How do you calculate adjusted gross income?

- You can find your annual income from the paystub. Add your other sources of income (rent, lottery, etc.) into it.

- Now add up all of your deductions like you did in the above steps.

- Subtract deductions from the annual income. This value will be your adjusted gross income.

Are federal tax brackets based on AGI?

Your total federal income tax owed is based on your adjusted gross income (AGI). When you complete your Form 1040 and its attached schedules, you enter all of your income from various categories, such as wages, interest and dividends, and business income.

How do you calculate federal tax brackets?

your total income – minus your adjustments and deductions. Under the federal income tax system, “tax bracket” refers to the highest tax rate charged on your income.

Is your tax bracket based on gross or net income?

Your specific tax bracket and your tax responsibilities are based on your adjusted gross income rather than your gross income. This is due to the fact that many individuals have additional expenses and responsibilities which impact their take-home pay. Gross Income v. Adjusted Gross Income

Are the tax brackets based on adjusted gross income?

Your AGI does not determine your tax bracket. It determines what deductions and credits you're eligible for. Your tax bracket is determined by your taxable income, which is your AGI minus deductions.

What determines your tax bracket?

Filing status, amount of taxable income and the difference between marginal and effective tax rates determine a taxpayer's federal income tax rate. The progressive federal tax system in the U.S. requires filers with higher incomes to pay higher tax rates, but taxpayers don't pay the same rate on every dollar earned.

Is tax bracket based on gross or net?

Taxable income starts with gross income, then certain allowable deductions are subtracted to arrive at the amount of income you're actually taxed on. Tax brackets and marginal tax rates are based on taxable income, not gross income.

Is your tax bracket after standard deduction?

CURRENT INCOME TAX RATES AND BRACKETS The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions.

How can I avoid higher tax bracket?

Here's an overview of each strategy and how it might reduce taxable income and help you avoid moving into a higher tax bracket.Contribute more to retirement accounts.Push asset sales to next year.Batch itemized deductions.Sell losing investments.Choose tax-efficient investments.The takeaway.More items...•

Is your tax bracket determined before or after deductions?

Your marginal tax bracket is the tax rate you paid on your last dollar of income and is how you determine which tax bracket you're in. Your effective tax rate, meanwhile, is the percentage of your income that you paid in taxes after all was said and done — in this case, about 13 percent ($6,617/$50,000).

How do tax brackets work 2022?

There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

How can I lower my tax bracket?

Contribute to a Retirement Account.Open a Health Savings Account.Check for Flexible Spending Accounts at Work.Use Your Side Hustle to Claim Business Deductions.Claim a Home Office Deduction.Rent Out Your Home for Business Meetings.Write Off Business Travel Expenses, Even While on Vacation.More items...

How to adjust your income on your 1040?

You adjust your gross income by claiming various deductions on the front of your 1040. If you put money in IRAs, for instance, you subtract it from your income as an adjustment. If you take write-offs for student-loan interest, tuition, moving expenses or part of any self-employment tax you pay, you make further adjustments. Even after that, you still claim your exemptions and standard deduction -- or your itemized deductions -- before calculating your tax based on what income remains.

What is the tax bracket for 2012?

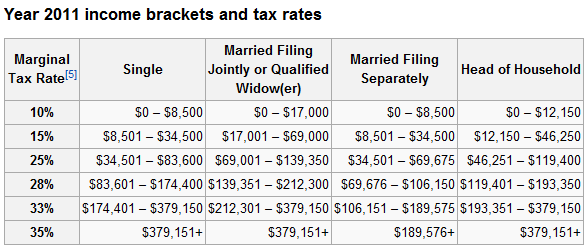

Tax Brackets. The United States uses a marginal tax-bracket system. If, say, your 2012 income falls into the 15 percent tax bracket, you don't pay 15 percent on all your adjusted gross income, only on income above an upper margin. On a joint return, you'd pay 10 percent on your income up to $17,400, and only pay 15 percent on income above that.

Can you shrink your tax bill?

Other Adjustments. After you calculate your tax bill, you may be able to shrink it some, if you qualify for any of the federal tax credits. You can claim credits for college expenses and foreign taxes, among other write-offs, and take them directly off your taxes, not your taxable income.

What determines your tax bracket?

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

How to calculate effective tax rate?

To calculate your effective tax rate, take the total amount of tax you paid and divide that number by your taxable income. Your effective tax rate will be much lower than the rate from your tax bracket, which claims against only your top-end earnings.

How much is long term capital gains taxed?

economy, long-term capital gains — gains from securities sold after having been held for at least a year — are taxed at rates lower than comparable ordinary income. Tax brackets for long-term capital gains (investments held for more than one year) are 15% and 20%. An additional 3.8% bump applies to filers with higher modified adjusted gross incomes (MAGI).

Why do married couples file separate taxes?

Married Filing Separately – A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

How much is the tax rate for dividends in 2020?

Youngsters with accounts that earn more than $1,100 in dividends and interest in 2020 will be liable for taxes according to the rates applied to trusts and estates — quickly escalating brackets that range from 10% (up to $2,600) to 37% (more than $12,950).

What is marginal tax rate?

Marginal Tax Rates. Marginal tax rates refer to the rate you pay at each level (bracket) of income. Increments of your income are taxed at different rates, and the rate rises as you reach each of the seven “marginal” levels in the current system. This means you may have several tax rates that determine how much you owe the IRS.

Why is Warren Buffett's tax rate lower than his secretary's?

Remember all that business a few years back when billionaire investor Warren Buffett lamented that his effective income tax rate was lower than that of his secretary? That’s simply because his secretary, who was not scraping by, was earning regular income; she got a paycheck. Buffett’s income came from investing: putting money at risk to help companies grow, and, thus, making his money grow along with them.

How is Arizona state income tax calculated?

The Arizona state income tax is a progressive tax, meaning that the percentage of your income taxed increases as your income increases. The lowest rate is zero point zero two seven percent.

What is the definition of a tax bracket based on income?

A tax bracket is the range of income or net worth that determines how much tax you will pay, or in other words, what percentage you’ll pay on your income tax bracket is the percentage of income that is taxed. This percentage is determined by the tax rate and your filing status.

What are the different tax brackets for 2020?

The United States income tax rates for the year 2020 are: 10 percent, 15 percent, 25 percent and 35 percent. The income tax rate is applied to gross income before deductions. The federal income tax does not change radically in 2020 but the number of tax brackets does.

Is income tax based on gross income?

Gross income is the total amount of money you made during a year. It includes any income that isn’t taxable such as interest income, capital gains, dividends, and government benefits.

What is adjusted gross income?

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income.

How much is the AGI for married filing jointly?

If you are filing using the Married Filing Jointly filing status, the $72,000 AGI limitation applies to the AGI for both of you combined. To e-file your federal tax return, you must verify your identity with your AGI or your self-select PIN from your 2019 tax return.

What figure determines your tax bracket?

You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket. Each bracket has its own tax rate. The bracket you are in also depends on your filing status: if you're a single filer, married filing jointly, married filing separately or head of household.

Are tax rates based on adjusted gross income?

The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions.

Is tax bracket determined by taxable income?

Your tax bracket depends on your taxable income and your filing status: single, married filing jointly or qualifying widow (er), married filing separately and head of household. Generally, as you move up the pay scale, you also move up the tax scale.

What is a tax bracket?

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat.

What is capital gains tax?

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

What is standard deduction?

The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

What is the federal tax rate for 2021?

2021 Federal Income Tax Brackets and Rates. In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples filing ...

What is CPI in tax?

The IRS used to use the Consumer Price Index (CPI) as a measure of inflation prior to 2018. [1] . However, with the Tax Cuts and Jobs Act of 2017, the IRS now uses the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly. [2]

How much is the tax deduction for pass through business?

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through business es against up to $164,900 of qualified business income for unmarried taxpayers and $329,800 for married taxpayers (Table 7).

Why was the Alternative Minimum Tax created?

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT.

What is modified taxable income?from irs.gov

Individual Income Tax Returns with Modified Taxable Income —MTI is a term used to describe "income subject to tax", the actual base on which tax is computed. For current-year returns, MTI is identical to taxable income.

What is considered a good individual income?from dqydj.com

A good income in the United States started around $54,151 in 2021. That's the median individual income for a person who typically worked 40 or more hours per week. A better income is probably $89,452, the 75th percentile of earnings for 40+ hour workers.

What was the top 1% individual income in 2021?from dqydj.com

The United States threshold for a top 1% individual earner was $357,552 in 2021.

What is the 1979 income concept?from irs.gov

Individual Income Tax Returns "1979 Income Concept" Income Excluding Dependents —The "1979 Income Concept" was developed to provide a more uniform measure of income across tax years. By including the same income and deduction items in each year's income calculation and using only items available on Federal individual income tax returns, the definition is consistent throughout the base years and can be used for future years to compare income by including only income components common to all years.

What is the AGI percentile?from irs.gov

The Statistics of Income (SOI) Division’s adjusted gross income (AGI) percentile data by State are based on individual income tax returns (Forms 1040) filed with the Internal Revenue Service (IRS) during a given calendar year. For Tax Year 2018 data, SOI tabulated the returns filed from January 1 through December 31, 2019. While the bulk of these returns were for Tax Year 2018, the IRS received a small number of returns for prior tax years. SOI uses these prior-year returns as a proxy for returns typically filed beyond the 12-month window [1]. Returns received from dependents claimed on another return have been excluded to avoid double counting, as well as returns with a negative AGI. AGI percentiles do not include income from non-taxable sources such as tax-exempt interest, non-taxable pensions and IRAs, and non-taxable Social Security Benefits.

What is the median income in 2020?from dqydj.com

What was the median individual income in 2020? In the United States, median individual income was $43,206.00 in 2020.

How many tax brackets are there?

There are seven federal income tax brackets. Here's what they are, how they work and how they affect you.

What does it mean to be in a progressive tax bracket?

Being "in" a tax bracket doesn't mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. The government decides how much tax you owe ...

How much does TaxAct save?

TaxAct is a solid budget pick, and NerdWallet users can save 25% on federal and state filing costs.

What is marginal tax rate?

What is a marginal tax rate? Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket. For example, if you're a single filer with $30,000 of taxable income, you would be in the 12% tax bracket.

What is the tax bracket for a single person with 30,000?

For example, if you're a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

What does it mean to take all the deductions?

In other words: Take all the tax deductions you can claim — they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate .

How do tax credits affect your tax bracket?

Tax credits directly reduce the amount of tax you owe; they don't affect what bracket you're in. Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket.

Why does the IRS adjust tax brackets?

On a yearly basis the Internal Revenue Service (IRS) adjusts more than 60 tax provisions for inflation to prevent what is called “bracket creep.” Bracket creep occurs when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income.

What is a tax bracket?

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat.

What is the TCJA tax deduction?

The TCJA includes a 20 percent deduction for pass-through businesses. Limits on the deduction begin phasing in for taxpayers with income above $170,050 (or $340,100 for joint filers) in 2022 (Table 7).

What is CPI in tax?

The IRS used to use the Consumer Price Index (CPI) as a measure of inflation prior to 2018. [1] However, with the Tax Cuts and Jobs Act of 2017 (TCJA), the IRS now uses the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly. [2]

What is the AMT rate?

However, this exemption phases out for high-income taxpayers. The AMT is levied at two rates: 26 percent and 28 percent.

What is taxable income?

Taxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

Why was the Alternative Minimum Tax created?

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two.