The short answer is yes—you can repay a skipped payment at any time without penalty. However, to avoid it drastically affecting how much interest you’ll pay over the life of your mortgage, you should also pay the additional interest accrued from that missed payment. What are the eligibility requirements to skip a payment?

Does Scotiabank do mortgage forgiveness?

Mortgage forgiveness by comparison means that a lender cancels or forgives part of the debt. Scotiabank is extending mortgage payment deferrals, not mortgage forgiveness. How do I apply for a mortgage payment deferral? Requests for mortgage payment deferrals had to be received by Scotiabank by September 30, 2020.

Do you have to pay back skipped mortgage payments?

The short answer is yes—you can repay a skipped payment at any time without penalty. However, to avoid it drastically affecting how much interest you’ll pay over the life of your mortgage, you should also pay the additional interest accrued from that missed payment. What are the eligibility requirements to skip a payment?

Is my credit score based on my Scotiabank balance?

However, your credit score is based on many factors, including the balance owing on your Scotiabank product, and is unique to you. Is a mortgage payment deferral the same as mortgage forgiveness? No, they are different.

Does Scotiabank charge prepayment penalty fees?

Depending on whether you have a fixed or variable mortgage rate, Scotiabank will charge you one of two prepayment penalty fees: Three months’ interest, or the Interest rate differential (IRD). If you have a fixed mortgage rate, you will pay the greater of three months’ interest or the interest rate differential.

How long is a mortgage overdue?

What happens to your mortgage when you defer payments?

What does mortgage forgiveness mean?

How long do you have to defer mortgage payments?

How long do you have to give notice to cancel a mortgage deferral?

What is the phone number for a mortgage?

See more

About this website

Can you skip a payment Scotiabank?

Any payment which you are permitted to skip will consist of principal only; you must still pay the appropriate amount of interest which you would have paid during the skipped month.

Will banks let you skip a mortgage payment?

Most homeowners can temporarily pause or reduce their mortgage payments if they're struggling financially. Forbearance is when your mortgage servicer or lender allows you to pause or reduce your mortgage payments for a limited time while you build back your finances.

How many times can you skip a mortgage payment?

Many lenders offer mortgage products that allow homeowners to skip between 1-4 monthly mortgage payments each year, without question. If you decide to skip a payment, it simply means you won't be making one of your regular mortgage payments (principal + interest).

Is it smart to defer a mortgage payment?

Deferrals are better than forbearances for people who know they can't make a lump-sum payment to pay off their missed payments during a forbearance. A mortgage payment deferral allows you to take those missed payments and put them at the end of your mortgage term to make your loan current.

What is it called when you ask to skip a mortgage payment?

If you've fallen behind on your mortgage due to a short-term hardship that is now resolved, and you are able to resume your regular monthly payments, you may qualify for a payment deferral.

Does deferring a mortgage payment hurt credit?

You can defer the amount you owe to the end of your loan. The lender may still observe teh original terms of your loan. Deferment should not hurt your credit score.

Is skip a payment a good idea?

When you skip a payment, the interest continues accruing, meaning you'll owe more the next month even if you haven't made new purchases with your card. “If you take a month off, all you've done is tread water,” McBride said.

What happens if you skip one mortgage payment?

While nobody wants to miss a mortgage payment, it can happen — especially if money is tight one month. Generally, missed payments can cause your credit score to plunge and lead to late fees. Multiple missed payments can even lead to foreclosure, further damaging your credit and leaving you with no home.

What happens if I miss 2 mortgage payments?

When you miss the second payment, you're considered in default. At that point, your loan servicer may become more aggressive in attempting to collect. This can be a frightening situation, but you may still be able to come to a workable agreement.

How long can you defer a mortgage payment?

Homeowners with federally backed loans have the right to ask for and receive a forbearance period for up to 180 days—which means you can pause or reduce your mortgage payments for up to six months. Additionally, you can request an extension of forbearance for up to 180 additional days, for a total of 360 days.

Do I qualify for deferment?

In-School Deferment You are eligible for this deferment if you're enrolled at least half-time at an eligible college or career school. If you're a graduate or professional student who received a Direct PLUS Loan, you qualify for an additional six months of deferment after you cease to be enrolled at least half-time.

What payments can be deferred?

Deferred payments also apply to loans and mortgages whereby borrowers in distress can defer payments for a specific period of time to ease their financial burden.Student Loans.Student Loan Forbearance: Pros and Cons.Debt Management. ... Debt Management. ... Debt Management.Debt Forgiveness: Escape Your Student Loans.

How many months can you miss your mortgage payment?

four consecutiveIn general, a lender won't begin foreclosure until you've missed four consecutive mortgage payments. Timing can vary from lender to lender as well as on the state of the housing market at the time. Lenders generally prefer to avoid foreclosure because it is costly and time-consuming.

What happens if I miss 2 mortgage payments?

If you miss a mortgage payment you can first expect to be charged a late fee. This fee is calculated as a percentage of your monthly payment amount—generally 3 to 6 percent. While one late fee may not seem like a large expense, these fees can quickly pile up if you continue to make late payments and aren't careful.

Terms and Conditions: Mortgage Payment Deferral - Scotiabank

In these terms and conditions, “Scotiabank” means Scotia Mortgage Corporation and/or The Bank of Nova Scotia, as appropriate and includes any of our subsidiaries or affiliates, and ‘you’ and ‘your’ refer to all those who are borrowers and guarantors under the mortgage loan with Scotiabank for which you are submitting a payment deferral request (the “Mortgage”).

Payment Deferral Terms and Conditions. - Scotiabank

· The customer is adhering to the CAP program and will skip scheduled payment for July 15, 2020. · The new maturity date of the loan will now be July 15, 2021 (extended by 1 month) As of June 15, 2020 the outstanding principal on the loan is and no more payments will be required to service the loan for the next one (1) month

Mortgage deferrals - Canada.ca

A mortgage deferral allows you to delay your mortgage payments for a defined period of time. Financial institutions also offer other mortgage relief options.

Manage Your Mortgage Online | Scotiabank Canada

We use cookies & other technologies to analyze website traffic, personalize content & provide relevant advertising on other websites. You can manage your preferences here.Select “Accept” to continue to the website.

COVID-19: Mortgage Payment Deferral | CMHC

COVID-19: understanding mortgage payment deferral. What you can do about your mortgage payment during the pandemic.

What happens if you break your mortgage with Scotiabank?

The fee, also known as a prepayment penalty, is your bank’s way of penalizing you for breaking your contract early.

What is prepayment penalty?

A prepayment penalty is a charge issued to you by a lender if you break a mortgage with them. A mortgage is a financial contract, and the prepayment charge is your mortgage provider’s compensation for you leaving early. Because there are several variables in the calculations, prepayment penalties can vary greatly, even from the same lender.

Does Scotiabank have prepayment privileges?

Scotiabank prepayment privileges. In order to try to lessen your prepayment penalty, Scotiabank will let you make a 15% lump sum payment and/or increase your payment amount by 15%, once a year. For example, if your contract says you can make a 15% lump sum payment each year, you can do that right before breaking your mortgage, ...

What is the Scotia Flex Value Open Rate 2020?

The Scotia Flex Value - Open term - Scotiabank Prime as of March 17, 2020 was 2.95%. As of March 17, 2020 the Scotia Flex Value Open rate was 6.25%. If there are no 'cost of borrowing' charges (for example, appraisal fees), the APR for the rate of 6.25% equals 6.27% (compounded semi-annually, not in advance).

Can you miss a mortgage payment?

Miss-a-Payment. You can miss a mortgage payment as long as you have matched one previously in your term. Conventional and insured financing available.

How does the skip-a-payment feature work?

Many of Canada’s mortgage providers offer products that allow homeowners to skip anywhere from one to four mortgage payments a year. If you find yourself strapped for cash, this is obviously a tempting offer.

How does skipping a payment affect a mortgage in the long term?

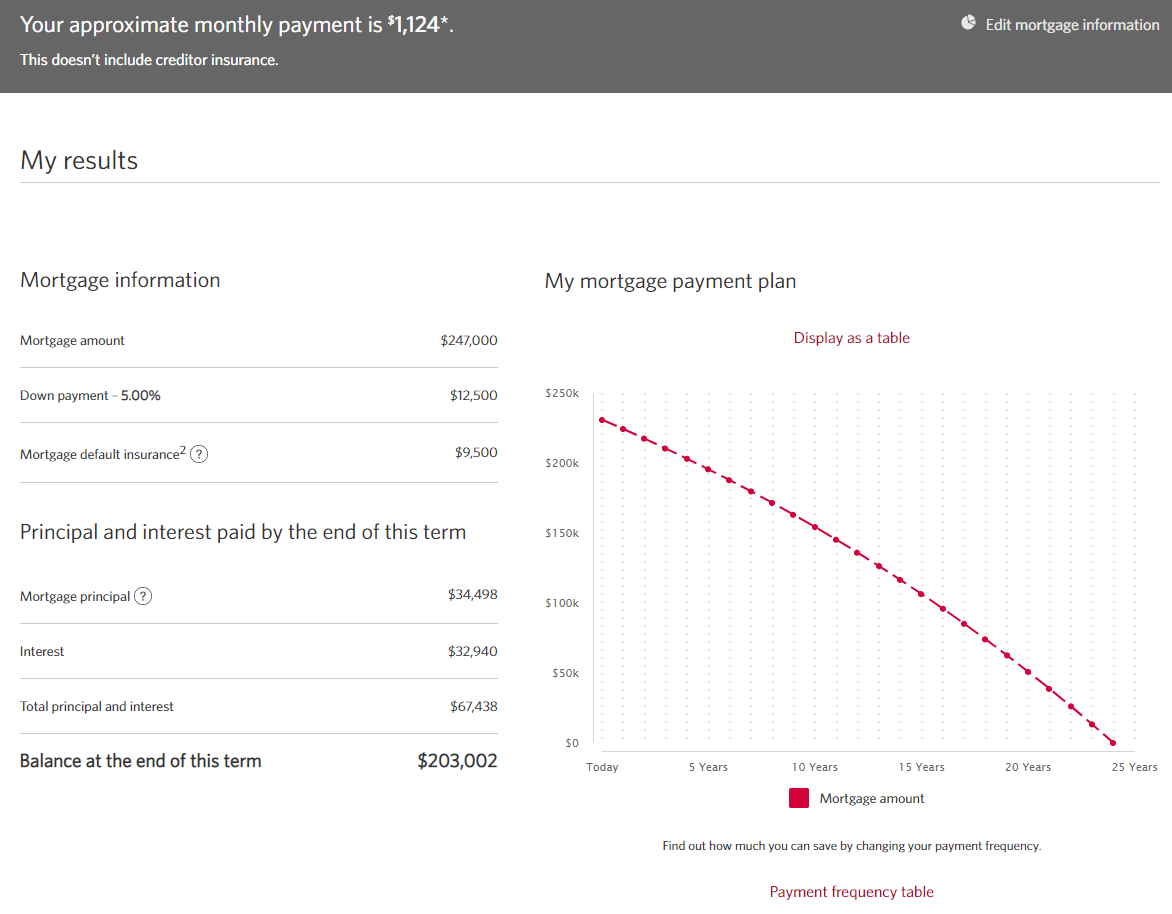

Skipping even just one payment throughout the life of your mortgage results in interest capitalization; this is when your interest is added to the balance of your loan (as shown above), which is continually charged more and more interest, until the day you make your final payment.

Can skipped payments eventually be repaid?

The short answer is yes—you can repay a skipped payment at any time without penalty. However, to avoid it drastically affecting how much interest you’ll pay over the life of your mortgage, you should also pay the additional interest accrued from that missed payment.

What are the eligibility requirements to skip a payment?

If the option to skip a payment is written into your mortgage’s terms and conditions, you’ll just have to meet a couple of criteria.

So, is it a good idea?

This is an entirely personal decision, but one that should be made with a couple of factors in mind.

How long is a mortgage overdue?

Note that if your mortgage payments are 90 days or more overdue for a default insured mortgage and 120 days or more overdue for an uninsured mortgage, that mortgage was not eligible for a deferral even if you submited a deferral request and received an acknowledgment from us.

What happens to your mortgage when you defer payments?

During the time you defer your mortgage payments, interest will continue to accrue and will be added to your mortgage account balance at the end of the deferral period . This means your payments will be slightly higher after the deferral period ends. You will pay more in interest over the life of your mortgage, but a deferral will also help ...

What does mortgage forgiveness mean?

Mortgage forgiveness by comparison means that a lender cancels or forgives part of the debt. Scotiabank is extending mortgage payment deferrals, not mortgage forgiveness.

How long do you have to defer mortgage payments?

If you obtained a mortgage payment deferral by September 30, 2020, this means that you will not be required to make regular payments on your mortgage (principal, interest, and property taxes, if applicable) for 6 months.

How long do you have to give notice to cancel a mortgage deferral?

You can contact us if you want to cancel your deferral before your mortgage deferral period ends, with a minimum of two weeks’ notice.

What is the phone number for a mortgage?

Should you have any questions regarding your mortgage, please contact us at 1-888-282-2620 Monday – Friday, 8:00 am – 9:00 pm EST, Saturday 9:00 am – 7:00 pm EST and a representative will be happy to assist you.