FDIC Deposit Insurance Coverage Limits by Account Ownership Category

| Single Accounts (Owned by One Person) | $250,000 per owner |

| Joint Accounts (Owned by Two or More Per ... | $250,000 per co-owner |

| Certain Retirement Accounts (Includes IR ... | $250,000 per owner |

| Revocable Trust Accounts | $250,000 per owner per unique beneficiar ... |

| Corporation, Partnership and Unincorpora ... | $250,000 per corporation, partnership or ... |

How do you insure funds more than the FDIC limit?

These examples illustrate how that works:

- You and your spouse have individual savings accounts at the same bank, each with $200,000 deposited. ...

- You have two checking accounts at two different banks, each with $200,000 deposited. ...

- You have a personal account and a business account at the same bank, each with $200,000 deposited. ...

What is the maximum insured by FDIC?

What does FDIC insurance cover?

- Single accounts owned by one person

- Joint accounts owned by two or more people

- Certain retirement accounts

- Revocable trust accounts

- Irrevocable trust accounts

- Corporation, partnership and unincorporated association accounts

- Employee benefit plan accounts

- Government accounts

What is the current FDIC insurance limit?

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC provides separate coverage for deposits held in different account ownership categories. Depositors may qualify for coverage over $250,000 if they have funds in different ownership categories and all FDIC requirements are met.

What is the limit FDIC will insure?

Standard FDIC deposit insurance includes coverage up to $250,000 per depositor, per FDIC-insured bank, per ownership category. This limit applies to the total for all deposits owned by an account holder. If you have multiple accounts, they are added together and insured to the limit.

Does FDIC cover multiple accounts at the same bank?

The FDIC adds together all single accounts owned by the same person at the same bank and insures the total up to $250,000.

How do I get around the FDIC limits?

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks. ... Use CDARS to Insure Excess Bank Deposits. ... Consider Moving Some of Your Money to a Credit Union. ... Open a Cash Management Account. ... Weigh Other Options.

How many FDIC accounts can you have at bank?

You and your spouse each can open individual accounts at a single bank, resulting in each of you having up to $250,000 FDIC-insured. You can then also open a joint account and each have $250,000 insured in that account. Between those three accounts, you could have up to $1 million FDIC insured at one bank.

Is FDIC insurance per account or per owner?

A: Yes. The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.

Does FDIC cover each account separately?

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC provides separate coverage for deposits held in different account ownership categories.

Can you have more than 250k in bank account?

Understanding FDIC insurance limits The FDIC wants to make sure it can cover everyone with a bank account, so to make that happen, it caps how much money it insures. The FDIC says its standard is to cover up to “$250,000 per depositor, per insured bank, for each account ownership category.

Are joint accounts FDIC-insured to $500000?

Joint accounts are insured separately from accounts in other ownership categories, up to a total of $250,000 per owner. This means you and your spouse can get another $500,000 of FDIC insurance coverage by opening a joint account in addition to your single accounts.

Can you deposit millions into a bank?

Banks do not impose maximum deposit limits. There's no reason you can't put a million dollars in a bank, but the Federal Deposit Insurance Corporation won't cover the entire amount if placed in a single account. To protect your money, break the deposit into different accounts at different banks.

Where can I put millions of dollars?

Savings accounts are a safe place to keep your money because all deposits made by consumers are guaranteed by the FDIC for bank accounts or the NCUA for credit union accounts. Certificates of deposit (CDs) issued by banks and credit unions also carry deposit insurance.

What is the maximum amount of money you can have in a bank account?

The standard insurance amount provided for FDIC-insured accounts is $250,000 per depositor, per insured bank, for each account ownership category, in the event of a bank failure.

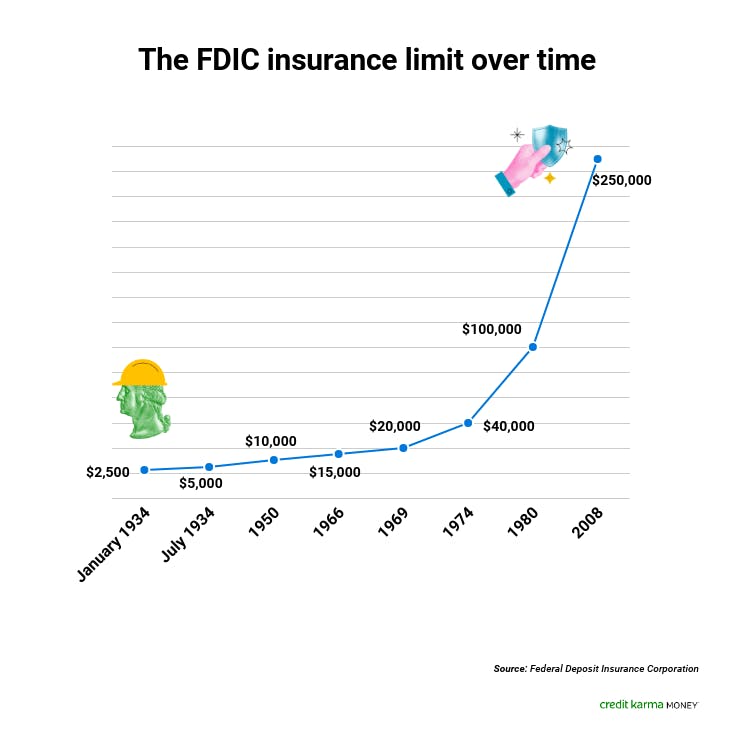

What is the FDIC limit for 2022?

$250,000That was back in 1934, and today not much has changed except for the FDIC coverage limit growing by a multiple of 100, from $2,500 to $250,000 as of 2022. Today, the FDIC covers accounts up to $250,000 in deposits per account owner / ownership category at each insured bank.

How much money can you put in a bank without questions?

Under the Bank Secrecy Act, banks and other financial institutions must report cash deposits greater than $10,000. But since many criminals are aware of that requirement, banks also are supposed to report any suspicious transactions, including deposit patterns below $10,000.

Are joint accounts FDIC insured to $500000?

Joint accounts are insured separately from accounts in other ownership categories, up to a total of $250,000 per owner. This means you and your spouse can get another $500,000 of FDIC insurance coverage by opening a joint account in addition to your single accounts.

How do I insure 250000?

Here are four ways you may be able to insure more than $250,000 in deposits:Open accounts at more than one institution. This strategy works as long as the two institutions are distinct. ... Open accounts in different ownership categories. ... Use a network. ... Open a brokerage deposit account.

Where do you put large sums of money?

ON THIS PAGEHigh-yield savings account.Certificate of deposit (CD)Money market account.Checking account.Treasury bills.Short-term bonds.Riskier options: Stocks, real estate and gold.Use a financial planner to help you decide.

How much money can you put in a bank without questions?

Under the Bank Secrecy Act, banks and other financial institutions must report cash deposits greater than $10,000. But since many criminals are aware of that requirement, banks also are supposed to report any suspicious transactions, including deposit patterns below $10,000.

How do you find out if a bank is FDIC insured?

You can look for FDIC signage at branch locations or online on a bank's website, use the FDIC BankFind tool, or call the FDIC at 877-275-3342.

Do some banks insure more than $250,000?

No, insurance limits are universally applied to all member FDIC banks. Insurance limits are regulated by the government and are not left up to the...

What Does FDIC Insurance Mean?

The Federal Deposit Insurance Corporation (FDIC) is an independent U.S. government agency that protects monetary deposit accounts — such as checkin...

How Can You Insure More than $250,000?

There are a number of reasons why you may want to insure more than $250,000 — even for a short period of time. You may have sold your home or busin...

How much does the FDIC cover?

In short, the agency covers up to $250,000 per person per account. 2 But it’s not just the type of account that matters—it’s whose name is on it.

What is the FDIC limit for a trust?

If a bank account is opened in a trust’s name, rather than an individual or couple, the FDIC insurance can grow far beyond that $250,000 limit.

What is the Depositors Insurance Fund?

The Depositors Insurance Fund protects all deposits in excess of FDIC limits at all banks chartered in Massachusetts—and you don’t have to be a Massachusetts resident to open account. 4 Many banks offer the Certificate of Deposit Account Registry Service, which insures CDs beyond FDIC limits. 5.

What does FDIC stand for?

FDIC stands for Federal Deposit Insurance Corporation. It was formed in the 1930s in response to the banking crashes that accompanied the Great Depression. It’s designed to keep America confident in its banks, but it also provides real-world safeguards for your money by doing precisely what its name implies: insuring your bank deposits.

What did the FDIC do during the 2008 housing crisis?

During the 2008 housing crisis, the FDIC took control of failing banks, protecting billions of dollars in assets. Just like you pay car insurance premiums, American banks pay premiums to the FDIC. The FDIC in turn uses that money, plus other federal funds, to repay customers if a bank fails.

How much money does a trust have to be insured?

That means a trust set up by 2 parents for their 3 kids is insured for up to $1.5 million (2 parents times 3 kids is 6; $250,000 times 6 is $1.5 million).

Does the FDIC cover checking accounts?

The agency insures most American banks, making it responsible for trillions of dollars in deposits. It also regulates those banks, monitoring their health in an effort to avoid collapse. Keep in mind that not every dollar is covered. The FDIC only insures bank deposits, including checking accounts, savings accounts , money market accounts and CDs.

How to find FDIC information?

You can look for FDIC signage at branch locations or online on a bank's website, use the FDIC BankFind tool, or call the FDIC at 877-275-3342. For credit unions, the National Credit Union Administration (NCUA) provides the same deposit insurance as the FDIC for the same amounts.

What does FDIC mean?

What Does FDIC Insurance Mean? The Federal Deposit Insurance Corporation (FDIC) is an independent U.S. government agency that protects monetary deposit accounts — such as checking accounts, savings accounts, and CDs — in the event of a bank default or closure.

What Does FDIC Insurance Mean?

The Federal Deposit Insurance Corporation (FDIC) is an independent U.S. government agency that protects monetary deposit accounts — such as checking accounts, savings accounts, and CDs — in the event of a bank default or closure.

How Can You Insure More than $250,000?

There are a number of reasons why you may want to insure more than $250,000 — even for a short period of time. You may have sold your home or business recently, received an inheritance, or heck, even won the lottery.

What is the highest deposit amount that can be insured with a single bank entity?

The highest deposit amount that can be insured with a single bank entity is $1 million.

What happens if a bank fails to take on the assets of the bank?

If the FDIC cannot locate a bank willing to take on the assets of the failed bank, the FDIC will simply issue checks for the insured amount to each individual depositor. If this is the case, the FDIC typically pays insurance on the next business day, according to their website.

How much is joint account insured?

Are Joint Accounts Insured for $500,000? Yes, if a joint account is owned by two people (i.e., depositors), it is insured for $500,000. Some banks allow more than two people to share ownership of joint accounts, in which case the FDIC insurance on said account would be higher.

What does FDIC send to account holders?

The FDIC sends accountholders a check equivalent to their insured account value.

How to find out if a bank has FDIC insurance?

To find out if a bank has FDIC insurance, check that the FDIC seal is present, which is usually on the bank’s door, or ask a bank representative. You can also use the FDIC’s BankFind tool.

What Happens to My Money When a Bank Fails?

If an FDIC-insured bank fails and your money is in an insured account, rest assured that you are covered up to $250,000. Accountholders are insured dollar for dollar. Depositors are usually paid their insurance within only a few business days after the bank’s closing and often by the next business day.

Why was the FDIC created?

The formation of the FDIC was in response to the many banks that failed during the Great Depression. The FDIC became an independent government corporation through the Banking Act of 1935. The role of the FDIC is to cover FDIC-insured bank deposits, up to a limit, in the event of a bank failure. This is what you know it for - it's supposed ...

How much is insured for multiple accounts?

For example, if you have a $100,000 account, a $150,000 account, and a $50,000 account, equaling $300,000 in total, only $250,000 of this total will be insured.

Does FDIC cover deposits?

FDIC insurance does cover earnings on deposits, assuming the overall account value does not exceed the $250,000 insurance limit. If you have $200,000 in an account that has earned $5,000, the full $205,000 is insured since it does not exceed the $250,000 limit. To better understand the various scenarios that deposits are covered under, ...

Can the FDIC sell off a bank?

The FDIC will become the receiver of a failed bank and sell off the bank’s assets. For depositors that have account values in excess of $250,000, proceeds from the bank’s assets are used to pay back uninsured funds. Although, it can take years to sell all of a failed bank’s assets. It is also unlikely those depositors will receive 100% of their uninsured funds.

How much is the maximum amount of insurance for a single account?

Coverage Limit: All single accounts owned by the same person at the same bank are added together and insured up to $250,000.

What are some examples of FDIC accounts?

Below are examples of some FDIC ownership categories, including single accounts, certain retirement accounts and employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts.

How to contact FDIC for deposit insurance?

You can also visit the FDIC Information and Support Center to submit a request for deposit insurance coverage information or call 1-877-ASK-FDIC (1-877-275-3342) to ask any other specific deposit insurance questions. Please Note: Not all products offered by banks are covered by FDIC insurance. Click here for more information about accounts ...

What is a government account?

Government Account. Government accounts include deposit accounts owned by: The United States, including federal agencies. Any state, county, municipality (or a political subdivision of any state, county, or municipality), the District of Columbia, Puerto Rico and other government possessions and territories. An Indian tribe.

How much is the maximum amount of retirement insurance?

Coverage Limit: All retirement accounts listed above owned by the same person at the same bank are added together and insured up to $250,000.

How much is the non-contingent interest limit?

Coverage Limit: The interests of each participant's non-contingent interest under the plan is insured up to $250,000 per bank. For plans where the interests are contingent, such as health and welfare plans, the coverage is $250,000 for the plan itself.

Who owns deposit insurance?

Deposits owned by corporations, partnerships, and unincorporated associations, including for-profit and not-for-profit organizations. The corporation, partnership, or unincorporated association must be separately organized under state law and operate primarily for some purpose other than to increase deposit insurance coverage.

How much does FDIC insurance cover?

The FDIC insures up to $250,000 per depositor, per institution and per ownership category. FDIC insurance covers deposit accounts — checking, savings and money market accounts and certificates of deposit — and kicks in only in the event a bank fails.

Why was FDIC established?

The idea behind FDIC insurance. The FDIC was established in 1933 in response to the many bank failures during the Great Depression. It was meant to (and still does) promote public confidence in the banking system by insuring consumers’ deposits. In 2015, eight banks failed, but during the Great Recession, dozens went under.

How much money is insured in a joint savings account?

Here’s one more example to show how different ownership categories affect how your money is insured: You’re married, and at a bank you have $500,000 in a joint savings account shared with your spouse and $250,000 in a CD in your name. All of this money is protected. How? The joint savings account is one ownership category, where both you and your spouse are covered up to $250,000. The CD is a second ownership category (single) where you are covered up to that amount.

How many banks failed in 2015?

In 2015, eight banks failed, but during the Great Recession, dozens went under. Still, since the creation of the FDIC, not one cent of insured deposits has been lost. Banks are not insured by default; like most forms of insurance, it comes at a cost.

How to make sure all your money is insured?

One way to make sure all of your money is insured is to spread it across multiple institutions. Let's consider a new example: You’re still single, but now you have $250,000 at one bank and $250,000 at another bank. All of your money is protected in this scenario.

Is my money protected by a bank?

In these rare cases, your money is protected as long as a bank is federally insured. That means backing by the Federal Deposit Insurance Corp. (Credit unions offer this security as well, through the National Credit Union Administration.)

Is it safe to deposit money in a bank?

Banks are safe and stable places to store your money. Still, the past several years have reminded us that these institutions can fail, meaning they can no longer meet their obligations to the people who have deposited money with them or to those they’ve borrowed from.

How much is FDIC deposit insurance?

The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.

What is the FDIC?

The FDIC—short for the Federal Deposit Insurance Corporation—is an independent agency of the United States government. The FDIC protects depositors of insured banks located in the United States against the loss of their deposits if an insured bank fails.

How much deposit insurance does a revocable trust have?

Therefore, a revocable trust with one owner and five unique beneficiaries is insured up to $1,250,000.

What does FDIC cover?

FDIC Coverage Basics. FDIC insurance covers depositors' accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest through the date of the insured bank's closing, up to the insurance limit. FDIC insurance covers all types of deposits received at an insured bank but does not cover investments, ...

What is FDIC insured deposit?

Your Insured Deposits is a comprehensive description of FDIC deposit insurance coverage for the most common account ownership categories. This brochure is not intended as a legal interpretation of the FDIC's laws and regulations. For additional or more specific information about FDIC insurance coverage, consult the Federal Deposit Insurance Act (12 U.S.C.1811 et seq.) and the FDIC's regulations relating to insurance coverage described in 12 C.F.R. Part 330.

Where do you find the fiduciary nature of a bank account?

The fiduciary nature of the account must be disclosed in the bank's deposit account records (e.g., "Jane Doe as Custodian for Susie Doe" or "First Real Estate Title Company, Client Escrow Account"). The name and ownership interest of each owner must be ascertainable from the deposit account records of the insured bank or from records maintained by the agent (or by some person or entity that has agreed to maintain records for the agent).

What is single account?

A single account is a deposit owned by one person. This ownership category includes:

How to contact FDIC about deposit insurance?

Contact the FDIC. 1-877-ASK-FDIC. Call us to determine your deposit insurance coverage or ask any other specific deposit insurance questions. FDIC Information and Support Center. Submit a request or complaint, check on the status of a complaint or inquiry, or securely exchange documents with the FDIC. Electronic Deposit Insurance Estimator (EDIE) ...

How to find out if your bank is insured?

Are My Deposits Insured? 1 Is Your Bank Insured? The BankFind tool can help you find out if your banking institution is insured. 2 Are Your Accounts Covered? Not all accounts, products, and investments are covered by FDIC insurance. Find out what is—and is not—covered. 3 How Much of Your Deposits Are Insured? Use the Electronic Deposit Insurance Estimator (EDIE) to find out.

What is deposit insurance seminar?

Deposit Insurance Coverage Seminars for Bankers. Covers the fundamentals of deposit insurance, advanced insurance topics, and insurance coverage for specific products, like Revocable Trust Accounts.

Is FDIC insurance covered by all accounts?

Are Your Accounts Covered? Not all accounts, products, and investments are covered by FDIC insurance. Find out what is—and is not—covered.

Are My Deposits Insured?

Use the tools below to double check that your accounts and bank are FDIC-insured and to find out how much insurance coverage you have.

How many POD accounts does John have?

John has three informal trust/POD accounts at the same insured bank. For each of these accounts, John has designated the same two unique beneficiaries, Jack and Janet.

How much insurance does a trust owner get?

When all the beneficiaries are assigned equal amounts in the trust, the trust owner receives insurance coverage up to $250,000 for each unique beneficiary.

How much insurance does a life estate beneficiary get?

An owner who designates a beneficiary as having a life estate interest in a formal revocable trust is entitled to insurance coverage up to $250,000 for that beneficiary. A life estate beneficiary is a beneficiary who has the right to receive income from the trust or to use trust deposits assets during the beneficiary's lifetime, where other beneficiaries receive the remaining trust deposits assets after the life estate beneficiary dies. Contingent or secondary beneficiaries, however, are not included in the calculation.

What is deposit insurance for revocable trusts?

In calculating deposit insurance coverage for revocable trusts, the FDIC combines the interests of all beneficiaries the owner has designated in all formal and informal revocable trust accounts at the same bank.

How much insurance does a revocable trust receive?

When a revocable trust owner designates five or fewer beneficiaries, the owner's share of each trust account is added together and the owner receives up to $250,000 in insurance coverage for each unique beneficiary. Formal and informal revocable trust accounts held by the same owner (s) are added together prior to determining coverage.

What is ITF in banking?

In trust for (ITF) Or similar language, including the word “trust” in the account title. Important Considerations. At the time a bank fails, the beneficiary must be entitled to his or her interest in the revocable trust assets upon the grantor's death.

What does the account title mean in a bank account?

The account title at the bank indicates that the account is a trust. For a Formal Revocable Trust, the account title uses such terms as: Living trust. Family trust. For an Informal Revocable Trust, the account title uses such terms as: Payable on death (POD) Totten trust.

What are some examples of FDIC accounts?

Examples of categories include single, joint, retirement account, trust, business, employee benefit plan and government. Accounts may need to meet certain requirements to be covered.

How much is the maximum amount of money per beneficiary?

Understand that the $250,000 limit applies per beneficiary. (Getty Images)

How Can You Insure More Than $250,000?

The $250,000 limit may sound high, but there are some common situations when you may have more cash in a bank , such as if:

How to insure large sums?

Use a network. Networks are designed to help depositors insure large sums, such as the Certificate of Deposit Account Registry Service, which divides big deposits into smaller certificates of deposit at FDIC-insured banks; the CDC Deposits Corp., which divides large deposits into money market accounts at FDIC-insured community banks; and a MaxMyInterest checking account, which allocates deposits among FDIC-insured banks to try to maximize interest earnings. These services may involve fees.

What is deposit insurance?

There are two main types of deposit insurance: 1 The Federal Deposit Insurance Corp. insures deposits at most banks. 2 The National Credit Union Administration insures deposits at most credit unions.

Why are checking accounts insured?

You're fully insured because your accounts are in different ownership categories – personal and business. You have two individual personal checking accounts at the same bank, each with $200,000 deposited. You're insured only up to $250,000 because both of your accounts have the same depositor, ownership category and institution.

How much is a deposit insured?

Deposits are insured up to $250,000 per depositor, per ownership category, per institution. These examples illustrate how that works: You and your spouse have individual savings accounts at the same bank, each with $200,000 deposited. You're fully insured because your accounts have different depositors – you and your spouse.

FDIC Deposit Insurance

The FDIC Covers

- Checking accounts

- Negotiable Order of Withdrawal (NOW) accounts

- Savings accounts

- Money Market Deposit Accounts (MMDAs)

The FDIC Does Not Cover

- Stock investments

- Bond investments

- Mutual funds

- Life insurance policies

When A Bank Fails

- A bank failure is the closing of a bank by a federal or state banking regulatory agency, generally resulting from a bank's inability to meet its obligations to depositors and others. In the unlikely event of a bank failure, the FDIC acts quickly to ensure depositors get prompt access to their insured deposits. FDIC deposit insurance covers the balance of each depositor's account, dollar …