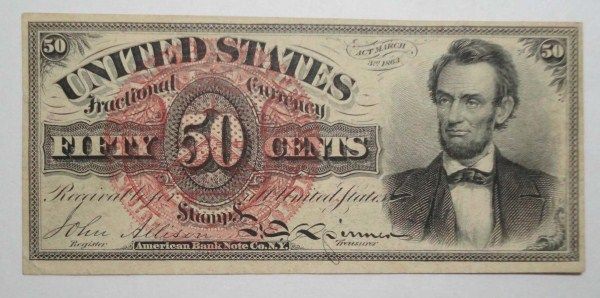

What was one of the earliest forms of credit?

Believe it or not, America's love-hate relationship with credit began before the 1900s. The earliest and most common form of credit were loans from local shopkeepers. That's right, hardworking Americans ran tabs to buy groceries, furniture, farm equipment and the like when times were tight.

Does the history of credit and consumerism segment make you view the use of credit differently?

Does the history of credit and consumerism segment make you view the use of credit differently than you did before? Explain your answer. Yes, because I will treat using a credit card differently to make sure I don't put myself in debt.

How was credit used in the 1920s?

Consumption in the 1920s The expansion of credit in the 1920s allowed for the sale of more consumer goods and put automobiles within reach of average Americans. Now individuals who could not afford to purchase a car at full price could pay for that car over time -- with interest, of course!

How did credit start in the 1920s?

During the Roaring Twenties, companies began to sell shares of stock to raise money. If the business made a profit, the value of the stock went up. This could earn large profits for investors. In the 1920s, people could buy stock on credit for the first time.

When was credit first used?

The concept of credit can be said to date back to at least 5,000 years ago in ancient Mesopotamia.

When did we start using credit cards?

1950The first universal credit card, which could be used at a variety of establishments, was introduced by the Diners' Club, Inc., in 1950. Another major card of this type, known as a travel and entertainment card, was established by the American Express Company in 1958.

When did credit start in history?

Credit reporting itself originated in England in the early 19th century. The earliest available account is that of a group of English tailors that came together to swap information on customers who failed to settle their debts.

Which of the following represents the functions of a product and the emotional satisfaction gained by owning it?

benefits include not only the functions of the product but also the emotional satisfaction associated with owning, experiencing, or possessing it. every product has cost, including sales price, the expenditure of the buyer's time, and even the emotional cost of making a purchase decision.

Which of the following terms is similar to a fad but usually is tied to a display of emotion or crowd excitement?

Like a fad because it is a passing love for a new fashion. However, this has a display of emotion or crowd excitement with it. It is a mania!

What is money personality?

Five common money personalities are investors, savers, big spenders, debtors, and shoppers. Debtors and shoppers may tend to spend more money than is advisable. Investors and savers may overlap in personality traits when it comes to managing household money.

How was banking in the 1920s?

Banks began to fail with the general economic downturn of 1920. For the United States as a whole, 505 banks failed in 1921. Failures continued to rise in the early twenties, averaging over 680 from 1923 to 1929 and peaking in 1926 at more than 950 failures.

What did banks do in the 1920s that became a huge problem?

This is where the banks became of huge importance because everyone who was trying to buy stocks began to get loans from the bank. Since there was a huge amount of people buying stocks, the banks started to become low on money. This became the very beginning of a very difficult and intense problem.

What was the role of commercial banks in the 1920s?

As described in this section, banks contributed to the economic boom of the late 1920s through five different channels—loans on se- curities, securities investments, public offerings of securities, real es- tate lending, and consumer credit.

Why did banks fail in the 1920s?

Deflation increased the real burden of debt and left many firms and households with too little income to repay their loans. Bankruptcies and defaults increased, which caused thousands of banks to fail. In each year from 1930 to 1933, more than 1,000 U.S. banks closed.

Why are credit laws relaxed?

The credit industry has become extremely profitable, there is strong consumer demand for big ticket items, and since 1920, credit laws in the United States have been relaxed in an attempt to create a mainstream alternative to loan sharks for the working class.

What is the credit system today?

The credit system today is structured to accommodate a state of uncertain employment and income instability, utilizing high interest rates and fees to turn huge profits.

Why is learning the language of money not important?

T or F. Learning the language of money is not that important because you will be able to depend on financial planners to manage your money.

What prevented lenders from charging high interest rates?

Laws prevented lenders from charging high interest rates, borrowing money was not socially acceptable, and lending money to others was not profitable.

Why is it important to know your money personality?

Recognizing who you are allows you the opportunity to grow and learn , and once you know your money personality you can develop a financial plan that works for you.

What is a loan in economics?

Loan. A period of temporary economic decline during which trade and industrial activity are reduced; generally identified by a fall in gross domestic product (GDP) Recession.

When is true financial security achieved?

T or F. True financial security is achieved when your money begins to generate an income -your money starts working for you .