The commission compensates the employee based on a percentage of the sales, according to the book "Contemporary Business Mathematics for Colleges." The gross sales refers to the amount of money taken in from sales before factoring in any business costs. Use this figure to calculate a salesperson's commission earnings.

What is the difference between gross sales&commission?

The commission compensates the employee based on a percentage of the sales, according to the book "Contemporary Business Mathematics for Colleges." The gross sales refers to the amount of money taken in from sales before factoring in any business costs.

What expenses are not included in gross sales?

Gross sales do not factor in expenses related to running a business, also known as cost of goods sold (COGS), which get deducted when calculating net sales. For example, they do not account for costs associated with item production, employee wages, building rent, returns, theft or sales tax. Related: 57 Common Accounting Terms

What is the use of Comps in business valuation?

Business Valuation Comps Uses. Such financial analysis comps are especially valuable when determining the fair market value (FMV) of a business. They can be used to formulate an asking or offer price in an acquisition or sale, or in the case of a dispute between partners or during a buyout.

Do you include sales from new stores in Comp Sales?

An inquisitive investor digs deeper and asks how much of the growth was due to new stores compared to old stores. They discover that new stores generated $3 million of the current year's sales and stores open for one or more years generated only $1 million of sales. To calculate comp sales, the investor does not include sales from new stores.

How do you calculate comp sales?

Calculating and Using Retail Sales Comps To calculate a company's sales growth rate, subtract the previous year's sales from the current year's sales and then divide the difference by the previous year's amount.

Does gross sales include cost of goods sold?

Gross sales do not factor in expenses related to running a business, also known as cost of goods sold (COGS), which get deducted when calculating net sales. For example, they do not account for costs associated with item production, employee wages, building rent, returns, theft or sales tax.

Are Restaurant comps taxable?

In most cases, charges to your employees for meals are taxable. If you provide meals to your employees and make a specific charge for those meals, the meal charges are taxable and must be reported on your sales and use tax return.

Whats included in cost of sales?

The Cost of Producing a Product or Service Cost of sales (also known as cost of revenue) and COGS both track how much it costs to produce a good or service. These costs include direct labor, direct materials such as raw materials, and the overhead that's directly tied to a production facility or manufacturing plant.

What is the difference between gross sales and cost of goods sold?

COGS refer to all the direct costs required in making the products or rendering services. Gross revenue refers to the total goods and services rendered during the organization. COGS are directly linked to the production or manufacturing of any finished product.

What is difference between net sales and gross sales?

Gross sales are the value of all of a business's sales transactions over a specified period of time without accounting for any deductions. Net sales are a company's gross sales minus three kinds of deductions: allowances, discounts, and returns.

What is the 80 80 rule?

Understanding the 80/80 Rule Sales tax can be applied if more than 80% of a businesses' revenue comes from selling food, and more than 80% of sales are from food eaten on the premises or is served hot.

What can you write off as a restaurant owner?

As a restaurant owner, you can typically deduct the following expenses you incur to operate your business when filing your income tax return with the IRS:Food costs, i.e. raw ingredients, pre-packaged/canned food items, oil, sugar, spices.Beverages, i.e. bottled water, soda, beer, wine, liquor, milk, juice, etc.More items...

How do I categorize restaurant expenses on my taxes?

12 Explosive Tax Deductions for Restaurant OwnersExplosive Tax Deductions for Restaurant Owners: Operating Expenses. ... 1) Operating Expenses. ... 2) Advertising Expenses. ... 4) Leasing or Buying a Car for Business Use. ... 5) Employee Pay and Benefits. ... 6) Cost of Goods Sold. ... 7) Improvements and Equipment. ... 8) Repairs and Maintenance.More items...•

What is the difference between sales and cost of sales?

Sales is the monetary value of income earned by an entity by selling its products and/or services. Cost of goods sold is the sum total of all expenses incurred by the entity to produce the goods it has sold.

How is cost of sales calculated on the income statement?

The cost of sales line item appears near the top of the income statement, as a subtraction from net sales. The result of this calculation is the gross margin earned by the reporting entity.

Is cost of goods sold included in net sales?

Net sales is the result of gross revenue minus applicable sales returns, allowances, and discounts. Costs associated with net sales will affect a company's gross profit and gross profit margin but net sales does not include cost of goods sold which is usually a primary driver of gross profit margins.

Is sales the same as cost of goods sold?

Key takeaways: The difference between cost of goods sold and cost of sales is that the former refers to the company's cost to make products from parts or raw materials, while the latter is the total cost of a business creating a good or service for purchase.

How cost of goods sold affect gross profit?

The cost of goods sold for a particular service or product refers to the direct costs associated with its production, including labor necessary to produce the product and materials for the product. Hence, an increase in the cost of goods sold can decrease the gross profit.

How do you calculate cost of goods sold with gross profit and sales?

Here are the steps Anthony needs to take to calculate his COGS.Calculate beginning inventory. Find your beginning inventory amount for the period you are calculating COGS for. ... Add inventory purchases for the period. ... Labor costs. ... Subtract ending inventory. ... Calculate cost of goods sold.

What Is Gross Sales?

Gross sales is a metric for the total sales of a company, unadjusted for the costs related to generating those sales. The gross sales formula is calculated by totaling all sale invoices or related revenue transactions. However, gross sales do not include the operating expenses, tax expenses, or other charges—all of these are deducted to calculate net sales.

How to calculate gross sales?

Gross sales are calculated by adding all sales receipts before discounts, returns and allowances together.

Why is gross sales misleading?

When gross sales are presented on a separate line, the figure is often misleading, because it tends to overstate the amount of sales performed and inhibits readers from determining the total of the various sales deductions.

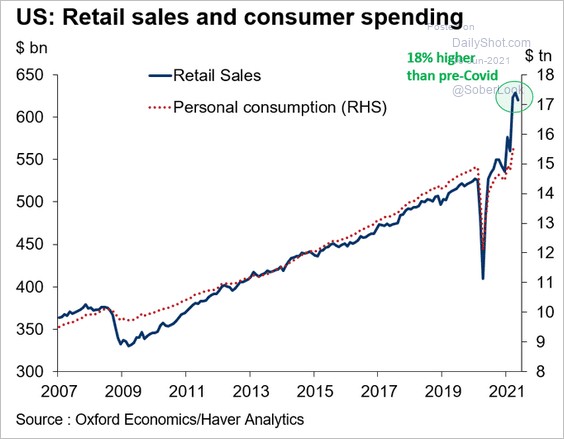

Why do you plot gross sales and net sales?

Analysts often find it helpful to plot gross sales lines and net sales lines together on a graph to determine how each value is trending over a period of time. If both lines increase together, this could indicate trouble with product quality because costs are also increasing, but it may also be an indication of a higher volume of discounts. These figures must be watched over a moderate period of time to make an accurate determination of their significance. Gross sales can be used to show consumer spending habits.

Why do analysts plot gross sales and net sales together?

Analysts find it helpful to plot gross sales and net sales together on a graph to determine the trend . If both lines increase together, this could indicate trouble with product quality.

Does a company have to include gross sales in their financial statements?

Most companies don’t provide gross sales in their publicly filed financial statements. Instead, it’s generally used as an internal number. For example, a company like Dollar General (NYSE: DG) or Target (NYSE: TGT) sells products to customers. However, they offer discounts and experience product returns.

Is gross sales a final word?

Gross sales can be an important tool, specifically for stores that sell retail items, but it is not the final word in a company's revenue. Ultimately, it is a reflection of the total amount of revenue a business brings in during a certain period of time, but it does not account for all of the expenses accrued throughout the process ...

How to calculate gross sales?

The formula for gross sales is simple. It is as follows: Gross sales = sum of all sales. To calculate gross sales, simply add the total amount of incoming sales throughout a specific period of time. Remember that the amount you get does not factor in discounts, returns or any later modifications to pricing.

What is the difference between gross and net sales?

There is one key difference between gross sales and net sales. Gross sales only consider the total amount of sales made during a specific period. It is the dollar amount associated with in-store purchases and online transactions. Net sales factor in the COGS. Businesses typically leave out gross sales numbers on accounting statements because they are not an indication of how well a business is doing.

What can you learn from gross sales?

Gross sales teach retailers and analysts about consumer buying trends. Analysts in the consumer retail industry typically look at gross sales when comparing them with net sales to understand buying trends. When analysts plot retail gross and net sales together, they learn valuable information about activity related to product quality, price increases and discounts. Overall, retailers look to gross sales for insight into consumer spending habits within a specific timeframe.

What is gross sales in 2021?

February 22, 2021. The term "gross sales" is one of many accounting terms in the business world that provides insight into a company's financial activity. Not only does it provide business owners with a total amount of sales for a specified period, but it also provides other information regarding ...

Why do businesses leave out gross sales?

Businesses typically leave out gross sales numbers on accounting statements because they are not an indication of how well a business is doing. Instead, they refer to net sales which do account for changes in revenue resulting from discounts, allowances and returns.

Do gross sales factor in expenses?

Gross sales do not factor in expenses related to running a business, also known as cost of goods sold (COGS), which get deducted when calculating net sales. For example, they do not account for costs associated with item production, employee wages, building rent, returns, theft or sales tax.

Analyzing one store

The main reason to calculate comp sales is to analyze the performance in one particular store. For example, maybe you opened a store three years ago in a different state. You might be curious to see if that store is doing well in that location compared to locations in the original state. Then, you could calculate the comp sales for that store.

Comparing multiple locations

It's also important to calculate comp sales if you want to compare how multiple locations are doing. This can help you determine a broader scope of how successful your company is. To do this, find the comp sales of two or more locations and compare them. You might find that some stores are performing better than others compared to previous years.

Justifying new stores

If you want to open more stores in different locations, then you can use comp sales calculations to justify it. This is important because the calculations can be supporting evidence that gives you a reason to open new stores.

Evaluating the company

You can use comp sales to evaluate how your company is doing as a whole. This is important because you can determine different ways to maintain or improve your business. For example, if the majority of your stores have positive comp sales, then you can deduce that your company is generally performing well.

Using other metrics

It's also important to calculate comp sales so you can use other metrics for your company. For example, you can compare your comp sales values to the enterprise value of your company, which is how you measure the total value of your company.

1. Find the net sales

First, you can find the net sales of the two years you want to compare. Net sales refer to a company's total sales, excluding its allowances, returns and discounts, over a specified time period. Typically, you would use the current year's net sales and the previous year's net sales.

2. Subtract new and closed stores

Next, subtract revenue gained from any new stores from both the years 2020 and 2021. This accounts for inaccurate sales information from grand openings, which can help you calculate a more average number. You can also subtract revenue from closed stores from both 2020 and 2021, which accounts for skewed data from stores going out of business.

Why do operators need comps?

In competitive environments, operators increasingly rely on promotions and comps to attract guests and increase sales. To be effective operationally, these comps need to be measured against their return on investment and also be kept to a budget so you don’t run the proverbial risk of losing money on every check and “making it up in volume.” There needs to be a balance, too, between empowering employees to make a situation right by comping an appetizer to apologize for a long wait, for example, and giving them free reign to give food away.

Why is it important to account for comps?

It is important to correctly account for comps to create an accurate picture of what’s happening, and to be sure that tax implications and ratios are observed. For example, if you are offering free happy hour appetizers to drive drink sales, improper accounting will knock your food cost out of whack and could have significant implications like a misevaluation of the chef’s performance. The promotion is an expense and should be properly accounted as such. Clear coding on the POS to manage promotions and comps helps with accounting, but it is important that operators and employees understand what happens to the books behind the scenes when that key is pressed.

Do restaurants remit sales tax on comps?

If comps are not significant they are sometimes just netted against sales, but this distorts gross margin. In any case, you want to make sure they are separately identified so the restaurant does not remit sales tax on the comps (unless required in some states—for example, for some beverage comps in some states, etc.).”.

Is promotion an expense?

The promotion is an expense and should be properly accounted as such. Clear coding on the POS to manage promotions and comps helps with accounting, but it is important that operators and employees understand what happens to the books behind the scenes when that key is pressed.

How to find commission based on gross sales?

Multiply the commission as a decimal by the gross sales to find the commission based on the gross sales. For example, if an employee sold $100,000 at 5 percent commission: $100,000 x 0.05 = $5,000.

What is gross sales?

The gross sales refers to the amount of money taken in from sales before factoring in any business costs.

How to convert commission percentage to decimal?

Convert the percentage of commission to a decimal by dividing the commission rate by 100. For instance, if an employee earns a 5 percent commission, 5/100 = 0.05.

How many comparables are required for a sales comparison?

A minimum of three closed comparables must be reported in the sales comparison approach. Additional comparable sales may be reported to support the opinion of market value provided by the appraiser. The subject property can be used as a fourth comparable sale or as supporting data if it was previously closed. Contract offerings and current listings can be used as supporting data, if appropriate.

When to use comparable sales in appraisal?

Comparable sales that have closed within the last 12 months should be used in the appraisal; however, the best and most appropriate comparable sales may not always be the most recent sales. For example, it may be appropriate for the appraiser to use a nine month old sale with a time adjustment rather than a one month old sale that requires multiple adjustments. An older sale may be more appropriate in situations when market conditions have impacted the availability of recent sales as long as the appraisal reflects the changing market conditions.

What is comparable sales in rural areas?

Comparable sales located a considerable distance from the subject property can be used if they represent the best indicator of value for the subject property. In such cases, the appraiser must use his or her knowledge of the area and apply good judgment in selecting comparable sales that are the best indicators of value. The appraisal must include an explanation of why the particular comparables were selected.

What does an appraiser need to include in an appraisal?

The appraiser must also provide an explanation as to why he or she used the specific comparable sales in the appraisal report and include a discussion of how a competing neighborhood is comparable to the subject neighborhood.

How many closed sales can an appraiser use in lieu of one closed sale?

In the event there are no closed sales inside a new subject project or subdivision because the subject property transaction is one of the first units to sell, the appraiser may use two pending sales in the subject project or subdivision in lieu of one closed sale. When the appraiser is using two pending comparable sales in lieu of a closed sale, the appraiser must also use at least three closed comparable sales from projects or subdivisions outside of the subject property’s project or subdivision.

What is comparable sales?

Comparable sales from within the same neighborhood (including subdivision or project) as the subject property should be used when possible, and must be used in certain instances (see below). Sale activity from within the neighborhood is the best indicator of value for properties in that neighborhood as sales prices of comparable properties from the same location should reflect the same positive and negative location characteristics.

What is the role of an appraiser in Fannie Mae?

The appraiser is responsible for determining which comparables are the best and most appropriate for the assignment. Fannie Mae expects the appraiser to account for all factors that affect value when completing the analysis . Comparable sales should have similar physical and legal characteristics when compared to the subject property. These characteristics include, but are not limited to, site, room count, gross living area, style, and condition. This does not mean that the comparable must be identical to the subject property, but it should be competitive and appeal to the same market participants that would also consider purchasing the subject property. Comparables that are significantly different from the subject property may be acceptable; however, the appraiser must describe the differences, consider these factors in the market value, and provide an explanation justifying the use of the comparable (s).