Restrictions on Housing Benefits

- Employee housing can't be included in a cafeteria benefits plan. ...

- If you pay employees a housing allowance or allow the employee to take extra pay instead of providing them housing, it's taxable to the employee, even if on-premises housing is ...

- Housing as part of an education benefit is considered taxable to the employee. ...

Do I pay tax on a housing allowance?

The housing allowance will allow you to reduce your federal taxes by the amount of your “allowance” and thus reduce your federal taxable income. However, when you figure your salary for the self-employed section, the housing allowance is added back in for tax purposes. For example, let’s say you make $50,000 a year.

Are taxes taken out of my Living Allowance?

Are taxes taken out of my living allowance? Federal taxes are withheld, but NOT state taxes, local taxes or Social Security. You are responsible for being able to pay any state or local taxes you may owe.

Should housing allowance be taxed?

Your housing allowance must still be declared as income for your self-employment income on your tax form. The housing allowance declaration removes “income” from your federal tax portion but not your SECA (self-employed portion). It can be confusing, especially for those who are new pastors or those who are new to this allowance.

Who qualifies for the low income housing tax credit program?

The Low-Income Housing Tax Credit is a tax credit for real estate developers and investors who make their properties available as affordable housing for low-income Americans. It’s paid for by the federal government and administered by the states, according to their own affordable housing needs.

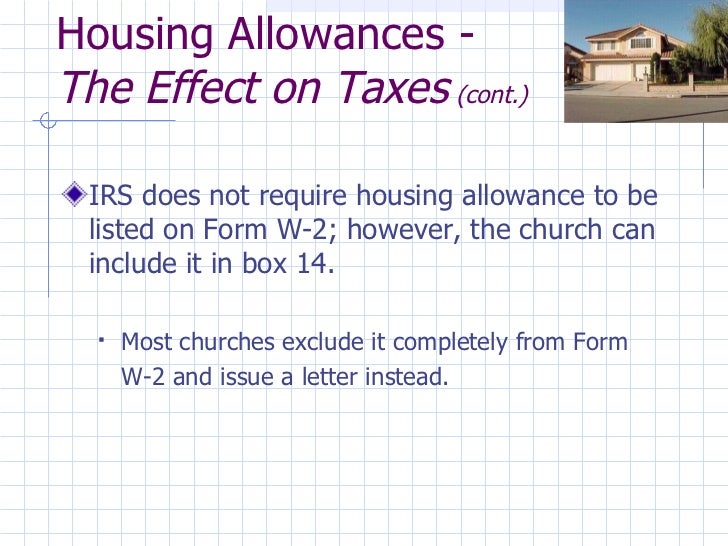

Should housing allowance be reported on W-2?

Generally, the housing allowance is reported in box 14 of the W-2 and is not included in boxes 1, 3 or 5. The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. No exclusion applies for self-employment tax purposes.

Is housing allowance subject to Social Security tax?

Qualifying payments for a housing allowance are excluded from federal income tax. (However, these amounts are included in the computation of Social Security/Medicare taxes (SECA) at the self-employment tax rate unless the minister is retired.) Generally, housing allowance payments also are exempt from state income tax.

How do you record housing allowance on W-2?

Also, as mentioned above, the housing allowance amount can be included in Box 14 on Form W-2. Box 14 is an informational box that employers use to report various kinds of information to employees, such as retirement contributions and housing allowance. Box 14 would simply say something like, “Housing: 18,000.” If it is ...

Is housing allowance considered earned income?

The housing allowance is an exclusion from income permitted by Section 107 of the Internal Revenue Code. It is not a deduction. In other words, a housing allowance is money that is not reported as income. A housing allowance is never deducted because it is never reported as income in the first place.

How do I report housing allowance on my tax return?

The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

Should housing allowance be reported on a 1099?

The 1099-MISC should only report your taxable wages not including the housing allowance.

How does housing allowance work?

The housing allowance is paid as a monthly contribution to qualifying employees to assist with their recurring costs of their accommodation. Employees must contact the Human Resources division in their respective departments in order to access the housing allowance.

How do I enter housing allowance on TurboTax?

To enter your housing allowance in TurboTax Deluxe online version, go to:Sign in to your account and select Pick up where you left off.Right upper corner, in the search box, type in “business code”, then Enter.On-screen, “ Did you have any self-employment income or expenses?” select Yes.Follow prompts.More items...•

What is the purpose of housing for a household worker?

For a household worker, your home would be the work premises. The housing is provided for the convenience of the employer. You must have a “substantial business reason” for giving the housing, not just as a way to give the employee additional pay. The employee must accept the housing as a condition of employment.

What is the term for an employee who accepts housing?

The employee must accept the housing as a condition of employment. A condition of employment, also called the terms of employment, is something the employee and employer agree to at the beginning of employment. Both parties agree to abide by these terms.

Is employee housing taxable?

Employee Housing: Taxable to Your Employees? Empl o yee benefits are almost always taxable to the employee because they are a part of the employee’s income. For some benefits, though, there are some ways that the benefit can be non-taxable (the IRS calls them “excluded”).

Do you have to give meals to employees on your property?

If meals aren’t available to employees who live on your property, meals for employees that are furnished on your business property and are for your convenience are also excluded from taxes. It makes sense that if you offer housing on this basis, you will have to give the employee meals too.

Is housing expense deductible?

If you pay for housing for employees, this expense is usually considered to be tax deductible to you as an employer as a business expense. That is, you can include these costs on your business tax return if you can show they are directly related.

Is housing benefit taxable?

In each case, the three factors are reviewed and the IRS rules that the housing benefit is or is not taxable to the employee .

Is a live in nanny taxable?

A live-in nan ny who must care for children at all hours. An example of housing that is taxable is if you give an employee a place to stay or offer a housing allowance because they have a long commute. That’s not a condition of employment.

What is the Minister's Housing Allowance?

What is the Minister’s Housing Allowance? The Minister's Housing Allowance is a great tax benefit —and a great financial benefit—for those who are licensed, ordained, or commissioned as a Minister.

When will the Minister's Housing Allowance be available in 2021?

February 3, 2021. You’re a minister and you’re currently receiving the Minister’s Housing Allowance. But you’re getting ready to file taxes and need to know if this Housing Allowance is considered income. Let’s start with the basics.

Can you deduct housing allowance on 1040?

This amount is not a deduction from your income—it is an amount of income not reported. A housing allowance is never deducted because it is never reported as income in the first place. However, the pastor is required to include any excess housing allowance as income on their Form 1040.

Is housing allowance taxed?

When the approved amount of compensation is determined to be a Housing Allowance, that amount is not taxed by either the federal or state taxing authorities. In other words, the Minister’s Housing Allowance can be excluded from your gross income when filing your taxes (permitted by Section 107 of the Internal Revenue Code ). ...

Does housing allowance reduce taxes?

The housing allowance payments must be used the same year that they are received. Note, it does not reduce your Self-Employment Contributions Act (SECA) taxes. When a portion of compensation is received as housing allowance, federal and state taxes are directly reduced, but SECA taxes are not .

Can a pastor exclude income from taxes?

Pastors can exclude an amount from federal and state income taxes that is the lowest of the following options: A church-designated housing allowance. The fair rental value of the residence (home, furnishings, utilities) The housing allowance payments must be used the same year that they are received.

What is housing allowance?

the amount officially designated (in advance of payment) as a housing allowance; the amount actually used to provide or rent a home; or. the fair market rental value of the home (including furnishings, utilities, garage, etc.). The payments officially designated as a housing allowance must be used in the year received.

Is minister's housing allowance taxable?

Answer. A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for self-employment tax purposes.

How much can you exclude from your income?

However, the amount you can exclude is limited to your employer's cost and can’t be more than $1,600 ($400 for awards that aren’t qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that don’t create a significant likelihood of it being disguised pay.

What is included in gross income?

In most cases, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

Is emergency financial aid included in gross income?

The amounts of these are not included in the gross income of the eligible self-employed individual. Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020.

What is the exception for housing on W-2?

The exceptions cover housing located on the employer's premises; housing for the clergy; housing for faculty members of an educational institution; and housing your employer provides when you relocate temporar ily. Unless employer-provided lodging meets one of the criteria for exemption, the value of the lodging is reported on your W-2 form ...

What happens if you get housing while on a foreign assignment?

If your employer transfers you to a job assignment in another country and provides you with housing or a housing allowance, several tax issues are raised, including a foreign lodging allowance allowed by the IRS, as well as the foreign taxing authority's interest in taxing the benefit.

Do you have to include housing expenses in your income?

If you work for an employer that provides you with housing or reimburses you for your living expenses, you must include the value of the housing or the amount of reimbursements in your taxable income unless you meet one of the exceptions.

Can you exclude housing?

To exclude the housing, the housing your employer provides must be on the same premises as your work location and it must be for the convenience of your employer instead of your own. In addition, accepting the employer on-site housing must be a condition of employment - that is, you must live in the provided lodging in order to be able ...

Do clergy members have to report housing?

Clergy Housing. If you are a clergy member, such as a minister, priest or rabbi, the IRS provides you with a special exemption and doesn't require you to report as taxable income any housing or living allowances you receive. However, the value of the housing you receive must reasonably relate to the services you provide to ...

Is lodging on W-2 taxed?

Unless employer-provided lodging meets one of the criteria for exempt ion, the value of the lodging is reported on your W-2 form or a form 1099, and is subject to income and payroll tax. Advertisement.

Is housing taxable if you are not on a temporary assignment?

If you are not on a temporary work assignment that requires you to be away from home, any housing for which your employer pays must be included in your taxable income unless you satisfy three requirements.

3. The church has a responsibility to designate the housing allowance in writing before the first of the year

After the pastor has determined the amount of his housing allowance (see above), the church’s governing body must declare in writing what the housing allowance will be for the year ahead and include it in the church’s minutes. Churches often finalize this in their annual meeting or a special-called business meeting.

4. Your housing allowance must still be declared as income for your self-employment income on your tax form

The housing allowance declaration removes “income” from your federal tax portion but not your SECA (self-employed portion). It can be confusing, especially for those who are new pastors or those who are new to this allowance. But, for a pastor, there are two sides to taxes—the federal and the SECA.

What is non cash benefit?

A non-cash (or “in kind”) benefit is the actual good, service, or property that you give to your employee. This includes a payment you make to a third party for the particular good or service if you are responsible for the expense.

How much is the overtime meal allowance for 2020?

For 2020 and later tax years, the value that the CRA generally considers reasonable for purposes of an overtime meal or allowance, and the “meal” portion of a travel allowance, has been increased from $17 to $23 (including the GST/HST and PST).

How is the value of an aircraft benefit determined?

The value of the benefit is determined on the basis of what is reasonable in relation to the facts of the case and the manner in which the aircraft is used. For more information about aircraft benefits, go to Taxable benefit for the personal use of an aircraft.

Where is the code 34 on a T4?

Report the value of the benefit including the GST/HST and PST that applies in box 14, “Employment income,” and in the “Other information” area under code 34 at the bottom of the employee’s T4 slip.

Do you have to include a benefit in your income?

You may have to include the value of a benefit or allowance in an employee's income, depending on the type of benefit or allowance and the reason you give it. This guide explains your responsibilities and shows you how to calculate the value of taxable benefits or allowances.

Is a move from one place of business to another taxable?

When you transfer an employee from one of your places of business to another, the amount you pay or reimburse the employee for certain moving expenses is usually not a taxable benefit. This includes any amounts you incurred to move the employee, the employee's family, and their household effects. This also applies when the employee accepts employment at a different location from the location of their former residence. The move does not have to be within Canada.

Is the non-accountable allowance included in 2019 taxes?

For 2019 and later tax years, the full amount of the non‑accountable allowances paid to elected officers will be included in their income. For more information, go to Municipal officer's expense allowance.