How to manage credit cards in QuickBooks?

- Go to Accountant.

- Select Make General Journal Entries.

- Under ACCOUNT, select the company credit card account in question.

- Enter the amount of expense under the DEBIT column.

- On the Account column, select your Partner's equity or Owner's equity account.

- Below the CREDIT column, enter the amount of expense.

- Click Save & Close.

How to process bank reconciliation in QuickBooks?

· To reconcile your QuickBooks Online records against your bank statements: Select Gear > Reconcile, or Accounting in the left sidebar, then the Reconcile tab. The Reconcile window opens. Select the account from the drop-down list. · By the end of the bank reconciliation process, this number should read 0.00.

How to enter credit card credits in QuickBooks?

To enter credit card transactions via the Chart of Accounts, follow these steps:

- Go to Accounting menu at the left.

- Look for the Credit Card account then click the View Register link.

- Click on the Add expense drop-down menu and select the specific transaction type.

- Enter the necessary information.

- Click Save.

How to create refund receipt in QuickBooks?

- Select + New.

- Select Refund receipt or Give refund.

- Select the Customer ▼ dropdown, then select the customer you want to refund.

- Select the Refund From ▼ dropdown, then select the bank you deposited the payment for the invoice to.

- Add all products or services the customer returned in the PRODUCT/SERVICE column.

Do I need to reconcile credit card in QuickBooks?

The answer is yes. You most definitely still do need to reconcile all of your bank and credit card transactions. That's how you can make sure that what you've got in QuickBooks is accurate, not doubled up, and you're not missing anything.

Do credit cards need to be reconciled?

If your organization issues credit cards to executives, managers, or other team members, each one of those must be reconciled. Credit card merchant services This is the income side.

How do you reconcile a credit card in QuickBooks?

0:249:02How to Reconcile Credit Cards Accounts in QuickBooks OnlineYouTubeStart of suggested clipEnd of suggested clipThere are several ways to get to the reconcile. Screen perhaps the easiest is to go up to yourMoreThere are several ways to get to the reconcile. Screen perhaps the easiest is to go up to your cogwheel in the upper right hand corner. And under tools we can go to reconcile.

What does it mean to reconcile your credit card?

Credit card reconciliation is the system accountants use to make sure that transactions in a credit card statement match those on the company's general ledger. For effective and accurate bookkeeping, businesses need to know that every transaction did in fact take place, and is what it says it is.

How do you account for credit card transactions?

Credit card expenses can be entered into your accounting system in one of three ways: Summary – Enter the information from the credit card statement by account summary through a journal entry or into Accounts Payable by summarizing the credit card statement each month to a credit card vendor.

How do businesses reconcile credit card statements?

2:3314:38How To Reconcile Business Credit Card Transactions - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe first field that we need to complete is the statement ending date your credit card statementMoreThe first field that we need to complete is the statement ending date your credit card statement will have a beginning date. And an ending date.

How do I record credit card transactions in QuickBooks?

This is the main way to record your credit card payments in QuickBooks.Select + New.Under Money Out (if you're in Business view), or Other (if you're in Accountant view), select Pay down credit card.Select the credit card you made the payment to.Enter the payment amount.Enter the date of the payment.More items...

Is a credit card payment an expense in QuickBooks?

To report your credit card payments as an expense in QuickBooks Self-Employed, you can simply enter them as an Expense transaction.

How do I reconcile multiple credit cards in QuickBooks desktop?

Method 2: For QuickBooks DesktopIn QuickBooks Desktop Run Chart of Accounts.Then choose which credit card account needs reconciliation and then press the option of Activities.Select Reconcile Credit Card from the menu you have.A box will appear for starting the process to reconcile.More items...

How do I reconcile a credit card for the first time in QuickBooks online?

Reconciling credit card accountsFrom the Company menu, select Chart of Accounts.Select Account or the plus icon, then New.Select Credit Card, then select Continue.On the Add New Account window, enter the credit card name. ... Select Enter Opening Balance... then enter the account's balance and date.Select Save & Close.

How do you fix credit card reconciliation in QuickBooks online?

Need to fix a credit card reconciliationGo to the Vendors menu, then select Pay Bills.Select the correct accounts payable account from the dropdown.Click the checkboxes of the bills you want to pay from the table.Enter the date you paid the bill. and select the payment method.Select Pay Selected Bills.Click Done.

How do I do a credit card reconciliation in Excel?

4 Suitable Steps to Reconcile Credit Card Statements in ExcelStep 1: Prepare Format for Credit Card Reconciliation. Our first step is to prepare a format for credit card reconciliation. ... Step 2: Find Mismatches Between Statements. ... Step 3: Record Mismatches in Reconciliation Statement. ... Step 4: Calculate Adjusted Balance.

How do I reconcile my personal credit card?

How to reconcile a credit card statementSort your receipts. Keep your credit card receipts in a separate compartment in your purse or wallet so they aren't accidentally lost or thrown away. ... Match your receipts to your credit card statement. ... Notify your bank.

How do I reconcile credit cards in Quickbooks online?

Reconciling credit card accountsFrom the Company menu, select Chart of Accounts.Select Account or the plus icon, then New.Select Credit Card, then select Continue.On the Add New Account window, enter the credit card name. ... Select Enter Opening Balance... then enter the account's balance and date.Select Save & Close.

What is debit and credit reconciliation?

When the company pays the bill, it debits accounts payable and credits the cash account. With every transaction in the general ledger, the left (debit) and right (credit) sides of the journal entry should agree, reconciling to zero.

Why there is a need to review and reconcile monthly credit card and bank statements?

Reconciling your bank statements simply means comparing your internal financial records against the records provided to you by your bank. This process is important because it ensures that you can identify any unusual transactions caused by fraud or accounting errors.

How to reconcile credit card transactions in QuickBooks?

Basically, there will be 5 easy steps to reconcile credit cards in QuickBooks: Step 1: Choose Accounting and Reconcile on the left menu. Step 2: From the drop-down box, choose the amount to reconcile and then enter your statement information. Step 3: Match the transactions of credit cards.

How to reconcile credit in QuickBooks?

The first step to do is opening the QuickBooks Credit Credit Reconciliation Screen. To do that, you hover your cursor over Accounting in the left menu bar and then choose Reconcile:

What is credit card reconciliation?

Every successful company needs a clean book to survive and thrive in the long term. Therefore, good accounting is not only a crucial factor for a growing business but it’s also a legal requirement that any business should know and follow carefully.

Why is reconciling credit cards important?

Reconciling credit cards is vital because it shows how financially healthy the company is. Reconciliation uses further documentary evidence to prove your book is accurate, using bank statements, receipts, and credit card statements to verify that each transaction is exactly what you claim it to be.

How to open a second tab in QuickBooks?

Note: You can open a second QuickBooks tab at the same time by right-clicking on the tab on your internet browser and choosing “Duplicate” to open it. That way you can navigate in the second tab to make needed changes as normal. After the changes are made and saved, refresh the original tab to see new changes you’ve just made.

What happens if there is a difference in the amounts of the transactions and the bank statement?

Identify incorrect amount s: If there is a difference in the amounts of the transactions and the bank statement, then the account cannot be reconciled.

Is the ledger accurate?

And if all payments in the ledger match with those on the statement then the ledger could be considered accurate. If parts of the ledger do not match what’s on the credit card statement, there will be discrepancies and the financial controller needs to find out what are its causes.

How to reconcile credit card statements in QuickBooks?

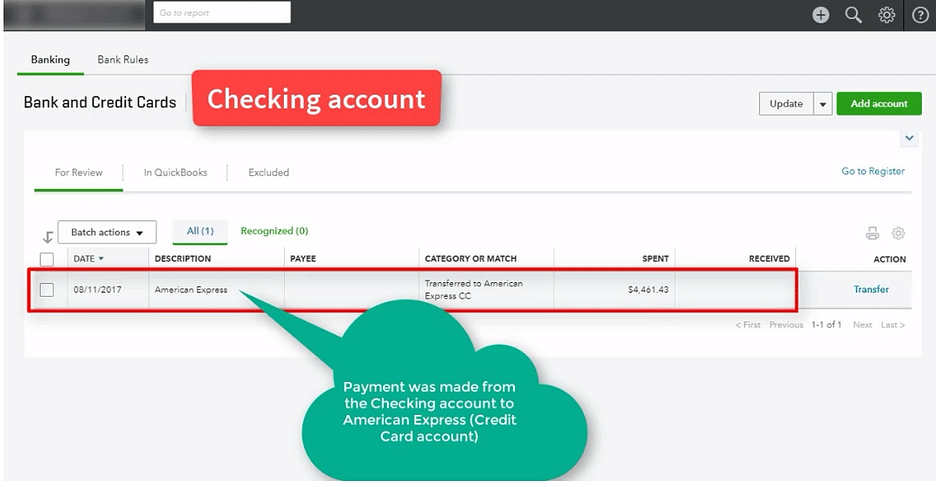

A credit card reconciliation in QuickBooks can be done in five easy steps: 1 Select Accounting then Reconcile from the left menu. 2 Select the account to reconcile from the drop-down box and enter your statement information. 3 Match credit card transactions. 4 Confirm $0.00 difference. 5 Make a payment or create a bill (optional).

What happens if the same transaction has different amounts in QuickBooks vs the bank statement?

Identify incorrect amounts: If the same transaction has different amounts in QuickBooks vs the bank statement, the account will not reconcile.

What is matching transactions in QuickBooks?

Matching transactions between QuickBooks and your statement consists of tracing transactions from QuickBooks to your statement and then investigating unmarked transactions on your statement.

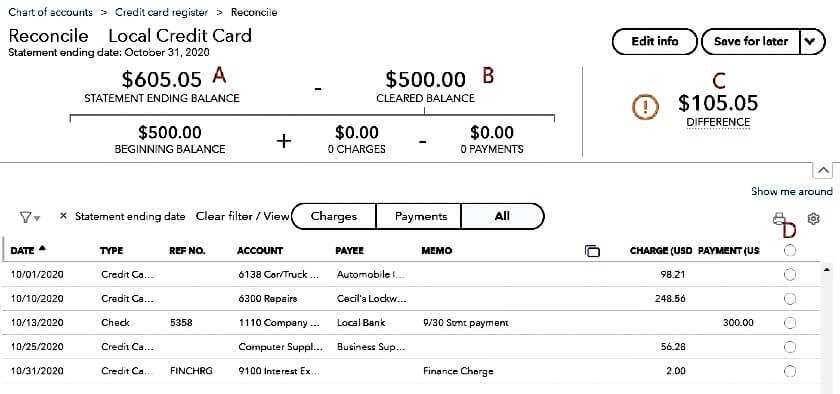

What is the last statement ending date in QuickBooks?

B. Last statement ending date: QuickBooks indicates the date of the last statement reconciled for this credit card account. This date will be missing if this is the first reconciliation for this credit card.

What is the beginning balance in QuickBooks?

C. Beginning balance: QuickBooks shows the ending balance of the prior statement reconciled, which also must be the beginning balance of the current statement. This amount will be zero if this is the first time this credit card has been reconciled.

How to open two tabs in QuickBooks?

Open a second QuickBooks tab: You can have multiple QuickBooks tabs open at the same time. Right-click on the tab in your internet browser and select “duplicate” to open a second tab. You can navigate as normal in the second tab to make necessary changes.

Where is the radial button on a credit card statement?

D. Cleared transaction: Click the radial button in the right-most column for each transaction if that transaction appears on your credit card statement. After you click the radial button, the transaction will be included in the cleared balance (item B).

How often do you need to reconcile your bank accounts?

You need to reconcile all of your accounts every month. That means bank accounts, credit cards, all loans, and all notes payable.

How to add missing transactions to credit card?

If you need to add in any other missing transactions or deposits to make up for any discrepancies, click on the left-hand side on “credit card registered.” This is where you can add in any missing transactions.

What is comparing the beginning balance and transactions to your accounts in QuickBooks Online?

It’s simply comparing the beginning balance and transactions to your accounts in QuickBooks Online with your monthly bank and credit card statements to make sure that they match. It’s a fancy word for a basic concept.

What happens if you click off all transactions?

Once you’re finished clicking off all of your transactions, the balance on the right hand side should be zero. If the statement is not zero, something has happened and it requires an investigation.

Is it easy to reconcile QuickBooks Online?

The good news is that reconciling your accounts in QuickBooks Online is easy if you know how. That’s what I’ll be showing you how to do today!

How to reconcile credit card in QuickBooks?

Steps to Reconcile a Credit Card. To do a credit card reconciliation using the card statement , first agree total card credits (payments on the card and credits from vendor refunds) per the card statement to the total payments and credits showing per the total in the reconciliation window in QuickBooks. If the two amounts do not agree, compare each ...

How often should credit card accounts be reconciled?

Credit card accounts should be reconciled each month just like your bank account.

How to duplicate a card purchase in QuickBooks?

(In QuickBooks desktop, right click on a transaction to find the duplicate option, in QuickBooks Online click More at the bottom of the transaction window, then Copy.)

Is it easier to reconcile a credit card account than a bank account?

Easier Than Bank Reconciliations. Generally reconciling credit card accounts is much easier than bank accounts since you don’t have to deal with outstanding checks. Sometimes you have a transaction or two that crosses the end of the statement cycle, but that’s about it for outstanding transactions.

Does Maya's card have a negative balance?

Payments on the card, however, only flow through to Maya’s card. You will see a negative balance begin to develop on Maya’s card since that card is getting credit for all the payments. You can either edit the payment to spread it to the various accounts, or do a journal entry to reallocate the individual card balances.

Is reconciling credit card accounts easy?

Reconciling credit card accounts should be a quick and easy process, especially if you’ve followed the steps in the prior post, A Right Way and a Wrong Way to Enter Credit Card Purchases, to import your credit card transactions. Posted in Bookkeeping.

First Off, What Does “Reconcile” Mean?

So Let’s Look at An Example For Reconciling Credit Cards.

- Step 1: Get your paper (and digital) statements in order. Before you log into QuickBooks, make sure you have all your relevant statements handy. That means credit card, bank, and loan statements whether they’re online or paper versions. Once you have all your info in order, log into QuickBooks. Step 2: Log into your account and navigate to “reconci...

Keep in Mind That This Must Be Done Every Month, and It Needs to Balance.

- So there you have it! If you’d like to watch the full-length version of this tutorial, click below! If you’ve been struggling with your QuickBooks online bookkeeping or you’re looking to delegate these tasks, we’ve got you covered! Find out about ALL of our QuickBooks online services right HERE! Until Next Time, Love, Light, and MONEY, Honey… Kaylee